As the region rebounds economically, demand for mid-weight trucks used in city deliveries and last-mile logistics has increased significantly. Local manufacturing and innovation continue to be a defining trait of the competitive landscape, with companies ramping up regional production. Fleet management is becoming more advanced with the rollout of cloud-based platforms, AI-powered predictive maintenance, and integrated optimization software included in vehicle packages. China remains the dominant market in the region, driven by strong demand, local manufacturing capabilities, and substantial government support for cleaner commercial vehicle solutions.

The diesel segment held 60% share in 2024 and is projected to grow at a CAGR of 7.7% through 2034. Diesel-powered trucks maintain a stronghold due to their ability to generate high torque, support extended hauling, and benefit from an established fuel infrastructure. These trucks remain critical across core sectors such as construction, transportation, and resource extraction, particularly in markets where fuel accessibility and service reliability are prioritized.

The box body configurations segment held 46.94% share in 2024 and is forecast to grow at a CAGR of 8.8% from 2025 to 2034. These trucks are essential for urban distribution, last-mile logistics, and cold chain applications due to their enclosed design, which helps protect cargo from environmental damage and theft. Rising demand for reliable delivery of perishable goods and parcel shipments in metro regions is boosting the popularity of box trucks across the region.

China Class 6 Truck Market held 44.3% share in 2024, generating USD 3.7 billion. The country's leadership in this segment is driven by its strong production ecosystem, a vast logistics network, and progressive policies supporting the transition to low-emission vehicles. Financial incentives for fleet upgrades and regulatory actions to phase out diesel units have further accelerated adoption of next-generation trucks within China’s commercial fleet sector.

Leading companies actively contributing to the Asia-Pacific Class 6 Truck Market include Dongfeng Motor Corporation, Tata Motor, Hino Motor, Sinotruk, Bharat Benz, Isuzu Motors, Ashok Leyland, Foton Motor, Mitsubishi Fuso, and FAW Jiefang. These players are reshaping the competitive landscape through strategic investments and innovation. To gain a stronger foothold in the Asia-Pacific Class 6 truck segment, major manufacturers are aggressively investing in electrification, regional manufacturing, and software integration. A focus on developing energy-efficient models with local sourcing has helped brands reduce costs while meeting regulatory requirements. Several companies are forming alliances with technology providers to offer integrated telematics and AI-driven fleet management systems, improving uptime and operational efficiency. Expansion of local production plants and parts networks has also been prioritized to ensure faster delivery and support.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Asia-Pacific Class 6 Truck market report include:- Hino Motors

- Isuzu Motors

- Mitsubishi Fuso Truck and Bus

- UD Trucks

- Toyota Motor

- Volvo Group

- Daimler Truck

- China National Heavy Duty Truck

- FAW Group

- Shaanxi Automobile

- Dongfeng Motor

- Foton Motor

- SAIC Motor

- JAC Motors

- Jiangling Motors Corporation (JMC)

- Beiben Trucks

- Chongqing Lifan Industry

- Tata Motors

- Ashok Leyland

- Mahindra & Mahindra

- VE Commercial Vehicles

- Force Motors

- Hyundai Motor

- Kia

- Thonburi Automotive

- PT Hino Motors Manufacturing

- Isuzu Malaysia

- Electric Vehicle Specialists

- BYD

- NIO

- Xpeng Motors

- Li Auto

- Technology-Focused Emerging Players

- Great Wall Motors

- Chery Commercial Vehicle

- Geely Commercial Vehicle

- BAIC Motor

- Regional Emerging Players

- Euler Motors

- Rivigo

- Altigreen Propulsion Labs

- Tevva Motors

- Startup and New Entrants

- Arrival

- Canoo

- Workhorse

Table Information

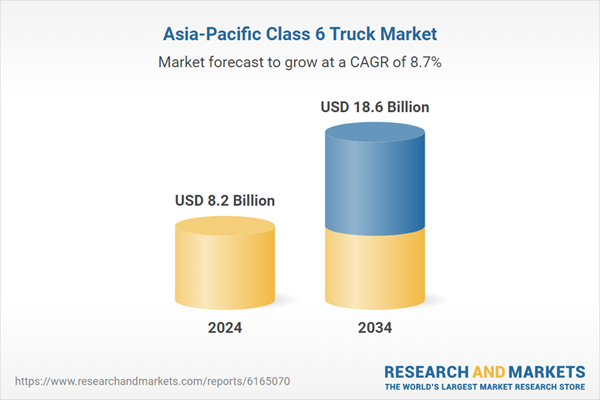

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 8.2 Billion |

| Forecasted Market Value ( USD | $ 18.6 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 47 |