Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Critical Role and Importance of Aerospace Aluminum Alloys in Driving Innovation, Efficiency, and Sustainability in Aircraft Manufacturing

The aviation industry's relentless pursuit of performance, efficiency, and sustainability has placed aluminum alloys at the forefront of advanced aircraft design. Over the last decade, progressive enhancements in alloy composition and processing techniques have not only bolstered mechanical strength and fatigue resistance but have also unlocked new possibilities for lightweight structures that can meet rigorous safety and environmental standards. Against the backdrop of rising fuel costs and escalating regulatory pressures, manufacturers and suppliers are seeking materials that balance cost-effectiveness with uncompromised reliability.Examining the trajectory of aluminum alloy development reveals a pattern of convergence between metallurgical expertise and digital manufacturing capabilities. Computational modeling has enabled rapid optimization of alloy chemistries, while additive and subtractive manufacturing methods have introduced unprecedented geometric freedoms, driving down component weight without sacrificing structural integrity. As a result, aerospace engineers now harness a wider array of aluminum-based solutions that address both conventional load-bearing requirements and emerging applications such as unmanned systems and urban air mobility.

Moreover, the integration of sustainability objectives has expanded the scope of aluminum alloy utilization. Innovations in recycling processes, life cycle assessment, and closed-loop manufacturing frameworks have become essential considerations for stakeholders throughout the value chain. In essence, the current landscape demands a holistic understanding of how aluminum alloys can deliver multifaceted benefits-ranging from enhanced fuel economy to reduced carbon footprints-while simultaneously supporting evolving design paradigms in next-generation aircraft.

Revolutionary Technological Advances and Material Innovations Reshaping Aerospace Aluminum Alloy Production and Application Across the Aviation Sector

The aerospace aluminum alloy ecosystem is undergoing a seismic transformation fueled by technological breakthroughs and evolving market demands. First, the advent of high-strength, corrosion-resistant alloy formulations has enabled engineers to push the envelope of airframe design, achieving weight savings that translate directly into extended range and reduced operational costs. These advancements have been underpinned by the application of artificial intelligence in materials discovery, where machine learning algorithms analyze vast metallurgical datasets to predict optimal alloy compositions and heat-treatment parameters.Simultaneously, additive manufacturing and robotics have begun to redefine production workflows. Complex geometries that were once prohibitive or cost-inefficient to machine can now be fabricated with precision, minimizing material waste and accelerating prototyping cycles. As these digital technologies mature, we are witnessing a shift from centralized fabrication hubs to more agile, decentralized production networks-a trend that enhances supply chain resilience while reducing lead times.

Environmental stewardship has also reshaped industry priorities. Producers are implementing more energy-efficient smelting processes and integrating recycled aluminum into new alloy streams, setting new benchmarks for circularity. Concurrently, regulatory bodies are tightening emissions and recycling standards, compelling manufacturers to adopt more transparent life cycle assessment methodologies. Together, these forces are driving an era of transformative innovation, where the confluence of advanced materials science and digital manufacturing is recasting the very foundation of aerospace aluminum alloy production.

Assessing the Far Reaching Effects of United States Tariff Policies Implemented in 2025 on Cost Structures and Global Aluminum Alloy Supply Chains

In 2025, the imposition of revised United States tariff measures introduced a complex dynamic into the global trade of aviation-grade aluminum alloys. By elevating import duties on select alloy categories, the policy forced supply chain stakeholders to revisit sourcing strategies and cost allocation models. Several leading distributors responded by diversifying their supplier base, partnering with mills in lower-tariff jurisdictions to stabilize procurement costs and maintain production continuity.However, the tariff adjustments produced ripple effects that extended beyond immediate input costs. Some manufacturers accelerated onshoring initiatives, investing in domestic extrusion, forging, and plating facilities to mitigate the uncertainties associated with fluctuating trade policies. While these capital expenditures have bolstered national production capacity, they have also introduced short-term operational challenges as new plants scale up and qualify critical aerospace alloys to stringent certification standards.

Globally, the tariff environment has spurred increased collaboration between non-US suppliers and regional assemblers, leading to novel trade routes and bonded warehousing solutions. This reconfiguration has enhanced the flexibility of just-in-time delivery models, yet it has also necessitated more sophisticated logistics planning to manage cross-border compliance, inventory levels, and duty-optimization strategies. As a result, industry participants must continuously calibrate their approach to sourcing and distribution in order to maintain competitive pricing while preserving the integrity of critical aerospace components.

Uncovering Deep Segmentation Insights Across Product Forms, Manufacturing Processes, Aircraft Types, Applications, and End Use Categories Driving Market Dynamics

A nuanced view of the aluminum alloy market reveals distinct performance and adoption patterns across various product forms and processes. In segments where extruded profiles prevail, complex cross-sectional components benefit from streamlined shaping and consistent mechanical properties. Forgings, by contrast, excel in high-stress applications due to their refined grain structure, while sheet plate solutions remain indispensable for large, contoured airframe assemblies where formability and weldability are critical.The manufacturing process landscape further diversifies material performance. Casting techniques offer cost-effective solutions for intricate parts but require advanced control measures to minimize porosity and ensure fatigue resistance. Extrusion continues to dominate cylindrical and profile-based components, whereas forging and rolling processes are favored for applications demanding superior tensile strength and uniformity.

Aircraft type segmentation sheds light on divergent alloy requirements. Fixed wing platforms emphasize weight reduction and corrosion resistance to optimize long-range missions, while rotary systems prioritize impact toughness and fatigue life in dynamic operating environments. Within these categories, application areas present unique demands: airframe structures seek a balance of stiffness and ductility, engines and turbines focus on heat tolerance, fuel systems demand high purity and pressure resilience, interior components call for formability and acoustic dampening, and landing gear assemblies require unparalleled toughness and dimensional stability.

End use considerations underscore the specialized nature of demand. Business jets often adopt premium alloys for luxury cabin and performance enhancements, commercial aircraft systems leverage high-volume production alloys to control cost and execution timelines, defense aircraft deploy ultra-high-strength grades for mission-critical reliability, and unmanned aerial vehicles exploit ultra-lightweight composites and alloys for extended flight endurance.

Mapping Regional Growth Patterns and Demand Drivers in the Americas, Europe Middle East & Africa, and Asia Pacific Aviation Aluminum Alloy Markets

Regional variances in aviation aluminum alloy utilization reflect broader economic and strategic considerations. In the Americas, concerted efforts to revitalize domestic manufacturing have led to expansions in extrusion capacity and forging facilities. These investments are driven by a desire to secure strategic autonomy and reduce exposure to geopolitical disruptions, resulting in robust demand for alloys optimized for structural and dynamic performance.Europe, the Middle East, and Africa present a heterogeneous landscape where legacy aerospace strongholds coexist with emerging production hubs. Western European nations continue to invest heavily in metallurgy research and green manufacturing initiatives, while the Middle East incentivizes facility development through public-private partnerships. In Africa, growing general aviation and defense projects are fostering pilot programs that integrate high-quality aluminum alloys for both legacy and next-generation platforms.

In Asia-Pacific, rapid fleet expansions and infrastructure investments underpin sustained growth. Regional aircraft manufacturers are collaborating with local alloy producers to customize products for humid and coastal environments, emphasizing corrosion resistance and lifecycle durability. Meanwhile, allied military procurements in key countries are driving the adoption of advanced forgings and sheet alloys for tactical and transport aircraft. Across all zones, regional supply chain integration and strategic stockpiling practices are shaping long-term procurement strategies and material qualification pathways.

Examining Strategic Initiatives, Collaborations, and Competitive Advantages of Leading Players Shaping the Aerospace Aluminum Alloy Industry Landscape

Leading industry participants are leveraging strategic collaborations, capacity enhancements, and proprietary technologies to solidify their market positions. Several multinational aluminum producers have entered joint development agreements with aerospace OEMs to co-create alloys that meet next-generation performance benchmarks, focusing on enhanced fatigue life and weight efficiencies.Key players are also expanding downstream capabilities by integrating value-added services such as precision machining, heat treatment, and surface finishing. This vertical alignment enables tighter control over quality standards and reduces time-to-market for custom components. Investment in digital platforms has further bolstered real-time monitoring of extrusion and forging lines, increasing yield rates and accelerating process optimization.

In addition, some innovators are piloting closed-loop recycling systems in partnership with major carriers and maintenance organizations. These initiatives recover high-quality chips and scrap from end-of-life components, feeding them back into primary production streams. Such efforts not only reinforce sustainability credentials but also provide a hedge against raw material cost volatility.

Collectively, these strategic moves have facilitated a competitive environment where agility, technological prowess, and supply chain integration define leadership. By continuously refining alloy formulations and operational models, standout companies are setting new performance standards and reshaping the industry architecture.

Strategic Actionable Recommendations for Industry Leaders to Propel Growth, Enhance Competitiveness, and Drive Sustainable Innovation in Aerospace Aluminum Alloy

Industry leaders should prioritize innovation pipelines that integrate advanced data analytics with metallurgical research to accelerate the development of next-generation alloys. By allocating resources to pilot programs and forging alliances with academic centers, organizations can shorten time-to-qualification and achieve performance breakthroughs in areas like thermal fatigue and extreme environments.Furthermore, establishing regional centers of excellence-complete with localized extrusion, forging, and finishing capabilities-will enhance supply chain resilience and reduce lead times. These hubs can also serve as testbeds for sustainable manufacturing practices, including closed-loop recycling and energy-efficient process upgrades. Aligning these efforts with regional regulatory frameworks will ensure compliance and position companies as sustainability leaders.

Optimizing inventory management through digital twin simulations and predictive demand modeling can minimize working capital tied up in raw material stockpiles. Such tools enable dynamic rebalancing of inventories across distribution nodes, reducing the impact of tariff fluctuations and logistical bottlenecks.

Lastly, embracing collaborative innovation ecosystems that bring together suppliers, OEMs, and end users will catalyze holistic solutions. Joint ventures, consortiums, and co-development agreements can bridge capability gaps and enable shared risk structures, paving the way for modular design approaches and standardized qualification pathways.

Comprehensive Research Methodology Detailing Data Collection, Analysis Techniques, and Validation Processes Underpinning Insights on Aerospace Aluminum Alloys

The insights presented here are founded upon a rigorous blend of secondary research and primary validation. Industry publications, scientific journals, and regulatory filings provided a robust base of background information on alloy compositions, processing techniques, and application benchmarks. These data sources were supplemented by detailed studies of technical standards and compliance requirements across leading aviation authorities.Complementing the secondary analysis, a series of structured interviews and workshops were conducted with engineers, procurement specialists, and material scientists from both OEMs and tier-one suppliers. These engagements furnished qualitative perspectives on emerging challenges, innovation priorities, and supply chain strategies.

Quantitative analysis techniques-including trend mapping and scenario modeling-were employed to interpret trade flows, production capacity movements, and cost factor influences. Data triangulation methods ensured the alignment of disparate inputs, while iterative validation cycles refined key findings and eliminated inconsistencies.

Finally, all proprietary information was anonymized in accordance with confidentiality protocols, and the research process adhered to strict ethical guidelines. The resulting framework delivers a comprehensive, multi-dimensional view of the aviation aluminum alloy landscape, equipping stakeholders with actionable intelligence.

Synthesis of Key Findings and Forward Looking Perspectives on the Future Trajectory of the Aviation Aluminum Alloy Industry Ecosystem

The analysis underscores how evolving material science, geopolitical dynamics, and digital manufacturing are converging to redefine aerospace aluminum alloy usage. From the impact of recent tariff policies to the strategic moves of key industry players, stakeholders face a multifaceted environment where agility and innovation are paramount.Segmentation and regional insights highlight the importance of tailored alloy solutions that align with specific production processes, aircraft applications, and geographic demands. At the same time, the growing focus on sustainability and supply chain resilience is driving unprecedented collaboration among OEMs, suppliers, and research institutions.

As the industry advances, companies that effectively integrate cutting-edge alloy formulations with streamlined manufacturing networks will lead the next wave of performance gains. By leveraging data-driven decision-making and forging strategic partnerships, organizations can navigate the complexities of material procurement, regulatory compliance, and evolving customer expectations.

In sum, the future trajectory of aviation aluminum alloys will be defined by the interplay of technological ingenuity, operational adaptability, and a steadfast commitment to environmental stewardship. This synthesis of insights provides a roadmap for decision-makers seeking to capitalize on emerging opportunities and mitigate evolving risks.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Form

- Extruded Profiles

- Forgings

- Sheet Plate

- Manufacturing Process

- Casting

- Extrusion

- Forging

- Rolling

- Aircraft Type

- Fixed Wing

- Rotory

- Application

- Airframe Structures

- Engines & Turbines

- Fuel Systems

- Interior Components

- Landing Gear

- End Use

- Business Jets

- Commercial Aircraft

- Defense Aircraft

- Unmanned Aerial Vehicles

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Alcoa Corporation

- Constellium SE

- Kaiser Aluminum Corporation

- Aleris Corporation

- Arconic Corporation

- Rio Tinto Group

- Norsk Hydro ASA

- UACJ Corporation

- AMAG Austria Metall AG

- Hindalco Industries Limited

- China Hongqiao Group

- Aluminum Corporation of China Limited

- Rusal

- Century Aluminum Company

- JW Aluminum

- Emirates Global Aluminium

- Vedanta Limited

- VSMPO-AVISMA Corporation

- Kamensk-Uralsky Metallurgical Works

- Materion Corporation

- Allegheny Technologies Incorporated

- Nippon Light Metal Holdings Company, Ltd.

- Kobe Steel, Ltd.

- Shandong Xinfa Group

- East Hope Group

- South32 Limited

- China Zhongwang Holdings Limited

- Aluminium Bahrain B.S.C.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Aviation Aluminum Alloy market report include:- Alcoa Corporation

- Constellium SE

- Kaiser Aluminum Corporation

- Aleris Corporation

- Arconic Corporation

- Rio Tinto Group

- Norsk Hydro ASA

- UACJ Corporation

- AMAG Austria Metall AG

- Hindalco Industries Limited

- China Hongqiao Group

- Aluminum Corporation of China Limited

- Rusal

- Century Aluminum Company

- JW Aluminum

- Emirates Global Aluminium

- Vedanta Limited

- VSMPO-AVISMA Corporation

- Kamensk-Uralsky Metallurgical Works

- Materion Corporation

- Allegheny Technologies Incorporated

- Nippon Light Metal Holdings Company, Ltd.

- Kobe Steel, Ltd.

- Shandong Xinfa Group

- East Hope Group

- South32 Limited

- China Zhongwang Holdings Limited

- Aluminium Bahrain B.S.C.

Table Information

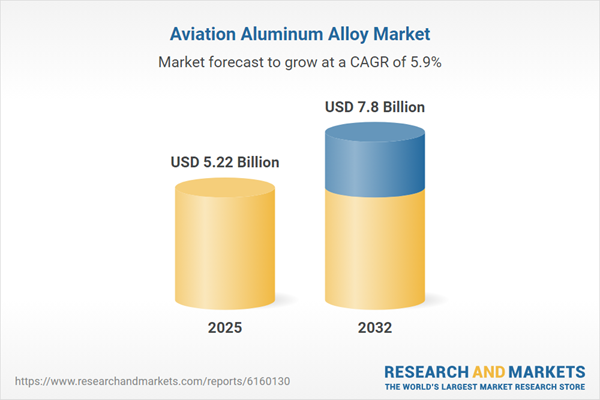

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 5.22 Billion |

| Forecasted Market Value ( USD | $ 7.8 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |