At the same time, rapid progress in battery chemistry, particularly in lithium-ion and ultracapacitor technologies, is delivering greater energy efficiency and faster charge cycles. These benefits are allowing manufacturers to cut downtime and increase throughput, while still adhering to environmental guidelines. Government initiatives offering financial incentives and subsidies for electric fleet conversions are reinforcing the adoption of clean-energy technologies across industries. Traction battery systems are now integral to next-gen industrial ecosystems aiming to reduce carbon output while maximizing uptime and operational resilience.

The lithium-ion segment held a 60.4% share and is projected to grow at a CAGR of 15% through 2034. This growth is being propelled by a growing preference for battery-powered equipment in warehousing, construction, and production, as organizations seek long-term efficiency gains and compliance with emissions regulations. Lithium-ion units are favored for their superior energy density, longer life span, and minimal maintenance compared to other battery types. Their compatibility with fast-charging technologies and ability to support high-duty applications make them a prime choice for continuous operation.

The rail segment was valued at USD 586.4 million in 2024. National and regional authorities are increasing investments in hybrid and electric rail infrastructure as part of decarbonization strategies. Battery-powered metro and light rail vehicles are becoming more prominent as urban areas prioritize cleaner, more efficient public transport networks. Traction batteries in rail not only support propulsion but also power auxiliary systems, enabling quieter, emission-free transit options in urban corridors.

North America Industrial Traction Battery Market is expected to register a CAGR of 10% through 2034. The rise of smart manufacturing, e-commerce, and industrial automation is pushing demand for electric industrial vehicles and supporting infrastructure. Advancements in battery technologies, particularly those that reduce charging time and extend service intervals, are supporting this momentum. Businesses across the U.S. and Canada are increasingly switching to low-emission equipment to meet both regulatory requirements and internal sustainability goals. Industrial hubs are integrating battery-powered fleets to align with green mandates and minimize energy-related costs over time.

Top players driving innovation in this Industrial Traction Battery Market include ENERSYS, BYD, Flux Power, Sunlight Group, and EXIDE INDUSTRIES, all of which are actively shaping the global competitive landscape. Leading companies in the industrial traction battery market are prioritizing long-term strategic investments in advanced battery technologies, particularly lithium-ion and solid-state chemistries. These players are expanding their global manufacturing footprints to address regional demand and reduce supply chain constraints. Product diversification is central to their approach, with a strong focus on modular battery systems compatible with a wide range of electric industrial vehicles. Companies are also collaborating with OEMs and logistics operators to co-develop integrated battery solutions that enhance performance and reliability. Several market leaders are enhancing their digital offerings by embedding telematics and battery management systems for real-time monitoring, predictive analytics, and performance optimization. Additionally, they are aligning with sustainability targets by promoting circular economy models and second-life battery programs.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Industrial Traction Battery market report include:- Amara Raja Batteries

- Aliant Battery

- BYD

- Camel Group

- East Penn

- EXIDE INDUSTRIES

- ecovolta

- ENERSYS

- Farasis Energy

- Flux Power

- Guoxuan High-tech Power Energy

- HOPPECKE Batteries

- Hitachi Energy

- Mutlu Corporation

- MIDAC

- Sunlight Group

- Sunwoda Electronic

- Toshiba Corporation

Table Information

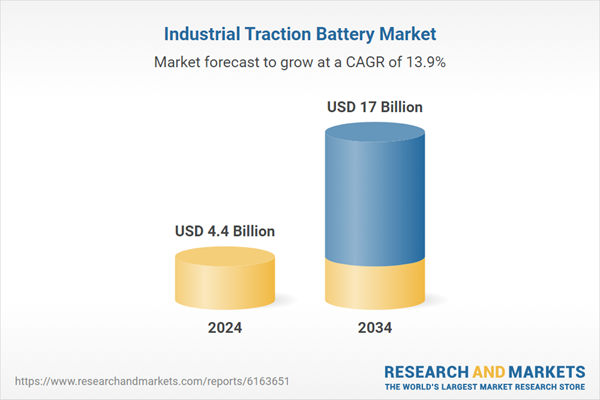

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 17 Billion |

| Compound Annual Growth Rate | 13.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |