Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for the Coated Ducts Market Evolution as Innovative Applications Drive Operational Efficiency and Structural Reliability in Modern Industries

Coated ducts serve as the lifeblood of modern industrial and commercial infrastructure, offering protection against corrosion, thermal degradation, and mechanical wear. Their relevance spans a wide array of sectors, from chemical processing facilities that demand high resistance to aggressive compounds, to commercial high-rise complexes seeking energy-efficient HVAC solutions. Given the intensifying focus on sustainability and operational uptime, these coated conduits have emerged as indispensable components in optimizing system longevity and performance.Recent technological advancements have enabled coating formulations that combine enhanced adhesion, ultraviolet resistance, and improved barrier properties, which work together to mitigate maintenance cycles. Simultaneously, end-users are placing greater emphasis on lifecycle cost management, prompting suppliers to innovate with thinner yet tougher layers that reduce material usage without sacrificing durability. Consequently, coated duct applications have expanded beyond traditional climates, finding new roles in coastal installations, pharmaceutical cleanrooms, and food processing plants where hygiene and contamination control are paramount.

Moreover, the integration of digital monitoring tools is elevating performance tracking, with sensor-embedded coatings providing real-time data on temperature fluctuations and corrosion progression. This convergence of smart infrastructure and advanced material science sets the stage for a transformative trajectory. As we move forward, the following sections will delve into specific shifts in regulatory frameworks, tariff impacts, and segmentation strategies, laying the groundwork for informed decision-making in this dynamic field.

How Regulatory Shifts Emerging Technologies and Market Forces Transform the Coated Ducts Landscape Across Global Operations

Over the past few years, the coated ducts sector has undergone significant evolution driven by tightening environmental regulations and escalating demands for energy conservation. Government agencies across key regions have introduced stricter emission controls and mandated more rigorous thermal insulation standards, compelling manufacturers to adopt eco-friendly coating chemistries and implement renewable energy considerations throughout the supply chain. As a result, industry stakeholders are increasingly prioritizing low-volatile organic compound (VOC) formulations and leveraging recycled material content without compromising product integrity.Concurrently, the rise of Industry 4.0 has spurred the adoption of digitalization strategies aimed at enhancing operational transparency and predictive maintenance capabilities. Smart coatings embedded with micro-sensors are now capable of transmitting real-time data on temperature shifts, humidity levels, and corrosion rates to centralized monitoring platforms. This innovation not only reduces unplanned downtime but also aligns with broader corporate sustainability objectives by optimizing resource utilization and extending service intervals.

Furthermore, as coating technologies advance to address lightweight designs and improved thermal performance, materials such as ceramic composites and next-generation polymers are gaining traction. These developments, coupled with shifting customer preferences toward modular and pre-insulated duct assemblies, are reshaping competitive dynamics. In turn, suppliers are expanding R&D investments, forging strategic alliances with raw material providers, and exploring geographic diversification to reinforce resilience against trade uncertainties and supply disruptions.

Assessing the Cumulative Impact of New United States Trade Tariffs on Coated Ducts Manufacturing Supply Chains and Pricing Dynamics in 2025

The introduction of additional United States tariffs on coated duct components in early 2025 has prompted a comprehensive reassessment of global supply chain configurations. Manufacturers that previously relied on key imports have faced increased costs for raw materials and finished goods, triggering a ripple effect that extends from procurement strategies to end-user pricing structures. In response, many producers have accelerated the diversification of their supplier base, seeking alternative sources in regions with favorable trade agreements and lower logistics expenses.Consequently, nearshoring initiatives have gained momentum, with firms relocating coating operations closer to major U.S. markets. This shift not only offsets the direct impact of import duties but also reduces lead times and mitigates currency fluctuation risks. At the same time, companies are investing in advanced coating equipment domestically to increase local value addition and qualify for potential tariff exclusions under evolving trade policies.

However, the tariff-driven cost pressures have not been uniform across all product categories. More complex composite coatings requiring specialized resins and proprietary pigments remain susceptible to higher duty classifications, whereas standard metallic and polymeric formulations can be sourced from a broader array of suppliers with lower tariff burdens. As a result, firms that balance cost-effective procurement with targeted R&D in alternative chemistries stand to preserve margin integrity and sustain market competitiveness.

Uncovering the Most Impactful Market Segmentation Drivers Shaping Material Insulation Size Shape Industry Applications and Distribution Strategies

A closer look at the segmentation framework reveals the nuanced drivers steering development across multiple dimensions. Based on material, coated duct performance diverges sharply between ceramic coatings renowned for extreme heat resistance, metallic coatings prized for structural reinforcement, and polymeric coatings that strike a balance between corrosion protection and cost efficiency. Within the polymeric category, subtypes such as Polyethylene (PE), Polypropylene (PP), and Polyvinyl Chloride (PVC) each present distinctive benefits and application pathways.Turning to insulation type, the dichotomy between double wall and single wall designs underscores an emphasis on thermal management. Double wall variants, encompassing both field insulated and pre-insulated configurations, cater to projects demanding rapid installation and consistent performance, while single wall options offer simplified fabrication for less demanding environments. The choice of duct size further refines specification, as large ducts exceeding 400 mm tend to be deployed in heavy industrial settings, medium units between 200 mm and 400 mm align with commercial HVAC systems, and small ducts under 200 mm find use in specialist laboratory and pharmaceutical contexts.

Moreover, shape plays a critical role in system design, with rectangular profiles optimizing space utilization in tight mechanical rooms, round ducts facilitating smoother airflow with minimal pressure loss, and spiral constructions offering both aesthetic appeal and enhanced rigidity. On the end-use front, commercial installations such as office buildings, industrial applications across chemical, food & beverage, and pharmaceuticals, and residential settings each impose distinct regulatory and performance requirements. Finally, distribution channels span offline avenues-encompassing direct sales and distributor/supplier networks-and online platforms that provide streamlined ordering and digital storefront experiences.

Revealing Regional Variances in Demand Supply Chain Complexity and Growth Potential Across Americas EMEA and Asia Pacific Markets

Regional dynamics play an instrumental role in shaping coated duct demand patterns, driven by localized regulatory frameworks, economic infrastructure projects, and climate considerations. In the Americas, aging commercial and industrial facilities are fueling retrofit waves, prompting an uptick in pre-insulated and polyethene-based coating solutions that deliver rapid deployment and robust thermal control. Moreover, aggressive federal and state-level energy efficiency mandates continue to incentivize facility owners to upgrade existing duct systems, resulting in sustained aftermarket activity.Meanwhile, Europe, Middle East & Africa (EMEA) presents a complex tapestry of sub-regional nuances. Stringent European Union directives on carbon emissions and circular economy targets have catalyzed adoption of low-VOC and recyclable coating materials. In the Middle East, rapid infrastructure development and extreme ambient temperatures are driving uptake of ceramic and advanced reflective coatings, whereas parts of Africa are embracing modular double wall assemblies to streamline construction timelines in burgeoning commercial hubs.

The Asia-Pacific region, characterized by accelerated urbanization and expansive public works programs, is emerging as a pivotal growth arena. Nations undertaking massive smart city and high-speed rail projects are prioritizing fire-resistant and antimicrobial duct linings, responding to health and safety imperatives. At the same time, domestic manufacturing expansion in key economies has fostered localized supply chains and joint ventures, enabling regional players to compete effectively on cost and speed to market.

Analyzing Competitive Benchmarking Product Innovation and Strategic Partnerships Among Leading Coated Ducts Manufacturers Worldwide

Leading organizations in the coated ducts sector have differentiated themselves through a combination of product innovation, strategic alliances, and targeted geographic expansion. Several top-tier manufacturers have introduced novel coating formulations that integrate nanomaterials to enhance barrier protection and reduce material thickness, thereby lowering weight and cutting transportation expenses. Others have formed joint ventures with insulation specialists to supply pre-insulated assemblies as turnkey solutions, streamlining the procurement process for large-scale projects.In addition to R&D collaborations, strategic partnerships with logistics providers and installation contractors have enabled expedited delivery and certified installation standards, bolstering service offerings. Some companies have also pursued acquisitions to secure access to proprietary polymer blends and specialty pigments, broadening their portfolio of high-performance options. Concurrently, a number of key players have expanded their footprint by establishing regional manufacturing hubs, mitigating tariff exposures and tailoring products to local code requirements.

Furthermore, an increasing number of providers are leveraging digital platforms to offer value-added services such as virtual duct configuration tools, sample tracking systems, and post-installation monitoring dashboards. This convergence of product excellence and digital engagement underscores a competitive landscape in which agility, technical depth, and customer experience form the cornerstones of lasting differentiation.

Formulating Actionable Strategies for Industry Leaders to Optimize Operations Enhance Collaboration and Drive Sustainable Growth in Coated Ducts Market

To thrive amid evolving regulatory demands and shifting supply chain dynamics, industry leaders should consider a multipronged strategic approach. First, investing in advanced coating R&D pipelines-particularly those focused on digital sensing capabilities and eco-friendly chemistries-can deliver long-term differentiation. By collaborating with academic and research institutions, firms can accelerate their product roadmaps and stay ahead of compliance requirements.Second, diversifying procurement footprints through regional manufacturing hubs and backup suppliers will enhance resilience against tariff fluctuations and logistical disruptions. Companies can further strengthen this approach by forging alliances with global distributors that possess deep local penetration and technical installation expertise. Together, these partnerships can reduce lead times and improve customer responsiveness.

Third, integrating digital tools across sales, production, and aftermarket service functions will create a unified data environment, enabling predictive maintenance offerings and dynamic pricing models. Such capabilities not only foster higher customer loyalty but also unlock new revenue streams through subscription-based monitoring services.

Finally, embedding sustainability into corporate strategy-by establishing rigorous recycling programs for spent coating materials and adopting carbon footprint tracking-will resonate with stakeholders across end-use industries. With ESG considerations ascending in boardroom agendas, proactive measures to minimize environmental impact can reinforce brand reputation and support premium positioning.

Detailing the Systematic Research Approach Combining Qualitative and Quantitative Techniques to Ensure Robust Data Integrity and Market Understanding

This analysis is grounded in a robust, multi-tiered research framework designed to ensure data integrity and practical relevance. Primary research encompassed in-depth interviews with coating technology experts, HVAC engineers, procurement directors, and senior executives representing end-use industries. These conversations provided qualitative insights into emerging challenges, priority performance attributes, and buying behaviors across diverse geographic corridors.Secondary research involved extensive review of industry publications, trade journals, regulatory filings, and technical white papers from authoritative sources. This step allowed for the cross-verification of raw data and the identification of prevailing trends in material science, compliance standards, and commercial adoption rates.

Quantitative analysis was conducted by aggregating proprietary shipment records, production statistics, and trade data, which were then normalized and examined through statistical modeling. Where applicable, triangulation techniques were applied to reconcile divergent data points, ensuring a high degree of accuracy and confidence in the findings.

Expert panels and peer reviews served as a final validation layer, challenging assumptions, refining segment definitions, and affirming the relevance of actionable insights. Together, these methodological pillars provide a transparent and comprehensive foundation for strategic decision-making in the coated ducts domain.

Consolidating Key Findings to Provide Clear Strategic Direction on Technological Trends Regulatory Impacts and Competitive Dynamics in Coated Ducts Industry

Throughout this executive summary, the interplay of regulatory developments, tariff adjustments, and segmentation complexities has been examined to illuminate the path forward. The convergence of eco-friendly formulations, digital monitoring integrations, and supply chain resilience emerges as a core theme, underscoring the need for a holistic response that spans R&D, procurement, and customer engagement.Regional nuances further reinforce the importance of localized strategies; what succeeds in retrofit-focused Americas may differ substantially from the pre-insulated adoption surge in EMEA or the rapid infrastructure expansion across Asia-Pacific. Recognizing these subtleties is essential for maximizing returns on innovation investments and ensuring compliance with a patchwork of standards.

By benchmarking against industry leaders and embracing actionable recommendations-such as diversifying sourcing frameworks, strengthening strategic partnerships, and embedding sustainability into product roadmaps-stakeholders can secure a competitive edge. Ultimately, navigating this evolving landscape demands agility, technical acumen, and a forward-looking mindset that anticipates both challenges and opportunities in equal measure.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Material

- Ceramic Coatings

- Metallic Coatings

- Polymeric Coatings

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Insulation Type

- Double Wall

- Field Insulated

- Pre-Insulated

- Single Wall

- Double Wall

- Duct Size

- Large (>400mm)

- Medium (200-400mm)

- Small (< 200mm)

- Shape

- Rectangular

- Round

- Spiral

- End-Use Industry

- Commercial

- Industrial

- Chemical

- Food & Beverage

- Pharmaceuticals

- Residential

- Distribution Channel

- Offline

- Direct Sales

- Distributors/Suppliers

- Online

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Acesian Partners Limited

- Airmaster Equipment Emirates

- CertainTeed Corporation

- Duro Dyne LLC

- Exyte Group

- Isocab HVAC S.A.

- Kenyon Pte Ltd.

- Langdon, Inc.

- Lindab AB

- Metal-Fab, Inc.

- Novaflex Industries

- Owens Corning

- Sigma Roto Lining Pvt. Ltd

- Spiral Manufacturing Co., Inc.

- Spiral Pipe of Texas, Inc.

- TAMCO

- Thermoseal Group Ltd.

- United McGill Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Coated Ducts market report include:- Acesian Partners Limited

- Airmaster Equipment Emirates

- CertainTeed Corporation

- Duro Dyne LLC

- Exyte Group

- Isocab HVAC S.A.

- Kenyon Pte Ltd.

- Langdon, Inc.

- Lindab AB

- Metal-Fab, Inc.

- Novaflex Industries

- Owens Corning

- Sigma Roto Lining Pvt. Ltd

- Spiral Manufacturing Co., Inc.

- Spiral Pipe of Texas, Inc.

- TAMCO

- Thermoseal Group Ltd.

- United McGill Corporation

Table Information

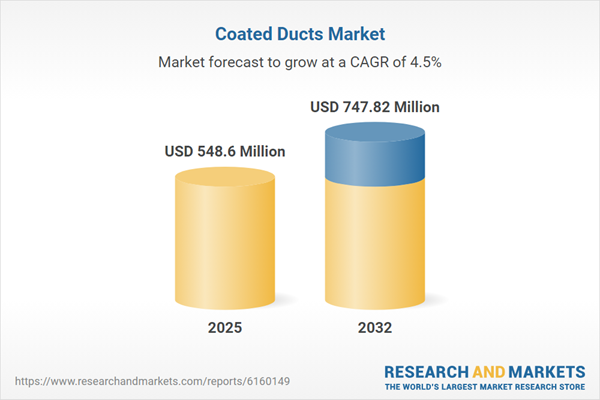

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 548.6 Million |

| Forecasted Market Value ( USD | $ 747.82 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |