Speak directly to the analyst to clarify any post sales queries you may have.

Understanding the Evolution of Shower Oil Consumption Driven by Wellness Trends and Formulation Innovations

In this executive summary, we embark on a journey to unravel the complexities underpinning the contemporary shower oil landscape. Over recent years, this segment has evolved beyond traditional cleansing routines to embrace multifunctional formulations that cater to both wellness sensibilities and aesthetic desires. Consumers are increasingly seeking products that not only cleanse but also nourish, hydrate, and deliver sensorial experiences reminiscent of spa rituals. This shift underscores the importance of understanding the interplay between consumer priorities, formulation science, and distribution innovations.To navigate this terrain, we explore the confluence of demographic trends, sustainability imperatives, and digital engagement strategies that collectively shape purchasing behaviors. New entrants backed by emerging technologies and established brands leveraging legacy strengths are both vying for attention, prompting a redefinition of value propositions. Our analysis identifies the foundational trends that form the bedrock of this report, setting the stage for deeper insights into regulatory changes, supply chain disruptions, and segmentation nuances that follow in subsequent sections.

How Sustainability Imperatives Digital Engagement and Advanced Delivery Technologies Are Redefining the Shower Oil Landscape

The shower oil landscape has experienced transformative shifts fueled by a convergence of sustainability mandates, digital empowerment, and ingredient innovation. First, heightened consumer consciousness around environmental stewardship has pressured suppliers to adopt biodegradable formulas and refillable packaging solutions. In parallel, advances in encapsulation technologies have enabled the stabilization of delicate essential oils, unlocking new possibilities for prolonging shelf life and enhancing sensorial delivery.Moreover, the proliferation of e-commerce platforms and social media influencers has redefined how brands connect with end users. Real-time feedback loops have accelerated product iteration cycles, compelling industry players to adopt agile development methodologies. Additionally, collaborations with wellness experts and dermatologists have elevated product credibility and driven experiential marketing initiatives such as interactive virtual try-ons. As a result, the competitive landscape is more dynamic than ever before, demanding constant vigilance and strategic adaptability.

Assessing the Broad Repercussions of New Tariff Measures on Supply Chains Procurement Practices and Cost Models in Shower Oil

The implementation of new United States tariff policies in 2025 has introduced significant variables into procurement strategies and cost structures across the shower oil supply chain. By increasing duties on key imported raw materials, these measures have incentivized manufacturers to reassess sourcing geographies, leading to a renewed emphasis on domestic or nearshore ingredient suppliers. Consequently, logistics networks have undergone recalibration as stakeholders optimize for lower freight costs and reduced lead times.Furthermore, the tariff-driven inflationary pressure has prompted pricing negotiations with distributors and sparked collaborative cost-sharing initiatives. In some cases, brands have reengineered formulations to maintain performance while substituting higher-duty inputs with lower-cost alternatives. Strategic alliances have also emerged, enabling consolidated purchasing volumes that mitigate the impact of additional levies. Taken together, these developments underscore the importance of agile financial planning and robust supplier relationship management to sustain margin resilience in an era of heightened trade policy uncertainty.

Uncovering Actionable Insights from Ingredient Product Form Packaging Distribution and End User Segmentation

A nuanced examination of ingredient-based segmentation reveals two principal formulation approaches: those relying on natural or organic botanicals and essential oils, and those leveraging synthetic compounds designed for consistency and cost efficiency. Within the former, botanical oil and essential oil variations have demonstrated particular appeal among discerning consumers who prioritize clean-label transparency. In contrast, synthetic alternatives often appeal to value-driven segments seeking reliable performance at accessible price points.Transitioning to product form, liquid oils continue to dominate due to their versatility, while oil mists have gained traction for their lightweight feel and travel-friendly appeal. Solid oil bars, though a smaller share, satisfy consumer demand for minimalistic, waterless solutions. Packaging type further influences purchase decisions, with traditional bottles and pumps remaining predominant, while sachets and tubes cater to trial experiences and on-the-go convenience.

Regarding skin type considerations, formulations targeting dry skin often feature emollient-rich profiles, whereas offerings designed for oily or acne-prone skin incorporate mattifying agents to balance hydration without clogging pores. Distribution channels encompass offline environments-pharmacies and drugstores, specialty stores, supermarkets and hypermarkets-and online avenues including company websites and third-party e-commerce platforms, each providing distinct paths to market. Finally, end-user segmentation highlights personal use as the primary driver, with commercial applications spanning gyms and fitness centers, hotels and resorts, and wellness and spa centers seeking to deliver differentiated guest experiences.

Decoding Regional Consumer Preferences Regulatory Drivers and Distribution Dynamics across Americas EMEA and Asia Pacific

Regional dynamics in the shower oil domain reflect diverse consumer preferences and regulatory landscapes. In the Americas, premiumization trends are pronounced, with a growing appetite for artisanal and sustainable formulations. Brands in North America are also accelerating digital loyalty programs to foster deeper consumer engagement, while Latin American markets show a rising interest in natural ingredients driven by a cultural affinity for botanical remedies.Within Europe, the Middle East, and Africa, stringent cosmetics regulation has catalyzed a shift toward accredited certifications such as ECOCERT and COSMOS. European consumers demand high transparency in ingredient sourcing, prompting brands to emphasize fair-trade partnerships. Meanwhile, Mid-East markets exhibit robust luxury segment growth, and African markets display potential for expansion as distribution infrastructure modernizes.

Asia-Pacific continues to be a hotbed of innovation, with East Asian markets leading in advanced delivery systems like microencapsulation. South-East Asian consumers demonstrate a strong preference for hybrid formulations that blend traditional oils with contemporary actives. Across the region, digital marketplaces dominate discovery channels, making omnichannel strategies essential for success.

Profiling Leading Innovators Alliances and Strategic Acquisitions That Shape Competitive Dynamics in Shower Oil

Industry leaders are charting ambitious paths to differentiate and fortify their market positions. Domestic champions have prioritized vertical integration, securing raw material sources to enhance supply certainty and control costs. Multinational corporations continue to leverage vast R&D budgets to pioneer novel emulsification and encapsulation technologies, cementing their reputations as innovation powerhouses.Collaborations between established personal care conglomerates and niche wellness brands have become increasingly common, resulting in co-branded lines that capture cross-sector audiences. Furthermore, strategic acquisitions are facilitating rapid portfolio diversification, allowing buyers to swiftly enter adjacent categories such as bath oils and serums. These corporate maneuvers underscore the evolving nature of competitive positioning and the necessity of maintaining both breadth and depth within product offerings.

Strategic Imperatives for Leaders to Drive Product Innovation Supply Chain Agility and Sustainable Competitive Advantage

To thrive in this rapidly evolving environment, industry leaders should embrace a multifaceted strategy that combines agile product development, strategic partnerships, and investment in sustainable practices. First, establishing an open innovation network with ingredient suppliers and research institutions can accelerate the introduction of next-generation formulations. In parallel, leveraging data-driven consumer insights-including purchase behavior and social media sentiment-will enable more targeted marketing campaigns and personalized offerings.Supply chain resilience must also be prioritized through dual-sourcing strategies and real-time visibility platforms to mitigate tariff volatility and logistical disruptions. Additionally, adopting circular packaging models and transparent certification frameworks will resonate with eco-conscious consumers while adhering to emerging regulatory expectations. Finally, cultivating omnichannel experiences that seamlessly integrate physical retail, direct-to-consumer touchpoints, and digital engagement will maximize market reach and foster long-term loyalty.

Illuminating a Rigorous Hybrid Research Framework Combining Qualitative Interviews Quantitative Analysis and Validation Protocols

This research combines primary and secondary data collection methods to ensure comprehensive and validated findings. Primary insights were gathered through in-depth interviews with industry veterans, ingredient suppliers, and key distributors, providing qualitative perspectives on emerging trends and strategic priorities. These interviews were augmented by a series of consumer focus groups, illuminating end-user preferences and unmet needs.Secondary research entailed a thorough review of regulatory filings, sustainability certifications, white papers, and publicly disclosed financial reports. Advanced analytical techniques, including trend mapping and scenario planning, were applied to interpret tariff impacts and regional growth differentials. Finally, a multi-stage validation process involving cross-functional experts ensured the accuracy and reliability of our conclusions, resulting in an actionable roadmap for stakeholders.

Conclusion Synthesizing Key Discoveries from Industry Transformations Tariff Effects and Segmentation Insights to Guide Strategy

In conclusion, the shower oil industry stands at a pivotal juncture characterized by shifting consumer priorities, evolving trade policies, and intensifying competitive dynamics. By understanding the transformative impact of sustainability expectations, digital engagement channels, and tariff interventions, stakeholders can craft resilient strategies that anticipate and adapt to market fluctuations.The segmentation insights underscore the necessity of aligning formulations with consumer lifestyles and preferences, while regional analyses highlight growth pockets and regulatory considerations essential for market entry and expansion. Moving forward, leveraging robust research methodologies and pursuing strategic collaborations will be critical for those aiming to capture value in this vibrant sector. Armed with these insights, decision-makers are well positioned to navigate uncertainty and drive long-term value creation.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Ingredients

- Natural/Organic Ingredients

- Botanical Oil

- Essential Oil

- Synthetic Ingredients

- Natural/Organic Ingredients

- Product Form

- Liquid Oil

- Oil Mist

- Solid Oil Bar

- Packaging Type

- Bottle

- Pump

- Sachet

- Tube

- Skin Type

- Dry Skin

- Oily/Acne-Prone Skin

- Distribution Channel

- Offline

- Pharmacies/Drugstores

- Specialty Stores

- Supermarkets/Hypermarkets

- Online

- Company Websites

- E-commerce Platforms

- Offline

- End User

- Commercial Use

- Gyms & Fitness Centers

- Hotels & Resorts

- Wellness & Spa Centers

- Personal Use

- Commercial Use

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Beiersdorf AG

- Johnson & Johnson Services, Inc.

- Amorepacific Corporation

- Aadhunik Ayurveda

- Bio Atoms

- Bioderma by NAOS USA INC

- Buff City Soap, LLC by Guideboat Capital Partners LLC

- Kao Corporation

- Kenvue Inc.

- L'Occitane International SA

- L'Oréal S.A.

- Lush Retail Ltd.

- Mary Kay Inc.

- META-LAB SCIENTIFIC INDUSTRIES

- Natura &Co Group of Companies

- Olverum Limited

- Palmer’s by E.T. Browne Drug Co., Inc.

- René Furterer by Pierre Fabre S.A

- Revlon, Inc.

- Rituals Cosmetics Enterprise B.V.

- Sadhev

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Shower Oil market report include:- Beiersdorf AG

- Johnson & Johnson Services, Inc.

- Amorepacific Corporation

- Aadhunik Ayurveda

- Bio Atoms

- Bioderma by NAOS USA INC

- Buff City Soap, LLC by Guideboat Capital Partners LLC

- Kao Corporation

- Kenvue Inc.

- L'Occitane International SA

- L'Oréal S.A.

- Lush Retail Ltd.

- Mary Kay Inc.

- META-LAB SCIENTIFIC INDUSTRIES

- Natura &Co Group of Companies

- Olverum Limited

- Palmer's by E.T. Browne Drug Co., Inc.

- René Furterer by Pierre Fabre S.A

- Revlon, Inc.

- Rituals Cosmetics Enterprise B.V.

- Sadhev

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

Table Information

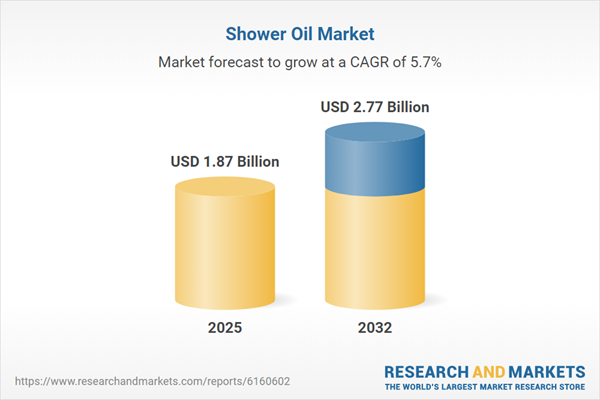

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.87 Billion |

| Forecasted Market Value ( USD | $ 2.77 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |