Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the transformative importance of human leukocyte antigen typing as a cornerstone in precision diagnostics and transplantation strategy planning

Human leukocyte antigen typing has emerged as a pivotal tool in the personalization of healthcare by enabling precise matching in transplantation and by informing risk assessments in disease association studies. This introduction explores the biological underpinnings of HLA polymorphism and the critical role that accurate allele identification plays in preventing graft rejection, optimizing pharmacogenomic interventions, and advancing forensic investigations.By tracing the evolution from serological assays to high-resolution molecular techniques, this section sets the stage for understanding how HLA typing undergirds both routine clinical diagnostics and cutting-edge research applications. The interplay between scientific innovation, regulatory standards, and clinical demand drives continuous refinement of typing methodologies. As precision medicine takes center stage, HLA typing stands as a foundational discipline that shapes patient outcomes, informs drug development pipelines, and catalyzes translational research across multiple domains.

Examining the paradigm shift driven by next generation sequencing innovations and regulatory evolutions in HLA typing landscapes worldwide

The landscape of human leukocyte antigen typing is undergoing a remarkable transformation fueled by advancements in next-generation sequencing, automation, and bioinformatics integration. High-throughput platforms now deliver unprecedented resolution at reduced turnaround times, enabling laboratories to transition from low-resolution group typing to detailed allele-level characterization. This shift not only improves transplant compatibility assessments but also expands applications in pharmacogenomics and disease association studies.Regulatory frameworks have adapted in parallel, introducing streamlined pathways for clinical validation while enforcing stringent quality management systems. These changes have lowered entry barriers for innovative technologies, encouraging collaboration between academic centers, diagnostic manufacturers, and contract research organizations. As digital transformation takes hold, the integration of cloud-based analysis tools and AI-driven interpretation pipelines is further accelerating throughput and consistency, promising a new era of rapid, data-rich HLA typing protocols.

Assessing the multifaceted influence of newly implemented United States tariffs on procurement costs and supply chain resilience in HLA typing ecosystem

The introduction of increased United States tariffs in 2025 has created a ripple effect across the global human leukocyte antigen typing supply chain, impacting the procurement of sequencers, reagents, and laboratory consumables. Organizations reliant on imports have reported escalated operational costs, prompting many to renegotiate supplier agreements or diversify sourcing strategies to mitigate financial pressures.In response, leading instrument manufacturers and reagent providers have intensified efforts to localize production and optimize logistical pipelines. While some laboratories have absorbed additional expenses without compromising service levels, others are accelerating adoption of cost-efficient assay formats or exploring reagent rental programs. These tactical adjustments underscore the need for agile supply chain management and proactive stakeholder communication as tariffs continue to reshape cost structures and competitive dynamics in HLA typing.

Highlighting critical segmentation revelations across technology platforms applications end users and product type classifications shaping HLA typing market dynamics

Analyzing the market through a technology-centric lens reveals that next generation sequencing platforms are rapidly gaining prominence due to their scalability and depth of allele resolution, while PCR sequence specific oligonucleotide probes and PCR sequence specific primers maintain a strong presence in medium-throughput settings. Sanger sequencing continues to serve niche applications where established protocols and legacy workflows prevail.From an application standpoint, disease association studies are increasingly leveraging high-resolution typing data to uncover novel genetic predispositions, while forensic investigations depend on specialized primer-based methods for precise individual identification. Pharmacogenomics has surfaced as a critical driver for personalized drug therapy, and transplantation remains the primary revenue source, demanding continuous improvements in matching accuracy.

End users such as hospitals and diagnostic laboratories are investing in integrated platforms to streamline clinical workflows, whereas research and academic institutes emphasize flexibility and depth of analysis. Transplant centers, in turn, require rapid turnaround and robust data interpretation to support time-sensitive decision-making.

Product segmentation highlights the evolution of comprehensive instrument and software suites that offer end-to-end solutions, alongside modular kits and reagents designed for specific assay components. This dual structure caters to fully automated laboratory environments and to facilities that prefer bespoke reagent packages, reflecting a nuanced approach to market coverage.

Delving into regional disparities and growth drivers across the Americas Europe Middle East Africa and Asia-Pacific HLA typing sectors

Regional analysis indicates that the Americas continue to lead in HLA typing adoption, propelled by substantial investments in genomic infrastructure and well-established clinical trial frameworks. The United States, in particular, has seen accelerated uptake of high-resolution sequencing technologies, supported by favorable reimbursement environments and robust academic-industry collaborations.In Europe, Middle East & Africa, a heterogeneous landscape emerges, where mature markets benefit from harmonized regulatory directives and centralized reference laboratories, while emerging economies are driving expansion through public health initiatives and cross-border partnerships. Demand for transplantation services and forensic capabilities remains a consistent growth catalyst across the region.

The Asia-Pacific region is distinguished by rapidly increasing government funding for genomics research, a growing network of private diagnostic chains, and escalating interest in pharmacogenomic profiling. Local manufacturing hubs are evolving to address cost sensitivities, and strategic alliances with global technology providers are accelerating technology transfer and capacity building across major economies such as China, Japan, and India.

Revealing competitive maneuvers strategic alliances and innovation pipelines that define the leadership landscape in HLA typing development

The competitive landscape of human leukocyte antigen typing is defined by a blend of established diagnostic equipment manufacturers and agile biotechnology firms. Leading stakeholders are expanding their portfolios through strategic acquisitions of niche assay developers and forging partnerships with genomics platforms to enhance end-to-end offerings. Collaborative ventures with academic institutions and contract research organizations are further solidifying their presence in emerging application areas.R&D pipelines are heavily oriented toward multiplexed assay formats, integrated software solutions that streamline data interpretation, and novel chemistries that reduce reagent consumption. Some entities are piloting subscription-based service models to deliver reagents and data analysis as a bundled solution, fostering deeper customer engagement. Competitive differentiation increasingly hinges on the ability to demonstrate clinical utility, regulatory compliance, and efficient supply chain management, as buyers seek reliable, validated systems for both routine diagnostics and advanced research.

Proposing strategic initiatives operational optimizations and collaborative frameworks to accelerate growth in the dynamic HLA typing arena

Industry leaders should prioritize the establishment of flexible supply chain networks that incorporate local manufacturing partners to mitigate exposure to international tariffs and logistical disruptions. Concurrently, investing in automation and cloud-based bioinformatics platforms will enhance throughput and consistency, enabling laboratories to balance high-resolution demands with resource efficiency.Developing strategic partnerships with academic and clinical research centers can accelerate validation of novel assay formats and strengthen adoption in transplantation and pharmacogenomics. Organizations should also explore subscription or reagent rental models as a means to streamline procurement processes and foster long-term customer loyalty. Lastly, maintaining active engagement with regulatory bodies will ensure early alignment with evolving quality standards and facilitate smoother market entry for innovative technologies.

Outlining the rigorous multi tiered research approach expert engagements and data validation techniques underpinning this HLA typing analysis

This analysis is grounded in a robust, multi-tiered research framework combining primary interviews with key opinion leaders, laboratory directors, and procurement executives, alongside a comprehensive review of regulatory filings, patent databases, and peer-reviewed publications. Quantitative data was triangulated across multiple vendor reports, industry white papers, and conference proceedings to ensure consistency and reliability.Secondary research involved mapping technology pipelines, assessing clinical validation studies, and synthesizing information from accreditation bodies. All findings were rigorously validated through follow-up consultations with subject matter experts and cross-checked against industry benchmarks. This meticulous approach ensures that the insights presented reflect the current state of technological innovation, competitive dynamics, and regional market drivers within the human leukocyte antigen typing domain.

Synthesizing core insights future outlook and the imperative for innovation adoption in human leukocyte antigen typing sphere

In conclusion, human leukocyte antigen typing stands at the nexus of scientific innovation and clinical application, with advances in high-resolution sequencing, automation, and bioinformatics reshaping the market. Tariff-driven supply chain realignments underscore the importance of diversified procurement strategies and localized manufacturing capabilities. Segmentation analysis reveals that technology, application, and end-user dynamics are intricately linked, driving tailored solutions for transplantation, disease association research, pharmacogenomics, and forensic investigations.Regional trends highlight leadership in the Americas, complemented by targeted growth in Europe, Middle East & Africa, and rapid expansion across Asia-Pacific. Competitive intensity is high as companies vie for differentiation through partnerships, product innovation, and flexible service models. The recommendations outlined herein provide a roadmap for stakeholders to navigate evolving regulatory landscapes, optimize operational efficiencies, and capitalize on emerging growth opportunities in this critical field.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Instruments

- Flow Cytometers

- PCR Systems

- Sequencing Instruments

- Next-Generation Sequencers

- Sanger Sequencers

- Reagents & Consumables

- Assay Consumables

- NGS & Sanger Sequencing Kits / Library Prep Kits

- PCR Reagents

- Software & Services

- Instruments

- Application

- Disease Association Studies

- Forensic Studies

- Pharmacogenomics

- Transplantation

- End User

- Hospitals & Diagnostic Labs

- Research & Academic Institutes

- Transplant Centers

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- QIAGEN N.V.

- CareDx, Inc.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Becton, Dickinson and Company (BD)

- Immucor, Inc.

- Omixon Inc.

- TBG Diagnostics Ltd.

- BAG Diagnostics GmbH

- Creative Biolabs

- Fujirebio, Inc.

- Pacific Biosciences (PacBio)

- Biofortuna Ltd.

- Takara Bio, Inc.

- Hologic, Inc.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Eurofins Scientific

- Beckman Coulter Life Sciences

- Oxford Nanopore Technologies Plc

- HistoGenetics LLC

- Bruker Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Human Leukocyte Antigens Typing market report include:- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- QIAGEN N.V.

- CareDx, Inc.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Becton, Dickinson and Company (BD)

- Immucor, Inc.

- Omixon Inc.

- TBG Diagnostics Ltd.

- BAG Diagnostics GmbH

- Creative Biolabs

- Fujirebio, Inc.

- Pacific Biosciences (PacBio)

- Biofortuna Ltd.

- Takara Bio, Inc.

- Hologic, Inc.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Eurofins Scientific

- Beckman Coulter Life Sciences

- Oxford Nanopore Technologies Plc

- HistoGenetics LLC

- Bruker Corporation

Table Information

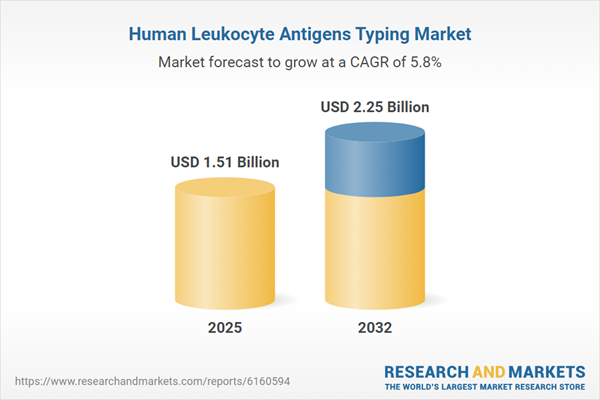

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.51 Billion |

| Forecasted Market Value ( USD | $ 2.25 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |