Ongoing digital transformation and e-commerce expansion across MEA are further accelerating this trend. With growing regional cooperation, trade agreements, and stronger customs frameworks, businesses are increasingly relying on smaller, more frequent shipments to access wider markets without incurring high logistics costs. As infrastructure improves and internet penetration deepens, especially in Africa and the Middle East, LCL services are becoming essential to support rising intra-regional and international trade volumes.

The standard LCL services held a 41.7% share in 2024 and are expected to grow at a 4.5% CAGR through 2034. With SME pushing for cost-efficient solutions, providers are scaling stopover LCL services connecting MEA ports to Asian and European destinations. Consolidation hubs and expanded shipping networks are being established to minimize transit delays and better accommodate small volume cargo.

The sea freight segment held 82% share and is projected to grow at a CAGR of 6.6% by 2034. Ocean-based LCL remains the most used method due to affordability, load capacity, and suitability for north-south trade between the MEA region and international markets. Ongoing upgrades in port infrastructure at major hubs such as Mombasa, Durban, and Jebel Ali are improving reliability and reducing delays. Digital freight booking solutions and direct LCL lanes are being launched to support the high shipping frequency required by SME.

UAE MEA Less-Than-Container Load (LCL) Shipping Market held a 33.8% share and generated USD 1.2 billion in 2024. The country’s dominance is rooted in its advanced logistics capabilities, modern port infrastructure, and consolidation services that support faster and more efficient shipment handling. Ports such as Fujairah and Jebel Ali act as vital regional gateways for small consignments. Strategic overland and maritime initiatives, including new corridor projects linking UAE with Europe, reinforce the country's leadership in cross-border LCL transport. As regional connectivity improves and trade volumes climb, the UAE remains the logistical backbone of LCL operations in the MEA region.

The top companies in the Global MEA Less-Than-Container Load (LCL) Shipping Market include Maersk Logistics, Gulf Agency Company (GAC), DHL Global Forwarding, DB Schenker, CEVA Logistics, Agility Logistics, and Kuehne + Nagel. To boost their foothold, leading logistics providers are investing in regional consolidation hubs and digitized freight booking systems. They’re also expanding direct LCL service lanes and improving route efficiency through AI-based logistics planning. These companies are targeting SME customers with flexible pricing models and tailored solutions for multi-origin shipments. Advanced tracking systems, end-to-end supply chain visibility, and value-added services such as customs clearance and warehousing are being used to strengthen service reliability and customer retention. Strategic partnerships with regional ports and authorities further enhance operational reach, while eco-friendly shipping practices help meet regulatory demands and sustainability goals.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this MEA Less-Than-Container Load (LCL) Shipping market report include:- A.P. Moller-Maersk

- Agility Public Warehousing Company

- CMA CGM Group

- COSCO SHIPPING Lines

- DB Schenker

- DHL Global Forwarding

- Evergreen Marine

- Hapag-Lloyd

- Kuehne + Nagel

- Mediterranean Shipping Company (MSC)

- Aramex International

- Bollore Logistics Africa

- CEVA Logistics

- Emirates Shipping Line (ESL)

- Grimaldi Lines

- Imperial Logistics

- National Shipping Company of Saudi Arabia

- Ocean Network Express (ONE)

- Safmarine (Maersk Group)

- Yang Ming Marine Transport

- Cargo Services Far East (CSFE)

- Freight in Time (FIT)

- GAC Group

- Kobo360

- Lori Systems

- Seaboard Marine

- Sendy

- Tristar Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | August 2025 |

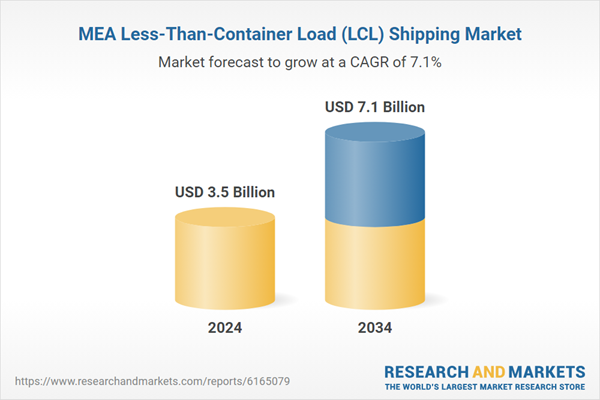

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 28 |