A key trend reshaping this space is the growing preference for electric propulsion systems. These upgrades enhance mission range, reduce acoustic footprint, and improve energy efficiency, making electric-powered underwater drones ideal for a range of applications. With the integration of lithium-ion batteries, brushless DC motors, and supercapacitors, modern electric drones now operate over 72 hours in certain missions. This transformation is especially valuable in mid-water and nearshore operations where low-noise and high-efficiency performance is essential. At the same time, there’s a surge in interest for autonomous underwater vehicles (AUVs), which operate independently using onboard navigation, sensors, and mission software, enabling precision without real-time operator input.

In 2024, the remotely operated vehicle (ROV) segment was valued at USD 2.3 billion. This segment is growing rapidly due to the rising need for real-time underwater operations in oil and gas, defense, and infrastructure inspections. ROVs are equipped with versatile tool systems, have strong payload capacities, and provide operators with full manual control, making them ideal for deepwater inspections, maintenance work, and underwater recovery tasks.

The light work-class drone segment generated USD 2.2 billion in 2024. These drones are widely adopted due to their operational flexibility, affordability, and effectiveness in performing inspection and light intervention missions. Their adaptability with sensors and manipulators, along with low deployment complexity and minimal surface support needs, makes them suitable for confined and harsh environments. To support evolving operational needs, manufacturers are focusing on plug-and-play designs, edge AI integration, and improved tether control systems to serve industries such as port management, infrastructure surveillance, and offshore contracting.

Canada Underwater Drones Market will reach USD 775.1 million by 2034. This growth is driven by the nation’s expanding offshore energy operations, increased maritime territorial monitoring, and deepening investments in marine science. The use of drones for under-ice navigation, remote subsea monitoring, and habitat mapping continues to rise. Equipment developers are advised to prioritize ruggedized, cold-water-capable drone systems with modular sensor configurations suitable for both scientific exploration and defense applications.

Key players in the Global Underwater Drones Market include PowerRay, Gavia AUV, SRV-8 ROV, Neptune ROV, Phantom ROV Series, FIFISH V6, Flying Nodes AUV, Marlin AUV, HUGIN AUV, Seaeye Falcon ROV, Sibiu Pro, SeaDrone ROV, SeaCat AUV, Seasam ROV, BW Space Pro, Blueye X3, Bluefin-21 AUV, Oceaneering ROVs, Eelume Subsea Robot, and Absolute Ocean AUV.

Companies in the underwater drones space are reinforcing their competitive position through multi-faceted strategies. A strong emphasis is placed on R&D to advance autonomy, sensor integration, battery longevity, and propulsion technology. Manufacturers are prioritizing modular designs to enable rapid customization for specific missions, such as exploration, defense, inspection, or scientific research. Strategic partnerships with government bodies, energy firms, and marine institutes are helping companies secure long-term contracts.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Underwater Drones market report include:- General Dynamics Mission Systems

- Deep Ocean Engineering, Inc.

- Nido Robotics

- Oceanbotics

- Neptune Robotics

- Terradepth

- SeaDrone Inc.

- Edgerov (Notilo Plus)

- Autonomous Robotics Ltd.

- Oceaneering International, Inc.

- Lockheed Martin Corporation

- Teledyne Marine

- Kongsberg Maritime

- Saab Group

- Atlas Elektronik

- QYSEA Technology

- PowerVision Inc.

- Youcan Robotics(Shanghai) Co., Ltd.

- Blueye Robotics

- Eelume AS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | August 2025 |

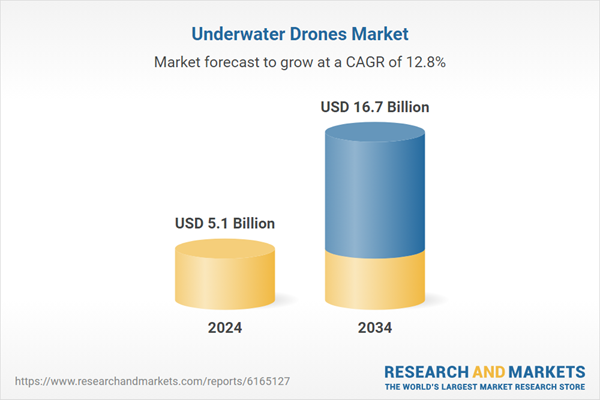

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 16.7 Billion |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |