Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Dynamic Rise of Programmable Slow Cookers Shaping Modern Kitchens with Enhanced Automation and Culinary Innovation

Over the last decade, the programmable slow cooker has transcended its humble origins as a basic set-and-forget appliance to become a cornerstone of modern culinary convenience. Innovations in automation and user-friendly interfaces have elevated its appeal among time-pressed consumers who seek easy yet nutritious meal preparation. These appliances have woven themselves into the daily routines of households that prize reliable performance, energy efficiency, and the flexibility to experiment with complex recipes without fuss.Technological breakthroughs have driven this transformation forward. Early models with simple analog knobs paved the way for digital control systems that offer precision timing, customizable heat settings, and memory functions. The incorporation of multifunctional cooking modes further enhances versatility, enabling consumers to slow cook, sauté, or even bake within a single device. As users demand greater customization and remote access via mobile applications, the industry continues to refine hardware and software alike.

Consequently, manufacturers are aligning product roadmaps with evolving dietary trends, sustainability initiatives, and smart home ecosystems. Shifts toward plant-based diets and meal prepping culture have prompted feature enhancements such as automatic temperature adjustments and recipe-driven programs. Moving into the next phase, the programmable slow cooker stands poised to integrate seamlessly with voice assistants, smart kitchens, and the broader Internet of Things, promising a dynamic future for this once-modest appliance.

Unveiling Pivotal Transformations in Programmable Slow Cookers Driven by Smart Home Integration, Connectivity Breakthroughs, and Sustainable Cooking Trends

In recent years, the programmable slow cooker has undergone radical evolution driven by advances in connectivity and intelligent design. Beyond traditional time-and-temperature controls, the latest models feature integrated Wi-Fi and Bluetooth modules that enable remote monitoring and real-time adjustments. This connectivity revolution has not only enhanced user convenience but also opened the door to software updates and new recipe downloads, creating ongoing value long after purchase.Moreover, the shift toward sustainable cooking has influenced material selection, energy consumption patterns, and product lifecycles. Manufacturers are adopting eco-friendly ceramics, efficient heating elements, and recyclable components to appeal to environmentally conscious buyers. As a result, energy usage per cooking cycle has decreased while product durability continues to improve, bolstering brand reputation and reducing lifecycle costs for end users.

In addition, the rise of smart home platforms has accelerated integration with voice assistants and centralized control hubs. Consumers can now initiate meal programs through simple voice commands, schedule cooking sequences from mobile devices, and receive notifications when meals are ready. These transformative features have elevated programmable slow cookers from passive kitchen gear to active contributors in the connected home environment, redefining expectations and fostering brand loyalty.

Assessing Comprehensive Effects of New United States Tariffs on Programmable Slow Cooker Supply Chains, Pricing Structures, and Global Sourcing in 2025

With the introduction of new United States tariffs in 2025, companies within the programmable slow cooker sector are reevaluating their global supply chain strategies. The levies have targeted key components and finished products, prompting inward scrutiny of import sources and cost structures. This regulatory shift has heightened the importance of tariff classification, compliance protocols, and trade agreement utilization.As a direct consequence, pricing models have adjusted to accommodate increased duties on certain parts and materials. Some manufacturers have opted to absorb these costs through margin optimization, while others have implemented incremental price adjustments. These measures ensure continued competitiveness without compromising product quality, although they require meticulous financial planning and transparent communication with distribution partners.

In response to these pressures, leading companies are diversifying vendor networks and exploring nearshoring options. By cultivating partnerships with North American component suppliers and investing in local assembly lines, they mitigate tariff impact and strengthen supply chain resilience. This strategic realignment not only reduces exposure to trade fluctuations but also accelerates lead times, enhances inventory management, and fosters closer collaboration across the value chain.

Deriving Core Segmentation Insights Illuminating Diverse Product Types, Control Technologies, Capacities, End User Profiles, and Distribution Channels

Analysis of product type segmentation reveals that multifunction slow cookers, equipped with stovetop-style sauté functions and programmable searing modes, are carving out a premium niche. In contrast, standard programmable devices continue to attract budget-conscious households seeking dependable set-and-forget cooking. Understanding this dichotomy empowers manufacturers to tailor feature sets and price positioning accordingly.Similarly, control technology segmentation highlights the contrasting impacts of analog interfaces that rely on manual dials versus digital platforms offering precise temperature control and timer presets. Digital control models are gaining traction among tech-savvy consumers who value repeatable results, while analog units maintain appeal in markets where simplicity and affordability drive purchasing decisions.

Capacity segmentation further refines product portfolios by aligning vessel size with user requirements. Compact units designed for solo diners and small families cater to below-3 liter needs, whereas 3-5 liter models serve most average households. Larger above-5 liter variants are sought after by communal settings, professional kitchens, and dedicated meal preparers. This tiered approach ensures that each consumer segment finds an optimal balance of volume and footprint.

End user segmentation distinguishes commercial environments, such as catering services and institutional kitchens, from household applications, each with unique reliability and throughput demands. Parallel distribution channel segmentation underscores the continued relevance of specialty stores and supermarkets & hypermarkets for hands-on purchase experiences, alongside brand websites and eCommerce platforms that cater to digital-first buyers seeking convenience and broad product assortments. Together, these segmentation insights provide a roadmap for product development, marketing strategies, and distribution planning.

Unearthing Strategic Regional Insights Highlighting Unique Drivers, Consumer Preferences, and Growth Dynamics Across Americas, EMEA, and Asia-Pacific

North American markets exhibit strong affinity for convenience cooking, with consumers embracing programmable slow cookers as a means of streamlining weeknight meals and accommodating busy lifestyles. Health-oriented buyers prioritize features such as low-temperature searing and programmable finish times that preserve nutrients, while outdoor enthusiasts have driven demand for portable, ruggedized models suited to tailgating and camping scenarios.Within Europe, Middle East & Africa regions, premium positioning and compliance with stringent safety regulations take center stage. Consumers often lean toward products certified by leading European standards organizations, valuing sophisticated control panels and multi-stage cooking programs. Meanwhile, emerging markets in the Middle East and Africa are witnessing a surge in household adoption as electrification rates climb and disposable incomes rise, paving the way for new entrants.

In Asia-Pacific, diverse culinary traditions and growing urbanization patterns redefine product requirements. Compact units optimized for small kitchens coexist with high-capacity cookers catering to extended family gatherings. Manufacturers tailor recipes and preset programs to regional flavors, for instance by integrating rice porridge modes popular in East Asia or curry-infused slow cook settings favored in South Asia. This localization strategy enhances consumer engagement and fosters brand loyalty.

Collectively, these regional insights underscore the necessity of nuanced go-to-market approaches that reflect local taste profiles, regulatory constraints, and distribution dynamics. Global players must calibrate product assortments to resonate with each market’s distinct cultural and economic contours.

Revealing Key Competitive Company Insights Exposing Strategic Initiatives, Partnerships, and Innovation Drivers Shaping the Programmable Slow Cooker Arena

In evaluating competitive positioning, several leading companies have channeled investments into advanced research and development to introduce novel functions such as AI-driven temperature adjustment and integrated recipe libraries. This focus on innovation differentiates their offerings from commoditized entries and elevates brand perception among discerning consumers.Strategic partnerships with technology firms have further accelerated feature rollouts. By collaborating with software developers, companies have integrated mobile apps capable of remote cooking control, performance monitoring, and personalized recipe suggestions. These alliances not only expand product capabilities but also foster ongoing engagement through periodic app updates and user feedback mechanisms.

Sustainability has emerged as a key lodestar, with companies forging alliances across material science and recycling sectors to minimize environmental footprints. Cross-industry collaborations aim to develop recyclable cook vessels, biodegradable packaging, and energy-efficient heating modules. Such initiatives align with corporate responsibility goals and resonate with a growing demographic of environmentally conscious buyers.

Pricing strategies and service offerings also vary widely across the competitive landscape. Premium brands command higher price points by bundling extended warranties, digital cookbooks, and customer support portals, whereas value-oriented entrants leverage streamlined feature sets and channel-specific promotions to capture price-sensitive segments. Understanding these differentiated approaches helps stakeholders anticipate competitive moves and identify areas for strategic advantage.

Actionable Recommendations for Industry Leaders to Drive Innovation and Operational Excellence in Programmable Slow Cooker Market

To maintain a competitive edge, industry leaders should prioritize integration of advanced control technologies that enhance precision and user convenience. Investing in digital interfaces with intuitive touchscreens and companion mobile applications will satisfy the growing demand for connectivity and data-driven cooking guidance.Operational resilience can be bolstered through diversified supply networks and near-shoring strategies. By expanding partnerships with regional component suppliers and establishing localized assembly lines, companies can mitigate tariff risks, shorten lead times, and improve inventory flexibility.

Market segmentation presents rich opportunities for customization. Tailoring kitchen appliances to specific capacity requirements, such as compact models for urban dwellers and larger vessels for professional kitchens, will address the distinct needs of household and commercial users. Concurrently, aligning distribution efforts with consumer preferences-balancing tactile experiences in specialty retail outlets against seamless digital purchasing journeys-will optimize reach and customer satisfaction.

Uncovering Rigorous Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Robust Insights

The research methodology underpinning these insights combines firsthand qualitative input with comprehensive secondary analysis. Industry veterans, channel partners, product designers, and end users participated in structured interviews, providing direct observations on emerging trends, feature adoption, and procurement behaviors.Secondary research encompassed an exhaustive review of government trade statistics, regulatory filings, trade publications, and technology white papers. This layered approach not only enriched the contextual backdrop but also validated anecdotal evidence through documented industry developments.

Data triangulation ensured the fidelity of conclusions by cross-referencing quantitative findings with qualitative narratives. Comparative analysis of historical product launches and competitive moves was juxtaposed with forward-looking expert forecasts, enabling a holistic view of the programmable slow cooker market. This rigorous methodology delivers robust, actionable insights that industry stakeholders can trust.

Conclusive Perspectives on the Programmable Slow Cooker Sector Summarizing Key Findings and Highlighting Emerging Opportunities Ahead

This executive summary has illuminated the multifaceted evolution of programmable slow cookers, from analog simplicity to digital sophistication and integrated smart home ecosystems. Core segmentation across product types, control technologies, capacities, end users, and distribution channels reveals tailored pathways for market entry and expansion. In addition, regional analyses underscore the need for localized strategies that align with cultural preferences, regulatory environments, and purchasing behaviors.The assessment of new United States tariffs highlights both challenges and strategic responses, including supply chain diversification and nearshoring initiatives that enhance operational resilience. Competitive insights further demonstrate how partnerships, sustainability commitments, and feature innovation define the competitive battleground.

Looking ahead, stakeholders are encouraged to leverage these findings to refine product roadmaps, optimize channel strategies, and strengthen brand differentiation. By embracing connectivity, energy efficiency, and consumer-centric design, industry participants can seize emerging opportunities and propel long-term growth in the programmable slow cooker arena.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Multifunction

- Standard Programmable

- Control Technology

- Analog

- Digital

- Capacity

- 3-5 Liter

- Above 5 Liter

- Below 3 Liter

- End User

- Commercial

- Household

- Distribution Channel

- Offline

- Specialty Stores

- Supermarkets & Hypermarkets

- Online

- Brand Websites

- eCommerce Platforms

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Conair Corporation

- Cuckoo Appliances Private Limited

- Usha International Ltd.

- DeLonghi Group

- General Electric Company

- Haier Company

- Hamilton Beach Brands, Inc.

- Instant Pot Brands Holdings, Inc.

- Midea Group

- National Presto Industries, Inc.

- Newell Brands Inc.

- SMEG UK Ltd

- Spectrum Brands Holdings, Inc.

- Sunbeam Products, Inc.

- Tiger Corporation

- Whirlpool Corporation

- Zojirushi Corporation

- Haden by Sabichi Homewares Ltd

- Twinbird Corporation

- Lyson Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Programmable Slow Cooker market report include:- Conair Corporation

- Cuckoo Appliances Private Limited

- Usha International Ltd.

- DeLonghi Group

- General Electric Company

- Haier Company

- Hamilton Beach Brands, Inc.

- Instant Pot Brands Holdings, Inc.

- Midea Group

- National Presto Industries, Inc.

- Newell Brands Inc.

- SMEG UK Ltd

- Spectrum Brands Holdings, Inc.

- Sunbeam Products, Inc.

- Tiger Corporation

- Whirlpool Corporation

- Zojirushi Corporation

- Haden by Sabichi Homewares Ltd

- Twinbird Corporation

- Lyson Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | November 2025 |

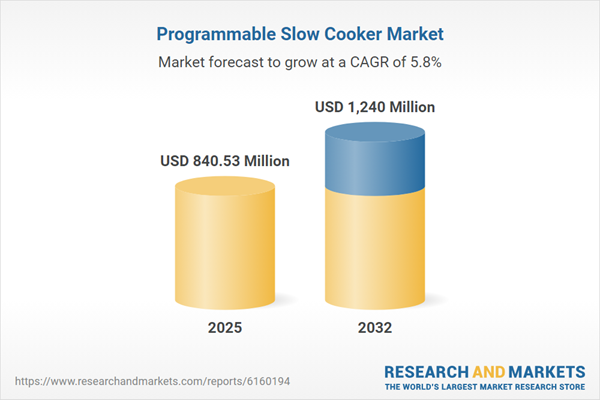

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 840.53 Million |

| Forecasted Market Value ( USD | $ 1240 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |