Continued product diversification and alignment with health-conscious trends position the sweet biscuits industry for sustainable expansion, as manufacturers increasingly invest in developing low-sugar, high-fiber, gluten-free, and fortified variants to cater to shifting consumer lifestyles. These innovations, paired with growing demand for on-the-go and functional snacks, allow brands to reach broader demographics, including health-aware millennials, aging populations, and wellness-driven consumers. Furthermore, the incorporation of plant-based ingredients, natural sweeteners, and digestive health benefits into sweet biscuit formulations is reinforcing consumer loyalty while opening up new revenue streams across both mature and emerging markets."

The wafer biscuits segment generated USD 16.3 billion in 2024 and is expected to reach USD 24.5 billion by 2034, reflecting a CAGR of 4.2%. These light and crispy products are increasingly popular thanks to their layered texture and wide range of flavor options - such as fruit creams, chocolate, and vanilla. Manufacturers are enhancing appeal by adding functional ingredients like antioxidants, probiotics, fiber, and superfood extracts. As consumers seek healthier snacking options, these fortified wafers offer both indulgence and nutritional benefit.

The flexible packaging formats segment captured 39.7% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. These packaging formats deliver user-friendly advantages - lightweight, easy to open, resealable, and freshness-preserving, making them ideal for modern, fast-paced lifestyles. Traditional box packaging remains relevant but is being redesigned with eye-catching graphics and sustainable materials to attract attention on shelves and support eco-friendly branding.

North America Sweet Biscuits Market held 34.3% share in 2024 and is estimated to grow at a CAGR of 4% through 2034, which is underpinned by strong consumer purchasing power, health-driven innovation, and demand for premium and niche products. Meanwhile, Asia-Pacific region is experiencing rapid expansion thanks to accelerating urbanization, evolving eating habits, and heightened snack consumption in populous markets like India and China.

Leading players shaping the competitive sweet biscuits market include Ferrero Group, Mondelez International, Grupo Bimbo, Mars, Incorporation, and Nestlé S.A. These companies continue to set the pace in innovation, branding, and distribution across global markets. Top firms in the sweets category are pursuing innovation by launching premium, health-forward products - such as low-sugar, gluten-free, and functional biscuits. They are investing in R&D to develop unique flavor profiles and incorporate nourishing ingredients like fiber, probiotics, and superfoods. Expanding their footprint in emerging markets through localized production and distribution provides growth opportunities. Partnerships with retail chains and food service platforms amplify visibility and reach. Brands are also enhancing packaging, transitioning to flexible, resealable, and sustainable formats. Marketing tactics emphasize ingredient transparency, clean-label credentials, and lifestyle alignment to build customer loyalty.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Sweet Biscuits market report include:- Mondelez International, Inc.

- Nestle S.A.

- Ferrero Group

- Mars, Incorporated

- Pladis (United Biscuits)

- Britannia Industries Limited

- Parle Products Pvt. Ltd.

- ITC Limited

- Grupo Bimbo

- Lotus Bakeries

- UNIBIC Foods India Pvt. Ltd.

- Anmol Industries Ltd.

- Bisk Farm (SAJ Food Products)

- Burton's Biscuit Company

- Walkers Shortbread Ltd.

- Kellogg Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

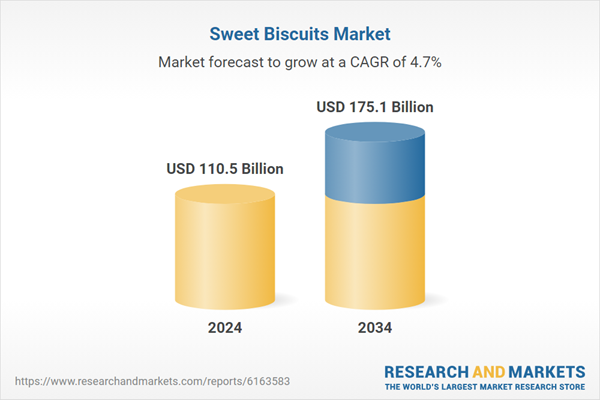

| Estimated Market Value ( USD | $ 110.5 Billion |

| Forecasted Market Value ( USD | $ 175.1 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |