The technological evolution of EDM systems continues to elevate demand across industries. The newest EDM machines are designed to offer higher precision, reduced electrode wear, and superior cutting speeds - key features that manufacturers seek for cost efficiency and productivity enhancement. The use of connected technologies such as AI-driven control systems and real-time monitoring features is becoming more common, supporting faster decision-making and reducing downtime.

The Die sink EDM systems segment held the largest market share in 2024, generating USD 1.5 billion and projected to grow at a CAGR of 5.2% through 2034. This segment continues to lead due to its ability to work with extremely hard and complex materials while maintaining top-level precision. Die sinker EDM machines are especially effective for detailed mold cavities and intricate part geometries that are difficult to process using mechanical tools. Their unique capability to reduce material waste while improving component quality makes them increasingly favored in applications where precision is critical and surface finish cannot be compromised. Furthermore, their eco-friendliness and reduced tooling costs contribute to broader sustainability initiatives within manufacturing operations.

The automotive segment held a 32% share in 2024 and is forecasted to grow at a CAGR of 5.6% during 2025-2034. EDM systems play a pivotal role in enabling the design and production of intricate automotive components, especially as the industry shifts toward electrification and autonomous technologies. The push toward lightweight construction using aluminum, composites, and other hard-to-machine materials continues to reinforce EDM’s appeal. Automakers are increasingly adopting EDM to manufacture high-precision gears, powertrain components, and mold tools, helping to accelerate production timelines and maintain tight tolerances. The industry's focus on process optimization and time-to-market reductions is likely to keep EDM usage on an upward trend.

United States Electrical Discharge Machine Market held a 77% share and generated USD 760 million in 2024, supported by continued expansion in aerospace, automotive, and defense manufacturing. High demand for complex part fabrication and precision machining solutions has contributed to EDM’s wide adoption. Additionally, the U.S. is benefiting from the rollout of Industry 4.0 strategies, with EDM machines integrated into smart factories and digitally controlled environments. The presence of top industry players and increasing R&D initiatives adds further momentum. Government policies supporting domestic production and advanced manufacturing are also enhancing the sector’s long-term outlook.

Leading companies operating in the Global Electrical Discharge Machine Market include Sparkonix, Fanuc, Makino, ONA EDM, Sodick, Mitsubishi Electric, AccuteX, Agie, CHMER, Seibu, Zimmer & Kreim, FEOB, Oscar E.D.M. Company, Excetek, and GF Machining Solutions. To strengthen their market presence, major EDM manufacturers are investing in product innovation with a focus on AI-driven automation, improved energy efficiency, and real-time performance analytics. Firms are forming alliances with precision engineering and aerospace companies to co-develop specialized EDM systems that address emerging application needs. Strategic expansion into developing markets is also being pursued to tap new demand from the automotive and medical device industries.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Electrical Discharge Machine market report include:- AccuteX

- Agie

- CHMER

- Excetek

- Zimmer & Kreim

- FEOB

- Fanuc

- GF Machining Solutions

- Makino

- Mitsubishi Electric

- ONA EDM

- Oscar E.D.M. Company

- Seibu

- Sodick

- Sparkonix

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | July 2025 |

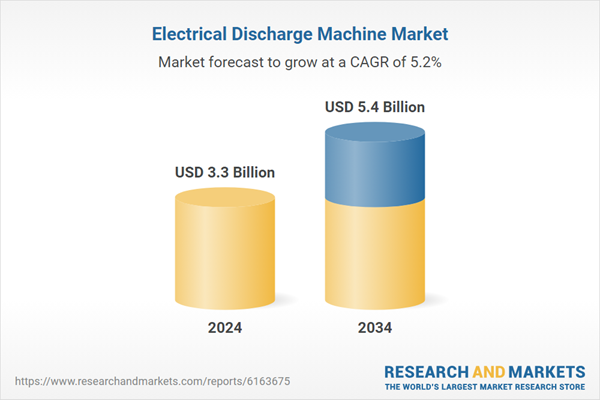

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |