Speak directly to the analyst to clarify any post sales queries you may have.

A precise and practical overview of engineering, safety and operational fundamentals that define strategic decision-making for LPG spherical tank stakeholders

The LPG spherical tank sector intersects complex engineering, rigorous safety regimes, and evolving regulatory expectations, making a precise introduction essential for stakeholders assessing asset strategy. At its core, the industry is shaped by the need to store pressurized liquefied petroleum gas reliably, balancing considerations such as material integrity, installation environment, and lifecycle maintenance. This introduction frames the technical foundations-pressure containment, corrosion resistance, structural support-and highlights how those foundations inform procurement, operations, and risk management decisions.Transitioning from fundamentals to practical application, the sector demands multidisciplinary collaboration between process engineers, structural designers, and operations teams. Consequently, decision-makers must prioritize interoperability across design and inspection workflows, integrate advanced nondestructive testing practices, and ensure that procurement specifications reflect real-world operating conditions. By foregrounding these imperatives, this introduction sets expectations for the remainder of the analysis and positions stakeholders to evaluate strategic options with a clear understanding of engineering constraints, safety obligations, and long-term asset stewardship.

How technological advances, regulatory tightening, and supply chain resilience are reshaping design, procurement, and lifecycle management across the LPG spherical tank sector

The landscape for LPG spherical tanks is undergoing transformative shifts driven by technological maturation, stricter safety and environmental regulations, and changing supply chain dynamics. Advancements in materials science and welding techniques are enabling improved fatigue resistance and extended service life, while digitalization initiatives, such as remote monitoring and predictive maintenance platforms, are altering asset management paradigms. These shifts are not isolated; rather, they interact to reshape procurement criteria, inspection intervals, and capital allocation strategies.Moreover, regulatory evolution is prompting operators to revisit design margins and inspection regimes. As a result, operational teams are integrating enhanced leak detection, automated pressure control, and environmental safeguards into retrofit and new-build projects. At the same time, supply chain pressures have catalyzed a greater emphasis on supplier qualification and logistics planning, encouraging firms to diversify sourcing and to invest in local fabrication capability where feasible. Taken together, these forces are prompting asset owners and EPC contractors to adopt more resilient, data-driven approaches to design, construction, and lifecycle management, ultimately affecting how projects are scoped, executed, and governed.

The 2025 US tariff measures and the resulting procurement, fabrication, and supply chain adjustments that prompted regional sourcing and contractual resilience strategies

The imposition of new tariffs by the United States in 2025 introduced an additional layer of complexity for global stakeholders involved in the manufacturing, export, and deployment of LPG spherical tanks. These measures influenced sourcing decisions and encouraged a reassessment of fabrication footprints and logistics models. Organizations with historically transnational supply chains faced the need to evaluate the trade-offs between cost efficiency and tariff exposure, prompting shifts in procurement strategies and contractual arrangements.In response to the tariff environment, several operators accelerated localization efforts, evaluating domestic fabrication or nearshoring options to reduce exposure to import duties. Simultaneously, engineering teams reassessed specifications to ensure comparability across different fabrication centers, while commercial teams negotiated revised terms with vendors to manage price pass-through and delivery commitments. These combined responses highlight how trade policy can catalyze structural change within capital goods sectors, creating momentum for regional supply chain development, stronger supplier partnerships, and an increased focus on procurement resilience and contractual clarity throughout the project lifecycle.

Deconstructing market segmentation to reveal how tank design, capacity, materials, application, installation, sales channels, and end-user needs drive differentiated technical and commercial strategies

Understanding the market through a segmentation lens reveals differentiated drivers and risk profiles tied to design choices, capacity ranges, material selection, application areas, installation environments, sales pathways, and end-user demands. Based on Tank Design, stakeholders must weigh the trade-offs between Double-wall systems that provide enhanced secondary containment and Single-wall designs that may offer lower upfront cost and simpler maintenance regimes, with implications for safety strategies and retrofit planning. Based on Storage Capacity, choices among Below 300 m³, 300-1000 m³, and Above 1000 m³ categories shape site layout, foundation requirements, and pressure management approaches, as larger capacities typically necessitate greater structural reinforcement and more sophisticated monitoring.Based on Tank Material, carbon steel and stainless steel present distinct corrosion profiles, fabrication considerations, and lifecycle maintenance implications, requiring operators to align material selection with ambient conditions and regulatory drivers. Based on End Use, distribution terminals, petrochemical plants, power generation facilities, and refineries each impose unique throughput patterns, cycling frequencies, and safety integration needs that influence design specifications and inspection regimes. Based on Installation Type, Above Ground installations enable easier inspection access while Underground installations alter maintenance planning and corrosion control strategies. Based on Sales Channel, offline procurement relationships continue to dominate complex capital purchases whereas online channels are growing for informational and preliminary sourcing activities. Based on End-User, sectors such as Agriculture, Chemical & Petrochemical, Energy & Utilities, Marine & Shipping, and Oil & Gas present varied cost pressures, reliability expectations, and regulatory compliance requirements that guide tailored commercial and technical approaches.

How regional regulatory regimes, fabrication capabilities, and operational priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific shape technical choices and supply chain strategies

Regional dynamics exert a powerful influence over technical standards, procurement practices, and deployment priorities across the LPG spherical tank landscape. In the Americas, capital projects are influenced by a combination of aging infrastructure, evolving safety regulations, and a focus on domestic fabrication capabilities that support rapid response and reduced tariff exposure. Consequently, project timelines and supplier qualifications are shaped by proximity to fabrication yards and the availability of qualified welding and NDT resources.By contrast, Europe, Middle East & Africa features a mosaic of regulatory regimes and climatic conditions that drive customization in design and material selection; regulatory stringency in parts of Europe prioritizes advanced safety systems and inspection fidelity, while Middle Eastern markets emphasize large-capacity storage and rapid throughput, and several African markets focus on scalable and cost-effective solutions. Meanwhile, Asia-Pacific is characterized by robust industrial growth, expanding petrochemical complexes, and a rising emphasis on digitalization and manufacturing capacity expansion, prompting investment in localized fabrication hubs and adoption of condition-based maintenance technologies. These regional tendencies illustrate how geography informs technical design choices, supply chain configurations, and risk management practices for stakeholders across the value chain.

Competitive dynamics and supplier strategies that combine fabrication excellence, lifecycle services, and strategic partnerships to meet complex project and customer needs

A competitive set of companies and suppliers is advancing technical differentiation through materials innovation, modular fabrication approaches, and integrated service offerings that combine engineering, inspection, and lifecycle support. Leading fabrication houses emphasize stringent quality control, weld integrity, and qualification testing, while service providers expand capabilities in non-destructive testing, coatings application, and digital monitoring. These strategic moves are accompanied by deeper collaboration between equipment manufacturers and end-users to co-develop maintenance programs that reduce downtime and extend service intervals.In addition, there is an observable trend toward strategic partnerships that link local fabrication yards with specialized engineering consultancies to deliver turnkey solutions that meet both local content expectations and international technical standards. Vendors that can offer comprehensive warranties, robust aftersales support, and flexible financing structures tend to be more effective at securing long-term frameworks with major operators. Ultimately, companies that integrate technical excellence with responsive commercial models and strong local presence position themselves to meet the nuanced needs of complex projects and evolving customer expectations.

Clear, prioritized actions for industry leaders to strengthen supply chain resilience, optimize maintenance through digital tools, and elevate procurement and quality assurance practices

Industry leaders should take actionable steps to strengthen resilience, lower operational risk, and capture strategic opportunities across the LPG spherical tank value chain. First, prioritize supplier diversification and regional fabrication capacity to reduce exposure to trade disturbances and to ensure timely delivery of critical components. Second, invest in digital monitoring and predictive maintenance systems to shift from time-based inspections to condition-based interventions, thereby improving uptime and optimizing maintenance budgets. Third, update procurement specifications to codify quality assurance criteria, welding qualifications, and testing regimes so that fabricators and contractors deliver consistent performance against operational requirements.Furthermore, implement cross-functional governance that links engineering, procurement, and operations teams to ensure specifications are practical and enforceable. Pursue targeted R&D in corrosion-resistant coatings and advanced inspection methodologies to reduce lifecycle costs and to support compliance with tightening safety standards. Finally, consider structured partnerships or joint ventures with local fabricators in strategic regions to balance cost, compliance, and lead-time considerations while maintaining rigorous technical oversight and quality assurance.

A transparent, multi-method research approach combining expert interviews, standards review, and case study analysis to produce validated technical and commercial insights

This research employs a multi-method approach that blends qualitative expert interviews, technical standards review, and comparative analysis of industry practices to deliver actionable insights. Primary inputs were gathered from interviews with design engineers, operations managers, fabrication specialists, and safety regulators to surface practical considerations on material selection, welding qualifications, inspection regimes, and lifecycle management. These conversations were triangulated with a systematic review of international codes and standards, engineering textbooks, and recent technical conference proceedings to ensure doctrinal alignment with prevailing best practices.Additionally, secondary analysis examined public domain technical literature, case studies of recent project deployments, and observable procurement trends to contextualize strategic decisions. Throughout the process, findings were validated by subject-matter reviewers to ensure accuracy and relevance, and care was taken to avoid proprietary confidential information. The methodology emphasizes transparency and traceability, enabling stakeholders to understand the provenance of insights and to apply them confidently within their own technical and commercial decision frameworks.

Summarizing how technical innovation, regulatory priorities, and supply chain adjustments converge to redefine resilience and strategic advantage for LPG spherical tank stakeholders

In conclusion, the LPG spherical tank sector is at an inflection point where engineering innovation, regulatory focus, and supply chain realignment converge to redefine asset strategy and procurement behavior. Stakeholders who proactively adapt-by integrating advanced materials, embracing condition-based maintenance, and aligning sourcing strategies with regional realities-will be better positioned to manage risk and extract operational value. The evolving policy environment and recent trade developments have underscored the importance of supply chain resilience and local fabrication capability, making adaptability a critical competitive differentiator.Looking ahead, success will require a balanced emphasis on technical rigor, commercial agility, and collaborative supplier relationships. By operationalizing the insights presented-updating procurement specifications, investing in digital monitoring, and cultivating strategic partnerships-operators and suppliers can navigate present challenges and capitalize on opportunities to deliver safer, more reliable, and cost-effective LPG storage solutions.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Tank Design

- Double-wall

- Single-wall

- Storage Capacity

- 300-1000 m³

- Above 1000 m³

- Below 300 m³

- Tank Material

- Carbon Steel

- Stainless Steel

- End Use

- Distribution Terminals

- Petrochemical Plants

- Power Generation

- Refineries

- Installation Type

- Above Ground

- Underground

- Sales Channel

- Offline

- Online

- End-User

- Agriculture

- Chemical & Petrochemical

- Energy & Utilities

- Marine & Shipping

- Oil & Gas

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Globe Gas Equipments Industry Pvt. Ltd.

- Çimtaş Group

- Tekfen İmalat ve Müh. A.Ş.

- CRYOCAN

- McDermott International, Ltd

- Startech Projects & Engineers

- BNH Gas Tanks

- CIMC ENRIC

- Bharat Tanks & Vessels LLP

- IBP GAS Engineers

- KADATEC Ltd.

- China Tanks and Vessels

- Srisen Energy Technology Co.,Ltd

- Bewellcn Shanghai Industrial Co., Ltd.

- Henan Jian Shen Metal Metenrial Co.Ltd

- Chengli Special Automobile Co., Ltd.

- TOYO KANETSU K.K.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this LPG Spherical Tank market report include:- Globe Gas Equipments Industry Pvt. Ltd.

- Çimtaş Group

- Tekfen İmalat ve Müh. A.Ş.

- CRYOCAN

- McDermott International, Ltd

- Startech Projects & Engineers

- BNH Gas Tanks

- CIMC ENRIC

- Bharat Tanks & Vessels LLP

- IBP GAS Engineers

- KADATEC Ltd.

- China Tanks and Vessels

- Srisen Energy Technology Co.,Ltd

- Bewellcn Shanghai Industrial Co., Ltd.

- Henan Jian Shen Metal Metenrial Co.Ltd

- Chengli Special Automobile Co., Ltd.

- TOYO KANETSU K.K.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | October 2025 |

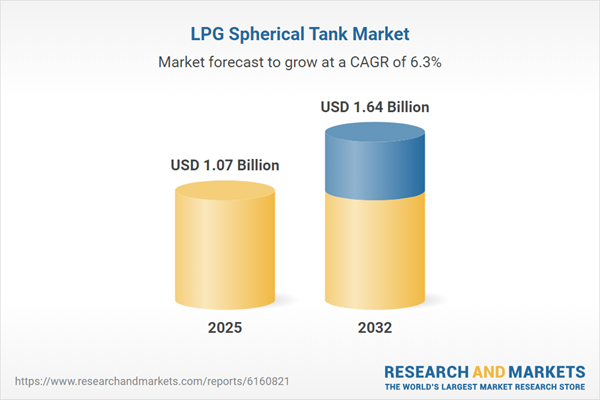

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.07 Billion |

| Forecasted Market Value ( USD | $ 1.64 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |