Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling Strategic Importance of Multiphase Flow Metering Technologies in Modern Oilfield Production Environments to Optimize Efficiency and Accuracy

In an era of intensifying production challenges and stringent regulatory expectations, the role of multiphase flow meters in oilfield operations has emerged as a cornerstone of operational excellence. These devices enable operators to accurately monitor the simultaneous flow of oil, gas, and water within a single pipeline, thereby eliminating the need for costly separation at wellheads and reducing plant footprint. Consequently, real-time flow measurement translates into enhanced reservoir management, improved production forecasting, and minimized environmental impact.Furthermore, the evolution of measurement technologies has introduced a range of techniques-ranging from capacitance and Coriolis devices to ultrasonic and vortex systems-that cater to distinct operational contexts. Each principle offers unique benefits in terms of accuracy, maintenance requirements, and adaptability to harsh subsea conditions. As a result, decision makers must navigate a complex array of technical options to align meter selection with specific field characteristics and production targets.

Moreover, the strategic deployment of these meters fosters data-driven decision making that extends beyond mere flow rates. Integrated analytics platforms leverage streaming data to detect anomalies, optimize artificial lift systems, and support predictive maintenance strategies. For stakeholders seeking to maximize asset value and ensure regulatory compliance, understanding the breadth of multiphase metering capabilities is the first step toward unlocking a higher tier of performance in oilfield production.

How Emerging Digital Technologies and Innovative Measurement Techniques Are Reshaping the Oilfield Multiphase Flow Meter Landscape for Enhanced Decision Making

In recent years, a wave of digital transformation has swept through the oil and gas sector, fundamentally altering how multiphase flow meters are designed, deployed, and operated. Advances in sensor miniaturization, coupled with the integration of edge computing, have enabled devices to process complex flow models in situ, delivering near-instantaneous insights on phase fractions and flow regimes. Moreover, the convergence of the Internet of Things and advanced signal processing has bridged the gap between remote wells and centralized control centers, fostering a new paradigm of real-time decision making.As a direct consequence of these technological strides, machine learning algorithms now augment traditional measurement principles by identifying patterns and compensating for measurement drift. In particular, the emergence of self-learning calibration routines has significantly reduced downtime associated with manual recalibration, thereby driving higher uptime and reliability. In addition, cloud-based analytics platforms are empowering operators to conduct cross-field benchmarking, harnessing collective intelligence to refine well performance and optimize asset utilization.

Simultaneously, hardware innovations have expanded the applicability of multiphase meters in previously intractable environments. Developments in ultrasonic transducer materials, for example, have enhanced tolerance to abrasive slurries and high-pressure steam injections, while novel Coriolis tube designs offer superior resistance to flow-induced vibration. Consequently, both onshore and offshore installations benefit from meters that endure the rigors of extreme temperatures and corrosive fluids.

In light of these transformative shifts, industry participants are adopting a more collaborative approach to technology adoption. Partnerships between equipment manufacturers, software developers, and service providers are accelerating the roll-out of integrated flow assurance solutions. Ultimately, this ecosystem-driven innovation is unlocking new value streams and enabling stakeholders to navigate the complexity of modern production environments with unprecedented clarity.

Assessing the Comprehensive Effects of the 2025 United States Tariff Measures on Oilfield Multiphase Flow Meter Supply Chains and Cost Structures

The introduction of revised tariff measures by the United States in early 2025 has precipitated tangible ripples across the oilfield equipment landscape, with multiphase flow meters experiencing pronounced cost pressures. Components such as specialized transducers, advanced electronics, and proprietary software modules are often sourced from international suppliers. Consequently, the imposition of additional duties has inflated landed costs, compelling original equipment manufacturers and end users to revisit sourcing strategies.In response to these elevated input expenses, many suppliers have expedited the localization of key manufacturing activities. This shift toward establishing regional production hubs has not only mitigated tariff impact but also yielded shorter lead times and improved supply chain resilience. However, the transition has required substantial capital investment and the requalification of processes to align with stringent quality and certification standards in the oil and gas industry.

Furthermore, the tariff environment has underscored the imperative for design optimization that reduces reliance on imported subcomponents. Today, leading meter developers are exploring alternative materials and modular architectures that allow for easier substitution of tariff-exposed parts. Consequently, cross-functional teams are collaborating to reengineer product lines without compromising measurement accuracy or environmental robustness.

Yet, the cumulative effect of these adjustments extends beyond manufacturing. Service companies and operators are encountering higher maintenance and replacement costs, spurring more rigorous total cost of ownership analyses. Additionally, long-term supplier agreements are being renegotiated to incorporate tariff pass-through clauses and volume incentives that cushion future fee fluctuations.

Moreover, the ongoing dialogue between industry consortia and government bodies suggests that future adjustments may prioritize strategic energy security considerations. In this evolving regulatory context, staying informed and maintaining flexible procurement protocols will be critical for sustaining competitive advantage.

Illuminating Critical Market Segmentation Dimensions Driving Adoption and Application of Oilfield Multiphase Flow Meters Across Diverse Operational Criteria

An in-depth examination of the market through various segmentation lenses reveals distinct adoption patterns and growth opportunities for multiphase flow meters. When considering measurement principle, the landscape encompasses technologies such as capacitance, Coriolis, differential pressure, ultrasonic, and vortex systems, each addressing specific field challenges. Within the ultrasonic segment, for instance, operators choose between Doppler and transit time modalities based on fluid composition and flow regime sensitivity.Shifting focus to application, these meters play a vital role in lease automatic custody transfer operations, enabling precise volumetric accounting without manual intervention. In pipeline monitoring, stakeholders distinguish between distribution and transmission networks, tailoring metering solutions to accommodate varying pressure profiles and flow rates. Similarly, in production monitoring scenarios, deeper analyses differentiate between downhole and surface facilities, ensuring that equipment installations align with subsurface constraints or surface processing requirements. At well testing facilities, the ability to rapidly characterize well performance across a spectrum of conditions further underscores the versatility of this instrumentation.

From the end user viewpoint, original equipment manufacturers integrate these meters into broader completions packages, while oil and gas operators-spanning international and national energy companies-leverage them to optimize reservoir output. Service companies also represent a critical segment, with drilling services relying on real-time flow diagnostics during well interventions and production services focusing on enhanced recovery processes.

Operational mode constitutes another pivotal category, as online installations are subdivided into fixed and retrofit configurations, and portable systems adapt to field mobility needs through handheld or skid-mounted designs. Subsea applications, whether in dry tree or wet tree setups, demand particularly robust packaging and corrosion resistance. Installation types further bifurcate into clamp on, with permanent or temporary configurations, and inline designs tailored for new installation or retrofit requirements.

Lastly, the spectrum of flow rate and pressure ranges-from low flow and low pressure to high flow and high pressure scenarios-guides meter selection and calibration strategies. By overlaying these segmentation dimensions, decision makers can pinpoint the optimal solution for any unique field condition and operational objective.

Determining Regional Dynamics and Growth Drivers That Influence Oilfield Multiphase Flow Meter Demand Across Americas EMEA and Asia Pacific Markets

Regional analysis illuminates how distinct market drivers and strategic investments shape the deployment of multiphase flow metering solutions. In the Americas, the shale revolution and deepwater exploration initiatives have fueled robust uptake of advanced metering systems. Operators in North America have shown particular interest in portable and subsea units that accommodate the rapid deployment cycles characteristic of unconventional plays. Meanwhile, Latin American markets are responding to renewed offshore licensing rounds with a heightened focus on instrumentation that withstands corrosive high-salinity environments.In contrast, the Europe, Middle East & Africa region is navigating a dual imperative: maximizing output from mature offshore fields while transitioning toward more sustainable production models. Here, fixed online installations and retrofit applications are prevalent as aging assets require performance upgrades rather than complete replacement. Additionally, national oil companies in the Middle East are increasingly integrating digital analytics to extract incremental gains from ultra-high-pressure reservoirs, driving demand for meters that deliver accurate readings under extreme operating conditions.

The Asia-Pacific arena presents a tapestry of emerging and established markets, each with unique requirements. In Southeast Asia, the proliferation of small to mid-scale offshore platforms has led to growing interest in compact, clamp on metering solutions that minimize platform top-side modifications. Australia’s deepwater projects, by contrast, demand subsea instrumentation with specialized pressure rating and flow range capabilities. Furthermore, South Asian nations are embarking on extensive onshore field redevelopment initiatives, offering opportunities for inline and retrofit meters to support production ramp-up initiatives.

Moreover, cross-regional collaboration is becoming more prevalent, with technology transfer agreements and joint ventures bridging capability gaps. This trend underscores the value of adaptive commercial models that account for regional procurement norms and long-term service commitments.

Profiling Leading Innovators and Strategic Players Shaping the Future of Oilfield Multiphase Flow Meter Technology Through Collaboration and R&D

Key industry players are navigating a competitive but collaborative landscape characterized by rapid technological advancement and strategic partnerships. Schlumberger, a pioneer in measurement While Drilling technology, has bolstered its flow metering portfolio by integrating real-time analytics into its digital asset management suite. Emerson has likewise expanded its footprint through targeted acquisitions, enhancing its capabilities in Coriolis and ultrasonic measurement systems. Meanwhile, ABB continues to innovate around signal processing algorithms, aiming to reduce measurement uncertainty in high gas volume fraction wells.Beyond these established names, specialized firms are staking out niches through bespoke solutions. KROHNE, for instance, leverages its strength in metallurgy to deliver vortex meters with superior erosion resistance, while Roxar focuses on subsea completions with modular transducer assemblies. Collaborative ventures between software developers and hardware manufacturers have also become more common. This convergence has yielded platforms that unify flow metering data with reservoir modeling tools, enabling operators to optimize production holistically rather than in isolation.

Furthermore, several players are piloting next-generation sensor technologies, such as distributed acoustic sensing and fiber-optic based pressure monitoring, to complement traditional multiphase measurements. These initiatives underscore an industry-wide recognition that future value lies in integrated solutions offering end-to-end visibility. As a result, the competitive landscape is evolving toward an ecosystem model, where alliances and co-development agreements drive differentiation more than standalone product features.

Strategic Imperatives for Industry Leaders to Navigate Technological Evolution Market Complexity and Regulatory Challenges in Oilfield Metering

Industry leaders must adopt a proactive approach to remain at the forefront of multiphase flow metering advancements. First, investing in research and development initiatives that emphasize modular designs and software-driven calibration will enable rapid adaptation to shifting field requirements. By prioritizing open architecture frameworks, companies can facilitate seamless integration with third-party analytics platforms and foster broader interoperability across upstream asset portfolios.In parallel, diversifying supply chains through a mix of regional manufacturing hubs and global sourcing agreements can mitigate the risks associated with tariff fluctuations and logistics disruptions. Strategic partnerships with local service providers also help ensure timely maintenance support and regulatory compliance, particularly in jurisdictions that impose strict certification standards for oil and gas instrumentation.

Moreover, cultivating a customer-centric mindset by offering outcome-based contracts rather than purely equipment-based sales will align provider incentives with operator performance goals. This shift toward service-oriented business models can drive deeper collaboration, unlocking shared value through performance guarantees and co-investment in digital monitoring capabilities. In tandem, embedding predictive maintenance protocols and remote diagnostics into service offerings can reduce unplanned downtime and extend equipment lifecycles.

Ultimately, a balanced focus on innovation, operational resilience, and customer engagement will be essential for leaders striving to capture emerging opportunities and shape the future trajectory of oilfield multiphase flow metering.

Detailed Overview of Rigorous Research Methodology Employed to Ensure Accurate, Transparent, and Actionable Insights into Multiphase Flow Meter Markets

This research combines comprehensive primary and secondary investigation to deliver robust insights into the multiphase flow meter market. Initially, expert interviews with oilfield operators, equipment manufacturers, and technical service providers were conducted to validate market drivers and identify emerging trends. In addition, in-depth discussions with regulatory bodies and industry associations provided context on certification requirements and trade developments.Secondary research encompassed a systematic review of industry publications, technical whitepapers, and patent filings to trace technological evolution and competitive positioning. Company disclosures and tender announcements were analyzed to gauge strategic priorities and pipeline activity. Triangulation of data sources ensured that findings were cross-verified for consistency and reliability. Finally, data synthesis employed qualitative trend mapping and scenario analysis techniques to derive actionable recommendations. This multi-pronged methodology underpins the credibility and relevance of the strategic insights presented throughout the report.

Synthesizing Core Findings and Strategic Implications to Guide Stakeholders Toward Sustainable Advances in Oilfield Multiphase Flow Meter Deployment

The analysis highlights how technological advancements, evolving trade policies, and regional market dynamics collectively shape the multiphase flow meter ecosystem. Key takeaways include the growing influence of digital analytics in enhancing measurement accuracy, the strategic realignment prompted by tariff implications, and the critical role of segmentation when aligning solutions with specific field conditions. Moreover, regional insights underscore the importance of tailoring deployment strategies to local production profiles and regulatory landscapes.In essence, operators and suppliers that harmonize innovation with resilient supply chain practices will be best positioned to capture value in an increasingly competitive environment. By leveraging integrated measurement platforms and fostering collaborative partnerships across the value chain, stakeholders can optimize production performance and reduce operational risk. The conclusions drawn here serve as a strategic compass, reinforcing the imperative for agile decision-making and continuous adaptation in the evolving oilfield metering landscape.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Measurement Principle

- Coriolis Meters

- Differential Pressure Meters

- Electrical Capacitance Meters

- Nuclear Meters

- Optical Meters

- Venturi Meters

- Installation Type

- Clamp On

- Inline

- Flow Rate Range

- High Flow

- Low Flow

- Medium Flow

- Pressure Range

- High Pressure

- Low Pressure

- Medium Pressure

- Application

- Lease Automatic Custody Transfer

- Pipeline Monitoring

- Production Monitoring

- Well Testing

- End User

- Chemical & Petrochemical

- Food & Beverage

- Oil & Gas

- Pharmaceuticals

- Water & Wastewater Management

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Emerson Electric Co.

- Schlumberger Limited

- ABB Ltd.

- Agar Corporation

- Baker Hughes Company

- Berthold Technologies GmbH & Co.KG

- Endress+Hauser AG

- Flowtech Measuring Instruments PVT. LTD.

- FLUIDO SENSE PVT LTD.

- Haimo Technologies Group Corp

- Halliburton Company

- Honeywell International Inc.

- KROHNE Messtechnik GmbH

- Lefoo Group

- MEDENG Technologies Canada Inc,

- Pietro Fiorentini S.p.a.

- SGS S.A

- Siemens AG

- Tek-Trol LLC

- Weatherford International Ltd.

- Yokogawa Electric Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Oilfield Multiphase Flow Meter market report include:- Emerson Electric Co.

- Schlumberger Limited

- ABB Ltd.

- Agar Corporation

- Baker Hughes Company

- Berthold Technologies GmbH & Co.KG

- Endress+Hauser AG

- Flowtech Measuring Instruments PVT. LTD.

- FLUIDO SENSE PVT LTD.

- Haimo Technologies Group Corp

- Halliburton Company

- Honeywell International Inc.

- KROHNE Messtechnik GmbH

- Lefoo Group

- MEDENG Technologies Canada Inc,

- Pietro Fiorentini S.p.a.

- SGS S.A

- Siemens AG

- Tek-Trol LLC

- Weatherford International Ltd.

- Yokogawa Electric Corporation

Table Information

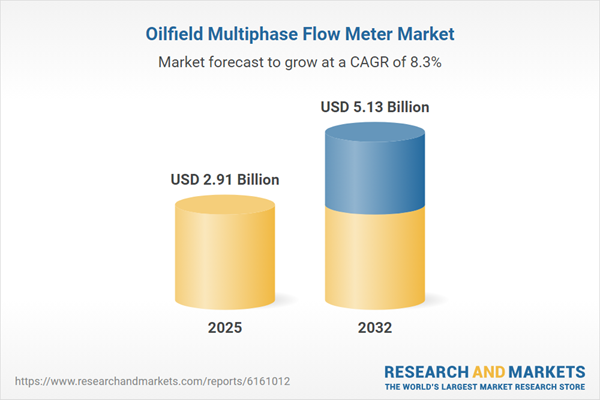

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.91 Billion |

| Forecasted Market Value ( USD | $ 5.13 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |