Speak directly to the analyst to clarify any post sales queries you may have.

Pioneering Industrial Data Management Strategies to Propel Operational Excellence and Competitive Edge Across Global Manufacturing and Service Sectors

As industries embrace digital transformation, the need for robust industrial data management has become paramount. Organizations are harnessing vast streams of operational and machine-generated information to drive real-time decision making, optimize production workflows, and elevate service delivery standards. In this evolving landscape, data emerges as both a strategic asset and a competitive differentiator, compelling enterprises to establish scalable frameworks that ensure data consistency, traceability, and security across complex ecosystems.Moreover, the convergence of operational technology and information technology is amplifying the volume and variety of data, challenging traditional architectures and governance models. As a result, leaders must adopt integrated platforms that facilitate seamless data ingestion from sensors, legacy systems, and third-party sources. By leveraging modular software tools alongside consulting and implementation services, companies can unlock advanced analytics, machine learning capabilities, and sophisticated visualization techniques that transform raw data into actionable insights.

In parallel, a growing emphasis on regulatory compliance and data sovereignty mandates rigorous control over where and how data is stored and processed. Consequently, organizations are evaluating hybrid and multi-cloud configurations to balance flexibility, latency, and security requirements. Through targeted training and support, teams can cultivate the specialized skills needed to maintain these environments and drive continuous improvement. Ultimately, a strategic approach to industrial data management establishes the foundation for innovation, resilience, and long-term growth in a rapidly shifting industrial milieu

Uncovering the Major Technological Innovations and Strategic Transformations Redefining Industrial Data Management Practices in Modern Global Enterprises

In recent years, the industrial data management landscape has undergone a profound transformation fueled by advances in cloud computing, artificial intelligence, and the Internet of Things. Innovative edge computing architectures are enabling real-time processing at the device level, reducing latency and empowering localized decision making in mission critical operations. This shift toward distributed intelligence mitigates bandwidth constraints and enhances the reliability of analytics-driven maintenance and quality assurance routines, driving operational agility and uptime.Concurrently, the maturation of machine learning algorithms and predictive analytics platforms has unlocked new possibilities for anomaly detection, demand forecasting, and process optimization. By embedding intelligent models within data integration workflows, enterprises are able to identify patterns in historical and streaming data that would previously have gone unnoticed. As such, these capabilities are forging a competitive edge for early adopters, translating into measurable gains in efficiency and resource utilization.

Furthermore, containerization and microservices have introduced a modular paradigm for software deployment, decoupling analytics engines from underlying infrastructure. This architectural shift simplifies updates, fosters interoperability, and accelerates time to market for new data management features. At the same time, heightened concerns around cybersecurity have driven the adoption of zero trust frameworks and encrypted data lakes, ensuring that data integrity and confidentiality remain uncompromised. Together, these technological and strategic transformations are reshaping how organizations capture, process, and leverage industrial data to stay ahead in an increasingly competitive environment

Analyzing the Complex Effects of Recent United States Tariffs on Industrial Data Management Solutions and Supply Chain Resilience Across Multiple Sectors

The imposition of new tariff measures by the United States on imported components and software licenses has introduced heightened scrutiny across the industrial data management ecosystem. Equipment manufacturers, solution integrators, and service providers have reevaluated sourcing strategies to mitigate cost pressures associated with increased duties on hardware modules, networking infrastructure, and specialized analytics software. As a result, many organizations have opted to diversify their supplier base, blending domestic and nearshore partnerships to preserve budgetary commitments and project timelines.This realignment has also prompted a closer examination of total cost of ownership for cloud-based services versus on-premises deployments. With tariffs affecting both physical infrastructure and certain proprietary software extensions, decision makers are weighing the advantages of open source frameworks and standardized data protocols to avoid tariff triggers and maintain flexibility. These shifts are fostering a gradual move toward hybrid deployment models that can seamlessly reallocate workloads between regulated environments and non-tariffed cloud regions.

Moreover, the ripple effects of tariff adjustments extend beyond procurement considerations into project planning and risk management practices. Organizations are increasingly incorporating tariff impact assessments into their project roadmaps, accounting for variable duty rates in capital expenditure forecasts and contract negotiations. By integrating dynamic scenario planning with advanced analytics tools, companies can better anticipate disruptions in their supply chains and adjust their data architecture strategies to ensure continuity. Consequently, industrial data management initiatives are now closely tied to broader trade compliance and operational resilience frameworks

Exploring Critical Segmentation Dimensions to Illuminate Component, Deployment, Organization, Vertical, Application, and Data Type Dynamics in Industrial Data Management

The component dimension of the industrial data management landscape reveals a dichotomy between services and software offerings, where value is realized through consulting engagements that lay the groundwork for tailored implementations. Services extend beyond mere installation to encompass comprehensive training and ongoing support, ensuring that teams can maintain and evolve data infrastructures. On the software front, solutions drift toward sophisticated analytics modules powered by machine learning, robust integration platforms that unify disparate data sources, and dynamic reporting tools that offer real-time visibility across operations.Turning to deployment mode, the spectrum spans from fully on-premises solutions favored for their direct control and compliance assurances to cloud-based architectures that unlock scalability and remote accessibility. Within cloud deployments, organizations often blend private, public, and hybrid environments to strike a balance between performance, security, and cost efficiency. This hybrid approach enables data-intensive workloads to reside where latency requirements are most stringent, while less sensitive tasks leverage the elasticity of public cloud resources.

Organization size further influences adoption patterns, as large enterprises typically invest in end-to-end platforms with extensive customization, whereas small and medium sized enterprises prioritize turnkey offerings that deliver rapid time to value without high overhead. Vertical considerations add another layer of complexity, with manufacturing plants and energy utilities demanding real-time monitoring and asset tracking, while chemical producers focus on quality management and water treatment facilities rely on precise predictive maintenance analytics to prevent downtime.

Applications such as data visualization and asset tracking serve as entry points for many customers, gradually expanding into predictive maintenance regimes that harness both historical and real time data streams. The distinction between structured and unstructured data underscores the need for versatile storage and management strategies that accommodate everything from sensor logs to multimedia records, ultimately shaping the overall architecture and governance models driving industrial data management success

Highlighting Distinctive Regional Trends Driving Industrial Data Management Adoption in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

In the Americas, robust investments in digital infrastructure and established manufacturing clusters underpin a strong appetite for integrated data solutions. Organizations across North America are focusing on edge analytics to accelerate decision making in critical operations, while Latin American companies are increasingly adopting cloud based platforms to overcome legacy system constraints at a lower capital outlay. This diverse regional tapestry underscores a combination of advanced research initiatives and growing demand for consulting services that guide enterprises through initial digital transformation phases.Meanwhile, in Europe, the Middle East and Africa, regulatory frameworks around data privacy and cross border transfers shape deployment choices. Enterprises in Western Europe emphasize compliance driven architectures and encrypted data lakes to align with stringent data protection regulations, leading to a surge in private and hybrid cloud configurations. Gulf region operators, benefitting from infrastructure investments, are exploring predictive maintenance applications to extend asset life cycles in energy and utilities sectors. Across the African landscape, emerging markets leverage scalable cloud offerings to leapfrog traditional on premises constraints, albeit infrastructure variability continues to influence rollout speed.

Across the Asia-Pacific region, a combination of government led digitalization programs and a dense manufacturing base drives rapid uptake of data integration and machine learning solutions. Markets such as East Asia and Oceania are pioneering smart factory implementations, fusing real time monitoring with advanced reporting to optimize throughput. Southeast Asia and South Asia are witnessing increased collaboration between local integrators and global technology providers to address unique operational challenges. Collectively, these regional dynamics reflect both mature environments and burgeoning opportunities for industrial data management solutions that cater to varied regulatory, infrastructural, and strategic imperatives

Profiling Leading Industry Players and Their Strategic Innovations Shaping the Competitive Landscape of Industrial Data Management Solutions

In the increasingly competitive arena of industrial data management, established enterprise software giants have leveraged their broad solution portfolios to extend analytics and integration capabilities across diverse industrial verticals. These incumbents often augment proprietary platforms with consulting arms that deliver end to end project execution, enabling clients to accelerate value realization. Parallel to this, specialist analytics providers focus on niche applications such as predictive maintenance modules and quality management dashboards, challenging larger players with agile development cycles and domain specific expertise.Meanwhile, cloud service providers have intensified their presence by embedding industrial grade data services within their infrastructure offerings. This trend has spurred partnerships between global technology companies and independent integrators, resulting in turnkey deployments that blend managed services with customizable analytics engines. Network equipment manufacturers and edge computing vendors are also innovating, creating lightweight appliances that facilitate secure data acquisition at source points and enable real time edge analytics, thereby reducing the load on centralized systems.

Emerging firms have capitalized on open source frameworks to deliver cost effective platforms that support structured and unstructured data streams alike. By fostering vibrant developer communities, these providers drive rapid feature enhancements while maintaining interoperability through standardized APIs. As a result, customers can mix and match best in class components, tailoring their architectures to specific performance, security, and regulatory requirements. Overall, the interplay between global titans and nimble upstarts continues to propel advancements in data management, integration, and visualization technologies

Strategic Recommendations Empowering Industry Leaders to Harness Data Management Capabilities for Sustainable Growth and Operational Resilience

To capitalize on the full potential of industrial data, companies should prioritize the integration of modular architectures that support both centralized and edge processing. Embracing a hybrid deployment strategy allows organizations to allocate workloads based on latency requirements and regulatory constraints, while maintaining the flexibility to scale resources in response to evolving demands. Furthermore, investing in comprehensive training programs ensures that internal teams develop the critical skills needed to operate, troubleshoot, and innovate within complex data environments.In parallel, leaders must establish robust data governance frameworks that encompass security protocols, access controls, and compliance standards. By incorporating zero trust principles and encrypted data repositories, enterprises can safeguard sensitive operational information against evolving cyber threats. Cultivating cross-functional collaboration between IT and OT stakeholders also accelerates alignment on data quality, lineage, and ownership, fostering a culture of shared responsibility.

Additionally, strategic partnerships with technology vendors and integrators can expedite the deployment of advanced analytics and machine learning capabilities. These alliances should be underpinned by clear service level agreements and performance benchmarking to ensure accountability. Finally, organizations are advised to implement continuous improvement cycles that leverage real time monitoring and feedback loops, enabling iterative enhancements to predictive models and reporting dashboards. By following these recommendations, industry leaders will be well positioned to drive efficiency gains, reduce unplanned downtime, and achieve their long term digital transformation objectives

Detailing the Rigorous Research Methodology Underpinning Comprehensive Analysis of Industrial Data Management Trends and Industry Insights

This report is grounded in a systematic research methodology that combines primary and secondary data collection techniques to deliver nuanced insights into the industrial data management landscape. Primary research comprised in depth interviews with C level executives, technology architects, and operational leaders across major industrial sectors. These conversations provided firsthand perspectives on deployment challenges, technology preferences, and strategic priorities. Secondary research involved reviewing credible industry publications, white papers, technical briefs, and regulatory documents to validate and augment the primary findings.Data triangulation was employed to cross verify insights obtained from multiple sources, ensuring consistency and accuracy in the analysis. Market segmentation frameworks were defined based on component, deployment mode, organization size, vertical, application, and data type to structure the examination of distinct adoption patterns. Geographic trends were mapped by analyzing regional infrastructure developments, regulatory environments, and macroeconomic indicators. Competitive intelligence was gathered through vendor press releases, product datasheets, and patent filings to trace innovation trajectories and partnership dynamics.

Quantitative data points were synthesized using statistical techniques to reveal correlations between investment strategies and operational outcomes, while qualitative themes were identified through thematic coding of interview transcripts. Finally, all data underwent rigorous validation checks to eliminate discrepancies and ensure that the conclusions drawn reflect the most current industry realities. This comprehensive approach underpins the strategic recommendations and actionable insights presented herein

Synthesis of Insights and Strategic Imperatives Illuminating the Future Trajectory of Industrial Data Management Excellence

The convergence of cloud computing, edge analytics, and advanced machine learning algorithms is reshaping how organizations collect, process, and leverage industrial data. Throughout this analysis, it has become clear that successful deployments rely on a balanced combination of modular software tools, tailored consulting services, and governance frameworks that address security and compliance concerns. Moreover, geographic and segment specific trends underscore the importance of customizing solutions to the unique requirements of each operational environment.Tariff related challenges have prompted a reassessment of sourcing and deployment strategies, reinforcing the value of hybrid architectures that can adapt to shifting cost structures and regulatory landscapes. Key segmentation insights reveal that while large enterprises invest deeply in comprehensive platforms, smaller companies seek ease of use and rapid implementation. Industry leaders must remain agile, adopting continuous improvement cycles that integrate feedback loops and performance metrics to refine their data management practices.

As regional dynamics continue to evolve, stakeholders should monitor emerging infrastructure developments, regulatory updates, and technological breakthroughs to stay ahead of the curve. Finally, fostering strategic alliances with specialized vendors and investing in workforce upskilling will be critical to sustaining momentum. In summary, the integration of data management excellence with strategic agility will define market leaders in the next decade

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Component

- Services

- Consulting

- Implementation

- Training & Support

- Software

- Data Analytics & Machine Learning

- Data Integration

- Data Storage & Management

- Reporting & Visualization

- Services

- Deployment Mode

- Cloud

- Hybrid Cloud

- Private Cloud

- Public Cloud

- On-Premises

- Cloud

- Organization Size

- Large Enterprises

- Small and Medium Enterprises

- Vertical

- Automotive

- Aftermarket

- Oem

- Chemicals

- Agrochemicals

- Bulk Chemicals

- Specialty Chemicals

- Energy & Utilities

- Power Distribution

- Power Generation

- Water & Wastewater Treatment

- Manufacturing

- Discrete Manufacturing

- Process Manufacturing

- Oil & Gas

- Downstream

- Midstream

- Upstream

- Semiconductors

- Discrete Components

- Integrated Circuits

- Semiconductor Devices

- Automotive

- Application

- Asset Tracking

- Data Visualization

- Predictive Maintenance

- Quality Management

- Data Type

- Historical Data

- Real-Time Data

- Structured Data

- Unstructured Data

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Schneider Electric SE

- General Electric Company

- Rockwell Automation Inc.

- AVEVA Group plc

- Aspen Technology, Inc.

- PTC Inc.

- Yokogawa Electric Corporation

- Emerson Electric Co.

- International Business Machines Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Infor, Inc.

- Hexagon AB

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Robert Bosch GmbH

- Fujitsu Limited

- Dassault Systèmes SE

- Toshiba Corporation

- Cisco Systems, Inc.

- Inductive Automation, LLC

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Industrial Data Management market report include:- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Schneider Electric SE

- General Electric Company

- Rockwell Automation Inc.

- AVEVA Group plc

- Aspen Technology, Inc.

- PTC Inc.

- Yokogawa Electric Corporation

- Emerson Electric Co.

- International Business Machines Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Infor, Inc.

- Hexagon AB

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Robert Bosch GmbH

- Fujitsu Limited

- Dassault Systèmes SE

- Toshiba Corporation

- Cisco Systems, Inc.

- Inductive Automation, LLC

Table Information

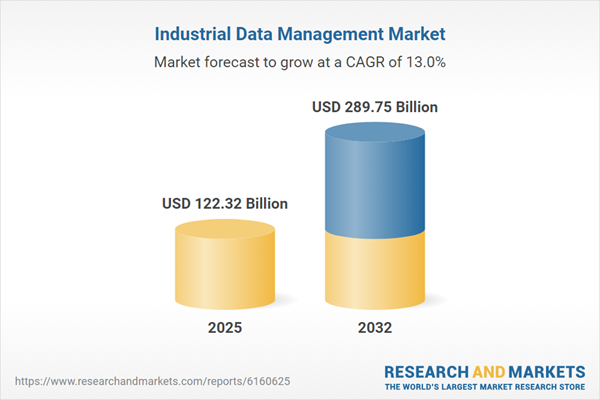

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 122.32 Billion |

| Forecasted Market Value ( USD | $ 289.75 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |