These features offer convenience, allowing users to optimize energy consumption and boost the market outlook. Tighter emissions regulations are pushing the industry toward low-NOx and ultra-low-emission units, prompting innovation across product lines. As regulations evolve, manufacturers are investing in cleaner and more efficient designs. Industry consolidation is also accelerating as major HVAC companies pursue mergers and acquisitions to broaden their offerings and gain access to innovative technologies and new customer bases.

The gas-fueled residential boilers segment held a 69% share in 2024 and is anticipated to grow at 8% CAGR through 2034. This category remains dominant because of favorable fuel pricing, widespread infrastructure, and relatively cleaner combustion compared to other fossil fuels. The shift toward high-efficiency condensing gas boilers is especially strong in colder regions, where heating needs are more intense. These boilers are often equipped with advanced features like modulating burners, adaptive controls, and built-in Wi-Fi for remote access. Improved sealed combustion technology is also helping address challenges related to indoor air quality and space limitations in compact housing.

The condensing boilers segment held a 99% share in 2024 and is expected to reach USD 6 billion by 2034. These systems are popular because they utilize heat from exhaust gases, which significantly improves energy use and reduces fuel costs. Demand for compact wall-mounted condensing units continues to rise, particularly in retrofits and smaller homes where floor space is constrained. More stringent energy codes and financial incentives from local programs are also driving adoption of these high-efficiency systems across the region.

United States Residential Boiler Market held an 85.7% share and generated USD 2.3 billion in 2024. Market expansion in the country is being driven by greater public awareness around energy efficiency and evolving building codes. A large portion of demand is replacement-oriented, targeting outdated systems in older homes. Updates in electrification mandates are shifting interest toward hybrid and electric-ready systems. Space-saving combi boilers are gaining popularity in high-density residential areas where mechanical space is limited, further supporting growth.

Leading companies in the North America Residential Boiler Market include WM Technologies, Viessmann, Lochinvar, NTI Boilers, Carrier, Bradford White Corporation, Navien, Rinnai America, ECR International, Burnham Holdings, Ariston Holding, LAARS Heating Systems, PB Heat, Bosch Thermotechnology, U.S. Boiler Company, Lennox International, ACV, New Yorker Boiler, A. O. Smith, Energy Kinetics, Daikin Industries, and BDR Thermea Group. To maintain competitiveness and expand market share, companies are prioritizing innovation in high-efficiency and low-emission boiler technologies. Many are enhancing connectivity features such as smart diagnostics, app-based controls, and integration with smart home systems to attract tech-savvy consumers. Strategic mergers and acquisitions are being pursued to diversify product lines and enter new market segments. Firms are also investing in R&D to comply with stricter environmental regulations and evolving efficiency standards.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this North America Residential Boiler market report include:- A. O. Smith

- ACV

- Ariston Holding

- BDR Thermea Group

- Bosch Thermotechnology

- Bradford White Corporation

- Burnham Holdings

- Carrier

- Daikin Industries

- ECR International

- Energy Kinetics

- LAARS Heating Systems

- Lennox International

- Lochinvar

- Navien

- New Yorker Boiler

- NTI Boilers

- PB Heat

- Rinnai America

- U.S. Boiler Company

- Viessmann

- WM Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | July 2025 |

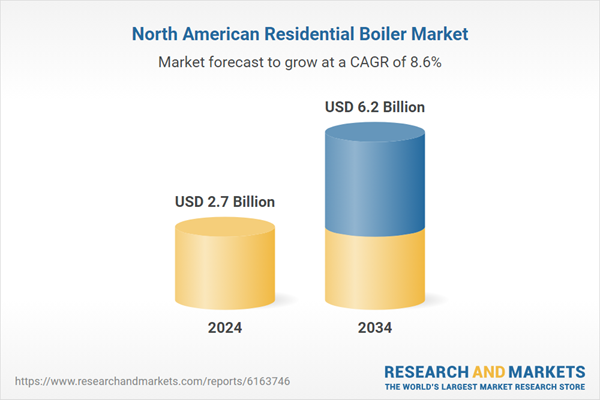

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 6.2 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 23 |