Governments worldwide are encouraging modern aquaculture practices by investing in infrastructure and regulating sustainability guidelines. Technological integration, including automation, IoT, and smart analytics, is transforming the way fish farms are managed, allowing for real-time observation of environmental parameters and fish conditions. These innovations not only increase efficiency but also reduce manual labor costs. As recirculating aquaculture systems and offshore fish farming practices continue to expand, the need for specialized and advanced equipment is set to grow, creating new business opportunities for manufacturers and suppliers globally.

The cage systems and pens segment generated USD 769.5 million in 2024. These systems dominate the market due to their scalability, flexibility, cost-effectiveness, and ease of installation. Their adaptability to various aquatic environments - ranging from freshwater to saltwater - makes them a preferred choice among fish farmers. Cage systems and pens support a wide variety of species, making them highly versatile for different aquaculture operations.

The marine or seawater segment held the largest share in 2024, accounting for 58.3% share and generating USD 1.6 billion. This segment continues to lead due to strategic geographic utilization and the farming of premium species that thrive in marine environments. Seawater farming helps reduce reliance on land and freshwater sources and can be paired with responsible environmental practices. Governments are also providing strong backing through supportive regulations and infrastructure development, which enhances the viability of offshore aquaculture operations and promotes the use of marine-based farming systems.

U.S. Fish Farming Equipment Market held a 59.2% share in 2024. The U.S. market is transitioning toward sustainable fish farming approaches and witnessing growing consumer demand for seafood. Technological advancements in this region are leading to the adoption of smart monitoring equipment and automated systems, enhancing overall farm productivity and environmental compliance.

Leading companies in the Global Fish Farming Equipment Market include CPI Equipment, Frea Aquaculture Solutions, PentairAES, eWater Aquaculture Equipment Technology Limited, Merck & Co. Inc., Grundfos Holding A/S, Morenot, ABB, LINN Gerätebau, Asakua, Innovasea, Pioneer Group, INVE Aquaculture, AKVA Group, and Xylem. To maintain their competitive edge, companies in the fish farming equipment market are prioritizing technological innovation and sustainability. Many leading firms like Innovasea, ABB, and AKVA Group are investing in R&D to enhance the efficiency and automation capabilities of their systems. There is a growing emphasis on integrating AI, real-time monitoring tools, and IoT sensors to streamline feeding, water quality control, and fish health tracking. Businesses are expanding their reach into emerging markets by forming strategic partnerships with regional aquaculture companies and governments. Product customization based on species type and water conditions is also helping brands capture niche market segments.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Fish Farming Equipment market report include:- ABB

- AKVA Group

- Asakua

- CPI Equipment

- eWater Aquaculture Equipment Technology Limited

- Frea Aquaculture Solutions

- Grundfos Holding A/S

- Innovasea

- INVE Aquaculture

- LINN Gerätebau

- Merck & Co. Inc.

- Morenot

- PentairAES

- Pioneer Group

- Xylem

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | July 2025 |

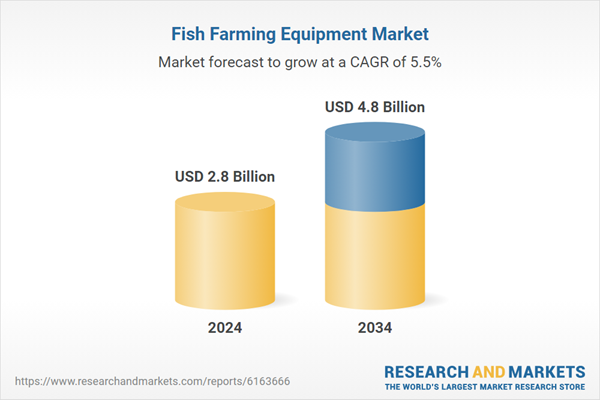

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 4.8 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |