Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Strategic Canvas of Plastic Thermoformed Products: Contextualizing Market Forces and Stakeholder Imperatives in an Evolving Industry

The plastic thermoformed products industry stands at a pivotal moment, shaped by converging technological breakthroughs, evolving regulatory frameworks, and shifting consumer expectations. As end-use markets from food and beverage packaging to medical trays demand ever greater levels of customization, efficiency, and sustainability, manufacturers and brand owners must navigate a landscape that rewards agility and foresight.This executive summary introduces the foundational themes driving industry transformation. It outlines the primary market influences, underscores the importance of strategic alignment across product innovation, material selection, and operational excellence, and frames the imperative for stakeholders to anticipate change rather than react to it. By contextualizing current dynamics within broader logistical, environmental, and geopolitical currents, the introduction sets the stage for a deeper exploration of the forces reshaping plastic thermoforming. Ultimately, this section underscores the value of an integrated approach to strategic planning, one that balances near-term operational imperatives with long-term resilience and growth.

Navigating the Convergence of Digital Automation, Sustainability Mandates, and Design Complexity Reshaping Plastic Thermoforming Operations

In recent years, the plastic thermoformed products arena has experienced transformative shifts that extend far beyond incremental efficiency improvements. Rapid advancements in digital process control, including the integration of IoT sensors and real-time analytics, have elevated operational precision while enabling predictive maintenance and throughput optimization. Simultaneously, the circular economy movement has accelerated the adoption of recycled and bio-based resins, compelling manufacturers to rethink sourcing, product design, and end-of-life considerations.Adding another layer of complexity, consumer demand for differentiated packaging experiences has spurred greater design intricacy, driving investments in advanced tooling and mold capabilities. Regulatory developments around single-use plastics and extended producer responsibility continue to reshape compliance obligations, especially in jurisdictions with stringent environmental mandates. As a result, companies are recalibrating their supply chains, forming strategic alliances with resin suppliers and recycling specialists to secure feedstocks that align with sustainability goals. Taken together, these shifts underscore the need for adaptive business models that can harness technological innovation, regulatory foresight, and consumer insight to maintain competitiveness.

Assessing the Far-Reaching Supply Chain and Sourcing Ramifications of New United States Tariff Measures on Plastic Thermoforming

The introduction of new tariff measures in 2025 has generated significant reverberations throughout the plastic thermoformed products supply chain. Early indicators reveal that increased duties on imported resins and finished goods have elevated total landed costs, prompting manufacturers to seek alternative sourcing strategies. Domestic resin producers have gained relative leverage, although capacity constraints and price volatility have posed fresh challenges.Consequently, many converters have explored near-shoring options and forged long-term agreements with regional partners to mitigate tariff exposure. Contract manufacturers have also reassessed their production footprints, reallocating volumes to facilities in lower-tariff jurisdictions. This reorientation has affected lead times, inventory strategies, and capital expenditure plans as companies balance cost pressures with the need for supply continuity.

Meanwhile, end-use customers in food and beverage, medical, and consumer electronics sectors are bracing for potential pass-through impacts on packaging and component pricing. In response, several large brand owners are reevaluating packaging specifications and engaging with thermoformer partners to identify material substitutions and design adjustments that can offset cost increases while preserving functional integrity.

Decoding Complex Product, Material, Production, Application, and Distribution Segmentation to Uncover Strategic Leverage Points

Examining the industry through multiple segmentation lenses reveals nuanced insights that guide strategic decision-making. When viewed by product type, the market comprises agricultural trays, containers, cups, display packaging, lids, and trays & clamshells, each presenting distinct design requirements, end-user specifications, and cost profiles. Meanwhile, material selection further differentiates opportunities and challenges; polyethylene, polypropylene in its copolymer and homopolymer forms, polystyrene, and polyvinyl chloride each bring unique mechanical properties, processing parameters, and sustainability footprints that inform product innovation.Diving deeper, variations in production techniques-from plug assist forming and pressure forming to twin sheet and vacuum forming-create significant differentiation in tooling costs, production cycle times, and achievable part geometries. Applications span consumer electronics, food & beverage with dairy and snack packaging segments, household goods, industrial components, and medical & pharmaceutical uses such as diagnostic and surgical trays. Finally, the route to market via offline and online distribution channels dictates customer engagement models, inventory strategies, and packaging design for shipping resilience. Integrating these segmentation frameworks clarifies where investments in capability expansion, materials R&D, or channel partnerships will deliver the greatest impact.

Comparative Analysis of Regional Regulatory, Capacity, and Sustainability Drivers Shaping Global Thermoforming Strategies

Regional dynamics exert a defining influence on strategic priorities within the thermoforming arena. In the Americas, established production hubs are leveraging advanced automation investments to maintain cost competitiveness while responding to heightened environmental regulations. Local resin economies benefit from proximity to feedstock sources, although shifts in trade policies have spurred an increased focus on near-shore collaboration and supply chain redundancy.By contrast, Europe, Middle East & Africa presents a fragmented regulatory tapestry that drives a pronounced emphasis on circular economy initiatives. Stakeholders in this region are pioneering take-back programs, innovative recycling partnerships, and bio-resin trials, capitalizing on policy incentives and consumer activism to differentiate their offerings. Meanwhile, Asia-Pacific distinguishes itself through scale and capacity growth. Rapidly expanding manufacturing corridors in Southeast Asia and China continue to attract investment in high-volume thermoforming lines, even as leading players explore material innovations and quality upgrades to satisfy stringent end-market requirements in medical and electronics applications.

Together, these regional insights highlight the imperative for a globally coherent yet locally attuned strategy that balances regulatory compliance, supply chain resilience, and market responsiveness.

Profiling Market Leaders' Strategies in Automation, Sustainable Resin Partnerships, Niche Application Specialization, and Global Expansion

Leading enterprises in the plastic thermoformed products space are differentiating themselves through a combination of technological leadership, sustainability commitments, and strategic partnerships. Industry frontrunners have invested heavily in state-of-the-art automation systems that harness machine learning for process optimization, while forging alliances with polymer innovators to co-develop next-generation resins. Others are advancing closed-loop recycling models, incorporating post-consumer and post-industrial feedstocks to meet aggressive environmental pledges.A cohort of agile specialist manufacturers is focused on niche applications-such as high-precision diagnostic trays or custom electronics housings-where rapid prototyping and tool redesign capabilities confer a competitive edge. Meanwhile, several heavyweight converters are expanding their global footprints through targeted acquisitions, aiming to bolster regional presence and diversify end-market exposure. Across the spectrum, top companies are aligning their R&D pipelines with evolving regulatory frameworks and consumer expectations, ensuring that future product launches deliver both performance enhancements and sustainability gains.

Strategic Imperatives for Manufacturers to Integrate Sustainable Materials, Digital Twins, and Flexible Production for Lasting Competitive Advantage

To thrive in an increasingly complex environment, industry leaders should pursue a set of interlocking strategic initiatives. First, accelerating the integration of recycled and bio-based materials into core product lines will not only bolster compliance with emerging regulations but also resonate with sustainability-minded customers. In parallel, deploying advanced digital twins and analytics tools can drive continuous improvement in cycle times, scrap reduction, and energy consumption.Furthermore, cultivating collaborative relationships with resin suppliers, recyclers, and equipment vendors will unlock joint innovation opportunities that yield differentiated product offerings. Developing flexible manufacturing cells designed for rapid changeover will address growing demands for short-run customization without sacrificing efficiency. In channel strategies, aligning online and offline distribution networks through integrated inventory management systems will enhance customer responsiveness and reduce working capital requirements.

Finally, investing in workforce upskilling around digital competencies and sustainability best practices will ensure that internal capabilities remain aligned with strategic aspirations. By executing these priorities in a coordinated manner, organizations can secure both near-term operational gains and long-term market leadership.

Detailing a Rigorous Multi-Method Research Framework Combining Primary Executive Interviews, Site Evaluations, and Data Triangulation for Reliable Insights

This analysis is grounded in a robust research framework that synthesizes both qualitative and quantitative inputs. Primary research encompassed in-depth interviews with senior executives across thermoforming operations, resin suppliers, equipment OEMs, and end-use brand owners, ensuring a diverse array of perspectives on industry trends and strategic priorities. These insights were enriched by field visits to manufacturing facilities, where process observations and technology demonstrations informed assessments of operational maturity.Secondary research drew upon technical journals, regulatory publications, and proprietary databases to validate material performance characteristics, process innovations, and policy landscapes. Data triangulation techniques were employed to reconcile differing viewpoints and to bolster the reliability of key findings. Expert panels convened at multiple stages of the study provided critical feedback, enabling iterative refinements to analysis hypotheses and ensuring alignment with real-world practices.

This rigorous methodology underpins the credibility of the insights presented and equips stakeholders with a high degree of confidence in using these findings to inform strategic decision-making.

Synthesizing Industry Drivers, Segmentation Opportunities, and Competitive Strategies to Illuminate the Path Forward for Thermoforming

The plastic thermoformed products industry is navigating a transformative era characterized by technological breakthroughs, sustainability imperatives, and evolving trade dynamics. As tariffs and regulations reshape supply chains, and as end-use sectors demand ever more sophisticated packaging and component solutions, the ability to respond with agility, foresight, and innovation will determine market leadership.Integrating the segmentation insights across product type, material, production technique, application, and distribution pathways reveals clear zones of opportunity for targeted investment. Regional analyses underscore the importance of tailoring strategies to regulatory environments, resource endowments, and customer preferences. By examining the competitive landscape, companies can discern which strategic moves-whether in automation, recycled material integration, or capacity expansion-will yield the greatest returns.

Ultimately, the recommendations outlined herein offer a roadmap for stakeholders to transform market complexity into a source of competitive differentiation. With a disciplined approach to execution and a commitment to continuous learning, industry participants are well positioned to harness the full potential of plastic thermoformed products in the years ahead.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Agricultural Trays

- Containers

- Cups

- Display Packaging

- Lids

- Trays & Clamshells

- Material Type

- Polyethylene

- Polypropylene

- Copolymer

- Homopolymer

- Polystyrene

- Polyvinyl Chloride

- Production Techniques

- Plug Assist Forming

- Pressure Forming

- Twin Sheet Forming

- Vacuum Forming

- Application

- Consumer Electronics

- Food & Beverage

- Dairy Packaging

- Snack Packaging

- Household

- Industrial

- Medical & Pharmaceutical

- Diagnostic Trays

- Surgical Trays

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Amcor plc

- Berry Global Inc

- Advanced Extrusion, Inc.

- Anchor Packaging LLC

- Dart Container Corporation

- Display Pack Inc.

- Engineered Plastic Products, Inc.

- Genpak LLC

- Huhtamäki Oyj

- Pactiv Evergreen Inc.

- Placon Corporation

- Plastic Ingenuity Inc.

- Plastic Technologies, Inc.

- Sabert Corporation

- Sealed Air Corporation

- SencorpWhite, Inc.

- Silgan Holdings Inc.

- Sohner Plastics LLC

- Sonoco Products Company

- Tekni-Plex company

- TransPak Corporation

- Universal Plastics Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Plastic Thermoformed Products market report include:- Amcor plc

- Berry Global Inc

- Advanced Extrusion, Inc.

- Anchor Packaging LLC

- Dart Container Corporation

- Display Pack Inc.

- Engineered Plastic Products, Inc.

- Genpak LLC

- Huhtamäki Oyj

- Pactiv Evergreen Inc.

- Placon Corporation

- Plastic Ingenuity Inc.

- Plastic Technologies, Inc.

- Sabert Corporation

- Sealed Air Corporation

- SencorpWhite, Inc.

- Silgan Holdings Inc.

- Sohner Plastics LLC

- Sonoco Products Company

- Tekni-Plex company

- TransPak Corporation

- Universal Plastics Corporation

Table Information

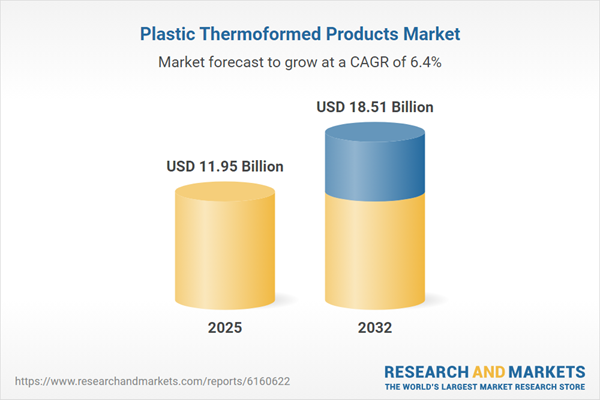

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 11.95 Billion |

| Forecasted Market Value ( USD | $ 18.51 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |