Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Transformative Potential of Screen Printed Glass Applications Across Diverse Sectors and Technological Frontiers

Screen printed glass has emerged as a versatile material solution that seamlessly blends aesthetic appeal with advanced functional performance. By applying ceramic or inorganic inks onto glass substrates through precision stenciling, manufacturers can create durable, high-definition patterns that adhere through thermal curing. This technique empowers designers and engineers to integrate both decorative and protective features into architectural façades, smart windows, automotive glazing, and appliance surfaces.Over the past decade, screen printed glass has transcended its legacy role in decorative applications. Advances in ink chemistries and cure processes have enabled improved weather resistance, UV protection, and electrical conductivity. Consequently, this technology now plays a pivotal role in energy-efficient building systems, intelligent display panels, and photovoltaic modules. As a result, stakeholders across construction, transportation, consumer goods, and renewable energy sectors are actively exploring new use cases.

This executive summary distills the most critical insights surrounding current trends, regulatory shifts, tariff impacts, segmentation dynamics, regional performance, and competitive positioning. In addition, it offers strategic recommendations and an overview of the rigorous research methodology employed. By the end of this summary, decision-makers will gain a holistic understanding of the forces reshaping the screen printed glass landscape and actionable direction for next-generation growth initiatives.

Mapping the Evolutionary Shifts and Pivotal Innovations Reshaping Screen Printed Glass Production and Application Worldwide

The screen printed glass sector is undergoing a fundamental transformation driven by technological breakthroughs, process automation, and evolving customer expectations. Historically reliant on manual stenciling and solvent-based inks, the industry now leverages digital printing platforms that deliver finer resolutions and faster turnaround times. As a result, manufacturers are able to introduce intricate patterns, variable opacities, and integrated electronic circuits directly onto glass surfaces with minimal human intervention.Concurrently, material innovations are redefining performance benchmarks. Water-based and UV-curable ink formulations reduce volatile organic compound emissions, aligning with stricter environmental regulations and sustainability goals. At the same time, novel additives are enhancing thermal stability and electrical conductivity, broadening the application scope to include smart windows, interactive touch panels, and photovoltaic back sheets.

Furthermore, the supply chain is consolidating around specialized service providers and regional production hubs. Manufacturers are increasingly adopting lean production principles, real-time quality monitoring, and just-in-time delivery models to maintain competitiveness. Taken together, these shifts signal an industry in rapid flux-one that is embracing digital prowess, sustainable practices, and agile operations to capture emerging opportunities.

United States Tariff Shifts Expected to Reshape Import Dynamics and Competitive Strategies in the Screen Printed Glass Industry

Recent policy announcements in the United States have introduced additional duties on key raw materials and finished glass products, culminating in a layered impact for import-reliant producers. As cumulative tariff rates rise, companies face elevated material costs and thinner margins. In response, many importers are recalibrating their sourcing strategies, seeking alternative suppliers with favorable trade agreements, or exploring vertical integration to retain pricing power.Simultaneously, domestic glass fabricators are presented with a window of opportunity. Investments in capacity expansion, combined with strategic partnerships with ink and equipment suppliers, allow local manufacturers to capture incremental market share. However, this shift is not without challenges, as accelerated lead times and workforce constraints can impede rapid scaling.

To mitigate exposure, organizations are diversifying their geographic footprints, establishing satellite production lines in exempt markets, and negotiating long-term supply contracts. They are also investing in process innovations that reduce raw material consumption and improve yield efficiency. These measures not only counterbalance tariff pressures but also strengthen resilience against future regulatory changes.

Deep Dive into Core Segmentations Revealing Diverse Glass Types Color Thickness Options Surface Finishes Ink Compositions Process Routes and End Use Applications

Breaking down the market by glass type reveals distinct demand patterns for annealed, laminated, and tempered substrates. Annealed glass retains relevance in cost-sensitive architectural and appliance applications, while laminated glass commands preference in safety-critical installations such as automotive windshields and security glazing. Tempered glass, with its superior mechanical strength and fracture characteristics, drives growth in consumer electronics and high-performance building façades.Turning to color type, monochrome printing continues to dominate minimalistic interior and exterior designs, offering consistency and ease of quality control. Nevertheless, the appetite for multicolor printing has surged in consumer goods and decorative façades, enabling brand differentiation and dynamic visual effects. Similarly, thickness considerations range from ultra-thin panels under 2 mm for lightweight displays to robust segments above 10 mm for structural applications, with midrange 2-10 mm glass providing a balanced compromise between flexibility and durability.

Surface finish preferences further influence end-use decisions. Glossy finishes cater to reflective display panels and premium architectural surfaces, whereas matte textures are sought after in privacy screens and glare-reduction solutions. Ink composition also plays a critical role, as solvent-based formulations excel in outdoor durability while water-based alternatives align with emerging environmental standards. Equally significant is the divide between automatic digital screen printing systems, which offer high throughput and precision, and manual approaches that retain relevance for prototyping and small-batch production.

Examining end-use segments underscores the multifaceted nature of this industry. In appliances, kitchen and laundry equipment integrate printed glass for control interfaces and aesthetic panels. The automotive sector leverages printed glazing in both OEM production and aftermarket customization. Within construction, exterior curtain walls and interior partitions benefit from printed patterns that combine functionality with design flair. Electronics applications include capacitive touch sensors, display backplanes, and decorative elements, while solar panels rely on printed glass as a lightweight, corrosion-resistant substrate for photovoltaic cells. Distribution channels split between offline partnerships with distributors and local fabricators, and online platforms encompassing both brand websites and third-party marketplaces, enabling manufacturers to reach diverse customer segments more effectively.

Uncovering Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Screen Printed Glass Markets

In the Americas region, North America leads adoption of screen printed glass technologies driven by stringent building codes, robust automotive production, and accelerating renewable energy installations. The United States, in particular, has witnessed heightened demand for printed solar glass substrates and high-definition glazing solutions. Meanwhile, Latin American markets are emerging as growth engines, with regional fabricators investing in entry-level automation to serve local construction booms.Across Europe, the Middle East, and Africa, sustainability mandates and energy efficiency targets form the backbone of market expansion. Western European nations prioritize low-emission ink systems and double-glazed insulating glass units featuring printed patterns for enhanced thermal performance. In the Gulf Cooperation Council, rapid infrastructure development fuels demand for architectural glass, while North African markets are exploring cost-effective tempering and printing solutions to support burgeoning automotive and appliance sectors.

Asia Pacific stands out as a manufacturing powerhouse, with China, India, and Japan driving both production and consumption. China's vibrant electronics ecosystem and large-scale solar panel manufacturing facilities underpin significant uptake of printed glass substrates. India's construction sector is embracing decorative and functional printed façades, while Japan continues to pioneer precision digital printing methods for specialty display and automotive applications. Together, these dynamics position Asia Pacific as the epicenter of innovation and scale economies in the screen printed glass domain.

Examining Competitive Landscapes and Strategic Positioning of Leading Innovators Shaping the Screen Printed Glass Industry Evolution

Leading incumbents in the screen printed glass arena pursue portfolio diversification through strategic acquisitions and joint ventures, aiming to marry traditional glassmaking prowess with cutting-edge printing technologies. Established glass producers expand their service offerings by integrating in-house ink formulation capabilities, enhancing product consistency and operational agility. As a result, they fortify global distribution networks that cater to both large OEMs and niche design studios.At the same time, specialized printing technology firms and ink developers carve out competitive advantages by focusing on R&D. They pioneer next-generation ink chemistries that balance performance with environmental compliance, and they innovate scalable digital printing platforms. By collaborating with application engineers, these players deliver turnkey solutions that reduce time-to-market for novel product introductions.

Moreover, the competitive landscape is marked by a rising wave of partnerships between glass substrate specialists and process automation experts. Through alliances and consortiums, they drive end-to-end integration, enabling seamless transition from design files to fully cured printed panels. This holistic approach not only elevates quality benchmarks but also accelerates adoption across new end-use sectors.

Formulating Strategic Roadmaps and Recommendations to Accelerate Growth Efficiency and Sustainability in Screen Printed Glass Manufacturing

To navigate the evolving market conditions, leaders should prioritize investments in automation and digital printing platforms that deliver higher throughput and reduced labor dependence. By implementing real-time process monitoring and advanced analytics, operations teams can identify bottlenecks, optimize curing cycles, and elevate yield consistency. These measures drive cost reductions and free up capacity for new value-added services.Simultaneously, embracing sustainable ink formulations and energy-efficient curing technologies will position organizations to meet tightening environmental regulations and customer expectations. By collaborating with chemical specialists to co-develop low-VOC or UV-curable inks, companies can differentiate through green credentials while preserving performance. Complementing these efforts with closed-loop water and solvent recovery systems further enhances resource efficiency.

Finally, forging strategic alliances across the value chain-from raw material suppliers to application integrators-can unlock new geographic and sectoral opportunities. Joint R&D programs with architectural glass manufacturers, automotive OEMs, and solar panel producers expedite innovation pipelines. At the same time, deepening ties with specialized distributors and digital marketplaces expands market reach. Together, these recommendations form a cohesive growth roadmap for manufacturers aiming to reinforce competitive advantage and unlock new revenue streams.

Detailing Rigorous Research Methodology Integrating Primary Interviews Secondary Data and Analytical Frameworks for Comprehensive Screen Printed Glass Insights

This research draws upon a multi-pronged methodology that integrates comprehensive secondary research, in-depth primary interviews, and rigorous analytical frameworks. Initial insights were gathered from regulatory filings, industry journals, patent databases, and technical white papers, establishing a foundational understanding of materials, processes, and applications.Building on this foundation, a series of structured interviews with senior executives, R&D directors, and procurement managers provided nuanced perspectives on market drivers, operational challenges, and investment priorities. These stakeholder engagements were supplemented by factory walkthroughs and virtual demonstrations of cutting-edge printing equipment to validate process efficiencies and quality metrics.

Data triangulation and cross-referencing across sources ensure the integrity and consistency of key findings. Quantitative and qualitative inputs were synthesized through scenario analyses and sensitivity tests, enabling identification of risks and opportunities under varying regulatory and economic conditions. This cohesive approach underpins the strategic insights and recommendations presented throughout the executive summary.

Synthesizing Key Learnings and Industry Takeaways to Highlight the Future Trajectory and Value Creation Opportunities in Screen Printed Glass Sector

The evolution of screen printed glass is propelled by a confluence of technological, regulatory, and market forces. Advances in ink chemistries, digital printing platforms, and sustainability imperatives have collectively expanded the addressable application space across construction, automotive, electronics, and renewable energy sectors. These transformative trends reshape product roadmaps, supply chain configurations, and go-to-market strategies.As tariff landscapes shift and competitive dynamics intensify, manufacturers and suppliers must adopt a proactive stance-reassessing sourcing models, investing in automation, and pursuing strategic partnerships. The segmentation insights underscore the importance of tailoring offerings to specific substrate types, color schemes, thickness requirements, and end-use demands. Regional performance patterns further highlight opportunities for localized production and targeted sales initiatives.

By synthesizing these learnings, industry stakeholders can chart a deliberate path forward, balancing risk mitigation with innovation acceleration. In doing so, they will harness the full potential of screen printed glass to deliver high-value solutions that address both functional requirements and aesthetic aspirations in an increasingly demanding global marketplace.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Glass Type

- Annealed Glass

- Laminated Glass

- Tempered Glass

- Color Type

- Monochrome

- Multicolor

- Thickness

- 2-5 Mm

- 6-10 Mm

- Greater Than 10 Mm

- Less Than 2 Mm

- Surface Finish

- Glossy

- Matte

- Ink Composition

- Solvent-Based Ink

- Water-Based Ink

- Process Type

- Automatic/Digital Screen Printing

- Manual Screen Printing

- End Use

- Appliances

- Kitchen

- Laundry

- Automotive

- Aftermarket

- OEM

- Construction

- Exteriors

- Interiors

- Electronics

- Solar Panels

- Appliances

- Distribution Channel

- Offline

- Online

- Company Website

- Third-party Marketplaces

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AGC Inc.

- Compagnie de Saint-Gobain S.A.

- Pilkington by NSG Group

- Guardian Industries Holdings

- Abrisa Technologies

- Artline Screen Printing Inc

- Asahi Glass Co., Ltd.

- Corning Incorporated

- Dongguan Hengping Industry Co., Ltd

- Essar

- Glasswerks

- Hangzhou Jinghu Glass Co., Ltd.

- JNS Glass & Coating

- Kite Glass

- Qingdao Eliter Glass Co., Ltd

- Qingdao Laurel Glass Technology Co.,Ltd

- Qingdao Tsing Glass Co.,Limited

- Schott AG

- ToughGlaze LTD

- Trident Combines

- Tuffx Glass

- Umrao Automation Pvt. Ltd.

- WT Glass Industrial Limited

- Qingdao Migo Glass Co.,Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Screen Printed Glass market report include:- AGC Inc.

- Compagnie de Saint-Gobain S.A.

- Pilkington by NSG Group

- Guardian Industries Holdings

- Abrisa Technologies

- Artline Screen Printing Inc

- Asahi Glass Co., Ltd.

- Corning Incorporated

- Dongguan Hengping Industry Co., Ltd

- Essar

- Glasswerks

- Hangzhou Jinghu Glass Co., Ltd.

- JNS Glass & Coating

- Kite Glass

- Qingdao Eliter Glass Co., Ltd

- Qingdao Laurel Glass Technology Co.,Ltd

- Qingdao Tsing Glass Co.,Limited

- Schott AG

- ToughGlaze LTD

- Trident Combines

- Tuffx Glass

- Umrao Automation Pvt. Ltd.

- WT Glass Industrial Limited

- Qingdao Migo Glass Co.,Ltd.

Table Information

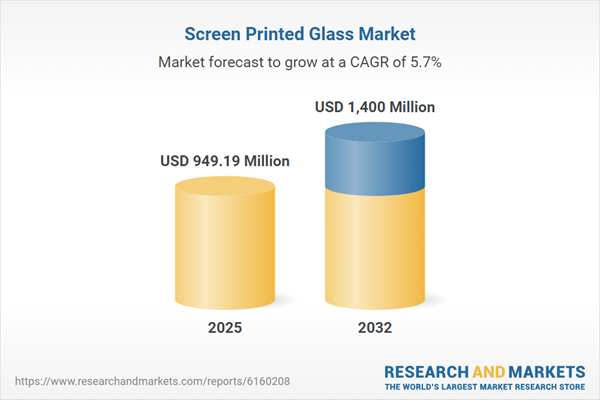

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 949.19 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |