Speak directly to the analyst to clarify any post sales queries you may have.

A strategic primer on the expanding role of rigorous testing inspection and certification in enabling safe scalable hydrogen-powered vehicle deployment

The maturation of hydrogen-powered mobility has shifted the testing, inspection, and certification domain from a niche engineering exercise to a central pillar of automotive program risk management. As vehicle manufacturers and suppliers integrate fuel cell systems, high-pressure hydrogen storage, and associated safety systems, the technical complexity of verification expands across materials, electrical systems, and integrated controls. This introduction frames why robust testing protocols and harmonized certification pathways are essential to enable safe vehicle deployment while preserving time-to-market and protecting brand reputation.Regulatory agencies, OEMs, and technology suppliers now confront overlapping responsibilities: regulators must set performance and safety baselines that reflect unique hydrogen hazards; OEMs must validate integration of fuel cell stacks, storage systems, and onboard sensors; and suppliers must demonstrate component-level resilience across lifespan and environmental conditions. Consequently, the ecosystem requires coordinated inspection regimes, repeatable testing methodologies, and transparent certification documentation. By establishing these foundations, stakeholders will reduce program uncertainty, accelerate public acceptance, and enable the scalable adoption of hydrogen propulsion across commercial and passenger vehicle segments.

How regulatory acceleration advanced test technologies and data-driven verification are reshaping inspection certification processes across the hydrogen vehicle landscape

Over the past several years, transformative shifts have redefined how the industry approaches hydrogen automotive validation and compliance. Regulation and standards development have accelerated, with safety protocols moving from experimental guidance toward formalized homologation requirements. This evolution requires test labs and inspection regimes to expand capabilities beyond traditional mechanical and electrical verification to encompass hydrogen-specific phenomena such as permeation, embrittlement, and high-pressure leak dynamics. At the same time, advances in materials science, sensor technologies, and digital simulation tools are enabling more predictive validation pathways that can shorten iterative design cycles while improving safety margins.Concurrently, the structure of testing itself is becoming modular and data-driven. Digital twins and model-in-the-loop testing complement physical rigs, permitting earlier identification of system-level risks and enabling more targeted physical test campaigns. Industry collaboration networks are emerging to harmonize component-level test protocols for fuel cell stacks, storage systems, and onboard sensors, which facilitates cross-recognition of results and reduces redundant testing across jurisdictions. Finally, the operationalization of inspection regimes is adapting to large-scale fleet deployment scenarios where in-service inspection, tank and line integrity verification, and rapid field inspection processes are essential to maintain safety and uptime as hydrogen vehicles move from pilots to commercial operation.

Understanding how trade measures and tariff shifts can reshape supply chain sourcing certification workflows and testing investment decisions in hydrogen vehicle programs

Policy shifts involving tariffs and trade measures influence supply chain design, component sourcing, and program timelines across the hydrogen automotive ecosystem. The cumulative impact of any United States tariff measures announced or implemented in 2025 will not be limited to direct cost implications; they will also ripple through procurement choices, certification sequences, and regional sourcing strategies. When tariffs target imported high-pressure tanks, fuel cell components, or specialized test equipment, manufacturers and suppliers typically respond by evaluating alternative suppliers, increasing localization of critical components, or accelerating qualification of domestically produced equivalents-actions that affect testing volumes, lead times, and certification planning.Tariff-induced reconfiguration can also change the locus of testing and certification activity. If import constraints raise the cost or reduce availability of international test rigs or calibration equipment, third-party labs and OEM-owned facilities may need to invest in expanded capability or establish reciprocal reciprocal recognition agreements with allied jurisdictions. At the program level, procurement teams must account for potential timeline slips driven by requalification of alternative suppliers and by extended inspection requirements for new domestic parts. From a regulatory perspective, authorities may face increased requests for clarification on acceptable evidence when component provenance shifts, reinforcing the need for transparent documentation and harmonized test protocols that can accommodate supplier transitions without compromising safety or certification integrity.

Targeted segmentation insights that connect service types fuel cell technologies components vehicle classes and end-user priorities to testing and certification resource allocation

A granular segmentation approach clarifies where testing and certification resources deliver the greatest program value. By service type, the market divides into certification pathways, inspection services, and testing operations; certification encompasses homologation services safety and compliance certifications and type approval processes, each requiring detailed documentation and regulatory liaison, while inspection includes field inspection in-service inspection pre-shipment inspection production line inspection and tank and line integrity verification that together verify installation quality and operational safety, and testing covers component testing material testing and vehicle testing which validate performance under real-world and accelerated stress conditions.Fuel cell architecture further differentiates validation needs: alkaline fuel cells and direct methanol fuel cells have distinct chemical and operational risk profiles, whereas proton exchange membrane fuel cells and solid oxide fuel cells demand specific thermal and water management verification. Component focus also drives testing scope: electrical and electronic systems fueling system interfaces hydrogen fuel cell stacks hydrogen storage systems onboard hydrogen sensors powertrain and drivetrain components and thermal management systems each require customized test protocols that address interaction effects and failure modes. Vehicle type matters for test regimes too, with commercial vehicles and passenger vehicles presenting divergent duty cycles and durability expectations; commercial extends into heavy commercial vehicles and light commercial vehicles while passenger vehicle testing spans hatchbacks sedans and SUVs. Finally, end users determine prioritization and evidence requirements: automobile manufacturers government and regulatory agencies hydrogen fuel cell manufacturers and research institutes and universities each place different emphasis on repeatability traceability and openness of testing data.

Critical regional intelligence that maps regulatory ecosystems testing capacity and cross-border recognition dynamics across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics dictate how testing infrastructures scale and which certification pathways become dominant. In the Americas the interplay of federal and state-level regulations influences where compliance testing is required and how inspection capacity is distributed; investment in domestic testing capacity often intersects with incentives to localize critical components, shaping supplier qualification strategies. Europe Middle East & Africa exhibits a mosaic of regulatory frameworks where European Union harmonization efforts coexist with country-specific homologation rules and where Gulf markets pursue rapid adoption of hydrogen infrastructure, creating demand for both export-aligned and locally tailored certification services.Asia-Pacific features a wide range of maturity across markets: some countries emphasize rapid fleet deployment supported by centralized certification authorities and strong domestic supply chains, while others leverage academic partnerships and research institutes to support early-stage fuel cell development and testing innovation. Across regions, cross-border recognition of test results and bilateral agreements can reduce redundant testing, but differences in standards and inspection practices still require careful program-level planning when vehicles or components move between jurisdictions. Understanding these regional contours enables urgent decisions about where to locate testing assets, how to structure compliance dossiers, and which regional partnerships will speed market entry.

Key company-level dynamics revealing how OEMs test houses equipment suppliers and research institutions collaborate to build trusted verification ecosystems for hydrogen vehicles

Industry incumbents and emerging specialists play complementary roles in the hydrogen testing and certification value chain. Established OEMs and Tier 1 suppliers are investing in in-house test rigs and qualification teams to retain control over critical validation activities and to protect intellectual property associated with integration of fuel cell systems. Specialized independent testing laboratories provide neutral third-party verification and increasingly offer modular service suites including component-level endurance testing system integration validation and environmental stress screening. At the component level, manufacturers of storage vessels, fuel cell stacks, and onboard sensors are expanding their internal test capabilities while partnering with external labs for third-party certification that supports global homologation.Testing equipment vendors and software providers are introducing instrumentation and digital platforms that automate data capture and enable traceability across test campaigns. Certification bodies and accredited laboratories are adapting to hydrogen-specific requirements by developing new test methods and accreditation scopes, and research institutions are contributing to protocol development, particularly around long-duration degradation mechanisms and materials compatibility. Together, these actors form an ecosystem where collaboration and recognized traceability determine how rapidly new vehicles can move from prototype to certified production.

Actionable recommendations for manufacturers suppliers and testing providers to derisk programs scale capabilities and maintain certification agility in evolving regulatory environments

Leaders in vehicle electrification and component supply should adopt several practical actions to mitigate program risk and accelerate compliance. First, prioritize early engagement with regulators and certification bodies to align test evidence requirements with design milestones, thereby reducing late-stage rework and unexpected approval delays. Second, invest in a hybrid testing strategy that combines physical rigs with digital twin and accelerated durability simulation capabilities to identify system-level failure modes earlier in development and to reduce cumulative physical test cycles. Third, diversify supplier qualification by creating pre-approved pools of alternate suppliers and by establishing standardized acceptance criteria that simplify requalification when sourcing changes occur.Additionally, organizations should develop an inspection playbook for in-service and field verification that integrates remote diagnostics and periodic integrity checks for hydrogen storage and distribution interfaces. Invest in workforce development to ensure technicians, test engineers, and certification specialists understand hydrogen-specific failure mechanisms and inspection techniques. Finally, scenario-plan for trade and tariff contingencies by modeling supplier relocation timelines and by negotiating flexible contractual terms that permit rapid supplier substitution without invalidating certification evidence. These actions will reduce program exposure and enable a more resilient path to large-scale deployment.

Transparent and repeatable research methodology that integrates primary stakeholder engagement technical literature and validation steps to produce operationally relevant test protocols

A rigorous methodology underpins the insights presented, combining structured primary engagement with targeted secondary synthesis and iterative validation. Primary inputs include in-depth interviews with program leads engineering managers certification specialists and laboratory directors, supplemented by technical reviews of publicly available regulatory documents standards proposals and white papers that define test methods and compliance expectations. Secondary analysis draws on peer-reviewed technical literature patents and product specifications to triangulate component-level test requirements and to map emerging instrumentation capabilities.Method validation is achieved through cross-referencing interview findings with documented test procedures and accreditation criteria, and by conducting scenario stress tests that evaluate how shifts in supplier sourcing or regulatory interpretation could influence testing workflows. Finally, evidence is curated to produce reproducible test matrices and protocol blueprints, ensuring that stakeholders can translate insights into operational test plans and certification dossiers. Transparency in the methodology enables stakeholders to assess relevance to their programs and to request targeted supplemental analysis when specific use cases require deeper examination.

A concise conclusion highlighting testing and certification as the decisive operational and strategic enabler for safe scalable hydrogen vehicle commercialization

The transition to hydrogen-powered mobility hinges on the industry's ability to validate complex systems reliably and at scale. Testing inspection and certification are not ancillary functions but strategic enablers that determine whether new technologies can be deployed safely and at speed. Across service types fuel cell architectures component categories vehicle segments and regional regulatory systems, program leaders must harmonize technical evidence generation with regulatory expectations to avoid delays and to protect operational safety. Collaborative standardization, investment in modular and digital testing capabilities, and strategic regional placement of facilities will reduce redundancy and accelerate recognition of test outcomes.As the ecosystem evolves, stakeholders who proactively align engineering development with certification pathways and who maintain flexible supplier strategies will gain decisive advantages. The landscape will continue to change as technologies mature and policy frameworks evolve, but the underlying mandate remains constant: rigorous, traceable, and repeatable testing is the foundation for safe hydrogen vehicle deployment and long-term commercial success.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Service Type

- Certification

- Homologation Services

- Safety & Compliance Certifications

- Type Approval

- Inspection

- Field Inspection

- In-service Inspection

- Pre-shipment Inspection

- Production Line Inspection

- Tank and Line Integrity Verification

- Testing

- Component Testing

- Material Testing

- Vehicle Testing

- Certification

- Fuel Cell Type

- Alkaline Fuel Cell

- Direct Methanol Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Solid Oxide Fuel Cell

- Component Tested

- Electrical/Electronic Systems

- Fueling System Interface

- Hydrogen Fuel Cell Stack

- Hydrogen Storage System

- Onboard Hydrogen Sensors

- Powertrain & Drivetrain Components

- Thermal Management Systems

- Vehicle Type

- Commercial Vehicles

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

- Hatchbacks

- Sedans

- SUVs

- Commercial Vehicles

- End User

- Automobile Manufacturers

- Government & Regulatory Agencies

- Hydrogen Fuel Cell Manufacturers

- Research Institutes & Universities

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Allison Transmission

- Bureau Veritas SA

- Apave Group

- Applus+ Servicios Tecnológicos, S.L

- AVL GmbH

- DEKRA SE

- dSPACE GmbH

- First Hydrogen Corp.

- Intertek Group plc

- Kiwa

- Mark Allen Group

- Ricardo Plc

- SGS SA

- TÜV SÜD

- UL LLC

- TÜV NORD Group

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Hydrogen Automotive Testing, Inspection, & Certification market report include:- Allison Transmission

- Bureau Veritas SA

- Apave Group

- Applus+ Servicios Tecnológicos, S.L

- AVL GmbH

- DEKRA SE

- dSPACE GmbH

- First Hydrogen Corp.

- Intertek Group plc

- Kiwa

- Mark Allen Group

- Ricardo Plc

- SGS SA

- TÜV SÜD

- UL LLC

- TÜV NORD Group

Table Information

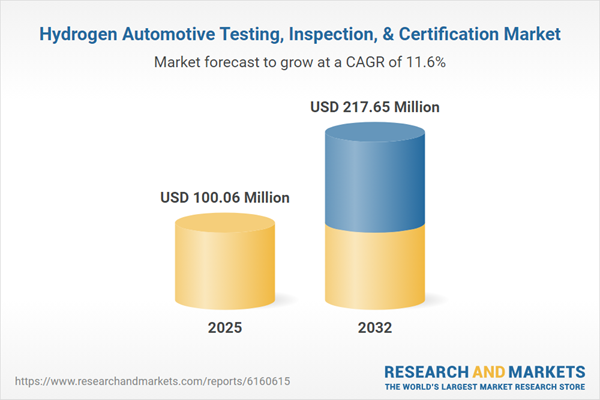

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 100.06 Million |

| Forecasted Market Value ( USD | $ 217.65 Million |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |