Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction to tower crane rental dynamics emphasizing fleet composition electrification and operational resilience across construction and heavy industries

The tower crane rental landscape is at a strategic inflection point driven by evolving urbanization patterns, infrastructure ambition, and heightened expectations for operational efficiency. Owners, equipment managers, and rental operators are balancing the need for reliable lifting capability against pressures to reduce emissions, manage lifecycle costs, and adapt to variable project timelines. In this context, a clear understanding of fleet composition, technology adoption, and service models is essential for stakeholders seeking to optimize asset utilization and competitive positioning.This introduction frames the core themes that shape contemporary decision-making: fleet electrification and hybridization, modular and flexible rental contracts, and the integration of telematics and predictive maintenance to minimize downtime. It also highlights how regulatory frameworks, project delivery models, and workforce capabilities interact to influence equipment selection and rental strategies. By situating the discussion in the operational realities of contractors, heavy industrial users, and infrastructure developers, the narrative prepares readers to evaluate tactical choices regarding crane type selection, rental durations, and mobility options while anticipating the commercial and technical trade-offs inherent in each approach.

How electrification digitalization and flexible rental models are fundamentally transforming fleet economics service delivery and competitive positioning in tower crane rentals

The industry is undergoing transformative shifts that are reshaping competitive advantage and operational approaches across the value chain. Advances in electric powertrains and hybrid systems are redefining the economics of operation, enabling quieter, lower-emission lifting solutions that meet rising regulatory expectations in dense urban centers. Simultaneously, digitalization through telematics, remote diagnostics, and task-level analytics is elevating uptime performance and creating new service-based revenue streams for rental operators who can deliver outcome-based contracts.Concurrently, procurement and project teams are gravitating toward more flexible rental durations and modular crane designs to accommodate compressed schedules and multi-site programs. Financing and lifecycle management are being influenced by new ownership models and secondary-market activity, with greater emphasis on refurbishment and certified pre-owned inventory. These shifts are also prompting operators to recalibrate their maintenance ecosystems, retrain technicians for electric and digital systems, and pursue partnerships with OEMs and systems integrators to accelerate capability build-out. Together, these forces are producing a more asset-efficient, service-oriented industry that prioritizes adaptability and measurable performance.

Assessing the broad and persistent effects of United States tariff adjustments on supply chains procurement strategies and fleet lifecycle management in tower crane rental operations

Recent tariff adjustments in the United States have introduced a distinct set of supply chain and cost-management challenges that ripple through procurement, fleet strategy, and project delivery. Increased duties on certain imported components and finished lifting equipment have elevated the importance of diversified sourcing and nearshoring strategies. Procurement teams are responding by reassessing vendor agreements, increasing scrutiny of total landed cost, and accelerating the qualification of alternative suppliers in lower-tariff jurisdictions.The cumulative effect extends beyond immediate purchase price impact; for rental operators, higher entry costs for new equipment shift the calculus toward extending operational life through enhanced preventative maintenance, refurbishment programs, and selective upgrades rather than rapid fleet turnover. Equipment manufacturers and distributors are also adapting by localizing production where feasible, redesigning supply chains to reduce tariff exposure, and exploring tariff mitigation strategies such as component substitution and altered assembly footprints. At the project level, contractors may seek longer rental durations or negotiate blended pricing to hedge against equipment cost volatility, while the secondary market for used cranes can become more active as firms optimize capital allocation. Regulatory compliance and customs complexity require enhanced legal and trade capability in procurement teams, and organizations that proactively map supply chain vulnerabilities position themselves to absorb or mitigate the financial and operational stresses associated with tariff-driven shifts.

Deep segmentation analysis revealing how operation type crane design rental duration capacity mobility height and end-use shape fleet strategy and rental offering design

A nuanced segmentation framework reveals where demand drivers and operational priorities concentrate across equipment types, durations, capacities, and applications. Based on operation, the distinction between Diesel and Electric powertrains has direct implications for emissions compliance, noise-sensitive sites, and total cost of operation, with each option carrying different maintenance profiles and fuel or energy logistics. Based on crane type, variations such as Flat Top, Hammerhead, Luffing Jib, and Self-Erecting Tower Crane offer discrete advantages depending on site constraints, tipping moment requirements, and erection complexity, shaping rental selection for tight urban footprints versus heavy lifting on large infrastructure projects.Based on rental duration, demand patterns diverge among Long Term, Medium Term, and Short Term engagements; the Long Term category, further refined into 12-24 Months and greater than 24 Months, favors investment in reliability and lifecycle programs, while Medium Term engagements, partitioned into 3-6 Months and 6-12 Months, require balanced availability and rapid re-deployment capability. Short Term rentals, subdivided into 1-3 Months and under 1 Month, emphasize fast mobilization and plug-and-play configurations. Based on load capacity, segments spanning less than 10 Tons, 11-20 Tons, and greater than 20 Tons dictate structural design and counterweight strategies, affecting transport and assembly costs. Based on mobility, the contrast between Mobile and Standalone solutions influences site repositioning flexibility and setup time. Based on height, categories that include Less than 50 Meters, 51-100 Meters, and More than 100 Meters determine mast engineering requirements and wind-load considerations. Based on end use, distinctions among Construction, Infrastructure & Transport, Mining & Heavy Industry, and Oil & Gas create different utilization profiles, while the Construction segment's split into Commercial and Residential underscores divergent cycle times and service expectations. Integrating these segmentation lenses enables stakeholders to match fleet composition, rental terms, and service offerings to the technical and commercial realities of distinct project archetypes.

Regional dynamics and policy landscapes driving divergent fleet requirements and service models across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics exert a decisive influence on fleet configuration, service models, and investment priorities. In the Americas, demand patterns are driven by large-scale infrastructure renewals, long-haul logistics projects, and a significant share of urban redevelopment, which together create steady need for high-capacity and mobile lifting solutions while also accelerating interest in lower-emission equipment for metropolitan regulations. Across Europe, Middle East & Africa, regulatory stringency, dense urban centers, and a heterogeneous mix of project types create a patchwork of needs: some markets prioritize compact, low-noise electric cranes for constrained sites, while others require robust heavy-lift units for energy and industrial sectors.In the Asia-Pacific region, accelerated urbanization and a robust pipeline of infrastructure programs sustain diverse demand across heights and capacities, with particular emphasis on scalable fleets and rapid erection solutions to meet compressed schedules. Regional supply chains, availability of skilled rigging and maintenance personnel, and local regulatory environments inform decisions about whether to favor new equipment purchases, long-term rentals, or reliance on certified pre-owned inventory. Understanding these regional distinctions is essential for operators and asset managers planning network coverage, stocking spare parts, and tailoring maintenance regimes to meet local climatic and regulatory conditions.

Evolving competitive dynamics where OEM innovation rental operator scale and service-driven differentiation determine access to premium projects and fleet efficiency

Competitive forces in the tower crane rental sector are shaped by the interplay of OEM capabilities, rental operator scale, and the emergence of service-driven differentiation. Original equipment manufacturers are advancing modular designs, electrified powertrains, and digital control systems, while rental companies are assembling integrated offerings that combine asset provision with predictive maintenance, operator training, and project consultancy. Scale remains an advantage for larger rental groups that can amortize capital investment, maintain broader geographic coverage, and offer rapid redeployment, yet smaller specialized operators can capture premium segments through niche expertise and high-touch customer service.Aftermarket service providers and certified refurbishment specialists are increasingly important as operators seek to extend asset life and manage lifecycle costs. Partnerships between equipment producers and service networks accelerate adoption of remote monitoring and performance-based contracts. At the same time, new entrants with digital-first platforms are redefining customer experience by simplifying booking, optimizing logistics, and offering transparent utilization metrics. Competitive differentiation will increasingly depend on the ability to combine fleet quality, local service excellence, and data-driven performance guarantees that reduce project risk for customers and improve capital efficiency for owners.

Clear and actionable strategic moves for leaders to modernize fleets adopt digital maintenance and strengthen supply chain resilience to capture higher-value rental contracts

Industry leaders should implement focused strategic actions to strengthen resilience and capture opportunities emerging from technological and regulatory change. Prioritize a phased fleet modernization program that balances electrified cranes for urban and noise-sensitive projects with diesel or hybrid units for remote heavy-lift requirements, aligning procurement with anticipated site profiles and regulatory trends. Parallel to fleet renewal, invest in telematics and predictive maintenance capabilities to convert reactive repair cycles into planned interventions that lower downtime and extend useful life.Recalibrate commercial models to include flexible rental durations and bundled service offerings that package operator training, certification, and uptime guarantees. Enhance supply chain resilience by qualifying alternative suppliers, exploring localized assembly where feasible, and maintaining critical spare-part inventories. Develop workforce capability through targeted training for electric powertrain maintenance and digital system diagnostics, and implement cross-functional teams that marry technical, commercial, and trade-compliance expertise. Pursue strategic alliances with equipment designers and systems integrators to access emerging technologies faster, and consider targeted acquisitions or joint ventures to broaden geographic reach and add complementary service capabilities. These prioritized steps will improve operational continuity, reduce total cost of ownership for customers, and position leaders to capture higher-value contractual relationships.

Methodological approach integrating primary stakeholder interviews secondary technical synthesis and segmentation mapping to derive practical fleet and procurement insights

The research methodology underpinning this analysis combined structured primary engagement with rigorous secondary synthesis to ensure conclusions are robust and actionable. Primary research comprised interviews with equipment managers, rental operators, procurement specialists, and technical leads to capture operational priorities, pain points, and strategic responses to regulatory and tariff pressures. These qualitative inputs were triangulated with technical literature, manufacturer specifications, regulatory texts, and industry-standard maintenance protocols to validate assumptions regarding performance characteristics, erection and transport constraints, and service requirements.Analytical techniques included segmentation mapping across operation type, crane design, rental duration, load capacity, mobility, height, and end-use to identify demand archetypes and fleet optimization levers. Supply chain analysis emphasized supplier concentration, tariff exposure, and logistical bottlenecks, while the competitive review focused on product innovation, service models, and aftermarket capabilities. All findings were reviewed in iterative workshops with industry practitioners to refine practical recommendations and identify implementation considerations. Limitations include variability in regional regulatory enforcement and project delivery models that can affect timing and adoption rates, warranting local validation when applying strategic decisions.

Concluding synthesis emphasizing adaptability operational excellence and lifecycle discipline as the foundation for sustained competitive advantage in tower crane rental services

The accumulated analysis underscores that success in tower crane rentals will be determined by the intersection of technical adaptability, service excellence, and strategic procurement. Operators who combine targeted fleet modernization with data-enabled maintenance practices and flexible commercial models will be better positioned to meet the varied demands of construction, infrastructure, and industrial clients. Equally important, resilient supply chain strategies and workforce development are non-negotiable components of an operational blueprint that seeks to mitigate tariff shocks, regulatory shifts, and rapid project schedule changes.Looking forward, the industry will reward organizations that manage the trade-offs between upfront capital, operational cost, and service reliability through disciplined lifecycle management and partnerships that accelerate technology adoption. By prioritizing adaptability, continuous improvement in uptime performance, and customer-centered service propositions, leaders can convert current disruptions into durable competitive advantage and deliver more predictable outcomes for project owners and asset stakeholders.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Operation

- Diesel

- Electric

- Crane Type

- Flat Top

- Hammerhead

- Luffing Jib

- Self-Erecting Tower Crane

- Rental Duration

- Long Term

- 12-24 Months

- >24 Months

- Medium Term

- 3-6 Months

- 6-12 Months

- Short Term

- 1-3 Months

- < 1 Month

- Long Term

- Load Capacity

- 11-20 Tons

- < 10 Tons

- >20 Tons

- Mobility

- Mobile

- Standalone

- Height

- 51 Meters- 100 Meters

- Less than 50 Meters

- More than 100 Meters

- End Use

- Construction

- Commercial

- Residential

- Infrastructure & Transport

- Mining & Heavy Industry

- Oil & Gas

- Construction

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Ainscough Crane Hire Ltd

- Bigge Crane and Rigging Co.

- Al Faris Group

- BKL Baukran Logistik GmbH

- Buckner HeavyLift Cranes

- Deep South Crane & Rigging

- Favelle Favco

- Felbermayr Holding GmbH

- Lampson International LLC

- Liebherr-Werk Biberach GmbH

- Mammoet

- Mantis Cranes LLC

- Maxim Crane Works, L.P.

- Nationwide Crane Services, Inc.

- Sanghvi Movers Limited

- Sarens NV

- Sarilar Heavy Lift & Transport

- Shanghai Zhenhua Heavy Industries

- Sweihan Cranes & Transport

- TEKA Rental

- TNT Crane & Rigging Inc.

- Wolffkran International AG

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Tower Crane Rental market report include:- Ainscough Crane Hire Ltd

- Bigge Crane and Rigging Co.

- Al Faris Group

- BKL Baukran Logistik GmbH

- Buckner HeavyLift Cranes

- Deep South Crane & Rigging

- Favelle Favco

- Felbermayr Holding GmbH

- Lampson International LLC

- Liebherr-Werk Biberach GmbH

- Mammoet

- Mantis Cranes LLC

- Maxim Crane Works, L.P.

- Nationwide Crane Services, Inc.

- Sanghvi Movers Limited

- Sarens NV

- Sarilar Heavy Lift & Transport

- Shanghai Zhenhua Heavy Industries

- Sweihan Cranes & Transport

- TEKA Rental

- TNT Crane & Rigging Inc.

- Wolffkran International AG

Table Information

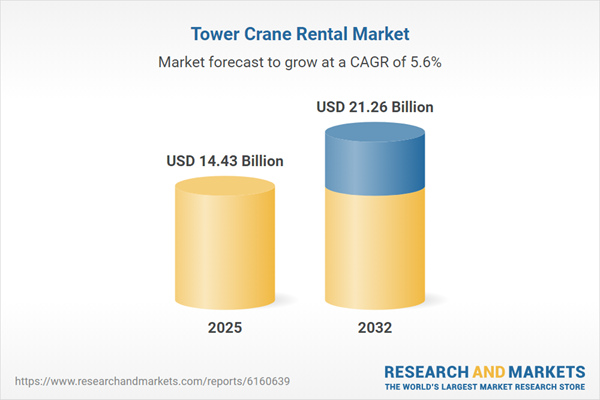

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 14.43 Billion |

| Forecasted Market Value ( USD | $ 21.26 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |