Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Transformative Role of Membrane Preservatives in Safeguarding Filtration Systems and Accelerating Innovation in Global Water Treatment Solutions

Unveiling the critical role of membrane preservatives in preventing biofouling and scaling, this executive summary sets the stage for a comprehensive exploration of how advanced chemistries enhance operational longevity. As water scarcity escalates and treatment facilities face stringent purity standards, the deployment of effective preservative systems has become indispensable. Additionally, evolving regulatory frameworks are accelerating the adoption of novel solutions that balance efficacy with environmental stewardship.Moreover, membrane preservative strategies have transcended traditional water treatment applications, extending into sectors such as pharmaceuticals manufacturing and oil and gas processing. In these domains, tailored formulations mitigate microbial proliferation on membrane surfaces, optimizing filtration performance. Synthetic compounds continue to dominate large-scale industrial implementations, while natural derivatives are gaining traction in environmentally sensitive installations thanks to their biodegradability and reduced toxicity.

Consequently, stakeholders require a clear roadmap to navigate these emerging dynamics. This summary distills pivotal shifts in policy, technology, and market segmentation, providing actionable intelligence for manufacturers, end users, and investors. By illuminating key thematic drivers and analytical frameworks, it lays the groundwork for informed decision-making and strategic positioning within this complex ecosystem. This report leverages robust research methodologies and cross-industry perspectives to deliver high-fidelity insights.

Charting the Paradigm Shifts That Are Reshaping Membrane Preservation Practices and Driving Unprecedented Technological Advancements

Initially, membrane preservation relied on rudimentary inhibitors that offered limited protection against biological fouling and mineral scaling. Over time, however, incremental advances in polymer chemistry and surface science triggered a paradigm shift, enabling formulations that target specific fouling mechanisms with greater precision. Consequently, today's preservative blends exhibit enhanced compatibility with diverse membrane materials, ensuring extended service cycles and reduced maintenance interventions.Furthermore, digital transformation has become a catalyst for more intelligent preservation regimes. Real-time monitoring systems, powered by sensor arrays and data analytics, now enable predictive dosing protocols that optimize chemical usage and minimize waste. By integrating artificial intelligence with process control, operators can adapt preservative strategies on the fly, responding to feedwater fluctuations and fouling indicators with unprecedented agility.

As environmental stewardship gains prominence, sustainability has emerged as a core directive. Green preservative platforms, formulated from bio-based feedstocks and designed for facile biodegradation, are redefining industry benchmarks. Coupled with circular-economy principles and closed-loop recovery systems, these innovations are driving a holistic transformation that balances operational performance with ecological responsibility.

Analyzing the Far-Reaching Implications of the 2025 United States Tariffs on Membrane Preservative Supply Chains and Industry Costs

In 2025, the United States implemented tariffs on select membrane preservative imports, reshaping supply chain dynamics and cost structures across the industry. Manufacturers and end-users alike have confronted higher input costs, prompting a strategic reevaluation of sourcing strategies. Consequently, many suppliers have accelerated efforts to localize production, thereby mitigating exposure to tariff-induced price volatility.Beyond direct pricing impacts, the tariff regime has spurred downstream negotiations, with distributors seeking revised contract terms to absorb or pass through incremental costs. As a result, relationships between chemical producers and channel partners have become more collaborative, focusing on value-add services such as just-in-time deliveries and bespoke preservative blends that justify premium pricing through enhanced performance.

Moreover, the tariffs have galvanized investment in regional manufacturing hubs and cross-border partnerships, aiming to capitalize on tariff exemptions and trade agreements. This geographical reconfiguration not only addresses immediate cost pressures but also fosters resilience against future trade disruptions. Ultimately, stakeholders that embrace supply chain agility and strategic collaboration will be best positioned to thrive amid evolving regulatory landscapes.

Unraveling Critical Segmentation Insights to Illuminate Diverse Preservative Origins, Product Forms, Distribution Channels, Membrane Types, and End-User Applications

The membrane preservative market exhibits nuanced differentiation when viewed through the lens of preservative origin. Natural extracts have cultivated a reputation for eco-compatibility, attracting end users in environmentally regulated sectors, whereas synthetic compounds maintain dominance in high-volume industrial settings due to their cost efficiency and consistent performance. Moreover, product form exerts considerable influence on application flexibility. Chemical preservative formulations encompass specialized functions such as antifoulant and antiscalant activities, biocidal efficacy, corrosion inhibition, and precise pH adjustment, while dry and powder formats offer extended shelf life and simplified logistics for transport-intensive operations.Distribution pathways further delineate market accessibility. Direct sales relationships facilitate tailored technical support and immediate replenishment, distributors and partners deliver expansive regional coverage, and e-commerce platforms cater to fast-track procurement needs for smaller-scale operators. Additionally, the diversity of membrane platforms introduces performance-driven preservative selection. High-flux applications leveraging nanofiltration and reverse osmosis membranes demand advanced anti-fouling chemistries, while ultrafiltration modules often rely on more generalized antimicrobial and scale-inhibition strategies for routine maintenance.

Finally, end-user industries impose distinct preservative requirements. Large desalination complexes emphasize scale control and biofilm mitigation, food and beverage processors prioritize food-grade compliance, industrial water treatment facilities focus on multi-contaminant protection, municipal systems require overarching reliability, oil and gas operations demand robust compatibility with hydrocarbons, and pharmaceutical and healthcare applications necessitate the highest levels of purity and regulatory adherence. Together, these segmentation dimensions offer a comprehensive framework for strategic market positioning.

Examining Regional Dynamics That Highlight Divergent Growth Drivers, Regulatory Frameworks, and Adoption Rates Across Key Global Markets

Regional dynamics reveal distinct growth trajectories and investment priorities across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, escalating demand from desalination facilities and industrial water reuse projects has driven advancements in both synthetic and bio-derived preservative chemistries. Regional policy incentives and infrastructure modernization programs have further stimulated adoption of digital dosing systems and predictive maintenance tools.Meanwhile, Europe Middle East and Africa markets balance stringent environmental regulations with ambitious capacity expansions. Here, biocidal performance standards and circular-economy directives have elevated interest in green chemistry platforms. Strategic collaborations between local manufacturers and international technology providers have accelerated the introduction of novel preservative blends tailored to emerging membrane applications.

In the Asia Pacific, rapid urbanization and industrialization underpin a robust appetite for scalable preservative solutions. Cost efficiency remains paramount, yet an increasing focus on lifecycle sustainability is driving uptake of combined chemical and physical mitigation approaches. Consequently, manufacturers are investing heavily in regional research centers to adapt formulations to diverse feedwater profiles and regulatory landscapes.

Revealing Strategic Competitive Movements and Innovation Portfolios That Define Leadership and Foster Differentiation Among Leading Membrane Preservative Companies

Leading membrane preservative companies have adopted multifaceted strategies to secure competitive advantage. Several have expanded their innovation pipelines by investing in R&D centers focused on next-generation biocides and scale inhibitors, accelerating time-to-market for high-performance blends. Concurrently, strategic partnerships with membrane manufacturers have enabled co-development of tailor-made formulations that optimize system compatibility and streamline validation protocols.On the operational front, key players have diversified their production footprints to balance cost efficiency with supply chain resilience. Facility expansions in emerging markets complement existing capacity in established hubs, mitigating geopolitical risks and tariff disruptions. Furthermore, a growing cohort of innovators has embraced sustainability as a core differentiator, integrating renewable feedstocks and designing closed-loop recovery programs that reduce chemical waste and environmental impact.

In parallel, digitalization initiatives are emerging as a pivotal competitive axis. Several leading firms now offer remote monitoring and analytics platforms that empower end users to transition from periodic to continuous preservative management. This value-added service model not only strengthens customer loyalty but also generates actionable data to inform future product enhancements.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position

Industry leaders should prioritize the integration of bio-based chemistries into their preservative portfolios, capitalizing on growing regulatory mandates and customer preferences for sustainable solutions. By advancing research into biodegradable inhibitors and leveraging green manufacturing processes, companies can differentiate their offerings while proactively addressing environmental and compliance imperatives.In addition, stakeholders must harness data analytics and digital monitoring tools to optimize dosing strategies and preempt fouling events. Deploying predictive models that correlate feedwater characteristics with preservative performance will enable more precise chemical usage, lower operating costs, and extend membrane lifespan. Collaborative pilot projects with end users can accelerate adoption and demonstrate value in real-world conditions.

Finally, fostering strategic alliances across the value chain will amplify resilience against tariff pressures and supply chain disruptions. Joint ventures with regional manufacturers, co-development agreements with membrane producers, and consortiums focused on standardizing green chemistry benchmarks will collectively strengthen market position and drive sustainable growth.

Detailing a Rigorous Research Methodology That Ensures Uncompromising Accuracy and Analytical Depth in Market Insights

The research approach underpinning this analysis combines exhaustive secondary research with targeted primary engagements. Comprehensive reviews of industry publications, regulatory filings, and patent databases established a foundational understanding of historical trends and emerging technologies. This desk research was complemented by in-depth interviews with membrane operators, chemical suppliers, and technical consultants to capture real-time insights and validation of market dynamics.Quantitative data underwent rigorous triangulation, aligning supply-side information from manufacturing records with demand-side perspectives drawn from end-user surveys. Advanced statistical techniques, including regression analysis and scenario modeling, were employed to ensure analytical robustness. Segmentation frameworks were defined through iterative consultation with subject-matter experts, ensuring that preservative origin, product form, distribution channel, membrane type, and end-user application dimensions accurately reflect market complexities.

Quality control measures encompassed cross-verification of source data, logical consistency checks, and peer review by independent analysts. This rigorous methodology ensures that the resulting insights deliver high confidence and practical relevance for stakeholders seeking to navigate the membrane preservative landscape.

Summarizing the Imperative Insights and Foresights That Will Guide Stakeholders Through the Future of Membrane Preservation

Membrane preservatives represent a critical lever for optimizing filtration performance, reducing operational disruptions, and extending system longevity across diverse water treatment contexts. The interplay of regulatory evolution, technological innovation, and shifting cost structures underscores the need for agile strategies that harmonize efficacy with sustainability. Stakeholders who master the nuances of preservative origin, product specialization, distribution pathways, membrane compatibility, and end-user requirements will unlock significant competitive advantage.Regional market behaviors further emphasize that one-size-fits-all solutions are inadequate. From the Americas' focus on digital dosing and large-scale desalination to Europe Middle East and Africa's green chemistry imperatives and Asia Pacific's cost-driven scalability, effective market engagement demands localized approaches. Meanwhile, tariff dynamics have catalyzed a reorientation toward supply chain agility and strategic partnerships.

By synthesizing these insights with robust research methodology and actionable recommendations, this summary equips decision-makers with the framework needed to navigate current challenges and capitalize on emerging opportunities within the membrane preservative sector.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Preservative Origin

- Natural

- Synthetic

- Products

- Chemical Preservatives

- Antifoulants / Antiscalants

- Biocides

- Corrosion Inhibitors

- pH Adjusters

- Dry / Powder Preservatives

- Chemical Preservatives

- Distribution Channel

- Direct Sales

- Distributors & Partners

- E-Commerce

- Membrane Type

- Nanofiltration (NF) Membranes

- Reverse Osmosis (RO) Membranes

- Ultrafiltration (UF) Membranes

- End-User Industry

- Desalination Plants

- Food & Beverage Industry

- Industrial Water Treatment

- Municipal Water Treatment

- Oil & Gas Industry

- Pharmaceuticals & Healthcare

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Desaltek by Advanced Watertek

- Applied Membranes, Inc.

- American Water Chemicals, Inc.

- Ashland Global Holdings Inc.

- Clariant AG

- DuPont de Nemours, Inc.

- Genesys International Limited

- Hydranautics

- LANXESS AG

- Reverse Osmosis Chemicals International, Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Membrane Preservative market report include:- Desaltek by Advanced Watertek

- Applied Membranes, Inc.

- American Water Chemicals, Inc.

- Ashland Global Holdings Inc.

- Clariant AG

- DuPont de Nemours, Inc.

- Genesys International Limited

- Hydranautics

- LANXESS AG

- Reverse Osmosis Chemicals International, Ltd.

Table Information

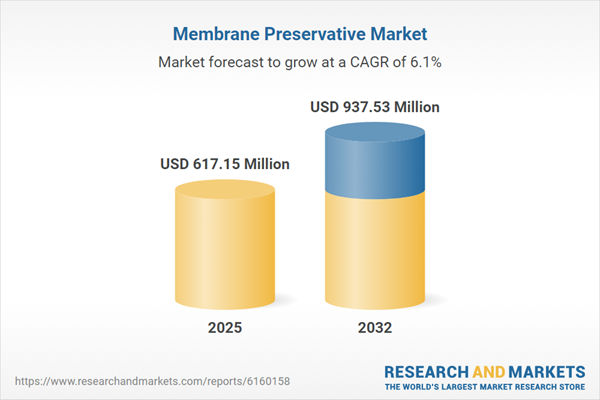

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 617.15 Million |

| Forecasted Market Value ( USD | $ 937.53 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |