Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive strategic introduction that situates multi-rope friction hoist fundamentals within modern mining operational priorities and lifecycle considerations

This executive introduction frames the technological, operational, and commercial forces currently reshaping multi-rope friction hoist deployment across underground and surface mining contexts. The purpose of this section is to orient decision-makers to the device-level fundamentals, the evolving engineering trade-offs, and the strategic priorities that guide equipment selection, lifecycle extension, and safety assurance. Beginning with core design considerations, the narrative links mechanical architecture and control-system choices to operational reliability and total cost of ownership, while acknowledging the differentiated demands that coal mining and metal and mineral mining place on hoisting systems.Moving from fundamentals to context, the introduction highlights how workforce dynamics, regulatory regimes, and capital-program timing exert persistent influence over procurement cycles. It also emphasizes the operational imperatives of availability and maintainability, as hoisting systems commonly form a critical path in shaft access and ore transport operations. Finally, the introduction sets expectations for subsequent sections by outlining the analytic lenses applied across the study: engineering performance, supply-chain resilience, regulatory impact, segmentation nuance, and regional strategy. These lenses provide a coherent structure for the deeper analysis that follows and prepare readers to translate insights into procurement, maintenance, and investment decisions.

Overview of profound technological, operational, and sustainability-driven shifts that are redefining hoist design, service models, and mining productivity paradigms

The landscape for multi-rope friction hoists is undergoing a series of transformative shifts driven by advancements in digital controls, materials science, and systems integration alongside changing regulatory and sustainability expectations. Digitalization has extended from condition monitoring and predictive maintenance into full lifecycle analytics, enabling operators to move from reactive maintenance to data-driven availability management. At the same time, automation and remote operation capabilities reduce exposure to hazardous environments and increase operational continuity, which in turn influences hoist control architectures and human-machine interface design.Concurrently, material and manufacturing innovations are altering component longevity and maintenance profiles. High-performance rope constructions, improved drum metallurgy, and modular drum assemblies facilitate faster rebuilds and lower mean time to repair. Sustainability goals are prompting electrification and energy recovery initiatives around hoisting systems, while circular economy considerations are reshaping parts supply and aftermarket practices. Workforce shortages and skill shifts continue to pressure training programs and service delivery models, elevating the value of remote diagnostics and vendor-managed maintenance. Together these shifts are producing a marketplace that rewards integrated systems thinking, where mechanical design, digital enablement, and service models converge to deliver sustained operational advantage.

Concise analysis of how 2025 United States tariff measures have reshaped sourcing, regional manufacturing choices, and aftermarket strategies for hoist systems

United States tariff policy developments in 2025 have had discernible effects on the procurement and supply chain strategies for multi-rope friction hoist systems and their components. Tariff measures affecting inputs such as specialized steels, wire rope, and electro-mechanical components have increased the relative cost of certain imported assemblies, prompting many buyers to reassess supplier geographies and sourcing strategies. As import costs rise, procurement teams are placing greater emphasis on supplier qualification in tariff-exempt jurisdictions and on securing longer-term terms to stabilize pricing volatility.In response, original equipment manufacturers and component suppliers are adapting their commercial and operational practices. Some have accelerated regionalization of production or shifted subassembly sourcing to countries with more favorable trade relationships, while others have pursued vertical integration to preserve margin and control quality. Compliance burdens and documentation requirements have also necessitated enhanced customs and trade capabilities within procurement organizations, adding administrative cost and delaying delivery timelines in some cases. Importantly, the tariff environment has increased the attractiveness of aftermarket refurbishment and in-region rebuild capacity, as operators prioritize local serviceability and shorter lead times to avoid tariff-related delays. These cumulative effects underscore the need for strategic supply-chain planning and tariff-aware sourcing when specifying hoist systems in a rapidly evolving trade landscape.

In-depth segmentation analysis revealing how product type, drum geometry, hoisting capacity, rope configuration, application demands, and channels affect specification and service choices

Key segmentation insights derive from how distinct product and operational categories influence specification, procurement, and service strategies. Based on Product Type, differentiation between double-drum and single-drum configurations creates trade-offs in redundancy, footprint, and control complexity that inform mine-level decisions about safety, maintenance windows, and hoistroom layout. Based on Drum Diameter, the availability and engineering implications of drums sized across ranges such as 2-5 meters, less than 2.5 meters, and more than 5 meters affect rope layering behavior, torque requirements, and spatial constraints in shaft design. These diameter distinctions influence component lead times and the selection of hoisting control parameters.Based on Hoisting Capacity, categories covering 2-10 tons, less than 2 tons, and more than 10 tons map directly to the duty cycles, brake sizing, and motor powering strategies that determine overall system robustness and energy profiles. Based on Number of Ropes, the choice between four-rope hoists and six-rope hoists impinges on redundancy, rope replacement schedules, and drum groove design, all of which feed into lifecycle maintenance planning. Based on Application, the dual focus on coal mining and metal and mineral mining, with metal and mineral subdivided into copper, gold, and iron ore mining, drives variations in duty intensity, corrosive exposure, and material handling interfaces. These application differences require tailored engineering controls and materials choices. Finally, based on Distribution Channel, whether procurement occurs through offline or online pathways shapes lead time expectations, contracting frameworks, and the role of digital catalogs and e-procurement platforms in accelerating specification and purchase.

Regionally differentiated strategic insights into how Americas, Europe Middle East & Africa, and Asia-Pacific dynamics shape hoist procurement, service, and compliance priorities

Regional dynamics for multi-rope friction hoists reflect capital allocation patterns, resource endowments, and regulatory environments across the major geographies of the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, long-standing mining operations combined with ongoing investments in life-extension projects and greenfield developments create demand for systems optimized for high availability and rebuildability. This region places heightened emphasis on aftermarket support and local service capacity, and procurement teams often prioritize vendors that demonstrate rapid-response maintenance and parts delivery capabilities.In Europe Middle East & Africa, regulatory stringency, labor standards, and a strong emphasis on safety and emissions control influence hoist specifications and project approval timelines. Mines and contractors operating in this geography increasingly require compliance reporting, energy-efficient drives, and integrated safety systems. In contrast, Asia-Pacific displays a broad spectrum of needs driven by both large-scale industrial mining and smaller, remote operations; the region is a focal point for manufacturing scale, innovation in rope and drum technologies, and rapid adoption of digital monitoring. Across all regions, cross-border supply-chain strategies and regional service hubs play pivotal roles in ensuring operational continuity, with variations in import duty exposure and local content requirements affecting procurement decisions.

Focused insights on competitive positioning where engineering capability, aftersales reach, and integrated service models determine supplier preference and partnership value

Competitive dynamics among suppliers and service providers are influenced by engineering excellence, aftermarket reach, and the ability to bundle digital services with mechanical hardware. Leading equipment manufacturers are increasingly evaluated on the basis of integrated lifecycle offerings that combine robust drum and rope engineering with remote diagnostics, OEM-trained service crews, and spare-part logistics. Strategic partnerships between component specialists and systems integrators are becoming more common, as clients seek single-point accountability for complex hoist assemblies and control systems.Service providers that maintain regional rebuild centers and certified rope-handling crews provide a demonstrable advantage in shortening downtime and preserving shaft availability. Meanwhile, newer entrants and specialist firms that focus on niche offerings-such as high-performance rope constructions, energy-regenerative drives, and advanced drum wear materials-are gaining traction by addressing specific operational pain points. Additionally, commercial models are evolving: long-term service agreements and performance-based contracts are appearing alongside traditional equipment sales, reflecting a shift toward risk-sharing and outcome-based relationships that align supplier incentives with operator uptime and safety.

Actionable and prioritized recommendations for manufacturers, operators, and service providers to enhance resilience, reduce lifecycle costs, and improve hoist uptime

Industry leaders should adopt a set of practical, prioritized actions to capture operational resilience and strategic advantage. First, procurement and engineering teams should embed tariff and trade-compliance analysis into early-stage supplier selection to reduce exposure to sudden input-cost shifts and to identify tariff-neutral sourcing alternatives. Second, companies should accelerate investments in remote monitoring and predictive maintenance to reduce unplanned stoppages and to optimize rope-change intervals, thereby improving availability and lowering lifecycle costs. Third, operators and OEMs can benefit from expanding regional repair and rebuild capabilities to reduce lead times and to mitigate tariff-driven import delays.Fourth, standardization of hoist interfaces and modular drum assemblies will enable faster retrofit cycles and simplify spare-parts inventories, which is particularly important when serving diverse applications such as coal mining and copper, gold, or iron ore extraction. Fifth, firms should explore outcome-based commercial models that align incentives across vendors and operators, incentivizing uptime and continuous improvement. Finally, investing in workforce training and cross-skilling for combined mechanical-digital competencies will ensure that the organization can operate advanced control systems and derive full value from condition-based maintenance programs. Taken together, these actions create a pragmatic roadmap for enhancing reliability, controlling cost, and securing long-term operational performance.

Transparent research methodology detailing primary interviews, technical validation, expert review, and triangulation approaches used to ensure analytic rigour

The research methodology underpinning this analysis combined qualitative and quantitative techniques to generate robust, actionable findings. Primary inputs included structured interviews with engineering leaders, procurement heads, and maintenance supervisors across mining companies, OEMs, and independent service providers. These conversations explored specification preferences, maintenance practices, and the operational impacts of trade policy and digital adoption, and they informed scenario-level assessments of supply-chain responses and service model evolution.Secondary analysis incorporated technical literature, standards documentation, and component specifications to validate engineering assertions related to drum design, rope behavior, and control-system architectures. Data triangulation was achieved by cross-referencing supplier capability statements, regional trade data on relevant input categories, and case-study evidence from recent refurbishment projects. Expert review panels provided iterative validation of key insights and recommendations, while sensitivity checks assessed the resilience of conclusions under varying assumptions about tariff trajectories and adoption rates for digital maintenance tools. Finally, limitations are acknowledged with transparency: the study prioritizes structural and strategic analysis over proprietary commercial performance metrics, and readers are advised to complement these insights with site-level assessments tailored to specific operational profiles.

Conclusion synthesizing strategic imperatives that combine engineering innovation, digital operations, and supply-chain resilience to sustain hoist availability

In conclusion, the multi-rope friction hoist sector is at an inflection point where digital capabilities, supply-chain strategy, and regional service footprint collectively determine operational value. Technological advances in rope materials, drum engineering, and predictive diagnostics are improving reliability and enabling new service models, while trade-policy shifts and tariff developments in 2025 have prompted a reorientation of sourcing and aftermarket strategies. The convergence of these forces requires that stakeholders act proactively to secure parts availability, to invest in predictive and remote maintenance capabilities, and to align contracting models with uptime objectives.Ultimately, success in this evolving environment will favor organizations that integrate mechanical design excellence with robust digital operations and flexible commercial arrangements. By prioritizing regional rebuild capacity, tariff-aware sourcing, and workforce upskilling, operators and suppliers can mitigate risk and capture performance improvements. These strategic priorities form the basis for informed procurement, maintenance, and investment decisions that will sustain shaft availability and support mine productivity across diverse applications and geographies.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Double-drum

- Single-drum

- Drum Diameter

- 2-5 m

- Less than 2.5 m

- More than 5 m

- Hoisting Capacity

- 2-10 tons

- Less than 2 tons

- More than 10 tons

- Number of Ropes

- Four-Rope Hoist

- Six-Rope Hoist

- Application

- Coal Mining

- Metal & Mineral Mining

- Copper Mining

- Gold Mining

- Iron Ore Mining

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ABB Ltd.

- CIC Luoyang Heavy Machinery Co.,Ltd.

- CITIC Heavy Industries Co., Ltd.

- Eurocrane (China) Co., Ltd.

- FLSmidth A/S

- Henan Datai Machinery Equipment Co.,Ltd.

- Jinzhou Dake Mine Machinery Manufacturing Co., Ltd

- Liaoning MEC Group Co., Ltd.

- Palfinger AG

- Shanghai Yiying Crane Machinery Co., Ltd.

- Sichuan Mining Machinery (Group) Co., Ltd.

- SIEMAG Tecberg GmbH

- Talleres Zitrón, S.A.

- Thern, Inc.

- Zhejiang Guanlin Machinery Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Multi-rope Friction Hoist market report include:- ABB Ltd.

- CIC Luoyang Heavy Machinery Co.,Ltd.

- CITIC Heavy Industries Co., Ltd.

- Eurocrane (China) Co., Ltd.

- FLSmidth A/S

- Henan Datai Machinery Equipment Co.,Ltd.

- Jinzhou Dake Mine Machinery Manufacturing Co., Ltd

- Liaoning MEC Group Co., Ltd.

- Palfinger AG

- Shanghai Yiying Crane Machinery Co., Ltd.

- Sichuan Mining Machinery (Group) Co., Ltd.

- SIEMAG Tecberg GmbH

- Talleres Zitrón, S.A.

- Thern, Inc.

- Zhejiang Guanlin Machinery Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

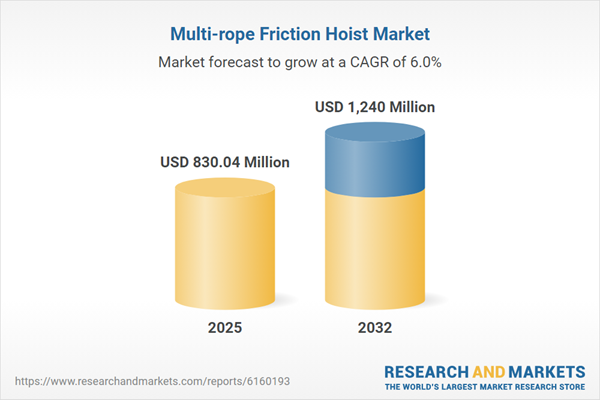

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 830.04 Million |

| Forecasted Market Value ( USD | $ 1240 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |