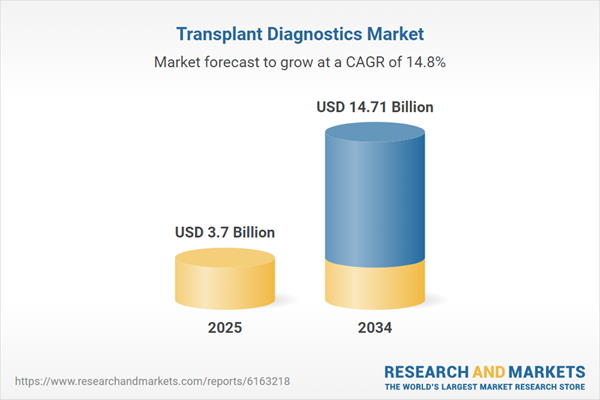

Global Transplant Diagnostics Market Analysis

- Market Growth and Size: The global transplant diagnostics market has witnessed significant growth over the years, driven by the increasing prevalence of chronic diseases and the rising demand for organ transplants. This market's expansion is further propelled by advancements in diagnostic technologies, which enhance the accuracy and efficiency of pre- and post-transplant screening, thereby improving patient outcomes. The market's size reflects the growing number of transplant procedures performed worldwide, coupled with the expanding application of molecular assays and next-generation sequencing technologies in transplant diagnostics. These factors collectively contribute to the broadening scope and scale of the transplant diagnostics market share, emphasizing its critical role in facilitating successful transplant outcomes and addressing the urgent need for organ matching and rejection monitoring.

- Major Market Drivers: The primary drivers behind the market's expansion include technological advancements in molecular diagnostics, increasing investments in healthcare infrastructure across various countries, and a notable rise in the number of organ transplantation procedures. Furthermore, the global increase in the prevalence of chronic diseases such as kidney failure, liver diseases, and heart conditions, which often require organ transplants, significantly contributes to the market's growth. Government initiatives and funding for research and development in transplant diagnostics also play a crucial role in driving market expansion.

- Key Market Trends: One of the prominent transplant diagnostics market trends is the shift towards precision medicine and personalized healthcare, leading to the development and adoption of next-generation sequencing (NGS) and polymerase chain reaction (PCR) based technologies. These advancements enable more accurate, faster, and comprehensive analysis of donor-recipient compatibility, improving transplant outcomes. Additionally, there is a growing emphasis on non-invasive diagnostic methods, which offer the potential for better patient management and monitoring without the need for invasive procedures.

- Geographical Trends: The market exhibits significant geographical disparities, with North America and Europe leading in terms of market size and technological adoption. This dominance is attributed to well-established healthcare systems, high healthcare expenditure, and the presence of key market players in these regions. However, the Asia-Pacific region is expected to witness rapid transplant diagnostics market growth, driven by improving healthcare infrastructure, rising healthcare spending, and increasing awareness of organ donation and transplant procedures in countries like China and India.

- Competitive Landscape: The transplant diagnostics market is highly competitive, with several key players dominating the industry. These companies are actively engaged in developing innovative diagnostic solutions, and forming strategic alliances to enhance their market presence. Competition is fuelled by continuous innovation, with companies investing in research and development to introduce more accurate, efficient, and cost-effective diagnostic tests.

- Challenges and Opportunities: Despite the market's growth, there are several challenges to navigate, including stringent regulatory requirements, ethical concerns related to organ donation and transplantation, and the high cost of diagnostic tests which may limit accessibility in lower-income regions. Additionally, the gap between the number of available organs and the number of patients in need presents a significant challenge to the market's potential.

Global Transplant Diagnostics Market Trends

Technological Advancements

There's a significant shift towards more sophisticated diagnostic solutions, including next-generation sequencing (NGS) and molecular assays, which offer high sensitivity and specificity. These technologies enable more precise matching between donors and recipients, reduce the risk of transplant rejection, and improve patient outcomes.Personalized Medicine and Precision Diagnostics

The market is increasingly embracing personalized medicine approaches, tailoring transplant diagnostics to individual genetic profiles. This trend is driven by the understanding that genetic compatibility plays a crucial role in the success of transplant procedures, thereby reducing the incidence of complications and improving long-term survival rates.Expansion of Applications

Beyond traditional organ transplants, there's a growing application of transplant diagnostics in stem cell therapy, bone marrow transplantation, and other emerging areas. This expansion is facilitated by the broadening capabilities of diagnostic technologies to support a wider range of transplant types.Automation and Integration

Laboratories and diagnostic centers are adopting automated platforms and integrated systems that streamline the diagnostic process, enhance throughput, and reduce the potential for errors. This trend towards automation also addresses the growing transplant diagnostics market demand by improving operational efficiency.Regulatory and Reimbursement Landscape Changes

The market is influenced by evolving regulatory policies and reimbursement scenarios, which can impact the adoption of new diagnostic tests and technologies. Positive regulatory developments and supportive reimbursement policies are critical drivers for the adoption of advanced diagnostic solutions in the transplant field.Growing Focus on Immune System Monitoring

There's an increasing emphasis on monitoring the immune system's response to transplants, aiming to detect early signs of rejection. This involves the use of biomarkers and other diagnostic tools to assess immune function and tailor immunosuppressive therapy accordingly.Rising Demand in Emerging Markets

Emerging economies are witnessing a surge in demand for transplant diagnostics, driven by improving healthcare infrastructure, increased healthcare spending, and growing awareness about organ transplantation. This trend represents a significant growth opportunity for market players.Global Transplant Diagnostics Market Segmentation

Global Transplant Diagnostics Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product and Services

- Reagent and Consumables

- Instruments

- Software and Services

Instruments are the hardware used to carry out diagnostic tests, ranging from simple devices for manual testing to sophisticated automated systems that can handle multiple samples simultaneously. The evolution of this segment towards more integrated and automated solutions reflects the market's demand for higher throughput, reduced errors, and greater efficiency in diagnostics. Instruments that offer faster turnaround times, higher precision, and compatibility with a range of tests are particularly influential in the market, enabling laboratories to scale up their operations to meet increasing transplant diagnostics market demand.

The software and services segment includes the software solutions for data analysis and interpretation, as well as the services related to transplant diagnostics, such as consulting, training, and maintenance services. As transplant diagnostics become more complex, incorporating large datasets and requiring detailed analysis, the role of software in interpreting results swiftly and accurately grows increasingly important. Moreover, services that support the effective use and maintenance of instruments and the continuous education of personnel are vital for ensuring the quality and reliability of diagnostic procedures. This segment's influence on the market is expected to grow as the integration of digital tools and AI into diagnostics deepens, facilitating more sophisticated data analysis and decision-making processes.

Each of these segments contributes uniquely to the transplant diagnostics process, and their development is closely intertwined with the overall transplant diagnostics market growth. Innovations in reagents and consumables, advancements in instrument technology, and the integration of software and comprehensive services are collectively driving the market forward, enhancing the efficiency, accuracy, and accessibility of transplant diagnostic procedures.

Market Breakup by Technology

- Molecular Assay

- PCR Based Molecular Assays Sequence Specific Oligonucleotide PCR Sequence Specific Primer PCR Real-time PCR Other PCR based Molecular Assays.

- Sequencing Based Molecular Assays Sanger Sequencing Next Generation Sequencing Other Sequencing based Molecular Assay

- Non-molecular Assay

Sequencing-based molecular assays segment includes next-generation sequencing (NGS) and Sanger sequencing, among others, offering high-throughput, comprehensive analysis of genetic variations. Sequencing-based assays provide a deeper insight into the genetic compatibility between donors and recipients, including the identification of HLA typing, which is crucial for transplant success. The ability of these assays to deliver detailed genetic information is expected to drive their adoption, particularly in complex cases where a high degree of matching precision is necessary. As sequencing technologies continue to advance and become more cost-effective, their impact on the transplant diagnostics market value is anticipated to grow, fostering more personalized and precise transplant diagnostics.

Non-molecular assays encompass serological and other immunoassay-based techniques used to detect antibodies and antigens without the need for genetic material amplification. While these assays offer valuable information on immune status and compatibility, their use is generally more limited compared to molecular assays due to lower sensitivity and specificity. However, non-molecular assays continue to hold importance in certain contexts and for specific applications where rapid screening is essential, albeit with a gradually diminishing market impact as molecular technologies gain prominence.

During the forecast period, molecular assay technologies, particularly PCR-based and sequencing-based assays, are expected to dominate the transplant diagnostics market share. Their influence will be driven by ongoing advancements in genetic analysis, the growing emphasis on personalized medicine, and the increasing need for high-precision diagnostics. As healthcare providers and patients alike seek more accurate, efficient, and cost-effective diagnostic solutions, the adoption of molecular assays is poised to rise, further propelled by technological innovations and improvements in sequencing speed and costs. This trend underscores the shifting dynamics within the transplant diagnostics market, where molecular technologies play a central role in enabling more successful transplant outcomes and patient care advancements.

Market Breakup by Application

- Diagnostic Applications

- o Pre-transplantation Diagnostics Infectious Disease Testing Histocompatibility Testing Blood Profiling

- Post-transplantation Diagnostics.

- Research Applications

Diagnostic applications are pivotal to the transplant diagnostics market value, encompassing pre-transplantation diagnostics, infectious disease testing, histocompatibility testing, and blood profiling. Pre-transplantation diagnostics are crucial for assessing the suitability of both donors and recipients before the transplant, including determining organ compatibility and the recipient's health status to undergo transplantation. Infectious disease testing is essential to ensure that both the donor and recipient are free from infections that could impact transplant outcomes. Histocompatibility testing, including HLA typing, is vital for matching donors and recipients to minimize the risk of transplant rejection. Blood profiling involves analyzing blood groups and other markers to further ensure compatibility and guide the selection of immunosuppressive regimens. Collectively, these diagnostic applications are foundational to the transplant process, ensuring that transplants are performed safely and with the highest chance of success.

Post-transplantation diagnostics focus on monitoring the recipient after the transplant has occurred. This includes detecting signs of organ rejection, monitoring the organ's function, and identifying any infectious complications that may arise. The importance of post-transplantation diagnostics lies in their ability to provide early detection of issues, allowing for timely interventions that can significantly improve patient outcomes and prolong the life of the transplant.

Research applications in the transplant diagnostics market are centered on advancing the field through the development of new diagnostic tools, techniques, and technologies. This segment is crucial for improving understanding of transplant immunology, developing more precise diagnostics, and ultimately enhancing the success rates of transplant procedures. Research applications drive innovation in the market, with potential impacts ranging from the discovery of novel biomarkers to the development of next-generation sequencing technologies for more accurate compatibility testing.

Looking forward, diagnostic applications are expected to continue influencing the market significantly in the forecast period. As the demand for transplants grows and the complexity of transplant procedures increases, the need for comprehensive diagnostic testing before transplantation will become even more critical. Advancements in diagnostics technology, such as more precise histocompatibility testing and infectious disease screening, are likely to enhance the efficiency and success rates of transplants. This, in turn, will drive demand for diagnostic applications, ensuring their continued impact on the transplant diagnostics market growth and development.

Market Breakup by Transplant Type

- Solid Organ Transplantation

- Stem Cell Transplantation

- Soft Tissue Transplantation

- Bone Marrow Transplantation

Solid organ transplantation encompasses the diagnosis before and after the transplantation of organs such as the liver, kidney, heart, and lungs. This segment is a significant contributor to the transplant diagnostics market due to the high volume of these transplant procedures and the critical need for precise matching and rejection monitoring diagnostics. The advancements in molecular assays and next-generation sequencing (NGS) technologies have greatly enhanced the success rates of solid organ transplants by ensuring better compatibility and reducing the risk of rejection.

Stem cell transplantation, involving the transplantation of hematopoietic stem cells, usually for the treatment of blood disorders and certain types of cancers, also represents a vital segment. The demand for stem cell transplantation diagnostics is driven by the need for high-resolution typing methods to achieve optimal donor-recipient matching and to monitor potential complications, such as graft-versus-host disease (GVHD).

Soft tissue transplantation includes the transplantation of tissues such as skin, corneas, and heart valves. Although this segment involves a wide range of transplant types, the common denominator is the requirement for effective diagnostic tools to assess the viability and compatibility of soft tissues, which is crucial for the success of these procedures.

Bone marrow transplantation is closely related to stem cell transplantation but is specifically focused on diseases affecting the bone marrow. The diagnostics for this segment are centered around ensuring the compatibility of donor and recipient, as well as monitoring the patient's response to the transplant. This segment's growth is propelled by the increasing prevalence of hematological diseases and the continuous improvement in genetic testing technologies.

Each of these segments is expected to influence the global transplant diagnostics market differently in the forecast period. Factors such as the increasing accessibility to advanced diagnostic technologies, the expansion of transplant registries, and the growing awareness of transplantation as a viable treatment option are likely to drive the market forward. Innovations in genomics and personalized medicine are also anticipated to enhance the efficiency and outcomes of transplant diagnostics, further contributing to the market's growth across all segments.

Market Breakup by End User

- Reference Laboratories

- Hospital and Transplant Centers

- Research Laboratories and Academic Institutes

- Others

Reference laboratories play a pivotal role in the transplant diagnostics market share, owing to their specialized capabilities in performing a wide range of complex tests. These laboratories are equipped with advanced diagnostic technologies and staffed by experts in the field, making them critical for the accurate typing, crossmatching, and antibody screening required for transplant compatibility and post-transplant monitoring. Their ability to offer high-throughput and specialized testing services makes them an essential component of the diagnostics chain, contributing significantly to the market's dynamics.

Hospitals and transplant centers are directly involved in the patient care pathway, from pre-transplant evaluation to post-transplant monitoring. This segment's impact on the transplant diagnostics market is substantial, as these institutions are the primary sites where transplants are performed and where immediate diagnostic services are required. The integration of diagnostic services in these settings facilitates timely decision-making, enhancing patient outcomes and operational efficiencies.

Research laboratories and academic institutes contribute to the transplant diagnostics market through their focus on innovation, research, and development of new diagnostic methodologies. This segment is crucial for the advancement of transplant diagnostics, as it drives the discovery and implementation of novel diagnostic markers, techniques, and technologies. Their work not only impacts the current market by improving diagnostic accuracy and patient outcomes but also shapes the future of transplant diagnostics through ongoing research endeavors.

During the forecast period, the hospitals and transplant centers segment is expected to have a significant influence on the transplant diagnostics market value. The increasing number of transplant procedures globally, coupled with the growing emphasis on personalized medicine and patient-centered care, is likely to drive demand for integrated and advanced diagnostic services within these settings. The push towards improving transplant outcomes and reducing rejection rates will further necessitate the adoption of cutting-edge diagnostic solutions in hospitals and transplant centers, making this segment a critical driver of market growth.

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Europe follows closely, with a well-established healthcare system and increasing awareness regarding the benefits of organ transplantation. The region benefits from favorable government policies, advanced healthcare facilities, and significant investment in healthcare research. Europe's strong network of organ donation and transplantation organizations plays a vital role in facilitating organ transplants, which in turn, boosts transplant diagnostics market demand.

Asia Pacific is anticipated to witness rapid transplant diagnostics market growth due to the expanding healthcare infrastructure, rising healthcare expenditure, and growing awareness about organ transplantation. The region's large population base, coupled with increasing incidences of chronic diseases requiring organ transplantation, is expected to fuel the market growth. Furthermore, government initiatives aimed at improving healthcare access and the increasing adoption of advanced diagnostic technologies are likely to propel the market in Asia Pacific.

Latin America and the Middle East and Africa are regions with potential for growth in the transplant diagnostics market. These regions are gradually witnessing improvements in healthcare infrastructure and an increase in the number of organ transplantation procedures. The growing awareness about the benefits of organ transplantation, coupled with government efforts to establish organ donation and transplantation frameworks, are factors expected to influence the market positively. However, these regions face challenges such as limited access to advanced healthcare facilities and a shortage of skilled healthcare professionals, which might affect the market growth rate.

Leading Key Players in the Global Transplant Diagnostics Market

The competitive landscape of the global transplant diagnostics market is characterized by its dynamic and innovative nature, with several key factors influencing the competitive dynamics. This landscape comprises a mix of established players and emerging companies, each contributing to the advancements and technological progress in the field of transplant diagnostics. The competitive environment is shaped by various factors, including technological innovations, regulatory policies, market demand, and strategic initiatives undertaken by companies.- Bio-Rad Laboratories Inc.

- Abbott Laboratories

- Becton, Dickinson and Company

- Biomérieux SA

- CareDx

- F Hoffman-La Roche AG

- Hologic Inc.

- Illumina Inc.

- Qiagen NV

- Thermo Fisher Scientific Inc.

- Immucor, Inc.

- Omixon Ltd.

- GenDx

- BioGenuix

Key Questions Answered in This Report

- How will the market landscape evolve in the forecast period?

- What are the major market trends influencing the market?

- What are the major drivers, opportunities, and restraints in the market?

- Which regional market is poised to lead the market share in the forecast period?

- Which regional market will experience expedited growth during the forecast period?

- Which transplant type is expected to witness maximum market demand?

- What is the breakup of the market based on the end users?

- Which applications are expected to significantly impact the transplant diagnostics market growth?

- What major companies are involved in the market?

- What technological advancements and innovations are influencing the market?

- Which segment has the highest impact on the market size?

- How are partnerships, collaborations, and mergers & acquisitions shaping the market dynamics?

Key Benefits for Stakeholders

- This industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global transplant Diagnostics market from 2018-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global transplant diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global transplant Diagnostics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories Inc.

- Abbott Laboratories

- Becton, Dickinson and Company

- Biomérieux SA

- CareDx

- F Hoffman-La Roche AG

- Hologic Inc.

- Illumina Inc.

- Qiagen NV

- Thermo Fisher Scientific Inc.

- Immucor, Inc.

- Omixon Ltd.

- GenDx

- BioGenuix

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 14.71 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |