Speak directly to the analyst to clarify any post sales queries you may have.

Uncovering the Growing Importance of Foam Roller Solutions in the Fitness and Rehabilitation Landscape as Consumer Preferences Shift to Self-Care

The foam roller market has emerged as a critical component of modern fitness, wellness, and rehabilitation routines, driven by growing awareness of self-myofascial release techniques and preventive care. As athletes, physical therapists, and wellness enthusiasts seek accessible solutions for muscle recovery, foam rollers have evolved from simple cylindrical tools to sophisticated wellness aids incorporating vibration technology and ergonomic designs. This shift underscores the importance of understanding not only the product innovations but also the broader market forces shaping demand and adoption across varied user segments.In this executive summary, we provide a clear and concise overview of the foam roller landscape, highlighting key trends, regulatory influences, and segmentation insights. By examining the technological innovations, tariff impacts, regional dynamics, and competitive strategies, decision makers will gain a holistic perspective on the market’s trajectory. Our objective is to equip stakeholders with actionable intelligence that can inform product development, marketing initiatives, and strategic partnerships, ultimately driving sustainable growth in a rapidly evolving sector.

Examining the Revolutionary Trends and Technological Innovations Shaping Foam Roller Development and Usage Across Diverse Wellness Applications

Over the past several years, the foam roller industry has undergone significant transformation, fueled by technological advancements and shifting consumer expectations. Manufacturers have introduced vibration-enabled rollers that deliver enhanced massage benefits, digital connectivity features that sync with fitness apps for guided recovery routines, and advanced surface textures designed to simulate various massage techniques. These innovations have elevated foam rollers from basic self-massage implements to sophisticated wellness accessories.Concurrently, the rise of at-home fitness regimens and virtual therapy sessions has accelerated adoption, prompting brands to invest in portable and travel-friendly designs. Sustainability has also become a crucial factor, with eco-conscious consumers demanding rollers made from recyclable or biodegradable materials. As a result, the competitive landscape now features a blend of heritage manufacturers expanding their portfolios and agile challengers leveraging novel materials and marketing strategies. This ongoing evolution underscores the importance of staying attuned to emerging technologies and consumer preferences in order to remain competitive and relevant.

Assessing the Consequences of Recent United States Tariff Adjustments on Foam Roller Production Supply Chains and Global Pricing Dynamics

Recent changes in United States tariff policy have introduced new challenges and considerations for foam roller producers and importers. By raising duties on certain raw materials and finished wellness products, these adjustments have increased cost pressures throughout the supply chain. As costs have risen, manufacturers have been forced to evaluate sourcing strategies, renegotiate supplier agreements, and, in some cases, relocate production facilities to mitigate financial impacts.These measures have also affected distribution channels, with retailers and e-commerce platforms recalibrating pricing strategies to absorb or pass through increased costs. In response, some brands have accelerated domestic production initiatives, leveraging local manufacturing to avoid import duties and reduce lead times. Meanwhile, global competitors have reexamined their market entry tactics, identifying alternative sourcing regions with more favorable trade terms. The cumulative effect of these tariff changes underscores the need for proactive supply chain resilience planning and strategic cost management.

Deep Dive into Foam Roller Market Segmentation by Type Material Length Density End-User and Distribution Channels to Reveal Growth Drivers

A detailed examination of market segmentation reveals that product type diversity has been instrumental in meeting specialized consumer needs, ranging from deep tissue rollers for intense muscle relief to grid rollers offering targeted fascia manipulation, along with softer and vibrating variations designed for gentler recovery sessions. Material composition further differentiates offerings, as ethylene-vinyl acetate variants balance affordability with cushioning, while expanded polypropylene models emphasize durability and resilience, and polyethylene rollers deliver a firmer, more stable surface for advanced users.Length options have expanded beyond standard sizes to include compact 12-inch rollers favored for portability, mid-range 18-inch options that strike a balance between usability and coverage, and full 36-inch rollers preferred in studio and professional settings. Density choices cater to individual comfort levels and therapeutic goals, spanning firm options for deep pressure, medium rollers for general use, and soft variants for sensitive areas or beginners. End users span commercial fitness facilities that require robust, high-volume solutions, home-use consumers seeking versatile recovery tools, and rehabilitation settings where medical-grade specifications and hygiene standards are critical. Distribution channels have also diversified, with offline sales channels in general merchandise environments, specialty wellness retailers, and sporting goods outlets coexisting alongside growing online platforms that offer direct-to-consumer convenience and product customization options.

Evaluating Regional Dynamics Influencing Foam Roller Demand Across the Americas Europe Middle East Africa and the Asia-Pacific Territories

The Americas region remains a core market for foam roller products, driven by high consumer spending on fitness and wellness, extensive networks of gyms and rehabilitation centers, and widespread adoption of recovery protocols among professional athletes. In North America, e-commerce platforms have significantly expanded reach, enabling niche brands to capture targeted segments. Latin America has shown gradual uptake of foam roller applications, supported by rising health awareness and the expansion of boutique fitness studios.Within Europe, Middle East and Africa, the market exhibits varied maturation levels. Western Europe benefits from established sports medicine communities and strong retail infrastructures, while Eastern European nations are experiencing growing interest in preventive health tools. In the Middle East, luxury fitness facilities and investment in wellness tourism have catalyzed higher-end roller adoption. Across Africa, emerging urban centers are starting to embrace self-care devices despite logistical challenges affecting distribution. Meanwhile, Asia-Pacific stands out for its rapid urbanization and rising disposable incomes, which have driven increased investment in home fitness equipment. Key markets in East Asia continue to innovate with smart rollers, while Southeast Asia sees growing independent retail networks, and Australia maintains stable demand through fitness professional endorsements.

Profiling Leading Foam Roller Manufacturers and Brands Highlighting Their Strategic Initiatives Technological Strengths and Market Positioning

Major players in the foam roller market are pursuing differentiated strategies to secure competitive advantage. Some leading manufacturers have focused on vertical integration, controlling material sourcing and production to ensure consistent quality and cost efficiency. Others have formed partnerships with rehabilitation clinics and sports teams to co-develop specialized products and gather user feedback for iterative improvements.Brand collaborations with technology companies have introduced rollers equipped with sensors and companion apps, enabling users to track usage patterns and optimize recovery routines. Innovation-focused firms have patented novel core structures and surface geometries that offer enhanced myofascial release while maintaining user comfort. At the same time, several established wellness brands continue to leverage expansive distribution networks, combining offline retail presence with robust online channels to capture both impulse purchases and planned investments. This competitive tapestry underscores the importance of R&D investment, strategic alliances, and omni-channel marketing to maintain leadership positions.

Strategic Actionable Recommendations for Foam Roller Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Market Challenges

Industry leaders should prioritize the development of advanced materials that balance sustainability, durability, and user comfort to address rising consumer expectations for eco-friendly wellness solutions. Expanding direct-to-consumer digital channels and e-commerce capabilities will enable brands to foster deeper engagement through personalized product recommendations, subscription models, and virtual coaching integrations.Collaborations with fitness influencers, sports teams, and rehabilitation specialists can elevate brand credibility and accelerate product validation. Additionally, integrating smart technologies such as embedded sensors and mobile connectivity can generate data-driven insights for users while creating new revenue streams through software services. Companies can also explore modular roller systems that allow consumers to customize texture, firmness, and length based on evolving fitness goals. Finally, establishing resilient supply chain frameworks by diversifying material sources and optimizing production footprints will be critical to mitigating future trade policy shifts and ensuring stable product availability.

Outlining the Research Methodology Employed to Ensure Robust Data Analysis Including Qualitative Expert Interviews and Quantitative Data Validation

This report synthesizes insights derived from a blended research approach combining primary and secondary data collection. Primary research consisted of in-depth interviews with product designers, supply chain executives, fitness professionals, and rehabilitation experts to validate market drivers and uncover unmet needs. A structured survey of end users provided quantitative perspectives on purchase criteria, usage patterns, and brand perceptions across diverse demographics.Secondary research incorporated analysis of industry journals, trade association publications, regulatory filings, and financial reports to map competitive landscapes and identify macroeconomic influences. Data triangulation techniques were applied to reconcile findings across sources, ensuring analytical rigor. Market segmentation frameworks were refined through iterative validation, and an expert review panel conducted a peer review of key assumptions and data interpretations. This methodology ensures that the report’s conclusions and recommendations are grounded in robust evidence and actionable intelligence.

Concluding Insights on the Foam Roller Market’s Evolutionary Path Forward Summarizing Key Findings and Strategic Imperatives for Stakeholders

The foam roller market stands at an inflection point, shaped by technological innovation, shifting consumer behaviors, and evolving trade environments. As the sector matures, differentiation through product quality, material innovation, and omni-channel outreach will define the leaders of tomorrow. The integration of digital features and sustainability considerations is not just a trend but a strategic imperative that will influence market dynamics across regions.In conclusion, stakeholders equipped with a nuanced understanding of segmentation trends, regional drivers, and competitive strategies will be best positioned to capitalize on growth opportunities. By aligning product development roadmaps with emerging wellness narratives and fortifying supply chains against policy uncertainties, market participants can secure long-term relevance and profitability.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Deep Tissue Foam Rollers

- Firm Foam Rollers

- Grid Foam Rollers

- Soft Foam Rollers

- Vibrating Foam Rollers

- Material

- Ethylene-Vinyl Acetate

- Expanded Polypropylene

- Polyethylene (PE)

- Length

- 12 Inch

- 18 Inch

- 36 Inch

- Density

- Firm

- Medium

- Soft

- End User

- Commercial

- Home Use

- Rehabilitation

- Distribution Channel

- Offline Sales

- General Merchandise Stores

- Specialty Retailers

- Sporting Goods Stores

- Online Sales

- Offline Sales

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- TriggerPoint by Implus LLC

- LuxFitProducts

- Adidas AG

- Alexandave Industries Co., Ltd.

- BLACKROLL AG

- Brightex Synergizer India Private Limited

- CoreFlex Technologies

- Ecom Fitness Platform LLC

- Elite Recovery Inc.

- Freewill Sports Pvt. Ltd.

- Kintex

- Kuber Industries

- Lifeprofitness.com

- Manduka, LLC

- Meglio Ltd

- Momentum Fitness Group

- OPTP

- ProsourceFit.

- RumbleRoller

- soulflex.in

- Technogym S.p.A.

- Tiger Tail USA

- TRX Training

- Zenith Wellness Corp.

- Zyllion, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Foam Roller market report include:- TriggerPoint by Implus LLC

- LuxFitProducts

- Adidas AG

- Alexandave Industries Co., Ltd.

- BLACKROLL AG

- Brightex Synergizer India Private Limited

- CoreFlex Technologies

- Ecom Fitness Platform LLC

- Elite Recovery Inc.

- Freewill Sports Pvt. Ltd.

- Kintex

- Kuber Industries

- Lifeprofitness.com

- Manduka, LLC

- Meglio Ltd

- Momentum Fitness Group

- OPTP

- ProsourceFit.

- RumbleRoller

- soulflex.in

- Technogym S.p.A.

- Tiger Tail USA

- TRX Training

- Zenith Wellness Corp.

- Zyllion, Inc.

Table Information

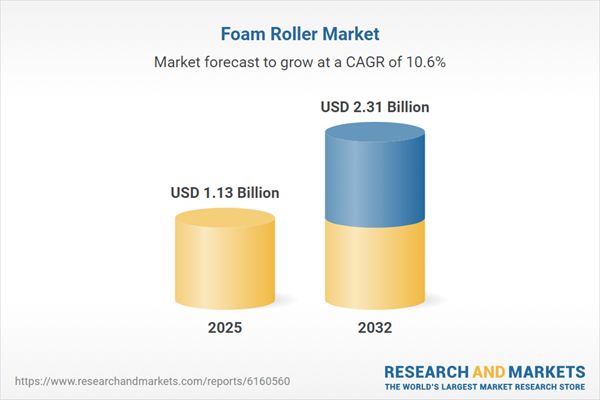

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.13 Billion |

| Forecasted Market Value ( USD | $ 2.31 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |