Global Osseointegration Implants Market Analysis

- Market Growth and Size: The market for osseointegration implants has expanded considerably, attributed to the rising prevalence of conditions requiring the use of such implants, including dental issues, Orthopaedic ailments, and the increasing number of amputations. The aging global population and the associated rise in these health conditions have further propelled the demand for osseointegration implants.

- Major Market Drivers: The osseointegration implants market demand is significantly influenced by the increasing prevalence of chronic diseases, technological advancements in the field, and the rising demand for cosmetic dentistry. The growing incidence of conditions such as osteoarthritis and periodontal diseases, along with other chronic conditions that impair mobility or oral health, plays a critical role in driving the need for these implants. These health issues necessitate the use of osseointegration implants to restore functionality and improve the quality of life for affected individuals. Further fueling the market growth are technological advancements in implant materials and design. Innovations, including the development of more biocompatible materials and the incorporation of digital imaging and 3D printing technologies, have markedly improved the success rates of implant procedures.

- Key Market Trends: The global osseointegration implants market outlook is rapidly evolving, marked by significant advancements such as customization through 3D printing, the adoption of robot-assisted surgeries, and a focus on biocompatible materials. The integration of 3D printing technology into the manufacturing process of implants is revolutionizing patient care by allowing for the customization of implants to match individual patient anatomy. This personalization not only enhances the effectiveness of the implants but also significantly improves patient comfort and satisfaction with the outcomes. Concurrently, the utilization of robotic systems in implant surgeries is gaining traction. These robotic systems offer unparalleled precision in implant placement, contributing to more predictable outcomes, reduced risk of complications, and notably shorter recovery times for patients.

- Geographical Trends: In the global landscape, North America stands out as the dominant player in the market, a position it owes to its advanced healthcare infrastructure, high healthcare expenditure, and a robust focus on research and development. Europe is experiencing significant osseointegration implants market growth. This growth is supported by rising healthcare investments and a demographic trend toward an aging population, which naturally increases the demand for healthcare services, including implant procedures. Meanwhile, the Asia-Pacific region is poised for rapid growth, driven by a confluence of factors including the improvement of healthcare facilities, an increase in disposable income among the general population, and a rising awareness about the benefits and availability of implant procedures. This trio of factors suggests a bright future for the adoption and development of osseointegration implants in the region, marking it as an area of high potential in the global market.

- Competitive Landscape: The osseointegration implants market is competitive, with several key players dominating the market. These include major multinational corporations that offer a wide range of implant products, alongside specialized companies focusing on specific types of implants. Companies are actively engaging in mergers, acquisitions, and collaborations to expand their product portfolios and geographical presence. Innovation and research are pivotal, with companies investing in developing new materials and technologies to improve implant success rates and patient outcomes.

- Challenges and Opportunities: The market for osseointegration implants, while burgeoning, faces several significant challenges that could impede its growth. Among these, the high costs associated with implant procedures stand out as a substantial barrier for many potential patients, making accessibility an issue. Furthermore, the risk of post-surgery complications adds a layer of concern for both patients and healthcare providers, potentially affecting the decision to opt for such procedures. Despite these challenges, the market is also presented with considerable opportunities. The increasing incidence of lifestyle-related diseases and conditions, such as diabetes and obesity, which are known to contribute significantly to bone and joint issues, fuelling the osseointegration implants market demand. These factors, combined with the rising awareness and acceptance of such medical interventions, create a promising outlook for the expansion and deeper penetration of the osseointegration implants market globally.

Global Osseointegration Implants Market Trends

Customization and Personalization through 3D Printing

The market has witnessed an increased use of 3D printing technology to customize and personalize osseointegration implants. This technology allows for implants to be tailored to the specific anatomical requirements of patients, improving the fit, comfort, and overall effectiveness of the implants. Personalization not only enhances patient outcomes but also reduces the risk of complications, leading to quicker recovery times and better integration of the implant with the patient's bone.Advances in Material Science

The osseointegration implants market growth is driven by the rising focus on the development and use of advanced materials that are more biocompatible and conducive to osseointegration. Materials such as titanium and certain ceramics that offer enhanced durability and a lower risk of rejection by the body are becoming more prevalent. Additionally, the surface of these materials is often treated or coated to improve osseointegration and minimize infection risks.Integration of Robotic Surgery

Robotic-assisted surgeries are becoming more common in the placement of osseointegration implants. These technologies offer greater precision and control during the surgical procedure, potentially reducing the surgery time and improving outcomes. The accuracy of robotic systems also minimizes the impact on surrounding tissues, leading to less post-operative discomfort and faster recovery.Rising Demand for Minimally Invasive Procedures

One of the most significant osseointegration implants market trends is characterised by growing preference for minimally invasive surgical techniques in the placement of osseointegration implants. These procedures, often enabled by advanced imaging and surgical techniques, result in less trauma, reduced pain, and quicker recovery times for patients. Minimally invasive approaches are particularly appealing in dental and Orthopaedic implant surgeries, where they can significantly improve the patient experience.Expansion of Application Areas

While dental implants have traditionally dominated the osseointegration implants market, there is a noticeable expansion into other application areas. Orthopaedic implants, such as those used for limb amputations or to replace joints, are witnessing increased adoption. The osseointegration implants market demand is driven by the aging global population and the rising prevalence of conditions such as osteoarthritis, which necessitate the use of such implants.Increased Focus on Regulatory Compliance

With the growing complexity of osseointegration implants and their applications, there is an increased focus on regulatory compliance and standards. Manufacturers and healthcare providers are diligently working to meet stringent regulatory requirements to ensure patient safety and efficacy of the implants. This trend underscores the importance of quality and safety in the development and use of osseointegration implants.Growing Popularity in Emerging Markets

Emerging markets are becoming increasingly important to the osseointegration implants market. Economic development, improving healthcare infrastructure, and rising healthcare spending in these regions are making advanced implant solutions more accessible to a larger population. This presents a significant growth opportunity for manufacturers and healthcare providers.Global Osseointegration Implants Market Segmentation

Global Osseointegration Implants Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Dental Implants

- Knee Implants

- Hip Implants

- Spinal Implants

- Others

Knee implants are crucial for addressing knee joint issues, including osteoarthritis and injuries, particularly among the elderly population. These implants play a significant role in restoring mobility and improving the quality of life for patients with knee problems. The segment's growth is driven by the aging global population, the rising prevalence of obesity, and advancements in implant design and materials that improve the longevity and success rates of knee replacement surgeries.

Hip implants are designed to replicate the hip joint's function in patients with hip degeneration or injuries. The osseointegration implants market demand is growing, reflecting the increasing incidence of hip fractures and osteoarthritis. Improvements in surgical techniques and implant materials have enhanced the success of hip replacement surgeries, contributing to this segment's growth. The focus on minimally invasive surgical approaches is also expected to positively impact the market.

Spinal implants address various spinal disorders and injuries, including degenerative disc disease, spinal stenosis, and vertebral fractures. This segment is expanding due to technological innovations in implant design, such as motion-preserving devices and biocompatible materials, which offer improved outcomes for spinal surgery patients. The rising global incidence of spinal conditions, coupled with an increasing preference for less invasive surgical interventions, is driving the demand for spinal implants.

The global osseointegration implants market size is expected to grow, owing to the advent of several other implant types, including auditory implants, craniofacial implants, and limb prostheses. These implants cater to specific patient needs, offering solutions for hearing loss, facial reconstruction, and limb replacement. The segment benefits from continuous research and development efforts aimed at enhancing implant functionality, biocompatibility, and patient comfort.

Market Breakup by Material Type

- Titanium Implants

- Zirconia Implants

- Stainless Steel Implants

- Ceramic Implants

- Others

Zirconia, a type of ceramic, is gaining popularity as a material for osseointegration implants, especially in the dental segment. It is chosen for its aesthetic qualities, as it more closely matches the color of natural teeth compared to titanium. Zirconia is also biocompatible and has been shown to resist plaque accumulation, making it an attractive option for patients and clinicians alike. Its use is expected to grow, particularly in areas where cosmetic outcomes are a significant consideration.

Stainless steel, once a common material for implants, has seen reduced usage in favor of materials that offer better biocompatibility and corrosion resistance. However, stainless steel implants are still used in specific applications where high strength and cost-effectiveness are paramount. Its impact on the osseointegration implants market share has diminished over time, with advancements in alternative materials that provide enhanced patient outcomes.

Beyond zirconia, other ceramics are used in osseointegration implants for their biocompatibility, wear resistance, and aesthetic properties. Ceramics are particularly valued in dental and some Orthopaedic applications for their ability to mimic the appearance of natural tissues and their low allergic potential. The development of new ceramic materials and composites is likely to expand their application and influence within the market.

Market Breakup by Application

- Dental Applications

- Orthopedic Applications

- Others

Orthopaedic applications of osseointegration implants encompass the replacement and support of bones and joints, including hips, knees, and spinal vertebrae. This segment is propelled by the increasing incidence of osteoarthritis, osteoporosis, and injuries resulting from sports and accidents, particularly in the aging population. Orthopaedic implants are critical for restoring mobility and improving the quality of life for patients with musculoskeletal issues. Innovations in implant materials and design, such as the development of more durable and biocompatible implants, along with advancements in surgical techniques, are driving osseointegration implants market growth.

Market Breakup by End User

- Hospitals

- Ambulatory Centers

- Dental and Orthopaedic Clinics

- Others

Ambulatory centers, also known as outpatient surgery centers, have been gaining traction in the osseointegration implants market outlook, owing to their cost-effectiveness and efficiency. These centers offer a convenient option for patients undergoing less complex procedures, such as certain dental implant placements, that do not require overnight hospital stays. The growth of ambulatory centers is fueled by advancements in surgical techniques and anesthetic methods, which allow for quicker recovery times and minimal post-operative discomfort. This segment is expected to grow as patient preference shifts towards less invasive procedures and faster recovery times.

Dental clinics are a crucial end-user segment for osseointegration implants, particularly due to the high volume of dental implant procedures performed worldwide. These clinics specialize in oral health and cosmetic dentistry, providing tailored solutions for tooth loss that leverage osseointegration technology. Orthopaedic clinics also play a significant role, especially for patients requiring limb prostheses or minor joint replacements. These specialized clinics offer personalized care and follow-up, important for the long-term success of implant procedures.

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Europe's osseointegration implants market is driven by its well-established healthcare infrastructure, high standards of patient care, and strong regulatory frameworks ensuring product quality and safety. Countries like Germany, the UK, and France are at the forefront of adopting osseointegration technology, supported by government healthcare systems and private insurance. The region's focus on improving healthcare outcomes and the increasing prevalence of conditions requiring implants contribute to its significant market position. Europe is expected to maintain steady growth, fueled by ongoing investments in healthcare technology and an increasing focus on cosmetic dentistry.

The Asia-Pacific region is experiencing rapid osseointegration implants market growth, attributed to improving healthcare infrastructure, rising disposable incomes, and growing awareness of osseointegration procedures. Countries like China, India, Japan, and South Korea are leading this growth, with an expanding middle class and increasing investments in healthcare. The region's large population base and rising prevalence of lifestyle-related diseases offer a vast potential market for osseointegration implants. APAC is anticipated to witness the fastest growth rate, driven by economic development, and increasing access to healthcare services.

Latin America's market for osseointegration implants is evolving, with countries such as Brazil, Mexico, and Argentina showing potential for growth. The region is characterized by increasing healthcare expenditures and a growing focus on improving healthcare infrastructure. However, challenges such as economic instability and disparities in healthcare access across the region impact the market's development. Despite these challenges, Latin America is expected to see growth in the osseointegration implants market, driven by gradual improvements in healthcare systems and a rising awareness of dental and orthopedic implants.

Middle East and Africa (MEA) region, while currently a smaller market, shows promise for future growth. The osseointegration implants market expansion is hindered by various challenges, including limited healthcare infrastructure and access. However, countries in the Gulf Cooperation Council (GCC), such as Saudi Arabia and the United Arab Emirates, are investing heavily in healthcare, including advanced dental and orthopedic treatments. The region's growth potential is supported by an increasing focus on healthcare improvements and the rising demand for medical tourism.

Leading Key Players in the Global Osseointegration Implants Market

The competitive landscape of the market is dynamic and features a mix of established multinational companies, mid-sized firms, and emerging players, each contributing to the market's growth and innovation. This landscape is shaped by various factors, including technological advancements, regulatory environments, strategic partnerships, and market demand dynamics. Understanding these factors is crucial for stakeholders to navigate the market effectively.The key features of the osseointegration implants market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

- Straumann Holding AG

- DENTSPLY Sirona Inc.

- Zimmer Biomet Holdings, Inc.

- Danaher Corporation

- Osstem Implant Co., Ltd.

- Stryker Corporation

- Medtronic plc

- Bicon, LLC

- Nobel Biocare Services AG

- BioHorizons IPH, Inc.

- Sweden & Martina S.p.A.

- Institut Straumann AG

- Kyocera Medical Corporation

- Smith & Nephew plc

- Integrum SE

Key Questions Answered in This Report

- How will the market landscape evolve in the forecast period?

- What are the major market trends influencing the market?

- What are the major drivers, opportunities, and restraints in the market?

- What will be the effect of each driver, challenge, and opportunity on the market?

- Which regional market is poised to lead the market share in the forecast period?

- Which regional market will experience expedited growth during the forecast period?

- Which type of osseointegration implants are expected to dominate the market?

- What is the breakup of the market based on the end users?

- Which applications are expected to significantly impact the osseointegration implants market growth?

- What technological advancements and innovations are influencing the market?

- Which segment has the highest impact on the market size?

- How are partnerships, collaborations, and mergers & acquisitions shaping the market dynamics?

Key Benefits for Stakeholders

- This industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global osseointegration implants market from 2018-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global osseointegration implants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Straumann Holding AG

- DENTSPLY Sirona Inc.

- Zimmer Biomet Holdings, Inc.

- Danaher Corporation

- Osstem Implant Co., Ltd.

- Stryker Corporation

- Medtronic plc

- Bicon, LLC

- Nobel Biocare Services AG

- BioHorizons IPH, Inc.

- Sweden & Martina S.p.A.

- Institut Straumann AG

- Kyocera Medical Corporation

- Smith & Nephew plc

- Integrum SE

Table Information

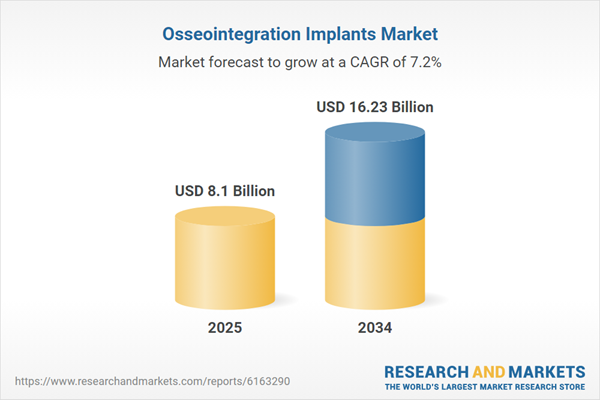

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.1 Billion |

| Forecasted Market Value ( USD | $ 16.23 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |