Speak directly to the analyst to clarify any post sales queries you may have.

Charting the Evolution of Modern Animal Health Diagnostics with Focused Strategies and Industry Context for Decision Makers Worldwide

The animal health diagnostics sector has undergone a profound transformation as advancements in molecular biology, immunology, and digital technologies converge to reinvent approaches for disease detection, prevention, and monitoring in veterinary medicine. Diagnostic solutions now extend well beyond traditional laboratory settings, empowering practitioners with rapid point-of-care platforms and cloud-based analytics that deliver actionable insights in real time. This evolution reflects a growing appreciation of animal welfare, food safety, and zoonotic disease mitigation as essential components of global public health strategy.As livestock production systems scale to meet surging demand for animal protein, diagnostic capabilities have expanded to encompass herd-level surveillance and predictive modeling, ensuring timely intervention and supply chain resilience. Meanwhile, the proliferation of companion animals as valued family members has spurred demand for personalized diagnostic protocols, enabling early detection of genetic disorders, nutritional deficiencies, and infectious diseases. Against this backdrop, stakeholders across the veterinary value chain-ranging from biotechnology firms to research institutions-are collaboratively pursuing innovations that drive both economic efficiencies and enhanced clinical outcomes.

This executive summary distills the most salient themes shaping the animal health diagnostics market, offering a clear roadmap for decision makers aiming to navigate competitive dynamics, capitalize on emerging opportunities, and anticipate regulatory and geopolitical headwinds. Through a synthesis of market intelligence, technological breakthroughs, and strategic imperatives, the insights herein equip industry leaders to set priorities, allocate resources, and forge partnerships that will define the next era of animal health management.

Unveiling the Revolutionary Technological and Data-Driven Shifts Redefining Animal Health Diagnostics Worldwide

Over the past decade, the convergence of high-throughput sequencing, advanced bioinformatics, and miniaturized assay platforms has precipitated a paradigm shift in how veterinary diagnostics are developed, validated, and deployed. Point-of-care molecular tests that once demanded centralized laboratory infrastructure can now be performed trackside in agricultural settings or within veterinary clinics, reducing turnaround times from days to hours and enabling faster clinical decision making.Simultaneously, the integration of data science and artificial intelligence has ushered in a new era of predictive diagnostics, where machine learning algorithms analyze vast datasets of clinical records, genomic sequences, and environmental parameters to forecast disease outbreaks before they occur. This proactive stance contrasts sharply with historical approaches that largely relied on reactive intervention. The advent of multiplex assay systems capable of detecting multiple pathogens in a single run further amplifies diagnostic throughput and cost efficiency, particularly in resource-constrained environments.

Emerging digital health platforms are also expanding the diagnostic continuum by facilitating remote consultation, telemedicine integrations, and cloud-based disease surveillance networks. These interconnected systems enable seamless data sharing among veterinarians, producers, and regulatory agencies, fostering a collaborative ecosystem dedicated to safeguarding animal populations and public health. Collectively, these transformative shifts are redefining the benchmarks for accuracy, accessibility, and actionable intelligence in animal health diagnostics.

Analyzing the Complex Consequences of United States Tariff Policies on Animal Health Diagnostic Supply Chains in 2025

In 2025, a complex tariff framework introduced by the United States government has reshaped the economic calculus of importing diagnostic reagents, instruments, and software solutions from international suppliers. These levies have incrementally increased the landed cost of consumables sourced from major manufacturing hubs, prompting end users to reassess procurement strategies and explore localized production partnerships.The cumulative impact of these tariffs has manifested in elongated supply chains as organizations seek alternative routes to mitigate additional duties. Some diagnostic instrument providers have accelerated plans to establish assembly lines or manufacturing nodes within North American jurisdictions to preserve cost competitiveness and shorten delivery timelines. At the same time, reagent developers are diversifying raw material sourcing, negotiating long-term contracts with regional suppliers, and optimizing batch sizes to offset incremental costs.

Furthermore, the tariff environment has stimulated renewed interest in in-house reagent synthesis and open-platform instrument architectures that enable modular component sourcing. Veterinary diagnostic laboratories and research institutes are investing in foundational process development capabilities to reduce reliance on single-source imports. While these adaptive measures demand upfront capital, they confer strategic resilience against future tariff fluctuations and geopolitical disruptions.

Amid these dynamics, stakeholders are reassessing value propositions across service contracts, maintenance agreements, and consumable subscriptions. The imperative to balance fiscal discipline with diagnostic excellence has never been more pronounced, underscoring the importance of agile supply chain orchestration in safeguarding the continuity of animal health programs.

Synthesizing Multi-Dimensional Segmentation Data to Reveal Critical Growth Drivers and Differentiated Market Dynamics

Deep segmentation analysis illuminates distinct growth trajectories and technology adoption patterns across product, animal, disease, and end-user categories. Based on Product Type, the market is studied across Consumables, Instruments, and Software & Services, with consumables further differentiated into Probes and Reagents & Kits, and instruments subdivided into Hematology Analyzers, Immunodiagnostic Analyzers, and Molecular Diagnostic Instruments. Each segment exhibits unique cost structures, regulatory pathways, and development timelines, influencing supplier strategies and end-user purchasing behavior.Considering Animal Type, the market is studied across Companion Animal and Livestock Animals, where companion animal demand is driven by pet owner willingness to invest in advanced diagnostics for Cats, Dogs, and Horses, while livestock applications focus on herd health management for Cattle, Pigs, Poultry, and Sheep & Goats. These animal classifications determine testing volumes, service models, and the relative importance of point-of-care versus centralized laboratory solutions.

From the standpoint of Disease Type, the market is studied across Bacterial Infections, Genetic Disorders, Nutritional Deficiencies, Parasitic Infections, and Viral Infections. Diagnostic tool developers prioritize multiplex panels and rapid assays for high-incidence pathogens, while genetic disorder screening protocols are refined through advances in targeted sequencing and bioinformatics pipelines. Nutritional deficiency diagnostics leverage biomarker discovery, whereas parasitic and viral infection detection benefit from CRISPR-based and isothermal amplification techniques.

Based on End User, the market is studied across Research Institutes, Veterinary Diagnostic Labs, and Veterinary Hospitals, each with evolving requirements for throughput, regulatory compliance, and integrated reporting. Research institutes emphasize flexibility and open architecture for experimental design, diagnostic labs focus on automation and sample throughput, and hospitals prioritize near-patient testing and clinician interoperability to streamline treatment decisions.

Uncovering the Distinctive Regional Forces Shaping Adoption of Animal Health Diagnostics Across Global Markets

Regional analysis underscores three broad geographies, each defined by distinct veterinary practices, regulatory environments, and infrastructure capabilities. In the Americas, robust agricultural production and growing companion animal care budgets drive demand for integrated diagnostic platforms that support both herd-level surveillance and personalized pet health screening. The maturity of laboratory networks and widespread adoption of electronic medical records facilitate rapid deployment of cloud-based analytics and point-of-care instruments.The Europe, Middle East & Africa region presents a tapestry of regulatory frameworks, from stringent European Union compliance directives to emerging national veterinary health initiatives in Middle Eastern and African markets. Investment in diagnostic capacity is rising, supported by government programs aimed at disease eradication and food safety. Innovations in decentralized testing models address challenges in remote or resource-limited areas, while EU-based R&D hubs continue to contribute breakthroughs in assay design and quality management systems.

In Asia-Pacific, accelerating industrialization and shifting dietary preferences have heightened focus on livestock health and biosecurity. Rapidly modernizing veterinary services in China, India, Southeast Asia, and Australia foster demand for scalable diagnostic solutions capable of handling high sample volumes with minimal infrastructure. Digital integration, mobile testing units, and localized manufacturing partnerships further bolster regional adoption rates, positioning Asia-Pacific as an increasingly influential player in global animal health diagnostics.

Examining the Strategic Alliances and Technological Innovations Defining Competitive Leadership in Animal Health Diagnostics

Leading companies in animal health diagnostics are dynamically aligning research, mergers, and partnerships to solidify competitive advantage. Established instrument manufacturers continue to expand modular platforms while forging alliances with biotechnology innovators to integrate next-generation assay chemistries. Meanwhile, consumable suppliers are investing heavily in reagent stabilization technologies and kit miniaturization to enhance shelf life and ease of use in field settings.Software developers, including cloud analytics and laboratory information management systems, are diversifying their service offerings through strategic acquisitions of data analytics firms. These acquisitions enable real-time disease surveillance and predictive modeling modules that differentiate their platforms. Concurrently, contract research organizations are broadening service portfolios to encompass sample processing, genomic sequencing, and bioinformatics analysis, catering to both large pharmaceutical players and academic institutions.

Smaller specialized enterprises are carving niches by focusing on high-value segments such as genetic disorder screening and CRISPR-based diagnostics. Their agility allows for rapid assay development and expedited regulatory clearances, placing pressure on larger incumbents to accelerate innovation cycles. Cross-sector collaborations-spanning veterinary pharmaceutical firms, feed producers, and precision agriculture startups-further exemplify the ecosystem’s interconnectedness, as integrated animal health solutions become a strategic imperative for holistic herd and companion animal management.

Overall, competitive dynamics are defined by a balance between technological differentiation, supply chain resilience, and strategic partnerships, driving continuous transformation of the industry landscape.

Implementing Supply Chain Flexibility and Data-Driven Integration to Propel Leadership in Animal Health Diagnostics

Industry leaders should prioritize investments in flexible manufacturing capabilities that can swiftly adapt to fluctuating tariff environments and global supply constraints. Establishing regional production facilities and securing diversified raw material agreements will fortify supply chain resilience and protect profit margins. Concurrently, allocating resources toward modular instrument architectures and multiplex assay platforms will maximize return on investment by catering to evolving end-user demands.Elevating data integration across diagnostic workflows is essential. Decision makers must champion the development of interoperable software ecosystems that seamlessly connect point-of-care devices, centralized laboratories, and cloud-based analytics. Embedding artificial intelligence and machine learning modules into these platforms will enhance predictive capabilities and strengthen client retention through value-added services such as outbreak forecasting and treatment optimization.

To capture new market segments, companies should deepen collaboration with veterinary associations and research consortia to co-develop targeted diagnostics for emerging zoonotic threats and genetic conditions. Engaging in public-private partnerships can accelerate product validation and foster trust among regulators and end users. Furthermore, investing in robust training programs for veterinarians and lab technicians will ensure proper assay utilization, enhance diagnostic accuracy, and drive customer loyalty.

By embracing these strategic imperatives, industry stakeholders will be well positioned to harness innovation, navigate regulatory complexities, and secure sustainable growth in the dynamic animal health diagnostics market.

Detailing the Comprehensive Primary and Secondary Research Approach Underpinning Robust Animal Health Diagnostics Insights

This research methodology integrates both primary and secondary data sources to ensure a comprehensive perspective on the animal health diagnostics landscape. Secondary research comprised a review of peer-reviewed journals, regulatory filings, industry white papers, and conference proceedings to establish foundational insights into technological trends and policy frameworks.Primary research involved in-depth interviews with subject matter experts, including veterinary pathologists, laboratory managers, supply chain executives, and research scientists. These interviews were designed to validate findings from secondary sources, uncover nuanced market drivers, and identify emerging challenges in assay development, regulatory compliance, and adoption barriers.

Quantitative data was triangulated using multiple sources, including procurement records, instrument installation logs, and reagent consumption reports, to discern patterns in technology uptake, service utilization, and end-user preferences. Data validation protocols included cross-verification with financial reports, corporate presentations, and stakeholder surveys to minimize bias and ensure reliability.

The insights were synthesized using a framework that maps technological maturity, regulatory alignment, and value proposition across market segments. This structured approach enables clear identification of strategic opportunities and potential disruptors, providing a robust foundation for actionable recommendations and decision-making guidance.

Summarizing Strategic Imperatives and Collaborative Pathways for the Future of Animal Health Diagnostics

As the animal health diagnostics sector continues to evolve, the most successful organizations will be those that combine technological innovation with supply chain agility and data-driven service models. The interplay of tariffs, regulatory shifts, and emerging disease pressures underscores the need for adaptive strategies that safeguard continuity while fostering growth.Segmentation insights highlight the importance of understanding distinct end-user requirements and regional nuances, from companion animal care in mature markets to large-scale livestock surveillance in developing economies. Competitive dynamics are increasingly defined by strategic partnerships and acquisitions that expand value-added service offerings, integrate analytics capabilities, and accelerate time to market for novel diagnostics.

Actionable recommendations emphasize the imperative of modular platform development, decentralized production, and AI-enabled software ecosystems to address the dual challenges of cost containment and clinical differentiation. By aligning R&D priorities with customer pain points, executives can proactively shape product roadmaps and capture high-value opportunities in emerging disease screening and precision veterinary medicine.

Ultimately, the future of animal health diagnostics will be determined by stakeholders’ ability to harness cross-sector collaborations, leverage predictive modeling, and embed resilience into every aspect of their operations. The insights contained herein provide a strategic blueprint for navigating this dynamic environment with confidence and foresight.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Consumables

- Probes

- Reagents & Kits

- Instruments

- Hematology Analyzers

- Immunodiagnostic Analyzers

- Molecular Diagnostic Instruments

- Software & Services

- Consumables

- Animal Type

- Companion Animal

- Cats

- Dogs

- Horses

- Livestock Animals

- Cattle

- Pigs

- Poultry

- Sheep & Goats

- Companion Animal

- Disease Type

- Bacterial Infections

- Genetic Disorders

- Nutritional Deficiencies

- Parasitic Infections

- Viral Infections

- End User

- Research Institutes

- Veterinary Diagnostic Labs

- Veterinary Hospitals

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Heska Corporation

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific SE

- Neogen Corporation

- Merck & Co., Inc.

- Sysmex Corporation

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- ALS Limited

- Becton, Dickinson and Company

- bioMérieux SA

- BioNote Inc.

- Boehringer Ingelheim Vetmedica, Inc

- Boule Diagnostics AB

- BYOVET

- Ceva S.A.

- Elanco Animal Health Incorporated

- Farmlab Diagnostics

- Fujifilm Holdings Corporation

- Hester Biosciences Limited

- Promega Corporation

- Randox Laboratories Ltd

- Red Belly

- Siemens Healthineers AG

- Vetoquinol Group

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Animal Health Diagnostics market report include:- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Heska Corporation

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific SE

- Neogen Corporation

- Merck & Co., Inc.

- Sysmex Corporation

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- ALS Limited

- Becton, Dickinson and Company

- bioMérieux SA

- BioNote Inc.

- Boehringer Ingelheim Vetmedica, Inc

- Boule Diagnostics AB

- BYOVET

- Ceva S.A.

- Elanco Animal Health Incorporated

- Farmlab Diagnostics

- Fujifilm Holdings Corporation

- Hester Biosciences Limited

- Promega Corporation

- Randox Laboratories Ltd

- Red Belly

- Siemens Healthineers AG

- Vetoquinol Group

Table Information

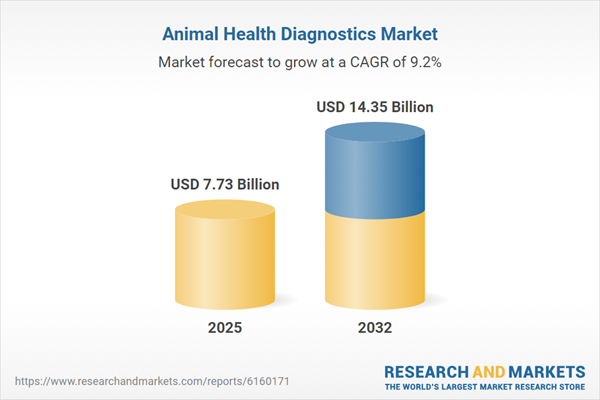

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 7.73 Billion |

| Forecasted Market Value ( USD | $ 14.35 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |