Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the Complexities of Home Hemodialysis Advancements and Patient-Centric Care Trends Shaping the Modern Healthcare Landscape

Home hemodialysis has emerged as a critical component in the management of end-stage renal disease, offering patients greater autonomy and improved quality of life. Over the last decade, advancements in dialysis equipment have enabled treatment to transition from clinical centers to home settings, reducing the burden on healthcare facilities and expanding access for patients living in remote or underserved regions. This shift is underpinned by innovations in blood pump technology, dialysate delivery systems and monitoring platforms that ensure safety and efficacy while simplifying operation for non-clinical users.Furthermore, the integration of user-friendly interfaces and real-time data analytics has addressed historical barriers to adoption by facilitating remote oversight and early intervention in case of complications. Training programs for caregivers and patients have evolved to leverage digital platforms, enhancing retention of procedural knowledge and confidence in equipment handling. As a result, the adoption of home hemodialysis is gaining momentum among adult, geriatric and pediatric patient cohorts who benefit from personalized scheduling and reduced hospital visits.

As policy makers encourage decentralized care models, the role of portable and wearable systems has become increasingly prominent. These solutions are designed for seamless integration into patients' daily routines, offering flexibility without compromising clinical outcomes. Consequently, home hemodialysis is positioned to redefine chronic kidney care, optimizing resource utilization and aligning treatment protocols with contemporary patient preferences.

Examining the Paradigm Shift Driven by Technological Disruption Regulatory Evolution and Patient Empowerment in the Home Hemodialysis Landscape

The home hemodialysis market is witnessing transformative shifts driven by the convergence of digital health technologies, regulatory reform and patient empowerment. Innovations in wearable and mobile processing units have accelerated portability, allowing individuals to carry out their dialysis regimen in familiar environments. At the same time, telemedicine platforms enable clinicians to monitor treatment parameters remotely, facilitating proactive adjustments that enhance safety and treatment adherence.Regulatory bodies have responded to these technological advancements by streamlining approval pathways for next-generation dialysis systems, which has reduced time to market and enabled manufacturers to roll out iterative improvements more rapidly. Reimbursement structures have also evolved to incentivize home-based treatments, recognizing their potential to alleviate pressure on hospitals and long-term care facilities. These policy shifts are complemented by growing interest from payers seeking cost-effective models that emphasize preventive interventions and patient-centric outcomes.

Simultaneously, sustainability considerations are prompting the development of eco-friendly dialysate solutions and energy-efficient devices, aligning the home hemodialysis ecosystem with global environmental priorities. Such design considerations not only minimize resource consumption but also reinforce commitments to corporate social responsibility. Collectively, these dynamics underscore a fundamental shift from equipment-centric supply chains toward an integrated service model that places patients at the center of care delivery.

Evaluating the Impact of 2025 United States Tariff Revisions on Supply Chain Resilience Manufacturing Strategies and Cost Structures in Home Hemodialysis

The introduction of revised tariff measures by the United States in 2025 has significantly impacted the home hemodialysis supply chain, compelling manufacturers and distributors to recalibrate sourcing strategies. Increased duties on imported components, including blood pump assemblies and membrane filters, have led to heightened procurement costs and prompted a reexamination of global production networks. In response, several leading system providers have diversified their supplier base, establishing strategic alliances with domestic manufacturers and exploring in-region partnerships to mitigate exposure to trade volatility.These adjustments have consequential implications for cost structures and product pricing, placing upward pressure on end user expenditures. However, the reconfiguration of logistics channels offers opportunities to enhance supply chain visibility and resilience. By integrating advanced tracking technologies and predictive analytics, stakeholders are improving lead times and inventory management, thereby reducing the risk of component shortages and production delays.

Moreover, the tariff-driven shift toward regional manufacturing has accelerated investments in localized assembly facilities and skill development programs. This trend is catalyzing innovation in component standardization and modular design, enabling faster customization for diverse patient needs. Consequently, organizations that adopt a proactive approach to tariff implications are better positioned to sustain growth and maintain service continuity in an increasingly dynamic regulatory environment.

Unraveling Key Market Segmentation Dynamics Spanning Components Device Types Patient Demographics and End User Preferences for Insightful Growth Planning

An examination of market segmentation reveals distinct patterns across component categories, device types, patient demographics and end user channels that define the competitive landscape. Within the component arena, demand dynamics for blood pumps are influenced by the choice between centrifugal and peristaltic mechanisms, with the former gaining preference for its reduced hemolysis risk, while perfusion systems that utilize synthetic membranes in hemofilters are experiencing heightened interest due to superior biocompatibility. Dialyzers and dialysate delivery technologies continue to evolve, integrating automated recalibration features that simplify operation and lower the threshold for home usage.The distinction between portable and stationary device types underscores the tension between mobility and clinic-style performance. Portable systems, whether mobile or wearable, cater to active lifestyles, whereas stationary platforms remain integral where heavier processing capacity is required. Patient segmentation further refines these preferences, as adult and geriatric populations often prioritize ease of use and remote support, while pediatric care pathways necessitate customizable treatment protocols and size-adapted equipment.

End users such as home healthcare agencies and independent dialysis centers play a pivotal role in facilitating training and monitoring services, while hospitals and clinics serve as referral hubs and emergency support structures. Together, these segmentation layers influence investment decisions, partnership models and technology roadmaps that will define the trajectory of the home hemodialysis market.

Assessing Regional Variations in Adoption Reimbursement and Infrastructure Development Across the Americas EMEA and Asia-Pacific Home Hemodialysis Markets

Regional disparities in home hemodialysis deployment are shaped by variations in healthcare infrastructure, regulatory frameworks and reimbursement policies across the Americas, Europe Middle East & Africa and Asia-Pacific. In the Americas, established reimbursement pathways have catalyzed the adoption of advanced devices, particularly in North America, where integrated health systems support remote monitoring initiatives and value-based care pilots. The mature outpatient dialysis ecosystem provides a robust foundation for scaling home-based solutions, while Latin American markets are beginning to align regulatory guidelines to encourage decentralized models.Within Europe, Middle East & Africa, heterogeneous regulations present both challenges and opportunities. Western European countries have advanced telehealth regulations and patient education programs that undergird home treatment uptake, whereas emerging markets in Eastern Europe and select Middle Eastern nations are investing in infrastructure to bridge urban-rural care gaps. In Africa, resource constraints necessitate cost-sensitive solutions, prompting collaborations between public health agencies and private technology firms to pilot portable hemodialysis units.

The Asia-Pacific region is distinguished by rapid urbanization, rising chronic disease prevalence and government-led initiatives to expand universal health coverage. Markets such as Japan and Australia have developed comprehensive support networks for home therapies, while expansion in Southeast Asia and South Asia is driven by technology transfer partnerships and local manufacturing incentives. These regional landscapes collectively inform market entry strategies, regulatory engagement and long-term service delivery models.

Profiling Leading Home Hemodialysis System Manufacturers Their Strategic Partnerships Innovation Portfolios and Competitive Positioning in a Rapidly Evolving Market

Key players in the home hemodialysis sector are pursuing an array of strategic initiatives to secure competitive advantage and address evolving customer requirements. Market leaders have fortified their portfolios through targeted acquisitions of innovative startups specializing in wearable processing units and smart monitoring platforms. By integrating vertical capabilities across component manufacturing and software development, these firms are enhancing end-to-end solution offerings that streamline installation, training and follow-up support.Collaborative alliances with research institutions and technology pioneers are underpinning the development of next-generation membrane materials and closed-loop dialysate management systems. Such partnerships not only accelerate time to market but also distribute research risks and costs among stakeholders. Simultaneously, investment in digital health capabilities, including predictive analytics and cloud-based dashboards, is enabling providers to deliver proactive care management and personalize treatment regimens.

Regional expansions remain a focal point, with leading manufacturers establishing local assembly facilities and service centers to navigate tariff complexities and meet country-specific regulatory requirements. Customer-centric service models, featuring bundled equipment leasing and remote monitoring subscriptions, are redefining traditional sales approaches and fostering recurring revenue streams. Future M&A activity is likely to concentrate on firms with specialized expertise in biocompatible membranes and digital therapeutics, reflecting the industry's drive toward holistic care ecosystems.

Actionable Strategies for Industry Stakeholders to Enhance Market Penetration Drive Innovation and Strengthen Patient Engagement in the Home Hemodialysis Sector

Industry leaders should prioritize the development of modular device architectures that accommodate evolving patient needs and regulatory changes. Investing in platforms that allow rapid integration of new membrane technologies or software upgrades will reduce time to market and optimize R&D expenditures. Advancing partnerships with healthcare payers to structure outcome-based reimbursement schemes can further align incentives and reinforce the value proposition of home hemodialysis.Expanding training and support infrastructure is critical to sustain adoption, particularly in underpenetrated regions. Establishing digital learning modules and virtual coaching services will enhance patient confidence and caregiver competence, while enabling remote evaluation of technique adherence. Cultivating relationships with home healthcare agencies and independent dialysis providers can streamline care coordination and create referral pipelines for at-risk patient cohorts.

To mitigate supply chain vulnerabilities, organizations should diversify raw material sourcing and invest in predictive analytics for demand forecasting. Strategic placement of regional assembly hubs will reduce lead times and circumvent tariff disruptions. Embedding sustainability metrics into product design and manufacturing processes will not only address environmental imperatives but also resonate with an increasingly conscientious stakeholder base, enhancing brand reputation and long-term resilience. Engaging patients through digital platforms that facilitate symptom reporting and treatment scheduling can deepen adherence and provide critical real-world insights for iterative product improvements. In parallel, fostering open innovation challenges with academic and clinical partners will broaden the pipeline of breakthrough solutions.

Elucidating a Rigorous Research Methodology Combining Primary Interviews Secondary Data Sources and Triangulation to Ensure Robust Home Hemodialysis Market Insights

This research combines a rigorous multistage methodology to ensure comprehensive and reliable insights. The process commences with an extensive review of publicly available regulatory filings, patent databases and scientific publications to establish foundational knowledge of emerging device technologies and clinical protocols. Secondary data sources, including government healthcare expenditure reports and industry white papers, are analyzed to contextualize market trends and regional policy frameworks.Primary research comprises in-depth interviews with key opinion leaders, encompassing nephrologists, dialysis nurses and biomedical engineers, as well as discussions with procurement specialists at home healthcare agencies and independent treatment centers. These interactions yield qualitative insights into adoption barriers, user preferences and operational challenges. Data triangulation techniques are employed to reconcile quantitative metrics with stakeholder perspectives, ensuring consistency and validity across the research.

Forecast verification sessions with senior executives from leading device manufacturers provide an additional layer of scrutiny, refining the analytical model and uncovering emergent strategic considerations. Finally, the research undergoes a quality assurance review by an editorial board of clinical and market intelligence experts, who evaluate methodological robustness and factual accuracy. This comprehensive approach underpins confidence in the conclusions and recommendations presented.

Drawing Comprehensive Conclusions on Market Trajectories Regulatory Influences Technological Breakthroughs and Practical Implications for Home Hemodialysis Providers

The home hemodialysis market stands at a nexus of technological innovation, regulatory evolution and shifting patient expectations. Modern blood pump technologies and advanced hemofilters have reduced clinical complexity, enabling safe adoption of treatment in residential settings. Concurrently, refined reimbursement pathways and tariff-driven supply chain realignments have introduced new considerations that demand strategic agility from stakeholders.Regional diversification strategies are essential to navigate heterogeneous healthcare ecosystems across the Americas, Europe Middle East & Africa and Asia-Pacific. Tailored engagement with payers and localized manufacturing partnerships will be instrumental in optimizing cost structures and expediting market entry. Segmentation of offerings by component sophistication, device portability and patient profiles ensures alignment with diverse user requirements and maintains differentiation in a competitive environment.

Collaboration between device providers, care networks and digital health innovators is poised to accelerate the shift toward patient-centered care models that emphasize treatment flexibility and proactive monitoring. As sustainability and value-based care imperatives gain prominence, organizations that integrate environmental stewardship and outcome-driven metrics into their product and service portfolios will secure a lasting competitive advantage. In conclusion, a holistic strategy that balances innovation, regulatory engagement and stakeholder collaboration will define market leadership in the home hemodialysis domain.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Component

- Blood Pumps

- Centrifugal

- Peristaltic

- Dialysate Delivery Systems

- Dialyzers

- Hemofilters

- Cellulose Membrane

- Synthetic Membrane

- Monitoring Systems

- Blood Pumps

- Device Type

- Portable

- Mobile

- Wearable

- Stationary

- Portable

- Patient Type

- Adult

- Geriatric

- Pediatric

- End User

- Home Healthcare Agencies

- Hospitals & Clinics

- Independent Dialysis Centers

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Allmed Medical Care Holdings Limited

- Fresenius Medical Care AG & Co. KGaA

- AWAK Technologies Pte. Ltd.

- B. Braun Avitum AG

- Baxter International Inc.

- Infomed SA

- Jiangsu Jihua Medical Instruments Co., Ltd.

- JMS Co., Ltd.

- Medica SpA

- Medtronic plc

- Nikkiso Co., Ltd.

- Nipro Corporation

- Outset Medical, Inc.

- Quanta Dialysis Technologies Ltd.

- SWS Hemodialysis Care

- Toray Medical Co., Ltd.

- Weigao Group

- Rockwell Medical, Inc.

- Bain Medical Equipment Co., Ltd.

- DaVita Inc.

- Kawasaki Laboratories, Inc.

- Medical Components, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Home Hemodialysis System market report include:- Allmed Medical Care Holdings Limited

- Fresenius Medical Care AG & Co. KGaA

- AWAK Technologies Pte. Ltd.

- B. Braun Avitum AG

- Baxter International Inc.

- Infomed SA

- Jiangsu Jihua Medical Instruments Co., Ltd.

- JMS Co., Ltd.

- Medica SpA

- Medtronic plc

- Nikkiso Co., Ltd.

- Nipro Corporation

- Outset Medical, Inc.

- Quanta Dialysis Technologies Ltd.

- SWS Hemodialysis Care

- Toray Medical Co., Ltd.

- Weigao Group

- Rockwell Medical, Inc.

- Bain Medical Equipment Co., Ltd.

- DaVita Inc.

- Kawasaki Laboratories, Inc.

- Medical Components, Inc.

Table Information

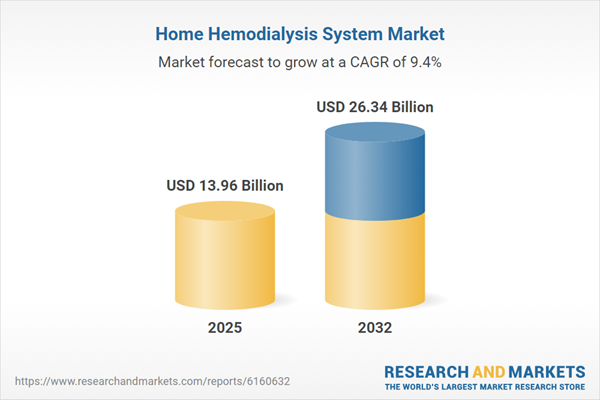

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 13.96 Billion |

| Forecasted Market Value ( USD | $ 26.34 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |