Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers

Growing Popularity of E-Sports and Virtual Racing Leagues

The rapid rise of e-sports has transformed competitive gaming into a mainstream entertainment avenue, and virtual racing leagues are becoming a central part of this ecosystem. Racing simulators offer an authentic, competitive environment where players can participate in global tournaments without physical track limitations. These platforms provide realistic driving physics, detailed track replications, and professional-grade setups that closely mimic real racing conditions. Such capabilities attract not only gaming enthusiasts but also aspiring drivers who use simulators as a stepping stone into motorsports.Brands and sponsors are heavily investing in virtual racing events, increasing both visibility and prize pools, which further fuels participation. The live streaming of these competitions through platforms like Twitch and YouTube expands audience engagement, creating a vibrant online community. For instance, in 2025, the global esports audience is expected to reach over 640 million people, comprising 318 million dedicated fans and 322 million casual viewer. With constant upgrades in simulation realism, audience interactivity, and tournament infrastructure, e-sports racing is transitioning from niche to mainstream.

Key Market Challenges

High Initial Investment for Advanced Setups

While racing simulators can be more affordable than on-track racing in the long term, the upfront cost for high-quality setups remains a significant challenge. Professional-grade simulators equipped with direct-drive steering systems, hydraulic pedals, motion rigs, and multi-screen or VR displays can cost thousands of dollars. For competitive players or professional teams, investing in such equipment may be necessary to achieve realistic performance feedback, but the price point can deter newcomers. Even mid-range systems require substantial expenditure compared to other gaming peripherals, making them less accessible to casual users.Key Market Trends

Integration of Virtual Reality and Augmented Reality

Virtual reality (VR) and augmented reality (AR) technologies are transforming the racing simulator experience by delivering unparalleled immersion and interactivity. VR headsets with high refresh rates and wide fields of view allow drivers to perceive depth, distance, and spatial awareness much like in real racing scenarios. AR can overlay live performance metrics, track data, and racing lines directly onto the driver’s field of vision without breaking immersion.This combination enhances both training efficiency and entertainment value. Motion tracking in VR further enables natural head movements, allowing drivers to look into corners, check mirrors, and assess surroundings intuitively. Developers are optimizing simulation software for VR, reducing latency and improving graphical fidelity to prevent motion sickness. AR integration is being explored for real-time coaching, enabling instructors to provide visual guidance during simulator sessions.

Key Market Players

- CXC Simulations

- Trak Racer

- Next Level Racing

- D-Box Technologies, Inc.

- Vi-Grade GmbH

- Cruden B.V.

- AB Dynamics Plc (Ansible Motion Ltd)

- Cranfield Simulation

- Simxperience

- Simworx Pty Ltd

Report Scope:

In this report, the global Racing Simulator Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Racing Simulator Market, By Component:

- Hardware

- Software

Racing Simulator Market, By End User:

- Racing Teams

- Training Centers

- Gaming & Motorsport Community

- Sports Car Manufacturer

Racing Simulator Market, By Simulator Type:

- Compact Simulator

- Mid-level Simulator

- Full-scale Simulator

Racing Simulator Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- France

- U.K.

- Spain

- Italy

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Australia

- Thailand

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Racing Simulator Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- CXC Simulations

- Trak Racer

- Next Level Racing

- D-Box Technologies, Inc.

- Vi-Grade GmbH

- Cruden B.V.

- AB Dynamics Plc (Ansible Motion Ltd)

- Cranfield Simulation

- Simxperience

- Simworx Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

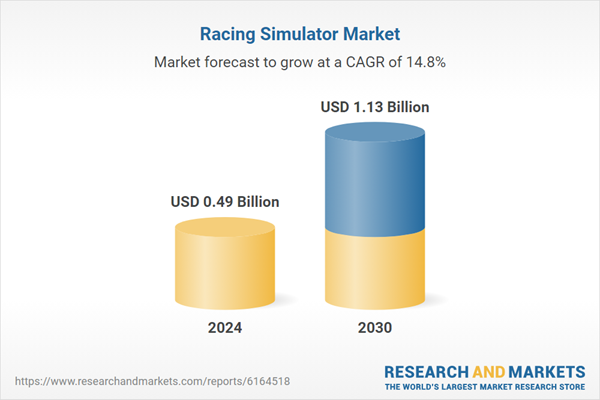

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.49 Billion |

| Forecasted Market Value ( USD | $ 1.13 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |