Speak directly to the analyst to clarify any post sales queries you may have.

High Purity Industrial Argon Gases Shaping the Industrial Gas Ecosystem with Unprecedented Quality and Reliability Drivers

Industrial argon with purities of 99.99% and above has emerged as a cornerstone of modern manufacturing and critical processes. Its inertness and stability enable precision metal fabrication operations, advanced semiconductor wafer production, and vital medical therapies. Manufacturers increasingly demand consistent gas quality to minimize defects, enhance energy efficiency, and maintain stringent regulatory compliance.In recent years, production technologies have evolved to deliver improved cryogenic distillation units and membrane separation systems that achieve the ultra-high purity levels required by leading electronics and healthcare sectors. Supply chain stakeholders have fortified logistics networks to support bulk deliveries, cylinder distribution, and onsite generation solutions, thereby reducing downtime and ensuring uninterrupted access to high purity argon.

As industries pursue next-generation materials and scalable clean energy applications, argon has become integral to refining processes, additive manufacturing, and laser deposition techniques. Given this evolving landscape, understanding the interplay between production capabilities, distribution strategies, and end use requirements is essential for stakeholders seeking to stay ahead in the competitive industrial gas arena.

Furthermore, the convergence of strategic capital allocations, collaborative research initiatives, and environmental regulations is reshaping the argon supply ecosystem. Suppliers and end users are aligning to optimize supply reliability and address sustainability goals by exploring low-carbon production methods and circular gas management practices. This synthesis of technological innovation and operational agility establishes a foundation for future growth across multiple industry verticals.

Emerging Global Forces Driving Transformative Shifts in High Purity Argon Supply Chains, Production Technologies, and Industrial Integration Dynamics

Global pressures to decarbonize heavy industry and ramp up digital monitoring have catalyzed significant transformations in the high purity argon landscape. Stringent environmental regulations and customer demands for traceability have prompted suppliers to integrate advanced process controls and remote diagnostics into cryogenic distillation and purification assets. Consequently, stakeholders are witnessing elevated expectations for both product performance and supply chain transparency.Parallel to regulatory influences, breakthroughs in production technologies are driving efficiency improvements. Next-generation membrane separation modules and hybrid distillation systems now achieve unprecedented purity thresholds with reduced energy consumption. These enhancements are complemented by modular onsite generation units that deliver tailored gas streams directly at customer facilities, fostering greater operational autonomy.

Market consolidation and strategic alliances are further altering competitive dynamics. Industry participants engage in joint ventures and technology partnerships to pool capital, share intellectual property, and accelerate scale-up. Such collaborations strengthen regional production footholds and streamline distribution networks through integrated logistics platforms.

As a result, manufacturers face a reshaped supplier landscape characterized by heightened innovation, expanded service portfolios, and evolving commercial models. Organizations that anticipate these shifts and realign their procurement and operational strategies will secure a decisive advantage in an era of rapid industrial modernization.

Assessing the Far Reaching Consequences of Newly Imposed United States Tariffs on the High Purity Argon Market Landscape for 2025

The imposition of new United States tariffs on high purity argon imports in 2025 has introduced a complex matrix of cost pressures and strategic recalibrations. Sudden increases in landed gas prices are prompting manufacturers to reevaluate procurement channels, driving a resurgence of interest in domestic supply capacity. In parallel, importers are negotiating amended contracts and exploring alternative sourcing corridors to mitigate tariff impacts.This tariff-driven environment has accelerated conversations around inventory management and supply continuity. Stakeholders are implementing just-in-case stockpiling strategies to shield operations from potential trade disruptions. At the same time, domestic producers are capitalizing on the opportunity to expand capacity and invest in localized purification units that meet evolving regulatory criteria.

Despite the immediate cost headwinds, the tariff framework is spurring longer-term structural adjustments. Companies are strengthening bilateral partnerships with regional gas suppliers and investing in dual-sourcing arrangements to enhance resilience. Moreover, end users are increasingly engaging in collaborative planning with logistics providers to ensure end-to-end visibility and agile response capabilities.

In this recalibrated market, organizations that proactively address tariff-related volatility and foster robust supplier relationships will be well positioned to navigate evolving trade policies and secure uninterrupted access to critical argon supplies.

Illuminating Critical Segmentation Insights That Reveal Strategic Imperatives across Purity Grades Products Formats End Use Industries and Distribution Channels

Insights into purity grade preferences reveal a nuanced demand profile. Sectors demanding tight process tolerances, such as semiconductor fabrication, are gravitating toward 99.999% argon. Meanwhile, applications in metal fabrication and healthcare often prioritize 99.995% purities to balance performance requirements with cost considerations. The widespread use of 99.99% grade underscores its role as a versatile standard for general industrial processes.Product form analysis indicates that bulk liquid gas shipments remain the primary delivery mechanism for large-scale users, offering economies of scale and streamlined storage solutions. Cylinder-based pack sizes serve smaller facilities or intermittent operations, providing convenience and flexibility. Concurrently, onsite generation systems are gaining traction among end users seeking to decouple from third-party logistics and achieve just-in-time availability.

End use industry trends highlight divergent growth vectors. Chemical processing facilities leverage high purity argon for inert blanket applications and polymer production, while the healthcare sector relies on its inert characteristics for respiratory therapies and diagnostic imaging. Metal fabrication operations depend on argon for optimized weld quality, whereas the semiconductor and electronics segments demand ultra-high purity for contamination-free manufacturing environments.

Distribution channel performance varies by region and customer scale. Direct sales and on-site supply models deliver tailored service levels and rapid response times to high-volume accounts. At the same time, distributors and gas dealers maintain extensive local networks that support smaller customers with flexible delivery schedules and technical guidance.

Unveiling Key Regional Insights Highlighting Growth Drivers and Trade Dynamics across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, advanced manufacturing hubs and semiconductor clusters have solidified the region's leadership in high purity argon consumption. Investments in domestic production and centralized supply terminals ensure resilient access to cryogenic gases, while integrated pipeline networks between major industrial centers facilitate cost-efficient transportation.Across Europe, Middle East & Africa, evolving energy policies and sustainability mandates are reshaping demand patterns. Western Europe's stringent environmental standards incentivize low-emission purification techniques, whereas Middle Eastern petrochemical complexes continue to drive volume requirements. In Africa, emerging infrastructure projects signal growing opportunities for argon users in metallurgy and construction.

Asia-Pacific has emerged as a dynamic growth engine, fueled by rapid industrialization and robust expansions in electronics manufacturing. Major markets in China, South Korea, and Japan lead in uptake of ultra-high purity grades for semiconductor fabs, while Southeast Asian economies are embracing onsite generation to support distributed manufacturing clusters. Across the region, government incentives and free trade agreements are accelerating capacity additions and cross-border trade flows.

As regional dynamics evolve, stakeholders must adapt supply chain configurations and partner with local operators to capture opportunities and mitigate logistical constraints. Sensitivity to regional regulatory frameworks and infrastructure landscapes will be critical for success in each geographic market.

Profiling Leading High Purity Industrial Argon Producers Companies Shaping the Competitive Environment with Innovative Capabilities and Operational Strengths

Major industrial gas producers have leveraged long-standing expertise and expansive asset bases to maintain leadership positions. The largest suppliers continue to invest in state-of-the-art cryogenic distillation plants and membrane separation facilities, strengthening global networks that deliver both bulk shipments and specialty packaging solutions.Innovative mid-tier companies are differentiating through specialized purification modules and rapid-deployment onsite generation units. By partnering with technology innovators and research institutions, these firms have accelerated development cycles for next-generation gas treatment processes that yield lower energy footprints and higher throughput.

Collaborative ventures between producers and end users are fostering integrated service models that combine gas supply, equipment leasing, and technical support. These partnerships aim to optimize total cost of ownership, enhance process uptime, and drive continuous improvement in purity specifications.

Meanwhile, nimble regional players and gas dealers capitalize on local market knowledge and logistical agility. By maintaining close customer relationships and offering tailored inventory management services, these companies address varied demand patterns and deliver rapid response times across diverse industrial clusters.

Actionable Strategic Recommendations for Industry Leaders to Navigate Volatility Capitalize on Technology Advances and Strengthen Supply Chain Resilience

Industry leaders should prioritize supply diversification strategies by engaging multiple production partners and pursuing dual-sourcing agreements. This approach mitigates exposure to tariff fluctuations and logistical disruptions while preserving contractual flexibility.Investing in onsite generation solutions can further insulate operations from transportation delays and reduce reliance on third-party logistics. By aligning capital deployment with facility footprints and consumption profiles, organizations can achieve leaner inventories and improved process control.

Embracing digital supply chain platforms enhances visibility into order status, equipment maintenance, and purity analytics. Real-time data integration supports proactive decision-making, enabling stakeholders to anticipate demand shifts and respond swiftly to market perturbations.

Finally, cultivating collaborative relationships with technology providers, academic institutions, and regulatory bodies will ensure that companies remain at the forefront of low-carbon production methods and evolving compliance requirements. Such multi-stakeholder engagements foster innovation and reinforce resilience against future industry disruptions.

Designing Rigorous Research Methodology Incorporating Qualitative and Quantitative Techniques to Ensure Robust and Transparent Market Analysis

The research methodology underpinning this analysis integrates comprehensive secondary research with targeted primary engagements. Industry publications, technical journals, and regulatory filings were systematically reviewed to construct a foundational understanding of production processes and market structures.Complementing the desk research, in-depth interviews were conducted with key stakeholders spanning production engineers, supply chain managers, and procurement executives. These expert consultations provided firsthand insights into operational challenges, technology adoption rates, and strategic priorities.

Qualitative findings were triangulated with quantitative metrics derived from historical trade data, capacity utilization records, and company annual reports. Rigorous data validation workshops ensured accuracy and consistency across multiple sources.

Finally, analytical frameworks were applied to synthesize trends, identify critical enablers, and map competitive positioning. This structured approach delivers transparent, robust, and actionable intelligence that supports informed decision-making in the high purity argon sector.

Concluding Perspectives on the Evolution of the High Purity Argon Market with Strategic Reflections on Industry Trajectories and Future Opportunities

This executive summary has traced the evolution of the high purity argon market through shifting regulatory landscapes, technological breakthroughs, and strategic repositioning. From the deepening segmentation of purity grades and product forms to the emergent regional growth hotspots, the sector continues to redefine the boundaries of industrial gas applications.Trade policy interventions, including the recent tariff measures, underscore the criticality of adaptive sourcing and resilient supply networks. Meanwhile, ongoing investments in low-carbon production methods and digital supply chain integration point to a future in which efficiency and sustainability converge.

Leading producers and end users alike are forging partnerships that transcend traditional supplier-customer relationships, emphasizing collaborative innovation and shared risk management. As competition intensifies, the ability to anticipate disruptive forces and deploy agile commercial models will determine success.

Looking ahead, the high purity argon market presents abundant opportunities for stakeholders that combine technical expertise with strategic foresight. By aligning operations with emerging industry trajectories and strengthening collaborative ecosystems, organizations can unlock new avenues for growth and maintain superiority in a dynamic global environment.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Purity Grade

- 99.99% (4N)

- 99.995% (4.5N)

- 99.999% (5N)

- Product Form

- Bulk Liquid Gas

- Cylinder

- Onsite Generation

- End Use Industry

- Chemical Processing

- Healthcare

- Metal Fabrication

- Semiconductor & Electronics

- Distribution Channel

- Direct Sales & On-site Supply

- Distributors & Gas Dealers

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Air Liquide S.A.

- Taiyo Nippon Sanso Corporation

- Air Products and Chemicals, Inc.

- Air Water Inc.

- Chem-Gas Pte Ltd.

- Cryotec Anlagenbau GmbH

- Cryotec Anlagenbau GmbH

- Ellenbarrie Industrial Gases Ltd.

- Gulf Cryo Holding C.S.C.

- Hangzhou Hangyang Co., Ltd.

- INDIANA OXYGEN COMPANY

- INOX Air Products Private Limited

- Iwatani Corporation

- Linde plc

- Matheson Tri-Gas

- Messer Group GmbH

- SOL Group

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- Universal Industrial Gases, Inc.

- WKS Industrial Gas Pte Ltd.

- Yingde Gases Group Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this High Purity Industrial Argon Gases market report include:- Air Liquide S.A.

- Taiyo Nippon Sanso Corporation

- Air Products and Chemicals, Inc.

- Air Water Inc.

- Chem-Gas Pte Ltd.

- Cryotec Anlagenbau GmbH

- Cryotec Anlagenbau GmbH

- Ellenbarrie Industrial Gases Ltd.

- Gulf Cryo Holding C.S.C.

- Hangzhou Hangyang Co., Ltd.

- INDIANA OXYGEN COMPANY

- INOX Air Products Private Limited

- Iwatani Corporation

- Linde plc

- Matheson Tri-Gas

- Messer Group GmbH

- SOL Group

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- Universal Industrial Gases, Inc.

- WKS Industrial Gas Pte Ltd.

- Yingde Gases Group Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2025 |

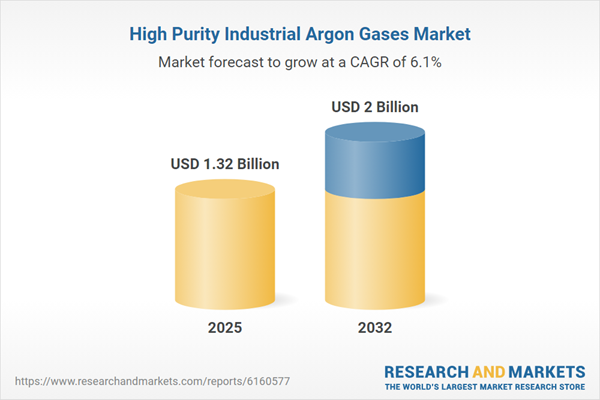

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.32 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |