Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Innovation and Efficiency in the Global Lamps Market Through Technological Advancements and Sustainable Practices

Over the past decade, the global lamps market has witnessed a profound evolution driven by breakthroughs in energy-efficient technologies, a heightened commitment to sustainability, and shifting end-user expectations. Manufacturers have embraced rapid advancements in semiconductor fabrication to deliver light emitting diode solutions that drastically reduce power consumption and extend operational life. Concurrently, legacy technologies such as incandescent and fluorescent lamps have been reengineered to meet stricter regulatory standards while niche segments like halogen and high-intensity discharge lighting continue to serve specialized industrial and commercial applications.As environmental imperatives gain momentum, initiatives to phase out mercury-based components and reduce greenhouse gas emissions have inspired industry collaborations and innovative material reforms. In parallel, design aesthetics and smart integration have become critical differentiators, propelling the emergence of networked lighting ecosystems capable of real-time monitoring and adaptive control. Against this backdrop, stakeholders across the value chain-from component suppliers to channel partners-must navigate an increasingly complex landscape in which technological prowess, regulatory alignment, and consumer-centric features converge to define market leadership.

Unraveling the Major Technological Shifts and Evolving Consumer Preferences Driving the Next Wave of Growth and Innovation in the Lamps Industry

Technological leaps in semiconductor efficiency and optical engineering have redefined the performance benchmarks for modern lighting solutions. As chip manufacturers push the boundaries of lumen output per watt, lamp designers are integrating advanced heat-dissipation mechanisms and modular architectures that facilitate swift upgrades and customization. Moreover, the proliferation of IoT-enabled fixtures has fostered demand for lamps embedded with sensors, wireless communication modules, and programmable drivers, thereby expanding the traditional role of illumination toward intelligent building management and user engagement.In concert with these engineering advances, consumer preferences have veered away from one-size-fits-all solutions toward personalized lighting experiences. End users now prioritize tunable color temperature, dynamic dimming profiles, and seamless interoperability with smart home platforms. Retailers and installers are responding by curating curated offerings that emphasize ease of installation and integrated control ecosystems. Consequently, manufacturers must balance the imperative to scale production and cost-effectiveness with the necessity to deliver modular, feature-rich products that resonate with both residential and commercial segments.

Assessing the Ripple Effects of 2025 United States Tariffs on Supply Chains, Cost Structures, and Competitive Dynamics in the Lamps Sector

The imposition of new United States tariffs in 2025 has introduced multifaceted challenges and opportunities across the lamps ecosystem. Rising duties on imported components have reverberated upstream, prompting suppliers to reassess manufacturing footprints and near-shore critical processes. These adjustments have, in turn, increased lead times and necessitated buffer inventories, compelling procurement teams to forge deeper partnerships with domestic fabricators while exploring alternative sourcing corridors.Meanwhile, downstream players have grappled with recalibrated cost structures, weighing the trade-off between passing additional expenses to end users and preserving market share through strategic price positioning. In response, several manufacturers have accelerated investments in automation and lean manufacturing to offset tariff-driven inputs, whereas others have introduced tiered product lines to absorb incremental costs at varying levels of the value chain. As a result, the competitive landscape is in flux: agile players adept at realigning supply networks and optimizing production efficiency are poised to strengthen their footholds, while less resilient entities may face consolidation pressures.

Decoding Critical Segment-Level Developments Across Lamp Types, Wattage Categories, and Distribution Channels That Are Shaping Market Opportunities

Segment-level analysis reveals substantial divergence in performance and innovation across different lamp types. Traditional incandescent and fluorescent solutions maintain a foothold in legacy installations and large-scale projects, yet they increasingly coexist with more efficient halogen and high-intensity discharge offerings tailored to industrial settings. Concurrently, light emitting diode lamps have ascended as the preferred choice for residential and commercial retrofit applications, while intelligent fixtures equipped with connectivity and adaptive controls signal the industry's shift toward smart ecosystems.Shifts in wattage and brightness ranges further underscore evolving user demands. High wattage configurations continue to serve warehouses, stadiums, and exterior security needs, whereas medium wattage luminaires address office and retail environments with balanced performance and energy efficiency. At the same time, low wattage solutions are gaining traction as accent and task lighting, particularly where precision and aesthetic appeal drive adoption. Distribution channels mirror these dynamics: brick-and-mortar outlets such as electrical supply centers, specialty lighting showrooms, and large-format retailers remain critical for bulk and professional purchases, while online platforms offer convenience and broad product assortments to end consumers seeking direct-to-door delivery.

Uncovering Regional Variations in Demand Patterns and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Uncovering Regional Variations in Demand Patterns and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

In the Americas, an emphasis on sustainable infrastructure upgrades and government incentives for energy-efficient retrofits is driving robust demand for next-generation LED and smart lighting solutions. North American facilities management teams are prioritizing lifecycle cost reduction and operational intelligence, creating a fertile environment for networked lamps with integrated analytics. Latin American markets, while more price-sensitive, are demonstrating accelerating uptake of mid-range LED products as distribution expands through both traditional retail chains and e-commerce channels.Turning to Europe, Middle East & Africa, regulatory frameworks in the European Union remain among the most stringent globally, compelling manufacturers to phase out legacy technologies and prioritize circular economy practices. Meanwhile, the Middle East is characterized by large-scale urban development projects that favor high-intensity discharge and high wattage LED configurations for outdoor and stadium lighting. In Africa, nascent electrification efforts and off-grid solar-LED collaborations are redefining access to illumination across remote regions. Across Asia-Pacific, rapid urbanization and rising disposable incomes in urban centers have fueled a surge in mid-to-high wattage LED installations, while smart lamp adoption is propelled by expanding 5G networks and integrated building automation strategies.

Highlighting Strategic Movements, Collaborations, and Technological Innovations Among Leading Players Influencing Competitive Positioning in the Lamps Market

Leading corporations are actively reshaping the competitive landscape through strategic acquisitions, technology partnerships, and targeted R&D investments. Several prominent firms have locked in exclusive agreements with semiconductor foundries to secure high-efficiency LED chips, while others have forged alliances with IoT platforms to enhance product interoperability and data analytics capabilities. Joint ventures between established lighting specialists and emerging sensor technology providers are also proliferating, underscoring a collective push toward integrated lighting control systems.Concurrently, forward-looking companies are allocating resources to open-architecture platforms that facilitate third-party add-ons and developer ecosystems, thereby expanding the utility and customization potential of core lamp offerings. Sustainability commitments have spurred collaborations with material innovators to explore recyclable modules and eco-friendly phosphor compounds. Overall, the race to differentiate through converged lighting and building management solutions has intensified, with market leaders seeking to establish full-stack propositions that address energy management, user experience, and data-driven maintenance services.

Implementable Strategies for Industry Leaders to Capitalize on Emerging Trends, Optimize Supply Chains, and Enhance Product Differentiation in the Lamps Space

To thrive amid rapid change, industry leaders should first prioritize supply chain resilience by diversifying supplier relationships and adopting dual-sourcing models for critical components. Investing in advanced automation and digital twins can mitigate tariff exposure and inventory volatility, while real-time visibility tools enable agile responses to demand fluctuations. Simultaneously, forging close partnerships with logistics providers will streamline last-mile delivery and support just-in-time inventory strategies.On the product front, firms can differentiate by accelerating the rollout of modular lamp systems that accommodate both hardware upgrades and software feature enhancements. Developing proprietary connectivity standards or leveraging open APIs will bolster compatibility with broader building management and home automation ecosystems. Lastly, cultivating thought leadership through case studies and pilot programs in collaboration with key end users will underscore the tangible benefits of energy savings and operational intelligence, thereby reinforcing brand credibility and driving market penetration.

Exploring a Rigorously Structured Methodological Framework Combining Primary and Secondary Research to Unveil Critical Market Insights and Trends

This report synthesizes data gathered through in-depth interviews with senior executives across manufacturing, distribution, and end-user segments, complemented by survey responses from facilities managers, architects, and procurement specialists. Primary research was supplemented by a comprehensive review of industry white papers, technical journals, and patent databases to ensure a robust understanding of current and emerging technologies.Secondary sources encompassing regulatory publications, sustainability reports, and trade association analyses provided contextual depth, particularly regarding regional compliance regimes and incentive structures. All qualitative inputs were triangulated with quantitative observations derived from financial filings, customs data, and macroeconomic indicators to produce a cohesive narrative. Rigorous validation rounds with subject matter experts ensured that findings are accurate, relevant, and aligned with the latest market developments.

Synthesizing Key Findings to Illuminate Strategic Pathways and Future Opportunities in the Evolving Global Lamps Market Landscape

The convergence of energy efficiency imperatives, digital connectivity, and sustainability mandates has transformed lamps from mere illumination tools into integral components of intelligent infrastructure. Technological innovations-from advanced LED architectures to smart sensors-are redefining performance benchmarks and user expectations. Simultaneously, new tariff regimes and regional regulatory shifts are compelling stakeholders to revisit supply chain configurations and pricing strategies.Looking ahead, companies that seamlessly integrate modular design, digital intelligence, and eco-friendly materials will be best positioned to capture growth across differentiated segments. Strategic collaboration-both across the value chain and with technology partners-will accelerate time-to-market for next-generation offerings. Ultimately, a holistic approach that balances supply chain agility, product innovation, and targeted go-to-market tactics will unlock sustainable value creation in a rapidly evolving ecosystem.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Lamp Type

- Fluorescent Lamps

- Halogen Lamps

- High-Intensity Discharge Lamps

- Incandescent Lamps

- Light Emitting Diode Lamps

- Smart Lamps

- Wattage / Brightness Range

- High Wattage

- Low Wattage

- Medium Wattage

- Distribution Channel

- Offline Retail

- Electrical Supply Stores

- Specialty Stores

- Supermarkets/Hypermarkets

- Online Retail

- Offline Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ams-OSRAM AG

- Artemide S.p.A.

- BEGA Gantenbrink-Leuchten KG

- Cree LED by Penguin Solutions

- Eaton Corporation

- Eglo Leuchten GmbH

- Fagerhults Belysning AB

- Feilo Sylvania Group

- Feit Electric

- Flos B&B Italia Group S.p.A.

- Herman Miller, Inc.

- Hubbell Incorporated

- IKEA Group

- Lutron Electronics Co., Inc.

- RAB Lighting Inc.

- VIBIA INC

- Zumtobel Group AG

- Moooi B.V.

- Foscarini S.p.A.

- Kartell S.p.A.

- Tom Dixon

- Anglepoise Ltd

- Ningbo Royalux Lighting Co., Ltd.

- FontanaArte srl by ItalianCreationGroup

- Verpan A/S

- Christopher Hyde Ltd

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Lamps market report include:- ams-OSRAM AG

- Artemide S.p.A.

- BEGA Gantenbrink-Leuchten KG

- Cree LED by Penguin Solutions

- Eaton Corporation

- Eglo Leuchten GmbH

- Fagerhults Belysning AB

- Feilo Sylvania Group

- Feit Electric

- Flos B&B Italia Group S.p.A.

- Herman Miller, Inc.

- Hubbell Incorporated

- IKEA Group

- Lutron Electronics Co., Inc.

- RAB Lighting Inc.

- VIBIA INC

- Zumtobel Group AG

- Moooi B.V.

- Foscarini S.p.A.

- Kartell S.p.A.

- Tom Dixon

- Anglepoise Ltd

- Ningbo Royalux Lighting Co., Ltd.

- FontanaArte srl by ItalianCreationGroup

- Verpan A/S

- Christopher Hyde Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | November 2025 |

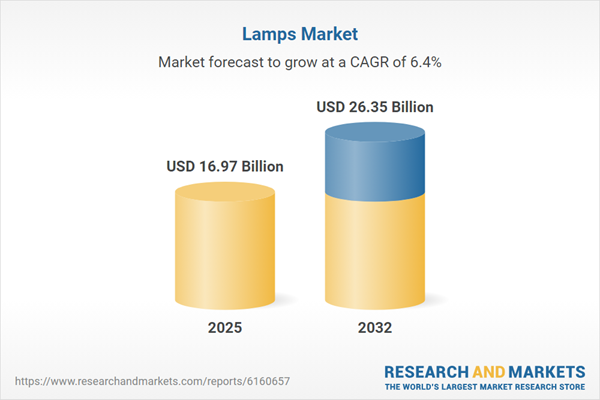

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 16.97 Billion |

| Forecasted Market Value ( USD | $ 26.35 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |