These innovations are rapidly shaping new urban and upscale lodging concepts, redefining the way hospitality spaces are designed, built, and experienced. Developers are increasingly incorporating smart infrastructure, modular construction techniques, and sustainable building materials to create adaptive, tech-forward environments that meet evolving guest expectations. From energy-efficient systems and contactless services to AI-enabled guest personalization and digital concierge platforms, modern lodging developments are focusing on operational agility and elevated comfort. Upscale hotels in metropolitan areas also embracing design flexibility, allowing for multifunctional spaces that cater to both leisure and business travelers.

The structural materials segment held a 35% share in 2024 and is projected to grow at a CAGR of 8% through 2034. Materials such as composite frameworks, structural steel, engineered wood, and reinforced concrete form the backbone of both new development and property redevelopment projects. Their ability to support vertical scalability, regional seismic codes, and structural longevity makes them essential across upscale and mid-tier property classes.

The Full-service hotels segment held the largest share in 2024, accounting for 35% share. These properties are central to the market due to their extensive facilities - ranging from spas and conference centers to multiple dining options - which require more frequent updates to retain market appeal and align with evolving hospitality trends. Full-service lodging investments are particularly concentrated in premium travel corridors and urban renewal areas.

United States Lodging Construction and Renovation Market held an 80.5% share and generated USD 135.8 billion in 2024. Its leadership stems from an advanced tourism infrastructure, growing real estate investment in hospitality, and the proactive deployment of technology-driven development methods. With widespread integration of sustainable construction and franchise expansion, the U.S. remains a key hub for next-generation hospitality projects. Major U.S. hotel operators continue to spearhead projects that combine modular buildouts, ESG criteria, and adaptive design strategies.

Notable companies active in the Lodging Construction and Renovation Market include InterContinental Hotels (IHG), Barton Malow, AccorHotels, Hilton Worldwide, Gilbane Building, Clark Construction, Balfour Beatty US, Hyatt Hotels, DPR Construction, and Hensel Phelps Construction. To enhance their market position, leading players in lodging construction and renovation are investing heavily in modular construction technologies, reducing project timelines and environmental impact. Companies are also aligning their development strategies with green building standards to meet regulatory compliance and secure LEED certifications. Strategic partnerships with technology vendors help integrate smart room controls, energy-saving systems, and digital twins into new and renovated properties.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Lodging Construction and Renovation market report include:- Clark Construction Group

- Skanska

- Turner Construction

- Whiting-Turner Contracting

- DPR Construction

- Gensler

- HKS

- Perkins & Will

- WATG

- Hensel Phelps Construction

- Mortenson Construction

- Suffolk Construction

- Lendlease

- Webcor Builders

- AccorHotels

- Hilton Worldwide

- Hilton Worldwide Holdings

- Host Hotels & Resorts

- Hyatt Hotels Corporation

- InterContinental Hotels Group

- Marriott International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

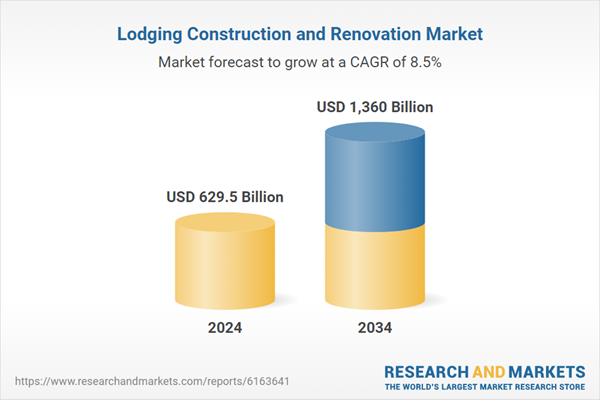

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 629.5 Billion |

| Forecasted Market Value ( USD | $ 1360 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |