Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Strobilurin Fungicide Market Dynamics: An In-Depth Exploration of Origins, Core Functions, and Strategic Importance

Strobilurin fungicides represent a cornerstone of modern crop protection, offering farmers and agribusinesses a broad-spectrum defense against fungal pathogens. Derived from natural metabolites produced by certain species of fungi, these compounds disrupt mitochondrial respiration in harmful organisms. Since the introduction of the first commercial strobilurin derivative, they have evolved into a diverse portfolio that addresses resistance management and efficacy across multiple crop systems.Over the past two decades, growers worldwide have increasingly adopted strobilurin-based solutions due to their protective, curative, and sometimes eradicative modes of action. Their systemic translocation and rainfast characteristics have redefined application protocols, enabling more flexible tank-mix strategies and extension of protection periods. This enhanced performance has positioned strobilurins alongside integrated pest management frameworks, supporting both yield goals and sustainability objectives.

As regulatory scrutiny intensifies and resistance concerns emerge, the industry is pivoting towards next-generation formulations and stewardship programs. Through advanced chemistries and digital monitoring tools, manufacturers aim to optimize product lifecycle management while safeguarding efficacy. In this introduction, we lay the groundwork for a comprehensive examination of how market forces, technological innovation, and policy shifts converge to shape the present and future of the strobilurin fungicide sector.

Mapping the Evolutionary Trajectory of Strobilurin Fungicide Adoption: Understanding Technological Advancements, Regulatory Milestones, and Market Transformations

In recent years, the strobilurin fungicide domain has undergone profound shifts driven by scientific breakthroughs, regulatory reappraisals, and shifting agronomic paradigms. The discovery of novel active ingredients has expanded the chemical toolkit, enhancing spectrum coverage and mitigating resistance concerns. Concurrently, advancements in formulation technology have enabled more precise droplet spectra and controlled-release profiles, aligning with the demand for reduced application rates and minimal environmental impact.Regulatory bodies across major producing regions have responded to emerging safety and resistance data by revising guidelines, triggering reformulation efforts and accelerated approval pathways for next-generation compounds. This regulatory evolution has prompted manufacturers to streamline registration processes in strategic markets and to forge alliances aimed at navigating complex compliance landscapes.

At the same time, digital agriculture platforms and precision application equipment have gained traction, enabling real-time decision support and optimized input deployment. Data-driven insights into disease pressure, weather patterns, and crop phenology are reshaping application timing and dosage strategies. As a result, stakeholders across the value chain are collaborating to integrate these technological innovations, transforming traditional approaches into proactive, targeted disease management solutions.

Unearthing the Consequential Effects of 2025 United States Tariffs: Assessing Trade Barriers, Price Fluctuations, and Strategic Adjustments in Fungicide Supply Chains

The introduction of new tariff measures by the United States in 2025 has reverberated across global supply chains for fungicidal active ingredients and formulated products. Import duties on certain intermediates and finished goods have elevated landed costs, prompting distributors and end users to reassess sourcing strategies. As a result, reliance on domestic manufacturing capacity and North American partnerships has intensified to offset rising import burdens.This shift has placed upward pressure on farm-gate prices, especially in regions where domestic production cannot fully compensate for reduced imports. Growers have responded by exploring alternative chemistry classes and adopting integrated practices that maximize residual efficacy, thereby cushioning the impact of higher input costs. Through forward contracting and bulk purchasing agreements, cooperatives and purchasing groups have sought to stabilize supply and secure volume discounts under the new tariff regime.

In parallel, exporters to the United States have diversified their customer base, targeting emerging markets where tariff barriers are less stringent. This strategic reorientation has underscored the importance of market intelligence in guiding trade negotiations and distribution partnerships. Ultimately, the ripple effects of these tariffs have accelerated conversations around localizing production, optimizing distribution networks, and fortifying resilience against policy-driven disruptions.

Delving into Multi-Tiered Segmentation of Strobilurin Fungicide Landscape: Unraveling Type Variations, Formulations, Crop Applications, and Distribution Pathways

The market's complexity is best understood through a multi-faceted segmentation lens. Based on type, the product landscape encompasses key active ingredients such as azoxystrobin, fluoxastrobin, kresoxim-methyl, picoxystrobin, pyraclostrobin, and trifloxystrobin, each offering distinct modes of action, solubility profiles, and resistance management benefits. These type variations influence both formulation design and application protocols, shaping end-user preferences and R&D priorities.Formulation considerations reveal that liquid formulations and solid formulations each cater to unique operational requirements. While liquid compositions facilitate rapid uptake and spray uniformity, solid granules and powders deliver extended shelf life and simplified transport. This duality has led manufacturers to invest in formulation innovation that bridges the performance trade-offs inherent in each delivery system.

Crop type segmentation highlights that cereals and grains-including barley, maize, rice, and wheat-constitute significant demand drivers owing to their global acreage and disease susceptibility profiles. Fruits and vegetables, with subdivisions into fruits such as apple, citrus, grapes, and strawberry, and vegetables such as onion, potato, and tomato, represent high-value sectors where disease control directly impacts marketability. Meanwhile, oilseeds and pulses, spanning canola rapeseed, peanut, soybean, sunflower and pulses like beans, chickpeas, lentils, and peas, require specialized treatment schedules to protect yield and quality under diverse agronomic conditions.

When examining application methods, choices range from foliar spray to post-harvest treatment, seed treatment, and soil treatment, each addressing specific disease cycles and crop resilience strategies. Distribution channel analysis reveals that traditional offline networks continue to dominate due to established frameworks, yet online channels are rapidly gaining relevance by offering transparency, customized solutions, and streamlined procurement processes.

Deciphering Regional Nuances in the Strobilurin Fungicide Arena: A Comparative Analysis Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional disparities in adoption of strobilurin fungicides are pronounced when comparing the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust agricultural infrastructure and integrated pest management frameworks drive high-volume usage, with emphasis on maize and soybean systems. Growers benefit from comprehensive advisory networks and well-established distribution channels, allowing for rapid uptake of advanced chemistries.Across Europe Middle East & Africa, stringent regulatory standards and diverse cropping patterns influence market dynamics. In Western Europe, farmers balance efficacy demands with environmental stewardship, often opting for lower-risk formulations. Regulatory alignment within the European Union furthers product harmonization, while emerging economies in the Middle East and Africa present growth opportunities as producers adopt modern agronomic practices.

The Asia-Pacific region experiences accelerated demand fueled by expanding cereal cultivation and rising horticultural output. Nations with burgeoning aquaculture and turf management sectors are experimenting with post-harvest and non-traditional applications, underscoring the versatility of strobilurins. In countries with fragmented smallholder landscapes, accessibility through both offline cooperatives and online platforms is critical to ensuring effective disease control.

Profiling Leading Industry Players in Strobilurin Fungicide Sphere: Examining Strategic Alliances, Innovation Trajectories, and Competitive Differentiators

Leading corporations have shaped the strobilurin fungicide sphere through strategic investments in research, acquisitions, and collaborative partnerships. Major agrochemical players continue to expand their pipelines by advancing novel active ingredients and synergistic combinations, thereby addressing evolving resistance profiles and regulatory thresholds.Some organizations have strengthened distribution networks through alliances with regional distributors and digital retailers, enabling enhanced market reach and after-sales support. Others have prioritized sustainability objectives by introducing reduced-risk formulations and stewardship programs that extend product lifespans. Investment in data-driven agronomy services, combined with in-field trials, underscores a shift from transactional sales to consultative engagements.

Moreover, mid-tier innovators and contract manufacturing specialists contribute to market dynamism by offering customized formulation services and flexible production scales. This collaborative ecosystem ensures that emerging strobilurin variants can be rapidly commercialized while meeting rigorous quality standards. Collectively, these strategic maneuvers by incumbents and challengers alike underscore a competitive landscape characterized by continuous innovation and proactive portfolio management.

Strategic Guidance for Market Leaders to Navigate and Capitalize on Emerging Opportunities in Strobilurin Fungicide Through Focused Initiatives and Investment Approaches

To thrive amid intensifying competition and regulatory evolution, industry leaders should prioritize the development of next-generation strobilurin chemistries with enhanced resistance profiles and reduced environmental footprints. By aligning R&D pipelines with granular segmentation insights, organizations can tailor solutions for high-value crops and emerging application methods.Diversifying supply chains through regional manufacturing hubs and strategic partnerships will mitigate risks associated with tariff fluctuations and logistical disruptions. Concurrently, establishing digital platforms for precision application guidance and stewardship reinforcement can differentiate offerings and foster long-term customer loyalty.

Leadership teams must also invest in robust regulatory intelligence capabilities to anticipate policy shifts and accelerate product registration timelines. Leveraging collaborative forums with growers, agronomists, and environmental agencies will ensure alignment with evolving safety standards and sustainability commitments. Ultimately, a customer-centric approach that integrates data analytics, training services, and end-to-end support will position companies to capture value across the strobilurin fungicide lifecycle.

Methodological Framework for Comprehensive Analysis of Strobilurin Fungicide Ecosystem: Synthesizing Primary Research, Secondary Validation, and Stakeholder Engagement

This analysis synthesizes insights derived from a structured methodology encompassing both primary and secondary research components. Primary inputs include in-depth interviews with agronomists, regulatory experts, manufacturers, distributors, and grower associations. These conversations provided qualitative understanding of market drivers, adoption barriers, and emerging best practices.Secondary research involved examining technical papers, patent filings, regulatory dossiers, and industry publications to triangulate key trends and validate stakeholder perspectives. Market intelligence databases were leveraged to track product launches, M&A activity, and distribution network expansions across major regions.

Data points were cross-verified through a multi-layered validation process, ensuring consistency and accuracy. Segmentation models were developed to capture variations in type, formulation, crop application, and distribution channel dynamics. Regional analyses were informed by localized field data and government reports. Competitive benchmarking incorporated financial disclosures and product pipelines to profile strategic trajectories of leading players.

Synthesizing Core Findings and Future Outlook for the Strobilurin Fungicide Domain: Bridging Analytical Insights with Strategic Foresight for Informed Decision-Making

Throughout this executive summary, we have explored the fundamental role of strobilurin fungicides in modern agriculture, from their biochemical origins to their strategic applications in diverse cropping systems. We examined how technological advancements and regulatory shifts have redefined product development and market positioning, as well as the ripple effects of recent United States tariffs on supply chain strategies.Our segmentation insights highlighted the importance of targeted approaches based on active ingredient, formulation type, crop type, application method, and distribution channel preferences. Regional analyses underscored significant disparities in adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific, while company profiling revealed a dynamic competitive landscape driven by innovation and partnership.

By integrating these threads, it becomes clear that success in the strobilurin fungicide market depends on agility, strategic foresight, and collaborative execution. As the sector continues to evolve, stakeholders who embrace data-driven decision-making and sustainable practices will be best positioned to capture value and drive long-term growth.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Azoxystrobin

- Fluoxastrobin

- Kresoxim-methyl

- Picoxystrobin

- Pyraclostrobin

- Trifloxystrobin

- Formulation

- Liquid Formulations

- Solid Formulations

- Crop Type

- Cereals & Grains

- Barley

- Maize

- Rice

- Wheat

- Fruits And Vegetables

- Fruits

- Apple

- Citrus

- Grapes

- Strawberry

- Vegetables

- Onion

- Potato

- Tomato

- Fruits

- Oilseeds And Pulses

- Oilseeds

- Canola Rapeseed

- Peanut

- Soybean

- Sunflower

- Pulses

- Beans

- Chickpeas

- Lentils

- Peas

- Oilseeds

- Turf & Ornamentals

- Cereals & Grains

- Application Method

- Foliar Spray

- Post-Harvest Treatment

- Seed Treatment

- Soil Treatment

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ADAMA Agricultural Solutions Limited

- BASF SE

- Bayer AG

- Corteva, Inc.

- FMC Corporation

- Pro Farm Group Inc.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta Global AG

- UPL Limited

- Ishihara Sangyo Kaisha, Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Strobilurin Fungicide market report include:- ADAMA Agricultural Solutions Limited

- BASF SE

- Bayer AG

- Corteva, Inc.

- FMC Corporation

- Pro Farm Group Inc.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta Global AG

- UPL Limited

- Ishihara Sangyo Kaisha, Ltd.

Table Information

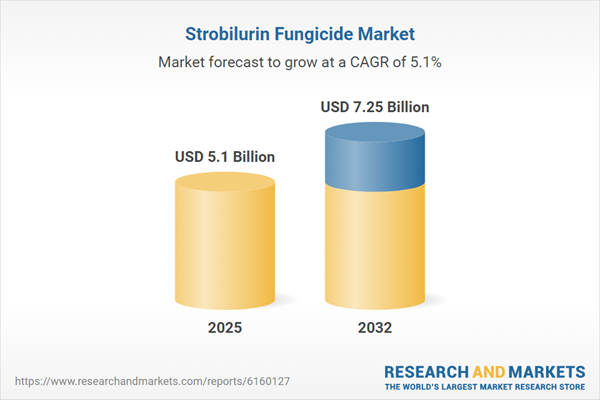

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 7.25 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |