As cockpit noise levels in smaller aircraft can reach hazardous thresholds, hearing protection becomes a crucial safety feature. The development of headsets with active noise reduction and wireless integration is enhancing pilot performance and reducing fatigue during prolonged operations. Meanwhile, wireless connectivity is reshaping how pilots interact with onboard systems, further increasing the need for integrated aviation headsets with enhanced digital features and long-duration comfort.

On-ear headset models led the market in 2024, reaching a valuation of USD 892.7 million. These headsets are favored by flight schools and professional pilots for their superior noise-blocking capabilities, long-wear comfort, and durability. Their ergonomic design, paired with strong active and passive noise reduction, makes them especially valuable for extended flight missions. Their compatibility with most avionics systems and widespread preference among commercial and business pilots is further contributing to their dominance. Moving forward, manufacturers need to prioritize the design of FAA-certified, ANR-equipped on-ear models with optimized weight distribution and robust construction to meet industry demands.

The wired headset systems segment generated USD 988.3 million in 2024. Their dominance is largely due to reliability, consistent audio performance, and compatibility with legacy and current avionics systems. These models are commonly used in airline operations and training institutions where dependable, interference-free communication is essential. Operators often favor wired headsets because of their affordability, simplified maintenance, and compliance with industry regulations. To retain and grow share in this segment, manufacturers must offer TSO-certified models with advanced noise reduction capabilities and rugged, long-lasting builds that can endure high-frequency use in institutional settings.

United States Aviation Headsets Market generated USD 371.8 million in 2024. This leadership is supported by the country’s significant general aviation activity and expanding pilot training infrastructure. Flight operations across regional jets, private aircraft, and training institutions are spurring demand for headsets that deliver high noise isolation, integrated wireless capabilities, and superior comfort over long durations. Aviation headset providers should focus on launching certified, ergonomic models tailored to meet the modern cockpit’s evolving digital ecosystem. Additionally, in neighboring Canada, rugged headsets with high-performance noise cancellation and thermal resistance are increasingly important for aviation operators working in cold, high-noise, and remote conditions.

Leading brands operating in the Global Aviation Headsets Market include Plantronics, Inc. (Poly), Sennheiser Electronic GmbH & Co. KG, Bose Corporation, ASA (Aviation Supplies & Academics), Lightspeed Aviation, David Clark Company, Bosch Sicherheitssysteme GmbH, Flightcom, Beyerdynamic GmbH & Co. KG, Faro Aviation, 3M Company, Phonak Communications, Clarity Aloft, KORE Aviation, Avcomm International, AKG Acoustics, Telex Communications, Pilot Communications USA, Rugged Air, and Sigtronics Corporation. Companies in the aviation headsets market are focused on delivering advanced solutions that combine ergonomic design, certified safety standards, and superior noise-cancellation. A core strategy is the development of lightweight, ANR-enabled headsets with wireless integration for seamless cockpit communication. Manufacturers are also enhancing product durability and battery life to ensure reliable performance during extended flights. To strengthen their presence, many companies are forming strategic alliances with aviation academies, aircraft OEMs, and commercial airlines to gain access to high-volume institutional customers.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Aviation Headsets market report include:- Bose Corporation

- 3 M Company

- Plantronics, Inc. (Poly)

- Sennheiser Electronic GmbH & Co. KG

- David Clark Company

- Lightspeed Aviation

- Flightcom

- Bosch Sicherheitssysteme GmbH

- AKG Acoustics

- Beyerdynamic GmbH & Co. KG

- Phonak Communications

- ASA (Aviation Supplies & Academics)

- Telex Communications

- Clarity Aloft

- Rugged Air

- KORE Aviation

- Pilot Communications USA

- Sigtronics Corporation

- Avcomm International

- Faro Aviation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

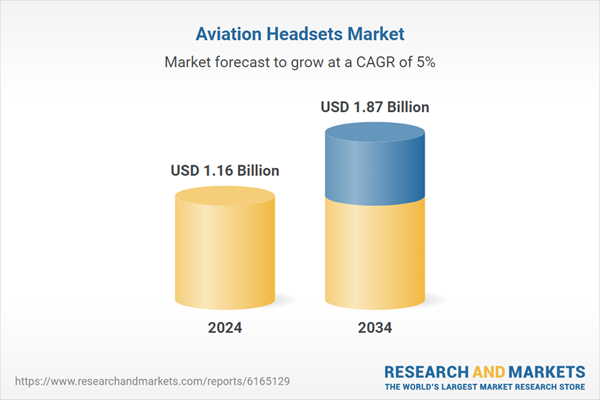

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.16 Billion |

| Forecasted Market Value ( USD | $ 1.87 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |