The expansion of elderly care reflects a broader trend toward enhancing quality of life through mobility aids, monitoring systems, and wellness support. These advancements are not just about addressing physical limitations but also about promoting independence and dignity for seniors. As technology improves, there is a growing focus on integrating smart features into devices - such as fall detection, GPS tracking, and health monitoring - that provide real-time data to caregivers and healthcare professionals. This helps in proactive care and reduces emergency situations. Wellness support also extends to personalized health management, nutrition, and mental well-being, emphasizing a holistic approach to senior care. Ultimately, these innovations empower elderly individuals to lead more active, connected, and fulfilling lives while easing the burden on families and care providers.

The mobility aids segment generated USD 14.3 billion in 2024. This dominance comes from the increasing reliance of aging populations on devices like mobility scooters, wheelchairs, walking aids, and stair lifts to maintain independence and safety. These tools not only support movement but also reduce the risk of injuries, especially falls, thereby playing a critical role in daily life. These devices are evolving rapidly, with demand rising for smarter, more ergonomic, and lightweight options. Mobility solutions remain universally relevant across a wide range of age groups and health conditions, making them central to elderly care ecosystems. Their adoption is closely tied to innovation and reimbursement policies that drive availability and affordability.

The offline retail segment accounted for a 52.5% share in 2024 and is expected to grow at a CAGR of 4.6% from 2025 through 2034. Brick-and-mortar outlets continue to serve as the most trusted points of sale for elderly care products, especially where professional advice is important. Pharmacies, medical supply stores, and specialty retailers provide essential personal interaction, tailored guidance, and immediate access - factors highly valued in the healthcare sector. In-person experiences remain essential for items like assistive devices, mobility tools, and nutritional products, reinforcing the strength of offline distribution in this market.

United States Elderly Care Products Market generated USD 5.7 billion in 2024. The aging population in the country is driving higher demand for health-focused products, mobility aids, and advanced in-home care technologies. With a growing emphasis on safety, well-being, and convenience, the U.S. elderly demographic is rapidly adopting innovations in elder care. Strong consumer interest in smart technology also opens avenues for connected monitoring tools and advanced personal care solutions that meet changing needs and lifestyles.

Key players operating in the Elderly Care Products Market include Medtronic, Kimberly-Clark Corporation, Pride Mobility, Baxter International, Invacare Corporation, Drive DeVilbiss Healthcare, Abbott, Golden Technologies, OMRON Corp, Sunrise Medical, Koninklijke Philips NV, Medline Industries LP, Sonova, Bruno Independent Living Aids, and ResMed Inc. To strengthen their presence in the global elderly care products market, companies are adopting strategies focused on technological advancement, strategic partnerships, and market expansion. Many are investing in R&D to create smart, lightweight, and ergonomic mobility aids and home monitoring tools. Partnerships with healthcare providers and insurance companies are also helping companies integrate products into larger care programs. Some are expanding their offline retail footprint, while others are enhancing online accessibility to reach broader demographics. Additionally, leading players are prioritizing global footprint expansion by targeting emerging markets where aging populations are rising rapidly, ensuring scalable and long-term market growth.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Elderly Care Products market report include:- Abbott

- Baxter international

- Bruno Independent Living Aids

- Drive DeVilbiss healthcare

- Golden technologies

- Invacare Corporation

- Kimberly-Clark Corporation

- Koninklijke Philips NV

- Medline Industries LP

- Medtronic

- OMRON Corp

- Pride mobility

- ResMed Inc

- Sonova

- Sunrise Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | July 2025 |

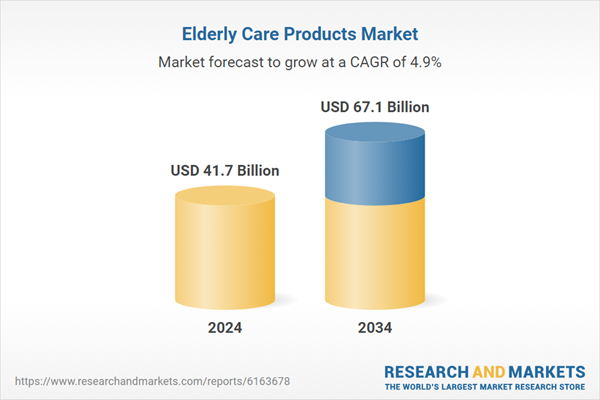

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 41.7 Billion |

| Forecasted Market Value ( USD | $ 67.1 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |