Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand for Processed and Convenience Foods

One of the most prominent drivers in the global food colors market is the continued rise in demand for processed and convenience foods. As lifestyles become increasingly hectic, especially in urban environments, consumers seek ready-to-eat and packaged products that not only taste good but also look visually appealing. Food colors play a critical role in maintaining the visual consistency and appeal of such products. They are used extensively in bakery products, confectionery, beverages, dairy items, and processed snacks to enhance consumer interest and influence purchasing decisions.The rise in global food retail and quick-service restaurants (QSRs) is another element supporting this trend. Colorful foods and drinks are more appealing to consumers and often symbolize freshness or flavor, even when synthetic or natural colorants are used purely for aesthetic purposes. Governments, too, recognize this pattern. According to the United States Department of Agriculture (USDA), processed foods account for approximately 60% of the total caloric intake among U.S. adults as of 2023, a number that continues to grow annually. This rising consumption fuels the use of food colors across mass-produced food products.

Additionally, India’s Ministry of Food Processing Industries reported a 7% year-on-year growth in the packaged food segment in 2022-2023, attributing part of the increase to rising urban populations and changing dietary habits. This expansion directly correlates with higher demand for food additives, especially colorants, which improve the sensory profile of processed foods.

Key Market Challenges

Higher Cost and Lower Stability of Natural Colorants

Despite their health benefits and regulatory preference, natural food colorants come with significant drawbacks that hinder their widespread adoption. Among the primary challenges are their higher cost and relatively lower stability when exposed to environmental factors such as heat, pH changes, and light.Unlike synthetic dyes, which offer bright, consistent colors and long shelf lives, natural alternatives like anthocyanins, betalains, and chlorophyllins are more sensitive. For instance, beetroot extract may lose its red hue at high temperatures, while turmeric may degrade under UV exposure. These limitations often make natural dyes unsuitable for certain categories like baked goods, acidic beverages, or shelf-stable snacks.

Additionally, the sourcing and extraction processes for natural colors are more complex and expensive. Plant-based pigments may require larger land areas, longer growth cycles, and careful processing to maintain purity, increasing production costs. This is particularly challenging for small to mid-sized manufacturers with limited R&D or budgetary capacity.

Key Market Trends

Growing Consumer Demand for Clean Label and Transparent Products

Consumers are increasingly conscious of the ingredients in their food. The demand for clean-label products - those made with recognizable, minimal, and natural ingredients - is no longer a niche but a mainstream expectation. Food colorants, particularly synthetic ones, have come under scrutiny as consumers associate them with health risks, especially in children.As a result, many global food companies are reformulating their products to eliminate artificial dyes in favor of natural alternatives. Clean-label formulations are not only perceived as safer but also as more premium, allowing brands to charge a price premium and foster brand loyalty. Major supermarket chains in the EU and North America have already mandated the removal of certain artificial colors from private-label products. Government initiatives are helping to reinforce this shift. For example, the UK Food Standards Agency (FSA) reported in a 2023 consumer behavior study that over 52% of UK consumers check product labels for artificial additives, a significant rise from 39% in 2019. This trend reflects rising consumer engagement and awareness around food ingredients, prompting manufacturers to prioritize transparency.

To address this demand, companies like Kellogg’s and General Mills have begun using colors derived from paprika, spirulina, and carrots in cereals and snacks. These changes are prominently displayed on packaging to appeal to clean-label-seeking consumers. This shift toward clean-label products represents a lasting trend, driven by both informed consumer demand and evolving regulatory expectations around food transparency.

Key Market Players

- Aromatagroup SR

- Archer Daniels Midland Company

- Givaudan (Naturex S.A.)

- Chr Hasen A/S

- Ddw The Color House

- Doehler Group SE

- International Flavors & Fragrances Inc.

- Kalsec Inc.

- Koninklijke Dsm N.V.

- Sensient Technologies Corporation

Report Scope:

In this report, the Global Food Colors Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Food Colors Market, By Type:

- Natural Colors (Carmine, Caramel, Anthocyanins, Carotenoids, Chlorophyll, Annatto and Others)

- Synthetic Colors (Blue, Yellow, Green, Red and Others)

- Nature Identical Colors

Food Colors Market, By Form:

- Liquid

- Gel

- Powder

Food Colors Market, By Solubility:

- Dyes

- Lakes

Food Colors Market, By Application:

- Food (Processed Food, Meat, Poultry & Seafood, Bakery & Confectionary Type, Dairy Type, Oil & Fats and Others)

- Beverages (Juice & Juice Concentrates, Carbonated Soft Drinks, Functional Drinks, and Alcoholic Drinks)

Food Colors Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Food Colors Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Aromatagroup SR

- Archer Daniels Midland Company

- Givaudan (Naturex S.A.)

- Chr Hasen A/S

- Ddw The Color House

- Doehler Group SE

- International Flavors & Fragrances Inc.

- Kalsec Inc.

- Koninklijke Dsm N.V.

- Sensient Technologies Corporation

Table Information

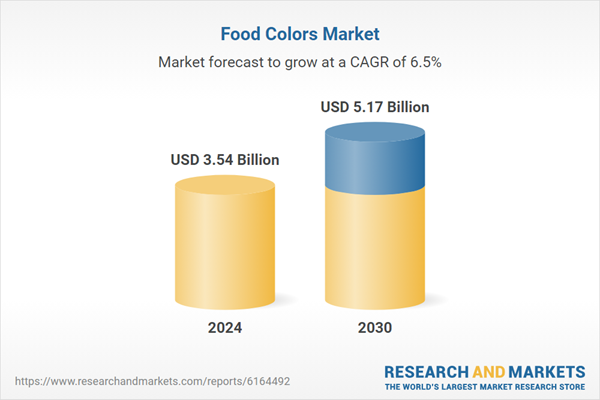

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.54 Billion |

| Forecasted Market Value ( USD | $ 5.17 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |