Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Manufacturers are investing in lightweight and durable materials such as chromium steel and advanced alloys to reduce tappet wear and optimize engine performance under high-temperature and high-pressure conditions. This evolution in tappet materials and designs has opened opportunities for innovation and product differentiation. Moreover, the shift towards hybrid powertrains and fuel-efficient vehicles is further influencing tappet design to accommodate more compact and integrated engine architectures. The emphasis on stricter emission norms has led to the development of tappets that support variable valve timing and other advanced valvetrain mechanisms, contributing to reduced emissions and improved fuel consumption.

These trends are reinforcing the need for technologically advanced and reliable tappet systems in modern automotive applications. For instance, The Japan tappet market is bolstered by robust automotive production and export performance. Between April 2023 and March 2024, Japan produced approximately 7.55 million passenger cars, marking a 10.7% year-over-year increase from 6.81 million units.

This uptick in production directly supports the demand for engine components like tappets. Despite the growth drivers, the tappet market faces several challenges, including rising cost pressures and high competition among component suppliers. Manufacturers are under continuous pressure to maintain quality while managing production costs, especially as raw material prices fluctuate. The growing complexity of engine systems also demands higher precision in tappet manufacturing, which increases production time and investment in quality assurance.

Market Drivers

Surge in Automotive Production

The expansion of the automotive industry significantly propels the demand for tappets. As vehicle production escalates, particularly in emerging economies, the need for efficient engine components like tappets rises correspondingly. Tappets are integral to the valve train system, ensuring optimal engine performance. The increase in vehicle manufacturing, driven by urbanization and rising disposable incomes, directly influences the growth of the tappet market. More advanced manufacturing processes now support high-volume production of tappets with consistent quality. Consumer preference for performance-oriented vehicles boosts the need for high-precision components. The increase in ICE-powered vehicle launches further sustains tappet demand.Growing demand in both OEM and replacement markets strengthens long-term opportunities. For instance, Japan exported 4.05 million passenger cars during the same period, up from 3.38 million the previous year, reflecting a 19.8% increase. The United States was the largest market, with exports valued at $41.07 billion, followed by Australia at $8.21 billion and China at $6.61 billion. These figures underscore the strength of Japan's automotive sector, which is integral to the tappet market's growth.

Key Market Challenges

Transition to Electric Vehicles (EVs)

The automotive industry's shift towards electric vehicles poses a significant challenge to the tappet market. EVs operate without internal combustion engines, eliminating the need for tappets. As EV adoption grows, the demand for traditional engine components like tappets is expected to decline, impacting market growth. Long-term ICE investment may shrink as OEMs pivot to electrification. Governments incentivizing EV sales amplify tappet obsolescence. EV drivetrains require different component ecosystems. Suppliers face decisions on diversifying or phasing out tappet-related portfolios.Tappet manufacturers must now rethink their business models and explore adjacent markets, such as precision components for EV systems. Some suppliers are experimenting with thermal management solutions and hybrid-compatible parts to mitigate volume loss. The pace of EV adoption directly influences long-term viability for tappet-centric production lines. Strategic partnerships and adaptive capacity planning have become essential to withstand this disruptive transition.

Key Market Trends

Rise in Lightweight Tappet Materials

There is growing emphasis on reducing vehicle weight to improve fuel efficiency and performance. This has led to the use of lightweight materials such as aluminum alloys and composite materials in tappet production. These lighter tappets reduce the inertia in the valve train, enhancing throttle response and engine speed capability. OEMs are exploring titanium-based variants for ultra-lightweight performance. Weight reduction aligns with emissions and mileage targets.Material innovation is often paired with process advancements. High-speed machining of lightweight materials reduces cycle time. Lightweight tappets also reduce valvetrain noise due to decreased impact forces. The switch to low-density metals improves engine start-up characteristics. Engineers are working on balancing mechanical strength with lower mass without compromising heat resistance. This trend supports sustainability goals by minimizing resource consumption and energy use during production.

Key Market Players

- Otics Corporation

- NSK Ltd.

- Schaeffler AG

- Federal-Mogul LLC.

- Rane Engine Valve Limited

- Wuxi Xizhou Machinery Co. Ltd.

- AC Delco

- TRW

- Competition Cams, Inc.

- SKF

Report Scope:

In this report, the Japan Tappet Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Japan Tappet Market, By Type:

- Flat

- Roller

Japan Tappet Market, By Engine Capacity:

- < 4 Cylinders

- 4-6 Cylinders

- >6 Cylinders

Japan Tappet Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicle

Japan Tappet Market, By Distribution Channel:

- OEM

- Replacement

Japan Tappet Market, By Region:

- Hokkaido & Tohoku

- Kanto

- Chubu

- Kansai

- Chugoku

- Shikoku

- Kyushu

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Japan Tappet Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Otics Corporation

- NSK Ltd.

- Schaeffler AG

- Federal-Mogul LLC.

- Rane Engine Valve Limited

- Wuxi Xizhou Machinery Co. Ltd.

- AC Delco

- TRW

- Competition Cams, Inc.

- SKF

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

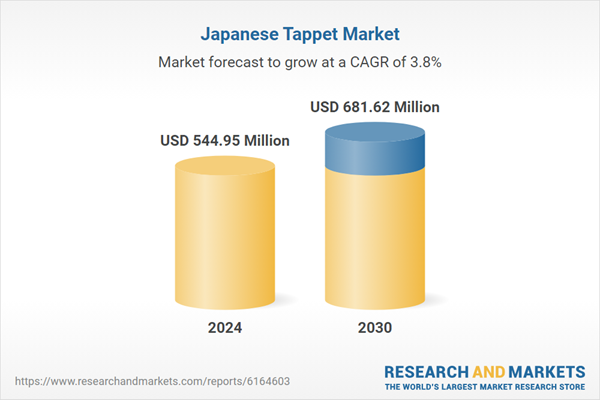

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 544.95 Million |

| Forecasted Market Value ( USD | $ 681.62 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 10 |