The introduction of government-backed initiatives through infrastructure legislation is further advancing domestic manufacturing and port equipment modernization, especially for heavy-duty and container-handling cranes. These investments are improving industrial capabilities across the region and encouraging new entrants and innovation within the market.

The knuckle boom cranes segment held 40% share and generated USD 460 million in 2024. Their flexible jointed design and compact form factor make them highly suitable for space-constrained offshore settings. Frequently deployed aboard support ships, FPSOs, and small offshore installations, they’re ideal for precision-based activities such as material handling, personnel movement, and onboard maintenance. These cranes offer adaptability and ease of operation, even in challenging marine conditions, and can be stored compactly, making them a preferred option in modular and retrofitted environments.

In terms of lifting capacity, cranes in the 0-500 mt segment held a 44% share in 2024 and is projected to grow at a CAGR of 6.1% through 2034. These light-duty systems are commonly utilized for routine offshore applications, including transferring supplies and conducting maintenance tasks. Typically installed on smaller oil platforms, FPSOs, and service vessels, these cranes offer excellent functionality for day-to-day operations, particularly in near-shore and shallow-water regions. Their affordability and operational versatility make them a dependable solution for logistical offshore duties, supporting ongoing activity across North American waters.

U.S. Off-Shore Crane Market held 86% share in 2024 generating USD 998 million. This dominance is bolstered by an expanding offshore wind sector, prompting demand for specialized lifting equipment and infrastructure. Major coastal ports are transforming into logistics hubs, supported by large-scale investments in wind energy. Infrastructure improvements are being accelerated in states aiming to become leaders in the clean energy transition, helping reinforce the country’s lead in offshore crane adoption.

Leading companies operating within the North America Off-Shore Crane Market include NOV, Huisman, Heila Cranes, Konecranes, Cargotec, Liebherr, and KenzFigee. To establish and sustain a competitive edge in the North America Off-Shore Crane Market, major players are focusing on strategic moves such as forming long-term contracts with energy companies and upgrading their product portfolios to offer cranes tailored for renewable projects. They are investing in R&D for safer, compact, and more energy-efficient crane designs suited for restricted offshore environments. Companies are also expanding regional service networks to ensure rapid maintenance and minimize downtime.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this North America Off-Shore Crane market report include:- Cargotec

- Huisman equipment

- Konecranes

- Liebherr group

- Manitowoc company

- National oilwell varco

- Palfinger

- Terex corporation

- TTS group

- Seatrax

- Allied systems company

- Appleton marine

- EBI cranes

- Forum energy technologies

- Hawboldt industries

- Heila cranes

- Kenzfigee

- Red rock marine

- Sparrows group

- Techcrane International

- Arctic crane services

- Bardex

- DMW marine group

- Favelle favco berhad

- Hydralift

- Indal technologies

- Melcal marine cranes

- MacGregor

- Rapp marine

- TMI

Table Information

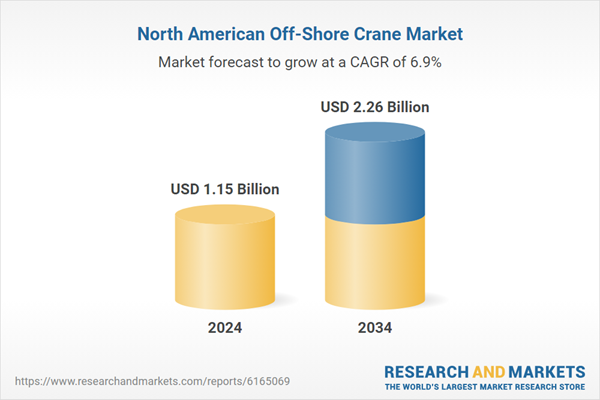

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.15 Billion |

| Forecasted Market Value ( USD | $ 2.26 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 31 |