Medical imaging relies on technologies that produce high-definition visual data to assist in clinical evaluations and surgical interventions. These tools have evolved into essential components of diagnostics, offering precision and speed across medical disciplines. Devices such as MRI systems, X-rays, CT scanners, and ultrasound machines are deployed across clinical settings to evaluate internal injuries, chronic conditions, and abnormalities. Their real-time imaging capabilities support diagnosis and improve workflow efficiency.

In 2024, the X-ray devices segment led the market, primarily due to its increased usage for early diagnosis of chronic illnesses. This segment's growth is supported by the constant upgrades in X-ray technologies that now include AI-powered imaging solutions designed to ensure accuracy, streamline workflows, and reduce the burden on radiologists. These advanced systems have proven their efficacy in multicenter evaluations and are widely adopted across clinical setups. The incorporation of smart diagnostic capabilities is significantly enhancing provider confidence and contributing to the rising utilization of X-ray systems in modern medical imaging practices.

The hospitals segment held a 52.6% share in 2024. Their growing share is influenced by rapid urbanization, population growth, and a rise in healthcare infrastructure investments. The widespread installation of advanced diagnostic equipment, coupled with skilled professionals available to operate them, is positioning hospitals as dominant end-users in this market. Additionally, increased funding for hospital upgrades and new construction, especially across developing regions, is elevating the adoption of imaging equipment. Government and private investments in improving hospital infrastructure are driving significant demand for high-performance imaging technologies.

United States Medical Imaging Market was valued at USD 15.1 billion in 2024. The rising cancer prevalence across the country, stemming from environmental and lifestyle-related factors, has intensified the need for effective and advanced imaging tools for early cancer detection and monitoring. The growing incidence of such conditions is pushing hospitals and clinics to invest in imaging systems that offer high diagnostic value and patient-specific accuracy, thus accelerating overall market growth in the U.S.

Prominent companies operating in the Global Medical Imaging Market include GE HealthCare Technologies, Shimadzu, Samsung Medison, Carestream Health, Canon Medical Systems, Fujifilm Holdings, Hologic, Konica Minolta, Esaote, Siemens Healthineers, and Koninklijke Philips. Leading medical imaging companies are prioritizing innovation by investing in AI integration, machine learning algorithms, and automation to boost image accuracy and diagnostic speed. They are expanding their digital health platforms to support remote diagnostics, cloud-based image storage, and data interoperability. Global market players are actively pursuing mergers, acquisitions, and collaborations with hospitals and technology firms to broaden their solution portfolios. Expansion into high-growth emerging markets is another critical strategy, supported by localized manufacturing and service centers. To remain competitive, manufacturers are also offering modular imaging systems that reduce maintenance and allow for easier upgrades.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Medical Imaging market report include:- Canon Medical Systems

- Carestream Health

- Esaote

- Fujifilm Holdings

- GE HealthCare Technologies

- Hologic

- Konica Minolta

- Koninklijke Philips

- Samsung Medison

- Shimadzu

- Siemens Healthineers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | August 2025 |

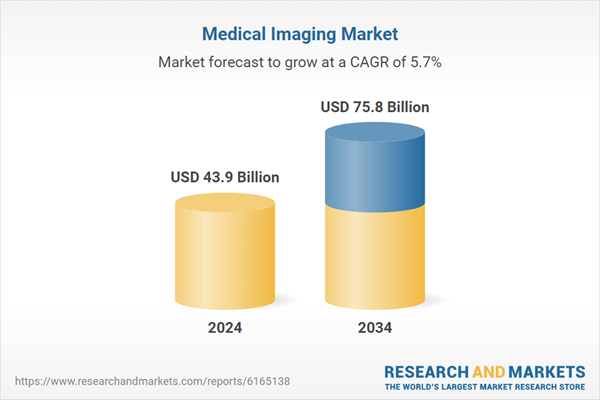

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 43.9 Billion |

| Forecasted Market Value ( USD | $ 75.8 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |