Computer-aided design software, 3D printing tools, and automated systems are helping manufacturers deliver detailed, consistent, and scalable designs while minimizing material waste and production time. These advancements are also contributing to significant reductions in labor costs. The Asia-Pacific region remains the dominant hub for this industry, thanks to its established infrastructure, skilled labor force, and growing domestic and global demand. Countries across the region benefit from low-cost labor, favorable regulatory frameworks, and cultural preferences that promote jewelry purchases, which collectively strengthen APAC’s influence on the global market landscape.

The casting equipment segment generated USD 866.5 million in 2024 and is forecasted to grow at a CAGR of 6.7% between 2025 and 2034. This equipment is highly favored in jewelry and precious metal applications due to its suitability for mass production, flexibility in customization, and cost efficiency. While laser-based systems like engraving and welding tools are increasingly used for precision finishing, casting technology remains the go-to for scalable production, particularly in emerging markets and among small to mid-sized manufacturers. Its adaptability and economic value continue to drive its widespread adoption across the sector.

The jewelry manufacturing segment accounted for a 38.8% share in 2024 and is expected to register a CAGR of 6.8% through 2034. As the leading application within the precious metals processing and jewelry equipment industry, this segment is expanding due to rising consumer demand, advancements in digital manufacturing processes, and the internationalization of jewelry production networks. Compared to other applications like industrial refining or recycling, jewelry production requires a greater variety of tools and equipment, giving it a central role in the industry's continued development and innovation.

U.S. Jewelry Making and Precious Metals Processing Equipment Market held a 76.5% share and generated USD 350.4 million in 2024. This strong position can be attributed to the country’s advanced manufacturing capabilities and well-established presence of luxury jewelry brands. American manufacturers widely utilize digital technologies such as CAD software, 3D printing systems, and laser-based tools to streamline workflows and enhance product output. This technological edge supports the country’s continued dominance in the high-end jewelry manufacturing space, making it a critical player in the overall market.

Key companies shaping the Global Jewelry Making and Precious Metals Processing Equipment Market include Durston Tools, UIHM, Orotig, Supermelt, Indutherm, LaserStar Technologies, CDOCAST Machinery, Gesswein, Rio Grande, EnvisionTEC, Gravotech, Schultheiss, Contenti, and Pepetools. To reinforce their market position, companies in this sector are focusing on product innovation, expanding digital design capabilities, and upgrading manufacturing technologies. Many are integrating automation and AI-driven tools to enhance design accuracy and streamline production timelines. Investing in user-friendly interfaces and modular machines allows businesses to serve a wide range of customer needs - from small artisan workshops to large-scale manufacturers. Firms are also increasing their global presence by establishing partnerships with regional distributors and offering responsive after-sales support.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Jewelry Making and Precious Metals Processing Equipment market report include:- CDOCAST Machinery

- Contenti

- Durston Tools

- EnvisionTEC

- Gesswein

- Gravotech

- Indutherm

- LaserStar Technologies

- Orotig

- Pepetools

- Rio Grande

- Schultheiss

- Superbmelt

- UIHM

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

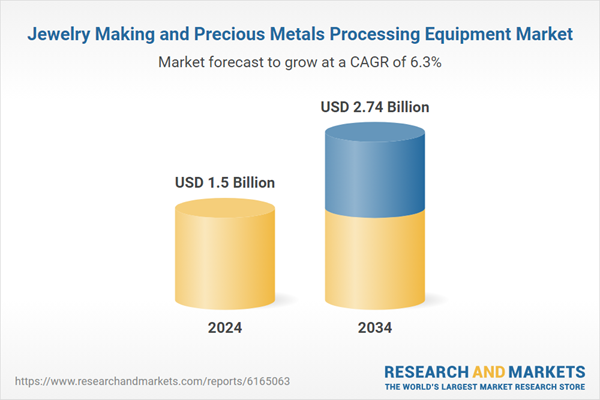

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 2.74 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |