Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Evolution of the Rubber Industry Amid Sustainable Practices Innovation and Disruptive Market Forces Driving Global Transformation

The global rubber ecosystem has transitioned from a regional specialty commodity to a cornerstone of modern industry, driving critical applications across transportation, manufacturing, and consumer goods. Historically, reliance on natural plantations in Southeast Asia gave way to widespread adoption of synthetic elastomers synthesized from petrochemical feedstocks, reflecting an industry shaped by resource availability and cost considerations.Today, the interplay between raw material volatility and shifting end-user requirements underscores the need for agility. Automotive manufacturers seek high-performance tire compounds compatible with electric and autonomous vehicles, while medical device producers demand sterile, biocompatible elastomers. Simultaneously, consumer electronics rely on miniature sealing and damping solutions to enhance product reliability.

Innovation in compounding techniques, including nano-reinforcement and bio-based polymer blends, has begun to redefine performance benchmarks. These advances not only extend service lifespans but also support circularity initiatives by enabling reclamation and recycling at scale. Sustainability metrics have emerged as a key differentiator, influencing procurement strategies and regulatory compliance.

As regional consumption patterns realign and new production hubs gain prominence, decision-makers require a holistic understanding of both macroeconomic drivers and granular segment trends. The insights presented here will inform strategic planning, investment prioritization, and competitive response across the rubber value chain.

This executive summary provides a concise overview of the prevailing dynamics in raw material sourcing, segment-specific developments, and evolving market structures. It establishes the analytical framework for understanding how transformative shifts, tariff pressures, and strategic segmentation coalesce to shape the future of the elastomer landscape.

Analyzing the Strategic Shifts in Raw Material Sourcing Technological Breakthroughs and Regulatory Changes Reshaping Rubber Market Dynamics

Recent years have witnessed a profound reconfiguration of the elastomer landscape driven by sustainability, technological innovation, and policy evolution. With growing emphasis on carbon reduction, bio-based feedstocks such as guayule and dandelion-derived polymers have emerged as viable natural alternatives, challenging the dominance of traditional Hevea-derived latex and petroleum-based synthetics.Furthermore, digitalization has permeated every stage of the value chain, from predictive maintenance of manufacturing equipment to real-time supply chain visibility platforms. These technologies enable stakeholders to anticipate disruptions, optimize inventory levels, and enhance product traceability, fostering resilience in a market defined by global interdependence.

Simultaneously, breakthroughs in compounding science have yielded nanocomposite formulations that deliver superior abrasion resistance, thermal stability, and weight reduction. Such advancements align with the performance demands of electric vehicles and next-generation industrial machinery, where material efficiency directly influences energy consumption and operational costs.

Regulatory frameworks have also evolved in tandem, with stricter emissions limits and extended producer responsibilities prompting manufacturers to reassess production footprints and embrace circular economy principles. Mandatory reporting schemes in key markets drive transparency around lifecycle emissions and waste management, reinforcing the case for eco-conscious innovation.

Collectively, these transformative shifts have elevated the strategic priority of sustainability and digital excellence. Market leaders are now tasked with navigating a complex matrix of technological capabilities, regulatory mandates, and stakeholder expectations to secure competitive advantage.

Assessing the Multifaceted Impact of New US Tariffs on Import Costs Supply Chain Resilience and Market Responses in 2025

Entering 2025, the introduction of new US tariffs on imports of rubber compounds and finished goods has generated a ripple effect across global trading networks. By increasing the cost of imported grades, these measures have incentivized domestic sourcing and accelerated the establishment of local production facilities. Manufacturers have responded by renegotiating supplier contracts and exploring nearshoring opportunities to mitigate exposure to price volatility.In parallel, the elevated import duties have placed upward pressure on raw material costs, prompting many buyers to explore alternative feedstock suppliers in Latin America and Africa. Logistics providers have adapted by restructuring shipping lanes to optimize transit times and reduce handling expenses. As a result, lead times are shorter in some corridors but remain variable in regions still reliant on Asia-Pacific shipments.

To preserve margin structures, downstream users have deployed lean manufacturing practices and intensified collaboration with distributors, aligning order cycles and inventory buffers to accommodate tariff-induced cost fluctuations. These adjustments have also fueled investments in process automation and digital procurement tools, reinforcing agility in price-sensitive markets.

While some segments have absorbed duties through targeted product premiuming, others face challenges in passing on incremental costs amid competitive pressure. Nevertheless, tariff pressures serve as a catalyst for supply chain diversification, prompting both established players and new entrants to reevaluate sourcing strategies and fortify resilience against future trade policy shifts.

Delving into Comprehensive Product Application and Distribution Channel Segmentation to Uncover Critical Growth Drivers and Customer Preferences

Market segmentation by product type illuminates the distinct characteristics and performance attributes that drive purchasing decisions in natural and synthetic elastomers. Natural rubber, sourced from Hevea brasiliensis plantations, is further differentiated into block, crepe, latex, and skim varieties, each offering unique stretch, tack, and purity profiles. These distinctions inform selection criteria for applications ranging from adhesive formulations to medical-grade components. Synthetic rubber encompasses established chemistries such as butadiene rubber, ethylene propylene diene monomer, nitrile butadiene rubber, and styrene-butadiene rubber, with each polymer presenting tailored resilience, oil resistance, and thermal properties. By correlating these material traits with end-use requirements, manufacturers optimize compound recipes for targeted performance outcomes.In terms of application, the adhesive sector spans non pressure sensitive and pressure sensitive technologies, catering to industries that require precision bonding or flexible sealing. The footwear category bifurcates into casual, industrial, and sports segments, reflecting divergent demands for comfort, protection, and performance. Industrial goods incorporate dampers and cushions, hoses and belts, and mechanical parts, underscoring the critical role of elastomeric damping and sealing in machinery. Medical devices rely on catheters, gloves, and tubing engineered for sterility and biocompatibility, while the tire market encompasses commercial vehicle, off-road, passenger car, and two-wheeler tires, each segment demanding compound innovations for load capacity, terrain adaptation, and rolling efficiency.

Distribution channels are categorized into offline and online models. Offline distribution operates through direct sales and a network of distributors and dealers that furnish technical support and regional inventory coverage. Online channels, including e-commerce marketplaces and manufacturer websites, offer streamlined ordering and access to custom compound options, bolstering market reach and customer convenience.

Unraveling Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Highlight Emerging Opportunities and Challenges

Regional dynamics across the Americas reflect a mature automotive and agricultural infrastructure, where North American tire manufacturers leverage technologically advanced compounding methods to meet stringent safety and performance standards. South American producers, in contrast, continue to invest in plantation expansion and local processing facilities to capture export opportunities and satisfy domestic demand.Europe, the Middle East, and Africa present a heterogeneous mix of mature markets and emerging growth corridors. Western Europe focuses on sustainability and circular economy models, deploying reclaimed rubber in tertiary applications and enforcing rigorous environmental regulations. In the Middle East, infrastructure development initiatives drive demand for industrial goods requiring durable elastomeric solutions, while emerging economies in Africa prioritize import substitution and capacity building to foster local value chains.

The Asia-Pacific region remains the largest consumption hub, fueled by robust automotive production in countries such as China, Japan, and India, as well as dynamic medical and footwear markets. Southeast Asian nations serve as critical natural rubber suppliers, with integrated plantations and processing plants that support both regional needs and global exports. Meanwhile, ongoing investments in greenfield synthetic rubber facilities underscore the region’s strategic role in securing resilient feedstock access amidst shifting trade policies.

Examining Strategic Positioning Investments and Innovation Portfolios of Leading Rubber Manufacturers to Reveal Competitive Strengths and Differentiation

Leading manufacturers such as Bridgestone, Michelin, and Goodyear exert substantial influence through vertically integrated operations, combining global raw material sourcing with advanced compounding and tire production capabilities. These corporations maintain competitive differentiation by investing in proprietary technologies, forging partnerships with raw material suppliers, and deploying digital platforms for real-time asset monitoring.Continental and Pirelli distinguish themselves through targeted innovation in high-performance and specialty elastomers, catering to premium automotive and niche industrial segments. Their strategic focus on material science collaboration with academic and research institutions accelerates development cycles for next-generation compounds. Meanwhile, Sumitomo Rubber and Yokohama have expanded capacity in Asia to capitalize on regional demand surges, aligning production footprints close to key automotive hubs.

In the synthetic rubber domain, producers of butadiene, EPDM, NBR, and SBR leverage optimized polymerization processes and catalyst efficiencies to deliver cost-effective solutions. Integration with upstream petrochemical operations ensures feedstock security, while joint ventures and licensing agreements facilitate technology transfer and local market entry. Collectively, these strategies underscore a competitive landscape defined by scale, innovation velocity, and supply chain resilience.

Implementing Strategic Imperatives for Sustainability Digital Integration and Operational Agility to Foster Growth and Competitive Advantage in the Rubber Industry

Industry leaders should prioritize the integration of bio-based and recycled elastomers to align with escalating environmental mandates and consumer expectations. By investing in pilot facilities that validate performance parity between conventional and alternative compounds, companies can de-risk commercial scale-up and secure first-mover advantages.Simultaneously, digitalization of procurement and manufacturing processes will prove essential to enhance transparency and operational agility. Deploying cloud-based supply chain management systems and predictive analytics tools enables real-time decision-making around inventory optimization, demand forecasting, and supplier performance monitoring.

Strategic alliances with upstream feedstock providers and specialty chemical developers can foster co-innovation, ensuring access to novel materials and collaborative R&D pipelines. These partnerships also facilitate joint investment in infrastructure upgrades that reduce energy consumption and waste generation.

Moreover, establishing flexible production platforms capable of rapid compound switching will bolster responsiveness to tariff disruptions and shifting end-use specifications. Embracing modular mixing lines and scalable extrusion units supports a diversified product portfolio without compromising throughput. Collectively, these actionable initiatives will reinforce competitive positioning and drive sustainable growth across the rubber value chain.

Detailing the Rigorous Research Approach Combining Secondary Analysis Primary Engagement and Triangulation to Ensure Data Accuracy and Insight Validity

A rigorous research methodology underpins the insights presented in this analysis, commencing with a comprehensive secondary review of industry publications, technical papers, patent filings, and regulatory documentation. This groundwork informed the development of detailed profiling frameworks for products, applications, channels, and regions.Primary research engagements supplemented these findings through structured interviews with a cross-section of stakeholders, including raw material suppliers, compounders, original equipment manufacturers, distributors, and end users. These discussions provided qualitative context around adoption drivers, pain points, and strategic priorities. Data triangulation techniques synthesized quantitative inputs from customs records, trade associations, and proprietary shipment databases to validate emerging trends and ensure robustness.

The analytical approach incorporated scenario analysis to assess the implications of evolving trade policies, technological breakthroughs, and sustainability regulations. Key assumptions and data sources underwent iterative validation with subject-matter experts to mitigate bias and reinforce credibility. Throughout the process, adherence to best practices in data integrity, traceability, and ethical research standards remained paramount.

Summarizing Core Insights Strategic Implications and Future Considerations to Conclude the Comprehensive Rubber Market Overview with Actionable Takeaways

In conclusion, the rubber industry stands at a pivotal juncture where sustainability, digital transformation, and trade policy considerations converge to redefine competitive landscapes. Stakeholders must navigate complex sourcing dynamics, adapt to tariff-induced cost shifts, and leverage segmentation insights to capture high-value applications. Regional variances underscore the necessity for localized strategies, while leading players continue to differentiate through innovation investments and integrated supply chains.The strategic imperatives outlined in this summary emphasize the importance of collaborative partnerships, agile manufacturing platforms, and data-driven decision-making to sustain growth. As material science advances and environmental requirements intensify, the capacity to align product development with evolving market expectations will determine leadership in the rubber ecosystem. This synthesis of key drivers, challenges, and actionable recommendations equips decision-makers with the context required to chart a resilient and forwardlooking trajectory.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Natural Rubber

- Synthetic Rubber

- Butadiene Rubber

- Chloroprene Rubber

- Nitrile Rubber

- Styrene Butadiene Rubber

- Application

- Adhesives & Sealants

- Automotive Parts

- Footwear

- Industrial Goods

- Dampers & Cushions

- Hoses & Belts

- Mechanical Goods

- Medical

- Catheters

- Gloves

- Medical Tubing

- Distribution Channel

- Offline

- Direct Sales

- Distributors

- Online

- E-Commerce Platforms

- Manufacturer Websites

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Eaton Corporation PLC

- Bridgestone Corporation

- Arlanxeo Holding B.V.

- Bando Chemical Industries, Ltd.

- China Petrochemical Corporation

- Continental AG

- Dolfin Rubbers Ltd

- Exxon Mobil Corporation

- Formosa Synthetic Rubber Corporation

- Gates Corporation

- Goodyear Rubber Company

- H.B. Fuller Company

- Hankook Tire & Technology Co., Ltd.

- Huntsman Corporation

- Imerys S.A.

- JSR Corporation

- Kuraray Co., Ltd.

- Lanxess AG

- LG Chem Ltd.

- Lion Elastomers

- Michelin Corporation

- Panama Petrochem Ltd

- Parker-Hannifin Corporation

- Pirelli & C. S.p.A.

- Reliance Industries Limited

- Rolex Reclaim Pvt. Ltd.

- SIBUR International GmbH

- Sinochem International Corporation

- Sumitomo Rubber Industries, Ltd.

- Toyoda Gosei Group

- TPC Group

- Trelleborg AB

- TSRC Corporation

- Yokohama Rubber Co., Ltd.

- Zeon Corporation

- Zhongce Rubber Group Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Rubber market report include:- Eaton Corporation PLC

- Bridgestone Corporation

- Arlanxeo Holding B.V.

- Bando Chemical Industries, Ltd.

- China Petrochemical Corporation

- Continental AG

- Dolfin Rubbers Ltd

- Exxon Mobil Corporation

- Formosa Synthetic Rubber Corporation

- Gates Corporation

- Goodyear Rubber Company

- H.B. Fuller Company

- Hankook Tire & Technology Co., Ltd.

- Huntsman Corporation

- Imerys S.A.

- JSR Corporation

- Kuraray Co., Ltd.

- Lanxess AG

- LG Chem Ltd.

- Lion Elastomers

- Michelin Corporation

- Panama Petrochem Ltd

- Parker-Hannifin Corporation

- Pirelli & C. S.p.A.

- Reliance Industries Limited

- Rolex Reclaim Pvt. Ltd.

- SIBUR International GmbH

- Sinochem International Corporation

- Sumitomo Rubber Industries, Ltd.

- Toyoda Gosei Group

- TPC Group

- Trelleborg AB

- TSRC Corporation

- Yokohama Rubber Co., Ltd.

- Zeon Corporation

- Zhongce Rubber Group Co., Ltd.

Table Information

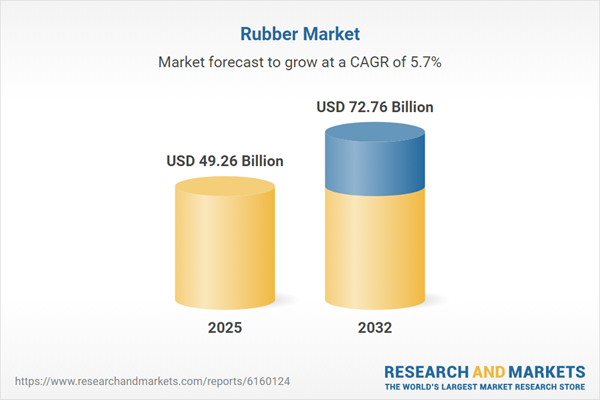

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 49.26 Billion |

| Forecasted Market Value ( USD | $ 72.76 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |