Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Historical Evolution of Nylon Bagging Film and Its Transformative Role in Enhancing Modern Packaging Performance Across Industries

From its inception in the mid-20th century, nylon bagging film has evolved from a niche polymer innovation into a cornerstone of modern packaging practices. Driven initially by the quest for superior mechanical strength and chemical resistance, nylon films have progressively displaced traditional materials where puncture resistance, moisture barrier properties, and load integrity are nonnegotiable. Over time, refinements in polymerization, crystallization, and orientation techniques have enhanced film uniformity and functional performance, unlocking applications across food, agricultural, chemical, and industrial sectors. As processing technologies matured, the ability to fine-tune thickness, clarity, and tensile properties led to broader acceptance in automated packaging lines and modified atmosphere packaging.Moreover, the integration of nanocomposite additives and specialty coatings has enabled films to deliver anti-fog, anti-microbial, and high-oxygen-barrier capabilities while maintaining recyclability. Meanwhile, regulatory shifts and consumer demand have compelled manufacturers to explore recycled resins and bio-based alternatives, balancing environmental stewardship with cost efficiency. In parallel, digital transformation within manufacturing facilities has introduced process monitoring, quality analytics, and supply chain transparency, collectively propelling the nylon bagging film domain into an era defined by precision, sustainability, and performance.

Identifying the Emerging Technological and Consumer-Driven Shifts That Are Reshaping the Competitive Dynamics of the Nylon Bagging Film Sector

Over the past decade, the nylon bagging film landscape has undergone transformative shifts shaped by both technological breakthroughs and changing consumer expectations. On the technology front, advancements in multilayer co-extrusion have enabled the integration of barrier layers without compromising film flexibility, while developments in biaxial orientation processes have delivered a balance of tensile strength and clarity previously unattainable. Simultaneously, the rise of smart packaging concepts has driven interest in films that can accommodate sensor integration and interactive labeling.In the marketplace, heightened emphasis on sustainability has led to a surge in demand for recycled and bio-derived polyamide variants. Consumers and regulators alike are calling for transparent supply chains and reduced carbon footprints, prompting companies to invest in closed-loop recycling programs and renewable feedstock partnerships. Furthermore, the need for bespoke packaging solutions that address specific end-use challenges-such as tamper evidence, microwaveability, and UV resistance-has intensified competition around R&D and collaborative ventures.

Consequently, manufacturers are forging alliances with specialty polymer developers, academic institutions, and technology startups to fast-track innovation cycles. At the same time, digital tools for demand sensing, predictive maintenance, and virtual sampling are streamlining product development and accelerating time to market. These converging trends are reshaping the competitive landscape, compelling stakeholders to adopt agile strategies and invest in cross-functional capabilities.

Evaluating the Far-Reaching Effects of the Newly Implemented United States Tariffs in 2025 on Global Supply Chains and Pricing in Nylon Bagging Film

The introduction of new United States tariff measures scheduled for 2025 has injected a wave of strategic reassessment across the nylon bagging film value chain. With additional duties targeting key upstream polyamide feedstocks and finished film imports, suppliers and end users are bracing for cost pressures that will reverberate through procurement budgets. Importers are exploring alternative sourcing geographies to mitigate exposure, while domestic producers are recalibrating capacity expansion plans to capture diverted trade flows. Meanwhile, buyers are renegotiating long-term agreements to hedge against volatility and preserve margin integrity.These tariff-driven dynamics are catalyzing shifts in global supply chain configurations. Some film manufacturers are evaluating nearshoring or regional manufacturing hubs to align production closer to consumption markets and bypass punitive import levies. Others are intensifying technology investments to optimize yield and reduce raw material waste, partially offsetting incremental duty costs through efficiency gains. End users, particularly in food and agriculture, are assessing packaging redesigns that use thinner films or hybrid material constructions to maintain protective performance at lower input volumes.

Moreover, the risk of retaliatory measures and evolving free trade agreements has underscored the importance of trade compliance expertise and scenario planning. Companies that proactively adapt sourcing strategies, diversify their supplier base, and invest in tariff classification audits are positioning themselves to navigate the 2025 tariff landscape with greater resilience.

Uncovering Critical Segmentation Insights That Highlight Untapped Opportunities and Complexity Within the Nylon Bagging Film Market Structure

The nylon bagging film market is defined by a multi-layered segmentation framework that encapsulates diverse production technologies and material characteristics. Based on production technology, the market encompasses cast film and extruded film manufacturing. Cast film operations further subdivide into slot die cast and T-die cast methodologies, each offering distinct surface finish and gauge control attributes. Conversely, extruded film production relies on blown film extrusion and flat die extrusion, techniques that influence film orientation and mechanical performance.Raw material segmentation reveals critical distinctions between polyamide 6 and polyamide 66 base resins. Each resin category bifurcates into co-polymer and homo-polymer variants, delivering tailored balances of thermal resistance, crystallinity, and barrier efficacy. Film type introduces an additional layer of complexity: biaxially oriented films, available in matte and transparent finishes, provide superior tensile integrity and optical properties, whereas monoaxially oriented counterparts-whether opaque or transparent-cater to strength-oriented and specialized packaging formats.

Thickness range segmentation spans films up to 75 micron, the 75 to 150 micron bracket, and films exceeding 150 micron. Within each band, further granularity exists in the form of subranges such as 5 to 25 micron and 25 to 75 micron under the up to 75 micron category or 150 to 200 micron and above 200 micron in the highest thickness division. Application segmentation underscores the versatility of nylon bagging film: agricultural packaging offers solutions for fertilizer and seed containment; chemical packaging addresses both corrosive and non-corrosive substance needs; food packaging accommodates dairy, fruit and vegetable, and meat protective films; while industrial packaging supports bulk goods and spare parts containment.

Collectively, this intricate segmentation structure highlights a landscape rich with niche growth pockets and technical differentiation opportunities, underscoring the importance of precise market positioning and targeted innovation strategies.

Assessing Regional Market Dynamics to Pinpoint Strategic Growth Drivers Across Americas, Europe Middle East & Africa and Asia-Pacific Territories

Regional market dynamics for nylon bagging film exhibit pronounced variability driven by economic activity, regulatory frameworks, and end-use sector maturity. In the Americas, established agricultural and food processing industries create a stable base demand for multilayer barrier films. The United States remains a focal point for capacity expansions and technology adoption, while Canada and key South American economies are demonstrating growing interest in high-performance films for export-driven livestock and produce markets.Across Europe, Middle East & Africa, stringent regulatory standards on packaging safety, recyclability mandates, and extended producer responsibility schemes are spurring investments in recyclable polyamide solutions. Western European nations are spearheading collaborations between film producers and waste management entities, whereas emerging economies in Eastern Europe, the Gulf Cooperation Council, and North Africa are becoming testing grounds for cost-effective packaging solutions tailored to regional agribusiness and petrochemical sectors.

The Asia-Pacific region continues to be the fastest-growing arena for nylon bagging film consumption, fueled by booming e-commerce, surging food and beverage production, and heightened industrial packaging needs. China and India are amplifying domestic polymer capacities to reduce import dependency, while Southeast Asian economies are elevating infrastructure for cold chain logistics, necessitating films with enhanced thermal stability and impact resistance. These regional variances underscore the need for market participants to calibrate their go-to-market strategies and capacity footprints according to localized demand drivers and regulatory landscapes.

Analyzing Strategic Initiatives by Leading Corporations That Are Driving Innovation, Capacity Expansion and Competitive Differentiation in Nylon Bagging Film

Leading corporations in the nylon bagging film arena have adopted multifaceted strategies to fortify their market positions and drive innovation. Some global resin suppliers have moved to integrate vertically by investing in downstream film extrusion and finishing capabilities, strengthening their control over raw material to finished product quality. Others have focused on strategic joint ventures with packaging converters and logistics partners to co-develop solutions that address end-to-end supply chain challenges.Innovation has seldom been more pronounced, as companies channel R&D resources into advanced polymer formulations, nano-additive integration, and proprietary co-extrusion techniques. These initiatives are designed to yield films with tailored barrier performance, antimicrobial properties, and recyclability features. Concurrently, capacity expansions in emerging markets-often accompanied by technology licensing agreements-are positioning these firms to capture growing demand in the food, agricultural, and industrial sectors.

Sustainability commitments have also become hallmark differentiators. Several market leaders have announced targets to increase recycled polyamide usage, implement energy-efficient manufacturing processes, and achieve zero-waste-to-landfill objectives. At the same time, investment in digital platforms for quality monitoring, predictive maintenance, and customer collaboration portals is strengthening customer loyalty and operational excellence. By blending technological prowess with strategic partnerships and sustainability leadership, these companies are crafting roadmaps for enduring competitive advantage.

Recommending Actionable Strategies for Industry Leaders to Navigate Regulatory Shifts, Sustainability Demands and Technological Advancements in Packaging Films

To thrive amid dynamic market pressures, industry leaders should prioritize a series of actionable strategies. First, investing in sustainable polymer sourcing and closed-loop recycling programs will address both regulatory expectations and consumer demand for eco-conscious packaging. By partnering with resin recyclers and waste management firms, companies can secure reliable feedstock while reducing carbon footprints.Second, embracing advanced extrusion and orientation technologies will enable the production of thinner films with enhanced barrier and mechanical properties. Deploying pilot lines for co-extrusion trials and leveraging digital twins for process simulations can accelerate product development cycles and optimize resource utilization. Concurrently, collaborating with end users to co-create custom packaging solutions will reinforce customer relationships and differentiate offerings.

Third, conducting comprehensive trade scenario analyses to navigate tariff uncertainties and supply chain disruptions will empower procurement teams to make informed sourcing decisions. Coupling these efforts with investments in regional manufacturing footprints can mitigate duty exposure and shorten lead times. Finally, adopting digital platforms that unify quality control, customer feedback, and production analytics will not only improve operational agility but also create data-driven insights for continuous improvement. Through these integrated initiatives, organizations can position themselves to capture emerging opportunities and maintain resilience against external shocks.

Detailing the Multi-Pronged Research Methodology, Data Collection Techniques and Analytical Framework Employed for This Comprehensive Market Study

The research methodology underpinning this comprehensive market study blends both secondary and primary investigative techniques. Initially, a thorough review of industry publications, technical journals, regulatory filings, and company disclosures established a foundational understanding of the nylon bagging film landscape. This desk research informed the development of a detailed segmentation framework, data triangulation model, and expert interview guide.Subsequently, primary research was conducted through in-depth interviews with industry stakeholders, including polymer scientists, manufacturing executives, procurement directors, and regulatory specialists. These discussions provided nuanced insights into emerging technologies, tariff implications, and customer requirements. Quantitative data on production capacities, material flows, and application trends were validated against proprietary databases and trade associations to ensure accuracy.

Data synthesis involved cross-referencing multiple information sources, resolving discrepancies through follow-up queries, and applying normalization techniques to create comparable datasets. Advanced analytical tools, including scenario modeling, sensitivity analysis, and growth-driver mapping, were deployed to evaluate the interplay between market forces. Finally, the study underwent a rigorous quality assurance process involving peer review, consistency checks, and validation against recent market events, ensuring robust and reliable conclusions.

Summarizing Key Findings and Strategic Implications to Guide Stakeholders Through the Evolving Landscape of Nylon Bagging Film Packaging

In conclusion, the nylon bagging film market stands at a pivotal juncture characterized by technological innovation, evolving regulatory landscapes, and supply chain realignments. The material's superior barrier properties, mechanical resilience, and adaptability have cemented its role in sectors ranging from food preservation to industrial packaging. Yet, the introduction of tariffs in the United States, shifting regional demand patterns, and sustainability imperatives present both challenges and opportunities.Strategic segmentation insights reveal a market rich with specialized niches, from co-extruded polyamide 6 variants to high-thickness films for rugged applications. Regional analyses underscore the necessity for differentiated approaches across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. Meanwhile, leading companies are demonstrating that investments in advanced extrusion technologies, circular economy initiatives, and digital integration are critical levers for competitive advantage.

Ultimately, success in this evolving landscape will hinge on the ability of industry participants to anticipate regulatory developments, engage in collaborative innovation, and realign supply chains for resilience. By leveraging the insights presented herein, stakeholders can chart informed strategies that not only navigate near-term disruptions but also capitalize on long-term growth trajectories within the dynamic nylon bagging film ecosystem.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Production Technology

- Cast Film

- Extruded Film

- Raw Material

- Polyamide 6

- Polyamide 66

- Film Type

- Biaxially Oriented

- Monoaxially Oriented

- Application

- Agricultural Packaging

- Fertilizer Packaging

- Seed Packaging

- Chemical Packaging

- Food Packaging

- Dairy Packaging

- Fruit & Vegetable Packaging

- Meat Packaging

- Industrial Packaging

- Bulk Goods Packaging

- Spare Parts Packaging

- Agricultural Packaging

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ACP COMPOSITES, INC.

- Aerovac LLC by Composites One LLC

- Airtech International, Inc.

- Diatex

- Easy Composites Ltd

- Fibre Glast Developments Corporation, LLC

- Freeman Manufacturing & Supply Company

- HEATCON Composite Systems

- Hipex Group

- K. R. Composites Pvt. Ltd.

- Kejian Polymer Materials (Shanghai) Co.,Ltd.

- Northern Composites

- PRO-VAC

- Qingdao Regal New Material Co., Ltd.

- Shanghai Leadgo-Tech Co.,Ltd

- Sil-Mid Limited

- SR Composites Pvt Ltd.

- VAC Innovation Ltd.

- Zhejiang Hengyida composite material Co., Ltd.

- Zhejiang Youwei New Materiais Co.,Ltd

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Nylon Bagging Film market report include:- ACP COMPOSITES, INC.

- Aerovac LLC by Composites One LLC

- Airtech International, Inc.

- Diatex

- Easy Composites Ltd

- Fibre Glast Developments Corporation, LLC

- Freeman Manufacturing & Supply Company

- HEATCON Composite Systems

- Hipex Group

- K. R. Composites Pvt. Ltd.

- Kejian Polymer Materials (Shanghai) Co.,Ltd.

- Northern Composites

- PRO-VAC

- Qingdao Regal New Material Co., Ltd.

- Shanghai Leadgo-Tech Co.,Ltd

- Sil-Mid Limited

- SR Composites Pvt Ltd.

- VAC Innovation Ltd.

- Zhejiang Hengyida composite material Co., Ltd.

- Zhejiang Youwei New Materiais Co.,Ltd

Table Information

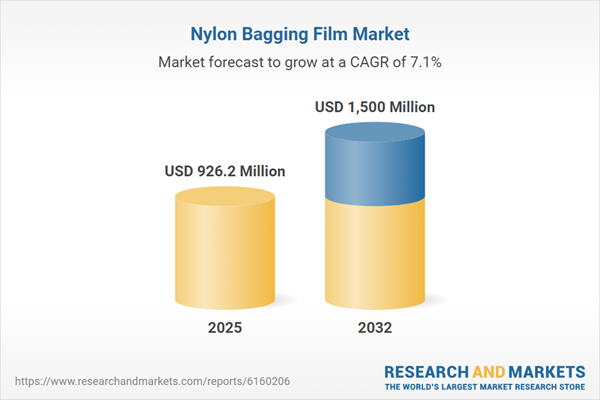

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 926.2 Million |

| Forecasted Market Value ( USD | $ 1500 Million |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |