Additionally, these industries face constant pressure to maintain pest-free environments to protect their reputation, ensure customer satisfaction, and avoid legal liabilities. For instance, even minor infestations in a restaurant or hotel can result in service shutdowns, regulatory penalties, or permanent damage to brand credibility. As a result, commercial businesses increasingly rely on comprehensive pest management contracts that include routine inspections, preventive treatments, and emergency response services. The shift toward proactive pest control strategies is growing, with businesses integrating pest monitoring technologies and data-driven systems to identify risks early and reduce long-term costs.

In 2024, the chemical segment led the market, generating USD 8.3 billion. Chemical solutions remain a staple across residential, commercial, and agricultural applications due to their rapid and broad-spectrum effectiveness. Products such as insecticides, rodenticides, acaricides, and fungicides continue to be favored for their efficiency. Recent innovations aim to combine high performance with environmentally friendly formulations to meet increasing consumer demand and regulatory requirements.

The commercial segment accounted for a 39.8% share in 2024, valued at USD 9.6 billion. This sector’s growth is supported by heightened emphasis on cleanliness and safety across diverse industries, including retail, healthcare, hospitality, and office environments. Pest issues in commercial spaces impact operations, public perception, and health, prompting businesses to invest heavily in advanced pest control solutions to meet strict regulatory standards.

U.S. Pest Control Product and Services Market generated USD 3.4 billion in 2024. The market in the U.S. is mature, supported by strong regulations, public awareness of health concerns, and widespread adoption of IPM practices. There is a growing trend towards sustainable and chemical-free pest control options driven by consumer preferences and stricter chemical regulations.

Leading companies in the Global Pest Control Product and Services Market include Rentokil, Fox Pest Control, Terminix Global Holdings, Abell Pest Control, Ecolab, MGK, Rollins Inc., Arrow Exterminators, Anticimex, Orkin LLC, Greenix Pest Control, Massey Services, Aptive Environmental, Home Paramount Pest Control, and PestCo. To strengthen their market presence, companies in the pest control sector focus on key strategies, including investing in research and development to create environmentally sustainable and effective products. Many firms are embracing technological innovations such as remote pest monitoring, automated detection systems, and digital platforms for better customer engagement and service delivery. Building strong partnerships with commercial clients in healthcare, hospitality, and food industries allows for tailored pest management solutions that meet industry-specific compliance requirements. Expanding service networks and improving after-sales support help retain customers and enhance brand loyalty.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Pest Control Product and Services market report include:- Abell Pest Control

- Anticimex

- Aptive Environmental

- Arrow Exterminators

- Ecolab

- Fox Pest Control

- Greenix Pest Control

- Home Paramount Pest Control

- Massey Services

- MGK

- Orkin LLC

- PestCo

- Rentokil

- Rollins Inc

- Terminix Global Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | July 2025 |

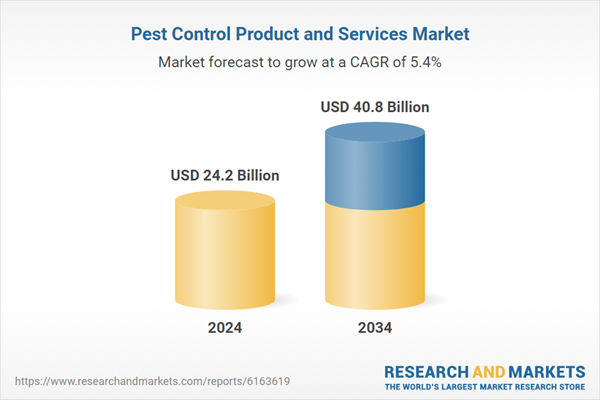

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 24.2 Billion |

| Forecasted Market Value ( USD | $ 40.8 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |