Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological advancements in food processing have further accelerated the adoption of pea protein. Enhanced extraction and isolation techniques have improved the taste, solubility, and texture of pea protein, allowing manufacturers to incorporate it into a wider range of food products without compromising on sensory quality. This has enabled the development of more innovative plant-based formulations in bakery items, snacks, confectionery, and ready-to-drink beverages. Major food and beverage companies are increasingly investing in R&D to launch new pea protein-based offerings, which is further supporting market expansion.

Key Market Drivers

Rising Demand for Plant-Based & Flexible Diets

The global shift toward plant-based and flexitarian diets continues to gain momentum, driven by growing awareness around health, sustainability, and ethical concerns. A 2024 global food trends report revealed that nearly 42% of consumers worldwide have reduced their meat intake over the past year, with many opting for plant-based alternatives at least once a week. This shift is not limited to vegans or vegetarians - flexitarians, who consciously reduce animal product consumption, now make up a large and influential segment of the global population fueling this protein transformation.Consumers are increasingly associating plant-based diets with a reduced risk of chronic illnesses such as heart disease, obesity, and type 2 diabetes. According to a recent health survey, around 68% of millennials and Gen Z respondents stated that they are motivated by long-term health benefits when choosing plant-based products. This behavior has significantly contributed to the rising popularity of pea protein, which is considered one of the most nutritious and allergen-friendly alternatives. Its digestibility and rich amino acid profile make it an ideal choice for health-focused consumers who are trying to reduce reliance on traditional animal proteins.

In addition to health, environmental concerns are shaping purchasing decisions. Pea protein is seen as a sustainable alternative since peas require less water and nitrogen fertilizer compared to other protein crops. Consumers are aligning their diet choices with eco-conscious values, as surveys show that over 55% of global shoppers prefer food brands with transparent sustainability practices. With its low environmental footprint, pea protein is increasingly integrated into product portfolios of companies targeting environmentally aware consumers, including those in urban and developed markets.

Cultural acceptance and culinary innovation are further accelerating plant-based adoption. Food manufacturers are now offering diverse product options - ranging from burgers and sausages to milk and protein bars - based on pea protein that mimic the taste and texture of traditional animal products. The versatility of pea protein in both savory and sweet applications enables brands to meet the expectations of experimental eaters. As consumer preferences evolve, pea protein continues to stand out as a reliable, scalable, and acceptable ingredient across multiple demographics and eating habits.

Key Market Challenges

High Processing Costs

The high cost of processing pea protein remains one of the most significant challenges limiting its widespread adoption in the global market. Unlike other plant proteins, extracting high-purity pea protein requires complex methods such as wet fractionation, centrifugation, and membrane filtration, which are energy-intensive and expensive to scale. These advanced technologies demand substantial capital investment in specialized equipment and infrastructure. Moreover, the yield of protein from yellow peas is lower than soy, leading to more raw material consumption for the same protein output. As a result, the cost per kilogram of pea protein isolate is often higher than conventional proteins like soy or whey. These elevated production costs are then passed on to manufacturers and ultimately to end consumers, making pea protein-based products less competitive in price-sensitive segments, especially in emerging economies where affordability plays a key role in purchasing decisions.Adding to the burden, the global supply chain for pea protein is still developing, and localized manufacturing is limited in several regions. In many countries, yellow peas need to be imported before they are processed, adding transportation and tariff-related expenses. Furthermore, smaller producers often lack access to modern fractionation technologies and must rely on toll processors, which further inflates operational costs.

For startups or small-scale food brands, the high input costs reduce their profit margins and limit their ability to scale or compete with larger players who benefit from economies of scale. This cost challenge also restricts innovation in mid- and low-income markets, where affordable, functional, and accessible plant-based alternatives are in demand. Thus, unless technological advancements reduce production complexity or governments offer financial support, the high processing cost will continue to act as a major bottleneck in the growth trajectory of the pea protein market.

Key Market Trends

Innovation in Textured & Specialty Pea Proteins

The market is witnessing a significant trend toward innovation in textured pea protein (TPP) and specialty isolates, driven by the demand for realistic meat alternatives. Textured pea protein offers a fibrous structure and chewiness that closely mimic animal meat, making it highly suitable for plant-based burgers, sausages, and nuggets. Food manufacturers are increasingly adopting advanced extrusion technologies to improve the texture and mouthfeel of TPP. These innovations have enhanced water retention and protein concentration, leading to improved nutritional profiles and palatability. Moreover, textured forms of pea protein blend well with other plant proteins like rice or chickpea, allowing for customized applications across food segments. As consumers seek cleaner, plant-based labels with improved sensory appeal, textured pea protein is becoming a key ingredient for innovation, especially in flexitarian product development aimed at taste parity with conventional meat.Specialty pea protein isolates are also gaining traction, designed to meet the specific needs of functional foods, sports nutrition, and infant formulas. These isolates are engineered for high solubility, neutral taste, and tailored amino acid profiles, making them suitable for protein-fortified beverages, shakes, and bars. New enzymatic processing methods and filtration techniques have made it possible to reduce the “beany” aftertaste of pea protein by nearly 30%, which has historically limited its use in mainstream beverages and dairy analogues. Additionally, the development of organic, non-GMO, and allergen-free variants aligns with clean-label demands. As more brands invest in specialty formulations for niche health and wellness categories, the scope of pea protein innovation continues to expand beyond basic nutritional value into multi-functional, sensory-optimized formats.

Key Market Players

- Roquette Frères

- Burcon Nutrascience Corporation

- Cosucra Groupe Warcoing

- Nutri-Pea Limited

- Sotexpro

- The Scoular Company

- Yantai Shuangta Food Co., Ltd

- Axiom Foods, Inc.

- Farbest Brands

- Shandong Jianyuan Foods Co., Ltd.

Report Scope:

In this report, Global Pea Protein Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Pea Protein Market, By Type:

- Isolates

- Concentrates

- Textured

Pea Protein Market, By Form:

- Dry

- Wet

Pea Protein Market, By Applications:

- Meat Extenders & Analogs

- Snacks & Bakery Products

- Nutritional Supplements

- Beverages

- Others

Pea Protein Market, by Region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- North America

- United States

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Qatar

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Pea Protein Market segment.Available Customizations:

With the given market data, the publisher offers customizations according the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Roquette Frères

- Burcon Nutrascience Corporation

- Cosucra Groupe Warcoing

- Nutri-Pea Limited

- Sotexpro

- The Scoular Company

- Yantai Shuangta Food Co., Ltd

- Axiom Foods, Inc.

- Farbest Brands

- Shandong Jianyuan Foods Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

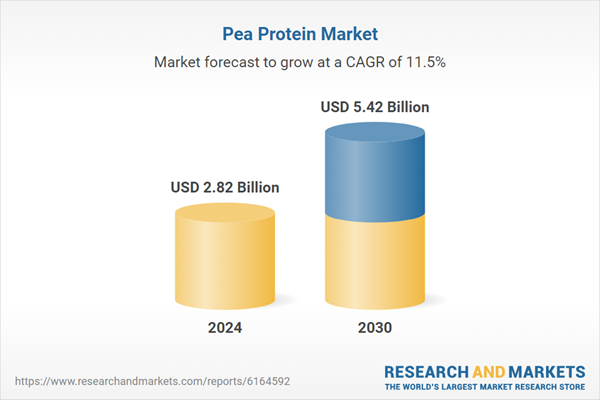

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.82 Billion |

| Forecasted Market Value ( USD | $ 5.42 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |