These trends are fueling the development of next-generation struts using advanced composites and embedded systems to support higher performance, weight reduction, and operational efficiency in cleaner aviation ecosystems. As the aerospace industry pivots toward more sustainable and energy-efficient platforms, there's a growing demand for structural components that offer both mechanical strength and reduced environmental impact. Advanced struts are now being engineered with smart materials that not only lower overall aircraft weight but also integrate real-time health monitoring systems to detect stress, fatigue, and structural integrity issues during flight. These intelligent systems help reduce unplanned maintenance, extend component life, and improve flight safety. Additionally, the use of lightweight composites enhances fuel efficiency and enables compliance with increasingly strict global emission regulations.

The private aviation segment is projected to reach USD 941 million by 2034. Rising demand for business jets and increased ownership by affluent individuals are playing a key role in this growth. These aircraft require structural components that not only meet high standards of performance and reliability but also align with aesthetic and comfort expectations of luxury aviation. Private aircraft struts are designed for quieter operations, smoother landings, and low-maintenance functionality. This segment is increasingly leaning toward bespoke, lightweight, and compact designs that provide a balance between form and function. To remain competitive, suppliers must focus on delivering highly customizable struts and offer robust aftermarket support. Establishing strategic collaborations with manufacturers of private aircraft and enhancing service capabilities can help suppliers build long-term customer relationships and establish themselves in this high-value niche.

The front wheel strut segment held a 21.5% share in 2024, driven by the expanding use of regional and single-aisle aircraft. Nose gear struts are a vital part of aircraft design and are being reengineered to support lightweight construction and enhanced shock absorption. As narrow-body fleets continue to dominate short-haul and mid-range routes, demand for high-performance front wheel struts has increased significantly. In addition, the emergence of electric taxiing systems is transforming nose gear design by introducing the need for embedded electronic controls and energy-efficient load handling. These developments are pushing manufacturers to engineer struts that are not only more compact but also electronically responsive. By aligning their R&D efforts with the requirements of next-generation narrow-body aircraft, suppliers can capture a greater share of the commercial aviation upgrade cycle and address the growing operational efficiency needs of airlines.

United States Aircraft Strut Market was valued at USD 1.5 billion in 2024. North America continues to lead in terms of both military and commercial aviation demand, with the U.S. at the forefront due to its substantial investments in defense and fleet modernization. The country is actively expanding its aircraft inventory, prompting increased demand for dependable and long-lasting strut systems. The market outlook is further supported by the country's emphasis on advanced aerospace technologies and its large base of OEMs and Tier-1 suppliers. Strut manufacturers looking to strengthen their footprint in the U.S. should prioritize alignment with government procurement efforts and next-generation aircraft platforms.

Major players in the Global Aircraft Strut Industry include Triumph, Liebherr Aerospace, CIRCOR International, Collins Aerospace, and SAFRAN. These companies are playing a vital role in shaping innovation, engineering excellence, and structural integrity within the aviation sector. To expand their market presence, key players in the aircraft strut industry are implementing a variety of strategic initiatives. A major focus is being placed on R&D investments to develop lighter, stronger, and smarter strut systems that cater to the changing needs of both commercial and defense aviation. Companies are also entering into long-term contracts with aircraft OEMs to ensure a consistent demand pipeline. Strengthening global supply chains and setting up regional service centers is helping them deliver timely aftermarket support.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Aircraft Strut market report include:- Collins Aerospace

- SAFRAN

- Spirit AeroSystems

- Liebherr Aerospace

- North America

- AvtechTyee

- CIRCOR International

- Orscheln Products

- Triumph

- Europe

- Epsilon Composite

- Oleo International

- Timetooth Technologies

- Asia-Pacific

- Sumitomo Corporation

- Latin America

- Embraer

- Heroux-Devtek

- Albany International

- Hartwell Corporation

- Park Aerospace

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

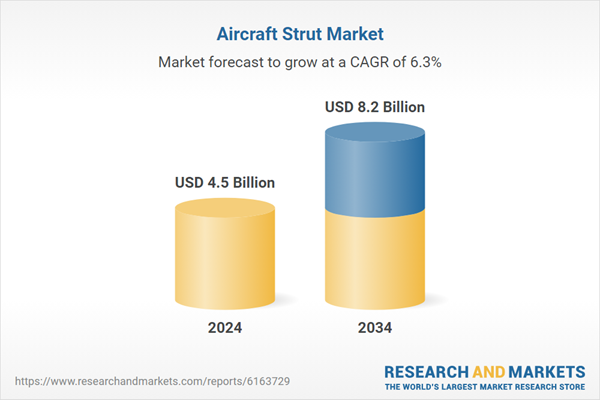

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 8.2 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |