Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative orientation to how AI-driven machinery and analytics are redefining farm operations, stakeholder expectations, and system-level outcomes

The agricultural landscape is undergoing a profound technological transformation driven by autonomous systems, sensor networks, and advanced analytics that converge to improve on-farm productivity, operational resilience, and environmental stewardship.This introduction frames how artificial intelligence and robotics are moving from pilot deployments into operational workflows, reshaping labor models and enabling precision interventions at scale. It emphasizes the interplay between hardware innovation and software-driven decision intelligence, where sensors and cameras feed analytics platforms that deliver prescriptive actions. As a result, farm operations are realizing more consistent input application, reduced waste, and improved traceability from field to market.

Further, this section highlights the shifting expectations of stakeholders across the food value chain. Retailers and processors increasingly prioritize provenance and sustainability, which amplifies demand for data-rich agricultural production methods. Investors are responding to these signals by backing integrated technology stacks that promise measurable gains in efficiency and compliance. In summary, the introduction establishes the context for the rest of the analysis by outlining the core forces driving adoption, the emerging win conditions for suppliers and adopters, and the strategic imperatives that will determine which solutions scale effectively across diverse farming contexts.

A concise synthesis of converging technological forces reshaping on-farm operations, data flows, and procurement priorities across the agricultural technology ecosystem

The landscape of agricultural technology is shifting rapidly as multiple transformative trends align to create a new operating reality for producers and solution providers.Firstly, autonomy is moving beyond proof-of-concept phase into routine deployment for tasks such as tillage and row cropping, allowing equipment to operate with minimal human intervention and increasing utilization windows. Secondly, aerial systems have matured from niche scouting tools to integrated platforms that perform aerial spraying, high-resolution mapping, and precision surveying, thereby enabling timely crop interventions and dynamic scouting workflows. Thirdly, irrigation systems are converging with predictive analytics to balance water efficiency and crop demand across drip, sprinkler, and surface infrastructures, which reduces input waste while supporting resilience under variable climatic conditions.

Concurrently, livestock operations are adopting continuous behavior analysis and health tracking to preempt disease and optimize herd performance, while precision farming suites combine soil analysis, crop scouting, and yield monitoring to create closed-loop agronomic recommendations. Components themselves are evolving: hardware advancements in cameras, GPS units, robotics, and sensors are paired with SaaS analytics platforms, farm management software, and field mapping tools, supported by services ranging from consulting to training. Taken together, these shifts are changing procurement cycles, influencing regulatory approaches to autonomous operations, and elevating data interoperability as a primary determinant of long-term value.

A strategic analysis of how 2025 tariff shifts are altering supply chains, procurement economics, and asset lifecycle choices across the AI-enabled agriculture value chain

The cumulative impact of U.S. tariff policy adjustments in 2025 introduces a complex set of operational and strategic consequences for suppliers, distributors, and farm operators that depend on cross-border supply chains for advanced agricultural equipment.Tariff-induced cost pressures are prompting manufacturers to reassess sourcing strategies for critical hardware components such as high-precision sensors, GPS modules, and actuation systems. In response, some suppliers accelerate near-shore manufacturing or diversify component suppliers to mitigate exposure, while others absorb margin compression to sustain competitive pricing. For distributors and integrators, the tariffs complicate inventory planning, as lead-time variability and cost volatility make just-in-time procurement riskier; consequently, stakeholders are building contingency stock and negotiating more flexible commercial terms with suppliers.

For farmers, elevated equipment procurement costs and potential delays in spare parts availability create stronger incentives to extend existing asset lifecycles through retrofits and enhanced maintenance regimes, and to adopt modular systems that allow staged upgrades rather than full replacements. In parallel, tariff dynamics catalyze commercial differentiation: service-oriented providers that offer installation, training, and local maintenance capability gain traction because they reduce total cost of ownership and downtime risk. Finally, policy uncertainty accelerates strategic consolidation among channel players and stimulates partnerships that localize supply chains, all of which bear directly on how quickly advanced equipment can scale across different farm segments.

Detailed segmentation intelligence illuminating differentiated adoption dynamics across applications, components, crop types, end users, and farm sizes to guide product and go-to-market choices

Segment-level insights reveal how adoption paths and product design priorities differ when viewed through application, component, crop type, end user, and farm size lenses.Based on application, autonomous tractors, drone solutions, irrigation management systems, livestock monitoring platforms, and precision farming suites each follow distinct adoption trajectories. Autonomous tractors split into use cases for row cropping and tillage operations, which influence platform ruggedness, guidance precision, and operational autonomy requirements. Drone solutions encompass aerial spraying, mapping, and surveying applications, driving divergent payload, flight-time, and regulatory compliance needs. Irrigation management spans drip, sprinkler, and surface irrigation methods, which in turn shape sensor placement strategies, control logic, and retrofit complexity. Livestock monitoring emphasizes behavior analysis and health tracking, requiring continuous telemetry and analytics tuned to species- and breed-specific indicators. Precision farming combines crop scouting, soil analysis, and yield monitoring to produce integrated agronomic recommendations and end-to-end traceability.

When the component perspective is applied, hardware, services, and software reveal different value capture dynamics. Hardware categories such as cameras, GPS units, robotics, and sensors demand capital-intensive R&D and supply-chain resilience. Services including consulting, support and maintenance, and training represent recurring revenue opportunities and critical enablers of successful deployments. Software domains like analytics platforms, farm management software, and field mapping tools concentrate on data integration, user experience, and algorithmic accuracy. Observing crop type differentiation, cereals oriented operations such as corn, rice, and wheat require scalable, high-throughput solutions, whereas fruits and vegetables, including berries, citrus, and leafy greens, prioritize delicate handling and high spatial resolution scouting. Oilseeds and pulses such as lentils, soybean, and sunflower present unique planting geometries and harvest considerations that influence equipment design. Finally, end-user profiles-commercial farms, contract farming enterprises, and individual farmers-plus farm size categories of large, medium, and small farms shape procurement capability, willingness to invest in upfront capital, and preference for as-a-service consumption models. Taken together, these segmentation perspectives clarify where product modularity, service bundling, and pricing flexibility will determine adoption velocity and long-term customer retention.

A comparative regional assessment showing how distinctive regulatory, infrastructure, and farm-structure realities influence adoption pathways and commercial models

Regional dynamics are driving differentiated pathways to adoption, with each geography presenting distinct regulatory, labor, and infrastructure conditions that shape technology value propositions.In the Americas, large-scale row cropping operations accelerate uptake of autonomous tractors and high-throughput precision platforms, supported by robust service networks and an ecosystem of agricultural OEMs. Meanwhile, Europe, Middle East & Africa presents a heterogeneous landscape where stringent regulatory frameworks around aerial spraying, data privacy, and autonomous operation coexist with high demand for sustainability-centric solutions; this region emphasizes interoperability, traceability, and compliance features. In Asia-Pacific, rapid mechanization, diverse cropping systems, and variable farm sizes create a market environment where adaptable, modular technologies and strong local support ecosystems outperform monolithic, capital-intensive offerings. Across these regions, infrastructure constraints such as connectivity and local technical capacity influence deployment models: subscription-based software and remote support tools gain particular traction where on-site expertise is limited, while on-premises solutions prevail where data sovereignty or latency concerns dominate.

Moreover, regional procurement patterns affect how companies prioritize localization versus centralized production and whether they invest in partnerships to provide training, retrofit services, and parts distribution. Consequently, a regionally nuanced go-to-market strategy that accounts for regulatory constraints, farm structure, and channel preferences proves essential to achieving meaningful penetration and long-term adoption.

An incisive look at how strategic product architectures, service models, and partnership tactics are determining competitive advantage and adoption scalability

Company-level insight highlights how strategic positioning, technology stacks, and go-to-market choices separate leaders from followers in the AI-enabled equipment space.Leading companies concentrate on end-to-end value by combining robust hardware platforms with cloud-native analytics and field-level integration; they invest in sensor fusion, edge computing, and intuitive farm management interfaces that reduce the cognitive load on operators. Others differentiate by specializing in a single high-value module-such as aerial spraying systems with advanced payload control, or irrigation controllers with precise water-balance algorithms-and then building partner networks to integrate those modules into broader solutions. Service-oriented firms focus on creating recurring revenue through maintenance contracts, training programs, and performance guarantees, which improves customer lifetime value and reduces churn. Strategic partnerships and M&A activity are prevalent among firms seeking to expand capability quickly, whether through acquiring analytics expertise, local maintenance networks, or complementary hardware technologies.

Additionally, investment in interoperability and open APIs is a common inflection point: companies that prioritize data portability and integration with popular farm management platforms secure broader adoption across heterogeneous farm IT environments. Intellectual property strategies also vary; some firms protect core algorithms and sensor designs aggressively while others emphasize rapid market entry and scale through licensing and standards participation. Ultimately, firms that balance product excellence with robust channel support and transparent total cost-of-ownership messaging are best positioned to convert early interest into sustained deployment across farm segments.

Practical and prioritized strategic actions that technology providers and operators can execute to accelerate adoption, enhance resilience, and optimize commercial returns

Industry leaders can translate the trends identified into concrete actions that accelerate adoption, improve unit economics, and strengthen customer relationships.First, prioritize modularity in product design so that equipment can be sold as an incremental upgrade rather than requiring full capital replacement; this reduces buyer friction for small and medium farms and enables staged technology adoption. Second, invest in a robust services layer-training, installation, and uptime-focused maintenance-so that customers experience rapid and sustained value realization; linking service SLAs to performance outcomes increases trust and willingness to invest. Third, embrace open data standards and API-first architectures to ensure interoperability with dominant farm management platforms and reduce integration barriers; interoperability drives network effects and increases the long-term utility of installed systems.

Fourth, localize supply chain and technical support where tariffs or logistics risks threaten continuity, using a mix of near-shore manufacturing and certified partner networks to maintain parts availability. Fifth, align product messaging to region- and crop-specific pain points: emphasize water-use efficiency and compliance capabilities in irrigation-intensive geographies, and focus on throughput and labor replacement in high-acreage cereal operations. Sixth, structure commercial offers with flexible financing and as-a-service options to match the cash flow profiles of commercial, contract, and individual farmers. By implementing these steps, companies can reduce adoption friction, build enduring revenue streams, and create defensible competitive positions in diverse agricultural contexts.

A transparent mixed-methods approach that integrates primary stakeholder engagement, technical verification, and secondary intelligence to validate actionable insights

The research methodology combines primary stakeholder engagement, technical system analysis, and structured synthesis of observational and secondary intelligence to ensure rigorous, actionable findings.Primary research comprises interviews and structured discussions with equipment manufacturers, software vendors, distributors, extension specialists, and end users spanning commercial farms, contract farming enterprises, and individual farmers. These engagements focused on deployment experiences, operational constraints, procurement decision drivers, and service expectations. Technical system analysis evaluated hardware component characteristics such as sensor fidelity, GPS accuracy, and robotics control architectures, as well as software capabilities around analytics, user experience, and integration. Observational validation included site visits and product demonstrations to verify claims about reliability, maintenance complexity, and ease of use.

Secondary intelligence involved reviewing regulatory updates, standards developments, and technology roadmaps from industry consortia and standards bodies, while excluding proprietary pricing or forecasting data. Cross-validation techniques reconciled primary impressions with technical observations to identify consistent patterns and divergent cases. Where ambiguity remained, sensitivity checks and scenario-based reasoning clarified how different operational contexts could affect adoption outcomes. This mixed-methods approach ensured that conclusions rest on convergent evidence from practitioners, technologists, and on-the-ground demonstrations, producing insights that are both practical and technically grounded.

A concise synthesis of strategic imperatives and concluding reflections on how integrated solutions and adaptive strategies will determine long-term success in AI-driven agriculture

In conclusion, the convergence of autonomy, sensor-driven intelligence, and resilient service models is reshaping how agricultural production systems operate and how stakeholders capture value across the supply chain.The critical takeaway is that technology alone will not drive transformation; success depends on integrating robust hardware, interoperable software, and reliable service delivery into coherent, regionally appropriate commercial propositions. Tariff dynamics and regional regulatory frameworks create both obstacles and incentives for localization, service innovation, and modular product design. Segmentation insights reveal that adoption pathways differ markedly across applications-autonomous tractors versus drone-based spraying-as well as across crop types and farm sizes, which compels vendors to refine product-market fit and to offer flexible commercial terms. Firms that invest in user-centric design, open integrations, and local support capabilities will reduce adoption friction and accelerate long-term retention.

Ultimately, the era ahead rewards organizations that combine technical excellence with strategic adaptability: those that can rapidly configure solutions for distinct agronomic, regulatory, and financial contexts will capture the most durable opportunities and help agriculture meet rising demands for efficiency and sustainability.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Application

- Autonomous Tractors

- Row Cropping

- Tillage Operations

- Drone Solutions

- Aerial Spraying

- Mapping

- Surveying

- Irrigation Management

- Drip Irrigation

- Sprinkler Irrigation

- Surface Irrigation

- Livestock Monitoring

- Behavior Analysis

- Health Tracking

- Precision Farming

- Crop Scouting

- Soil Analysis

- Yield Monitoring

- Autonomous Tractors

- Component

- Hardware

- Cameras

- Gps Units

- Robotics

- Sensors

- Services

- Consulting

- Support And Maintenance

- Training

- Software

- Analytics Platform

- Farm Management Software

- Field Mapping Tools

- Hardware

- Crop Type

- Cereals

- Corn

- Rice

- Wheat

- Fruits And Vegetables

- Berries

- Citrus

- Leafy Greens

- Oilseeds And Pulses

- Lentils

- Soybean

- Sunflower

- Cereals

- End User

- Commercial Farms

- Contract Farming Enterprises

- Individual Farmers

- Farm Size

- Large Farms

- Medium Farms

- Small Farms

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Deere & Company

- AGCO Corporation

- CNH Industrial N.V.

- Kubota Corporation

- CLAAS KGaA mbH

- Mahindra & Mahindra Limited

- Trimble Inc.

- Topcon Positioning Systems, Inc.

- SZ DJI Technology Co., Ltd.

- Yanmar Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this AI-Based Farming Equipment market report include:- Deere & Company

- AGCO Corporation

- CNH Industrial N.V.

- Kubota Corporation

- CLAAS KGaA mbH

- Mahindra & Mahindra Limited

- Trimble Inc.

- Topcon Positioning Systems, Inc.

- SZ DJI Technology Co., Ltd.

- Yanmar Co., Ltd.

Table Information

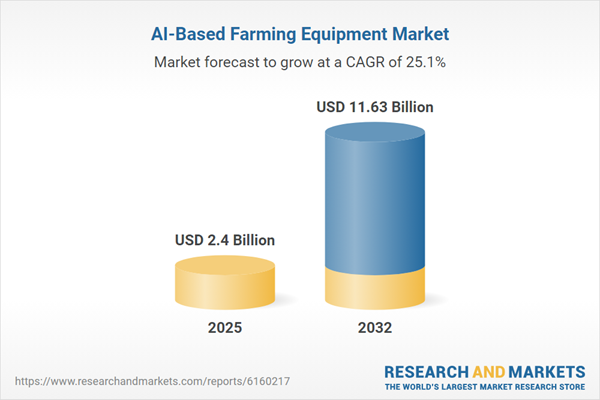

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 11.63 Billion |

| Compound Annual Growth Rate | 25.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |