Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The shift towards high-performance lubricants, especially synthetics and semi-synthetics, is gaining traction due to their extended drain intervals, better fuel efficiency, and superior engine protection. Moreover, stringent emission norms and fuel economy standards are pushing automakers and lubricant manufacturers to innovate in formulation technologies that reduce friction and environmental impact. The market is also witnessing growing penetration of electric and hybrid vehicles, prompting lubricant companies to diversify their offerings with specialized e-fluids for electric drivetrains, thermal management, and brake systems. While EVs reduce traditional engine oil demand, they open new avenues in transmission fluids and thermal greases. Another trend is the increasing digitalization of supply chains and retail channels, with e-commerce and quick-lube service networks making lubricants more accessible to consumers and fleet operators.

Key Market Drivers

Increasing Average Vehicle Age and Expanding Vehicle Parc

One of the most influential drivers of the U.S. automotive lubricants market is the steadily increasing average age of vehicles on the road. The U.S. Department of Transportation, show that the average age of light vehicles reached 12.6 years in 2024 - up from 12.5 in 2023 - and climbed further to 12.8 years in 2025, with nearly 38-40% of the fleet aged between 6-14 years. This trend is primarily fueled by improvements in vehicle quality, consumers' inclination to retain their cars for longer periods, and the rising cost of new vehicles, which is delaying vehicle replacement cycles.As older vehicles require more frequent servicing and maintenance, including regular oil changes, filter replacements, and gear or transmission fluid top-ups, the aftermarket demand for automotive lubricants sees a direct and sustained boost. Moreover, the U.S. vehicle parc (the total number of vehicles in use) continues to grow steadily, especially in suburban and rural regions where vehicle ownership remains essential.

With the aging fleet comes an increased emphasis on maintenance to preserve performance and reduce operating costs, which in turn sustains long-term lubricant consumption. Furthermore, independent garages, quick-lube centers, and authorized service stations are witnessing heightened service frequency, directly benefiting lubricant manufacturers and distributors. This aging vehicle phenomenon, combined with consumer awareness of preventive maintenance, ensures a resilient replacement market that will continue to drive lubricant volumes even as the automotive landscape evolves.

Key Market Challenges

High Production Costs & Pricing Pressure

One of the foremost challenges is the elevated cost of producing advanced lubricants, particularly synthetic and bio-based oils. According to the U.S. Energy Information Administration (EIA), base oil prices surged by 18% year-on-year in January 2024, significantly straining producers’ margins. Synthetic base stocks and advanced additive packages cost substantially more than conventional oils - on average, synthetic engine oil costs 2-4 times more per liter than mineral oil, which typically ranges around $1.80 compared to $5.80 for uniform synthetic types.This cost disparity influences purchasing decisions; particularly among cost-sensitive small to medium-sized enterprises (SMEs) and older vehicle owners, the premium on synthetic lubricants can deter uptake - even when long-term savings are evident. Additionally, fluctuating crude oil and raw material prices add volatility to production costs and complicate pricing strategies, making it hard for manufacturers to ensure competitive yet profitable pricing. Overcoming this requires supply chain efficiency, technological innovation, and effective consumer education about total-cost-of-ownership benefits.

Key Market Trends

Proliferation of Low Viscosity Synthetic and Semi Synthetic Oils

The market is experiencing a clear shift toward low-viscosity synthetic and semi-synthetic engine oils - such as 0W 20 and 5W 30 - driven by automakers seeking compliance with stringent fuel economy and emission standards. In North America, use of these advanced formulations is rising as they reduce friction, improve cold-start performance, and extend drain intervals, propelled largely by the automotive segment embracing synthetics for both traditional and EV drivetrains. Modern internal combustion engine (ICE) vehicles increasingly rely on synthetic lubricants for engine protection, fuel efficiency, and emissions reduction. This trend toward premiumization is strengthening industry profitability, encouraging R&D of tailored low-viscosity blends that balance performance and regulatory compliance.Key Market Players

- ExxonMobil Corporation

- Valvoline Inc.

- Pennzoil-Quaker State Company dba SOPUS Products

- Castrol Limited

- Chevron U.S.A. Inc.

- Calumet Branded Products, LLC

- AMSOIL INC.

- Lucas Oil Products, Inc.

- Motul S.A.

- Red Line Synthetic Oil Corporation

Report Scope:

In this report, the United States Automotive Lubricants market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Automotive Lubricants Market, By Vehicle Type:

- Passenger Car

- Two-Wheeler

- Light Commercial Vehicle (LCV)

- Medium & Heavy Commercial Vehicle (M&HCV)

- Off the Road Vehicle (OTR)

United States Automotive Lubricants Market, By Lubricant Type:

- Engine Oil

- Grease

- Gear Oil

- Transmission Fluids

- Others

United States Automotive Lubricants Market, By Demand Category:

- OEM

- Replacement

United States Automotive Lubricants Market, By Region:

- Southeast

- Midwest

- West

- Northeast

- Southwest

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Automotive Lubricants market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- ExxonMobil Corporation

- Valvoline Inc.

- Pennzoil-Quaker State Company dba SOPUS Products

- Castrol Limited

- Chevron U.S.A. Inc.

- Calumet Branded Products, LLC

- AMSOIL INC.

- Lucas Oil Products, Inc.

- Motul S.A.

- Red Line Synthetic Oil Corporation

Table Information

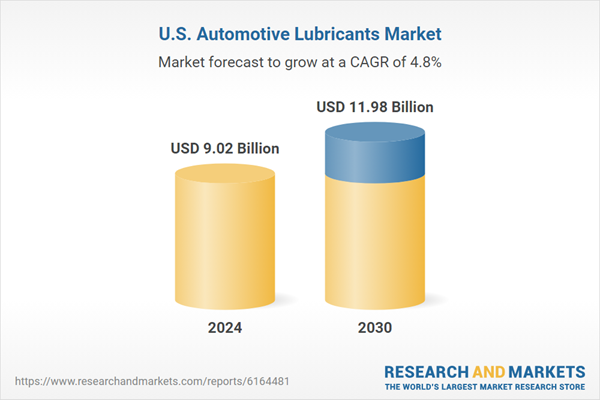

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.02 Billion |

| Forecasted Market Value ( USD | $ 11.98 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |