Global Refurbished Medical Equipment Market Overview

A refurbished medical device is reconstructed to fulfil safety and performance standards equivalent to its original state without altering the device's intended usage. Refurbished equipment includes replacing worn-out parts, repairing mechanical and electrical components, reassembly, cosmetic touches, software upgrades, quality control, testing, and labelling changes, in contrast to used equipment, which is typically just cleaned up and sold as is. Medical devices are used for monitoring, therapy, palliation, diagnosis, prevention, and rehabilitation. They are an essential component of health care systems, that assists medical professionals in carrying out clinical or surgical operations include imaging equipment, in vitro diagnostic kits, implants, mobility aids, inhalers, and other devices.Global Refurbished Medical Equipment Market Growth Drivers

Increasing Demand for Healthcare to Affect the Market Landscape Significantly

As medical expenses rise on a global level, healthcare providers are compelled to look for economical alternatives. Hospitals and clinics prefer to use refurbished equipment because it is more affordable than new, especially in situations where resources are limited. Infrastructure for healthcare is expanding due to growing populations and rising healthcare needs in both developed and developing nations. Healthcare facilities can increase the range of services they offer without incurring the high expenditures of purchasing new equipment by using used equipment.Ease in Government Regulations to Meet Rising Global Refurbished Medical Equipment Market Demand

To increase the accessibility and affordability of healthcare services, several governments support the use of reconditioned medical equipment in their healthcare programs. Subsidies, tax breaks, or laws that encourage the purchase and use of these equipment are common examples of such initiatives. Governments fund public health initiatives that need medical equipment for diagnosis, treatment, and screening. Refurbished equipment makes it possible to expand these programs more affordably while also improving underprivileged communities access to healthcare.For instance, in June 2023, the Government of India relaxed the regulations to allow import of refurbished devices to ensure access to affordable health care. As a result, Indian third parties were allowed to import nearly 50 types of pre-owned medical equipment, including MRI, CT, PET-CT, X-ray, ultrasound, mammography, laparoscopy systems, molecular infectious diagnostics systems, and robotic assisted surgical instruments.

Global Refurbished Medical Equipment Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:Increasing Number of Diagnostic Centres and Hospitals

The global refurbished medical equipment market value is increasing with increasing establishment of diagnostic centres and hospitals. Refurbished equipment provides cost-effective solutions for such facilities which is helpful for expanding capabilities as well as improving healthcare access.Technological Advancements

The global market is expanding with technological advancements, enabling healthcare providers to access advanced equipment affordably. This satisfies growing healthcare demands while advancing ecological initiatives.Cost-Effectiveness

Medical professionals on a tight budget find refurbished equipment appealing since it is typically less expensive than new. This financial benefit helps facilities around the world with limited resources, enabling improved patient care and operational effectiveness.Growing Preference for Eco-Friendly Products

As the preference for eco-friendly products are increasing, the market is also increasing as refurbished equipment extends device lifecycle which further reduces the waste while also supporting sustainability goals in healthcare facilities.Global Refurbished Medical Equipment Market Segmentation

Refurbished Medical Equipment Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Medical Imaging Equipment

- X-Ray Machines

- Ultrasound Systems

- MRI Machines

- CT Scanners

- Nuclear Imaging Systems

- Other Medical Imaging Equipment

- Operating Room and Surgical Equipment

- Anaesthesia Machines

- Operating Room Tables and Lights

- Surgical Displays

- Electrosurgical Units

- Other Operating Room and Surgical Equipment

- Patient Monitors

- Multi-Parameter Monitors

- Electrocardiography Devices

- Pulse Oximeters

- Mobile Cardiac Telemetry Devices

- Non-Invasive Blood Pressure Monitors

- Foetal Monitors

- Other Patient Monitors

- Cardiology Equipment

- Heart-Lung Machines

- Defibrillators

- Other Cardiology Equipment

- Urology Equipment

- Dialysis Machines

- Lithotripsy Devices

- Neurology Equipment

- EEG Machines

- EMG Machines

- Intensive Care Equipment

- Ventilators

- Infant Incubators and Warmers

- Endoscopy Equipment

- Others

Market Breakup by Application

- Diagnostic

- Therapeutics

- Others

Market Breakup by End User

- Hospitals

- Diagnostic Centers

- Clinics

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Refurbished Medical Equipment Market Share

Hospitals Segment Based on End-Users Holds a Significant Market Share

Hospitals, diagnostic centers, and clinics make up the three end-user segments of the global market for refurbished medical equipment. The major users are hospitals because they require a large range of medical equipment to treat patients. Diagnostic centers are also poised to hold a notable market share as such equipment is frequently including ultrasound systems, CT scanners, and MRI machines. These facilities enable them to provide cutting-edge imaging services at more affordable prices. Refurbished medical equipment is also used by clinics. But compared to hospitals, they usually use a lesser selection of medical equipment.Market Share Based on Product Type

The global refurbished medical equipment market based on product type is broadly segmented into medical imaging equipment, operating room and surgical equipment, patient monitors, cardiology equipment, urology equipment, neurology equipment and intensive care equipment among others. Out of these, medical imaging equipment, which is segmented X-ray machines, ultrasound systems, MRI machines, CT scanners, nuclear imaging systems and others hold a significant share of the market. This is because of high emphasis on the prevention, diagnosis, or treatment of diseases in healthcare. X-ray machines are used to generate images of tissues and structures inside the body. The images help healthcare providers diagnose a wide range of conditions and plan treatments. An ultrasound machine can be used for pediatric investigations, small tissue examinations, gynecological, obstetrical, urological, and cerebrovascular examinations, as well as abdominal and heart examinations.Global Refurbished Medical Equipment Market Analysis by Region

Based on region, the market report covers North America, Europe, Asia Pacific, Latin America along with the Middle East and Africa.North America holds the largest refurbished medical equipment market share due to its advanced healthcare infrastructure and strict regulations. Refurbished medical equipment is in high demand due to sustainability and cost-effectiveness measures. The North American and European markets for refurbished medical equipment are expanding due to government measures and financial restrictions. Out of all refurbished equipment, approximately 46% of devices are sold in the United States of America, while 24% are marketed in the European Union.

The Asia Pacific market is experiencing rapid growth due to rising healthcare investments, private sector growth, and public awareness of affordable medical alternatives. Latin America's market is expanding due to initiatives to make healthcare more accessible, while the Middle East and Africa's market is expanding due to investments in healthcare infrastructure and the need for affordable medical equipment.

Leading Players in the Global Refurbished Medical Equipment Market

The key features of the market report include patent analysis, as well as strategic initiatives including recent partnerships and collaborations by the leading players. The major companies in the market are as follows:GE Healthcare

This American multinational medical technology company having its headquarters in Chicago is a well-known company, offering a wide variety of medical monitoring and imaging devices. GE Healthcare offers over 10,000 GoldSeal reconditioned parts for GE Diagnostic Imaging equipment, catering to the growing demand for high-quality used parts in healthcare systems.Agito Medical A/S

AGITO Medical was established in 2004 in Aalborg, Denmark, with the goal of offering affordable imaging equipment and replacement parts to clients in the healthcare sector.Avante Health Solutions

Avante Health Solutions was established in 1985 and has its headquarters in Louisville, Colorado, USA. The business specializes in offering a broad range of medical supplies and services on a global scale. The company offers a broad variety of devices to healthcare professionals globally.Block Imaging International Inc.

The US company Block Imaging was founded in 1997, and has its headquarters in Holt, Michigan. The company sells and refurbishes equipment used for medical imaging. Many imaging modalities, including MRI machines, CT scanners, ultrasound systems, and X-ray equipment, are refurbished by the company. They supply refurbished equipment to medical facilities all around the world, with an emphasis on offering dependable and affordable substitutes for the acquisition of new equipment.Other players in the market include Everx Pvt. Ltd, Siemens Healthcare Systems, Koninklijke Philips NV, Hilditch Group, Soma Technology, Radio Oncology Systems Inc., Integrity Medical Systems Inc., Cambridge Scientific Products, and Master Medical Equipment.

Kindly note that this only represents a partial list of companies and the complete list has been in the report.

Key Questions Answered in the Global Refurbished Medical Equipment Market Report

- What was the global refurbished medical equipment market value in 2024?

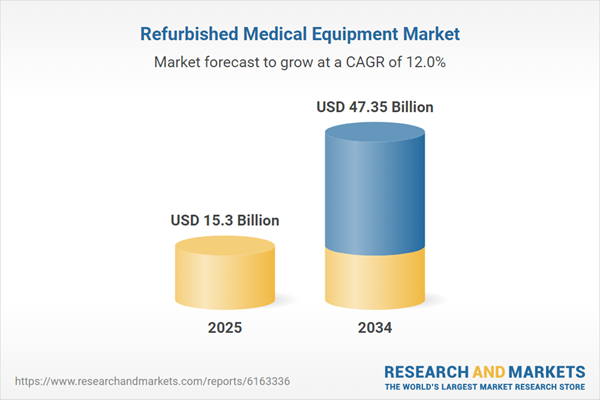

- What is the global refurbished medical equipment market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on applications?

- What is the market breakup based on product type?

- Who are the major end users in the market?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the major trends influencing the market?

- What are the major drivers, opportunities, and restraints in the market?

- Which regional market is expected to dominate the market share in the forecast period?

- Which country is likely to experience elevated growth during the forecast period?

- Which end user will contribute significantly to the market growth?

- Who are the key players involved in the global refurbished medical equipment market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Agito Medical AS

- Avante Health Solutions

- Block Imaging International Inc.

- Everx Pvt. Ltd

- GE Healthcare

- Integrity Medical Systems Inc.

- Koninklijke Philips NV

- Radio Oncology Systems Inc.

- Siemens Healthcare Systems

- Soma Technology

- Hilditch Group

- Master Medical Equipment

- Cambridge Scientific Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 15.3 Billion |

| Forecasted Market Value ( USD | $ 47.35 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |