Speak directly to the analyst to clarify any post sales queries you may have.

Defining the Strategic Importance and Operational Foundations of Molded Case Circuit Breakers Driving Reliability and Safety in Contemporary Electrical Networks

Molded case circuit breakers serve as the foundational components of modern electrical distribution systems, delivering critical protection against overloads, short circuits, and ground faults. These devices are engineered to safeguard installations ranging from residential dwellings to large-scale industrial facilities, ensuring uninterrupted power flow and minimizing risks to equipment and personnel. Over the decades, advances in rated current capacities, voltage ratings, trip unit technologies, mounting configurations, and pole arrangements have expanded the applicability and performance of these breakers. Simultaneously, evolving end-user demands across commercial, industrial, and residential sectors have driven manufacturers to refine product portfolios and enhance reliability standards.As global energy consumption accelerates and infrastructure networks undergo modernization, the role of molded case circuit breakers becomes increasingly strategic. Heightened regulatory requirements, the integration of renewable energy sources, and the push for smart grid implementations are reshaping the expectations placed on protective devices. Against this backdrop, this report offers a rigorous exploration of the molded case circuit breaker landscape by examining transformative industry shifts, the impact of United States tariffs, granular segmentation, regional dynamics, leading players’ strategies, and expert recommendations. Together, these insights equip stakeholders with a clear understanding of current market conditions and future trajectories in the pursuit of resilient power distribution.

Illuminating the Paradigm Shifts Redefining Molded Case Circuit Breaker Evolution Amid Digital Transformation and Sustainable Energy Demands

The evolution of molded case circuit breakers reflects broader transformations within the power distribution domain, where digitalization, connectivity, and sustainability have emerged as pivotal catalysts. Smart grid deployments and the proliferation of monitoring solutions now demand breakers capable of delivering real-time diagnostics, remote control, and predictive maintenance capabilities. Consequently, electronic trip units have gained prominence by offering granular fault detection and communication interfaces that feed into supervisory control systems. In parallel, thermal magnetic trip designs continue to serve applications where cost-effective protection suffices.Furthermore, the global push toward decarbonization and renewable energy integration is challenging conventional protection paradigms. Rapid cycling from solar inverters and wind turbines introduces novel fault characteristics, compelling manufacturers to optimize coordination settings and response times. At the same time, modular mounting approaches and plug-in configurations support accelerated installation and maintenance cycles, allowing facility managers to adapt to dynamic load profiles. These converging forces underscore a landscape in which innovation, agility, and adherence to evolving regulatory frameworks define competitive leadership in molded case circuit breaker solutions.

Examining the Comprehensive Impact of Upcoming United States Tariffs on Molded Case Circuit Breaker Market Dynamics and Supply Chains

The implementation of new tariffs on imported molded case circuit breakers in 2025 introduces a complex layer of cost pressures and supply chain recalibration for manufacturers, distributors, and end users. By imposing additional duties on key components and finished products, these measures have elevated procurement costs and prompted industry participants to reexamine supplier relationships. In response, some lead manufacturers have accelerated the localization of critical manufacturing processes to mitigate duty impacts, while others have diversified sourcing across low-tariff jurisdictions.Beyond immediate price adjustments, the cumulative effect of these tariffs extends to inventory management strategies and contract renegotiations. Distributors are compelled to balance the trade-off between higher carrying costs and the risk of stock outs, whereas project developers must account for potential schedule delays driven by redirected shipments. Moreover, rising landed costs have intensified negotiations on long-term agreements, pushing both buyers and sellers toward cost-sharing arrangements and volume-based incentives. As a result, tariff-induced shifts are reshaping the competitive landscape and redefining value propositions across the molded case circuit breaker industry.

Revealing Critical Segmentation Insights that Illuminate the Intricacies of Rated Current Voltage Trip Unit Mounting Poles and End User Applications

A nuanced understanding of market segmentation reveals critical drivers underlying demand patterns for molded case circuit breakers. Based on rated current capacities, installations span models designed for up to 100 amperes, mid-range breakers rated between 101 and 250 amperes, and high-capacity units exceeding 250 amperes, each addressing distinct load requirements and safety protocols. Meanwhile, voltage segmentation distinguishes low voltage solutions deployed in conventional commercial and residential settings from medium voltage systems favored in industrial and infrastructure projects requiring elevated fault-current interrupting capabilities.Trip unit technology further refines product differentiation, with electronic trip units offering programmable protection parameters, data logging, and communication interfaces that align with smart facility initiatives. Thermal magnetic trip configurations retain relevance for applications prioritizing simplicity and cost efficiency. Mounting types also play a vital role in specifying solutions, as fixed assemblies provide secure, space-stable integration, whereas plug-in designs facilitate rapid maintenance and modular scalability. Poles segmentation into one-pole through four-pole breakers accommodates single-phase and multi-phase systems, maintaining circuit integrity across diverse electrical architectures.

The final layer of segmentation pertains to end-user applications, where demand is categorized into commercial, industrial, and residential sectors. Within commercial real estate, healthcare facilities, hospitality venues, and IT and telecom centers, reliability and uptime are paramount. Industrial adopters from chemical and petrochemical plants to manufacturing facilities, oil and gas operations, and power generation and distribution networks place emphasis on robustness under high-stress conditions. Residential buyers, differentiated between single-family homes and multi-family units, seek seamless integration with building management systems and heightened safety features, reflecting the accelerated pace of smart home adoption.

Highlighting Pivotal Regional Dynamics Shaping Adoption and Growth Patterns Across the Americas Europe Middle East Africa and Asia-Pacific Landscapes

Examining regional dynamics underscores how market forces, regulatory frameworks, and infrastructure investments vary across geographies. In the Americas, robust infrastructure renewal initiatives and a growing emphasis on grid resilience have elevated demand for advanced protection devices. Governments and utilities are channeling capital into modernization projects that prioritize digital integration, driving growth in both traditional molded case circuit breaker offerings and smart, network-enabled variants.Across Europe, the Middle East, and Africa, regulatory harmonization efforts and sustainability targets are reshaping specification standards. Stringent safety regulations in Europe and ambitious renewable energy deployments in Middle Eastern markets propel the uptake of medium voltage solutions with enhanced diagnostic capabilities. In African economies, electrification programs and industrial expansion foster demand for versatile protective devices that can withstand variable environmental conditions.

Asia-Pacific stands out as a dynamic arena where rapid urbanization, industrial automation, and renewable energy proliferation converge. Large-scale public infrastructure ventures in Southeast Asia, coupled with surging consumption in residential and commercial sectors, underscore the need for high‐performance breakers. Furthermore, local manufacturing ecosystems in key nations are maturing, enabling shorter lead times and cost-competitive pricing that cater to region-specific requirements.

Providing Intelligence on Leading Industry Players Shaping Innovation Competitive Positioning and Collaborations in the Molded Case Circuit Breaker Sector

Leading industry players continue to advance product portfolios through targeted investments in research and development, digital functionality, and global service networks. Schneider Electric has intensified its focus on IoT-enabled breakers, embedding cloud-native analytics and remote monitoring to support predictive maintenance regimes. Similarly, ABB has expanded its electronic trip unit offerings to address emerging renewable integration challenges, aligning new products with sector-specific certification requirements.Siemens has reinforced its presence by integrating modular plug-in configurations and live line swap capabilities, enabling swift field replacements without compromising system uptime. Eaton has pursued strategic partnerships to bolster its smart infrastructure suite, combining comprehensive breaker solutions with advanced energy management platforms. General Electric’s streamlined breaker designs emphasize lightweight, high-interrupting capacity models tailored for rail and transportation applications.

Across the board, collaboration with technology providers, adherence to international standards, and the deployment of advanced manufacturing techniques underscore a competitive environment where innovation, supply chain resilience, and customer-centric service define leadership.

Offering Targeted Recommendations to Bolster Operational Efficiency Innovation and Market Resilience for Molded Case Circuit Breaker Manufacturers

Manufacturers and distributors should prioritize the integration of digital monitoring and predictive analytics into breaker product lines to meet growing demand for smart grid compatibility. Investing in flexible production systems and regional manufacturing capacity will mitigate tariff impacts and shorten lead times, supporting robust supply chains. Strategic alliances with software providers and equipment integrators can amplify the value proposition of protection devices through seamless connectivity and data-driven insights.Emphasizing modular designs and plug-in mounting configurations will enhance serviceability and scalability for customers navigating evolving load profiles. Customizing solutions for end-user segments, such as healthcare, petrochemical, and multi-family residential, will drive differentiation by addressing sector-specific safety, reliability, and regulatory requirements. Additionally, reinforcing after-sales support and training programs will foster long-term customer loyalty and reduce total cost of ownership.

Finally, aligning product roadmaps with sustainability targets-such as low-power consumption trip units and recyclable housing materials-will resonate with stakeholders committed to decarbonization and circular economy principles, positioning companies for continued growth.

Detailing a Robust Methodology Combining Qualitative and Quantitative Research Expert Consultations and Data Triangulation to Ensure Comprehensive Market Insights

The research methodology underpinning this report combines rigorous qualitative and quantitative approaches to ensure comprehensive market coverage. Secondary research involved an extensive review of trade publications, regulatory documents, industry standards, and corporate filings to establish baseline insights and historical context. These findings were supplemented by primary research, including interviews with key stakeholders such as product managers, engineering specialists, procurement executives, and end-user representatives across commercial, industrial, and residential domains.Data triangulation techniques validated emerging trends and cross-checked conflicting viewpoints, while expert consultations provided real-world perspectives on technological advancements and regulatory developments. Market intelligence was further refined through participatory observations at industry conferences, workshops, and technical seminars. Quality assurance processes, including peer review and methodological transparency, guarantee the robustness and reliability of the presented insights, empowering decision-makers with actionable, fact-based intelligence.

Synthesizing Key Findings and Strategic Imperatives to Illuminate Future Directions and Investment Considerations within the Molded Case Circuit Breaker Domain

This report synthesizes the critical forces shaping the molded case circuit breaker landscape, from digital transformation and sustainability demands to the nuanced impact of new trade tariffs. By dissecting multi-layered segmentation, regional market dynamics, and leading players’ strategic maneuvers, stakeholders gain a holistic view of the factors that will drive future innovation and adoption. The convergence of smart grid integration, renewable energy growth, and regulatory evolution presents both challenges and opportunities for product developers, suppliers, and end users.Ultimately, success in this domain hinges on agility-whether through digital enhancements, localized manufacturing, or bespoke solutions tailored to end-user requirements. Armed with these findings and strategic imperatives, industry participants can position themselves to capitalize on emerging market gaps, navigate policy fluctuations, and deliver next-generation protection solutions that meet the stringent demands of modern power systems.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Rated Current

- 101 To 250 A

- Above 250 A

- Up To 100 A

- Voltage

- Low Voltage

- Medium Voltage

- Trip Unit Type

- Electronic

- Thermal Magnetic

- Mounting Type

- Fixed

- Plug In

- Poles

- 1 Pole

- 2 Pole

- 3 Pole

- 4 Pole

- End User

- Commercial

- Commercial Real Estate

- Healthcare

- Hospitality

- IT & Telecom

- Industrial

- Chemical & Petrochemical

- Manufacturing

- Oil & Gas

- Power Generation & Distribution

- Residential

- Multi Family

- Single Family

- Commercial

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Schneider Electric SE

- ABB Ltd.

- Changshu Switchgear Co., Ltd.

- CHINT Group

- E‑T‑A Elektrotechnische Apparate GmbH

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- Hager SE

- Havells India Limited

- Hitachi, Ltd.

- Korlen

- Legrand SA

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- NHP Electrical Engineering Products Pty Ltd

- NOARK Electric Co., Ltd.

- OMEGA Engineering, Inc.

- ONESTOP Electrical

- Rockwell Automation, Inc.

- Sensata Technologies Holding plc

- Siemens Aktiengesellschaft

- Terasaki Electric Co., Ltd.

- TOSUNlux

- WEG S.A.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Molded Case Circuit Breaker market report include:- Schneider Electric SE

- ABB Ltd.

- Changshu Switchgear Co., Ltd.

- CHINT Group

- E‑T‑A Elektrotechnische Apparate GmbH

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- Hager SE

- Havells India Limited

- Hitachi, Ltd.

- Korlen

- Legrand SA

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- NHP Electrical Engineering Products Pty Ltd

- NOARK Electric Co., Ltd.

- OMEGA Engineering, Inc.

- ONESTOP Electrical

- Rockwell Automation, Inc.

- Sensata Technologies Holding plc

- Siemens Aktiengesellschaft

- Terasaki Electric Co., Ltd.

- TOSUNlux

- WEG S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | October 2025 |

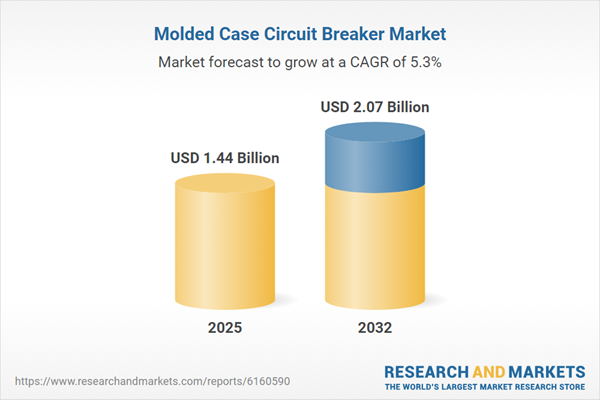

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.44 Billion |

| Forecasted Market Value ( USD | $ 2.07 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |