Global Colposcopy Market Overview

A colposcopy is a diagnostic procedure to check any abnormal tissue growth in the lower part of the uterus (cervix) and the wall of the vagina. The procedure, usually lasting for 10 to 20 minutes, employs a specialized microscope called a colposcope to magnify the tissue, lining the cervix and vagina. In case any abnormalities are detected, a biopsy is done to test the tissue for precancerous or cancerous cells. Besides checking for cancerous cells, colposcopies can also be used to test for noncancerous growth (polyps), genital warts, vulvar itching, or abnormal vaginal bleeding.The rising incidence of cervical cancer is acting as the key driver for colposcopy market growth. According to the report released by the World Health Organization (WHO), cervical cancer is the fourth most common cancer in women worldwide. It is also reported that women with human papillomavirus (HPV) are 6 times more prone to cervical cancer as compared to the ones without HPV infection. In addition, it is estimated that around 600,000 women suffer from cervical cancer caused by the sexually transmitted infection HPV, which has prompted the demand for effective screening procedures including colposcopy globally. Moreover, the robust government support to raise awareness about cervical cancers and the importance of colposcopy is expected to bolster the market growth in the coming years.

Development of Novel Colposcopy Products for Cervical Cancer Screening

The recent advancements in technology led to the development of digital and portable colposcopes, facilitating enhanced imaging capabilities and convenience. Additionally, the integration of artificial intelligence (AI) has substantially improved the speed and accuracy of the screening method. This has resulted in a spike in the number of patients opting for the diagnostic procedure, fueling the colposcopy market demand.In May 2023, MobileODT, an AI-based FemTech company in Israel introduced EVAPro next gen digital colposcope featuring high image quality with superior software capabilities. The lightweight and portable colposcope utilizes artificial intelligence and machine learning for cervical cancer screening on a large scale, offering quick evaluation (under a minute) and instant consultation. Thus, the novel product redefines cervical cancer screening as compared to the existing standard of care.

Increased Government Initiatives and Awareness Campaigns

Initiatives to raise awareness about the importance of colposcopy for early detection of cervical cancer by government, non-profit organizations, and healthcare facilities have boosted the colposcopy market share significantly.In May 2023, the National Health Service (NHS), a publicly funded healthcare system in England, pledged to eliminate cervical cancer by 2040. The initiative aims to improve the accessibility of online vaccine appointments and encourage more people to undergo cervical screening, with 3.5 million tested in the last year. With the help of colposcopy teams, and immunization staff, among others, the NHS is actively working towards reducing the global burden of cervical cancer. The robust campaigns are reaching a wider audience, prompting them to adopt regular cervical cancer screening practices, which is likely to contribute to notable market growth in the forecast period.

Global Colposcopy Market Segmentation

Colposcopy Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Instrument Type

- Optical

- Digital

Market Breakup by Portability

- Stationary

- Handheld

Market Breakup by Applications

- Cervical Cancer Screening

- Physical Examinations

- Other Applications

Market Breakup by End User

- Hospitals & Clinics

- Diagnostic Centres

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Colposcopy Market Regional Analysis

North America is anticipated to account for the largest share in the colposcopy market which can be attributed to the rapidly rising cases of cervical cancer in the region. Other key factors, like the technological advances in the healthcare sector, product launches of innovative colposcopes integrated with artificial intelligence, and the presence of pioneering medical device companies in the region are also expected to propel the growth of the market in the forecast period.In Asia Pacific, various programs led by government and non-government organizations have bolstered the colposcopy market share, with the increased number of people seeking regular cervical cancer screening procedures including colposcopy. In November 2023, the ROSE Foundation (a non-profit organization committed to eliminating cervical cancer in Malaysia) via its Program ROSE (Removing Obstacles to cervical ScrEening) celebrated a milestone in facilitating cervical cancer screening to over 25000 women, with 90% of women receiving appropriate follow-up examinations and treatments. To eliminate cervical cancer in Malaysia, the Foundation plans to implement a mobile colposcopy service in a remote village in Sarawak, a Malaysian state. The surge in such initiatives surrounding cervical cancer treatment are poised to elevate the application of colposcopes, boosting the market demand during the forecast period.

Global Colposcopy Market: Competitor Landscape

In November 2023, Indonesia based medical devices companies such as PT Forsta Kalmedic Global, PT Kalgen DNA, PT Swayasa Prakarsa, and PT Prima Alkesindo Nusantara, made strategic collaborations and trade transactions amounting to IDR 363.08 billion (USD 21.5 million) during the 4 days of the world's largest health equipment exhibition MEDICA 2023 event in Germany. The exhibition, boasting participation from over 6200 multinational companies, revealed the market expansion efforts of Indonesian medical device companies carrying a diverse product portfolio including colposcopy machines, bone graft equipment, etc. Such events of collaborations and investment are projected to increase the colposcopy market size in the forecast period.The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

- DYSIS Medical Inc.

- Olympus Corporation

- Kaps GmbH & Co. KG

- Carl Zeiss AG

- CooperSurgical, Inc

- Koninklijke Philips N.V.

- MedGyn Products, Inc.

- Danaher Corporation

- Schmitz Cargobull AG

- Seiler Instrument Inc.

- ATMOS MedizinTechnik GmbH & Co. KG

- MobileODT Ltd.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- DYSIS Medical Inc.

- Olympus Corporation

- Kaps GmbH & Co. KG

- Carl Zeiss AG

- CooperSurgical, Inc

- Koninklijke Philips N.V.

- MedGyn Products, Inc.

- Danaher Corporation

- Schmitz Cargobull AG

- Seiler Instrument Inc.

- ATMOS MedizinTechnik GmbH & Co. KG

- MobileODT Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

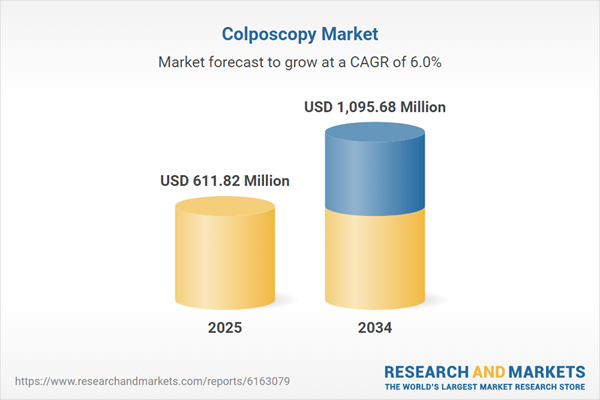

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 611.82 Million |

| Forecasted Market Value ( USD | $ 1095.68 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |