Manufacturers are developing advanced skin-friendly and hypoallergenic options that reduce irritation and improve healing outcomes. Innovations in adhesives, including silicone-based and biocompatible materials, are reshaping product standards. The shift toward patient-specific care further influences purchasing behavior, with sensitivity, mobility, and wound site factors considered. Major players such as Flexcon Company, Paul Hartmann, Berry Global Group, Solventum, and Lohmann GmbH are helping shape the market landscape by prioritizing product innovation and clinical efficacy.

In 2024, the acrylic-based medical adhesive tapes accounted for a 59.8% share. Their appeal lies in their breathability, resistance to heat and moisture, and compatibility with both short-term and extended applications. The ability of acrylic adhesives to manage moisture vapor transmission helps reduce the risk of skin breakdown and supports better healing environments. This balance of comfort and durability makes them ideal for use in wound care and surgical settings.

The single-coated tapes held the largest share at 62.9% in 2024, favored for their easy application and consistent adhesion across different surfaces. These tapes are designed for a range of clinical uses, from securing tubing and dressings to medical devices, making them a reliable option in both hospital and home care settings. Their breathable and skin-friendly properties, combined with moisture resistance, allow for safer and quicker patient handling, which is critical in fast-paced care environments.

U.S. Medical Adhesive Tapes Market generated USD 2.4 billion in 2024. This dominance is driven by its advanced healthcare infrastructure and increasing demand for reliable wound care products. A growing elderly population and the high prevalence of conditions like diabetes are major contributors to rising usage. The country’s extensive healthcare network continues to promote the use of high-performance tapes that offer enhanced healing and patient comfort.

Key companies actively involved in the Global Medical Adhesive Tapes Market include Johnson & Johnson, Smith & Nephew, Nitto Denko Corporation, McKesson Corporation, Dermarite Industries, Medline Industries, Medtronic, Avery Dennison Corporation, DermaMed Coatings Company, Nichiban, Lintec Corporation, and Cardinal Health. To strengthen their position, companies operating in the medical adhesive tapes market are adopting a variety of growth strategies. They are investing in R&D to engineer more advanced, skin-safe, and breathable adhesive solutions tailored to different skin types and clinical needs. Partnerships with healthcare providers and expansion into high-growth regions allow for improved product reach. Many are focusing on expanding manufacturing capabilities and supply chains to meet increasing global demand.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Medical Adhesive Tapes market report include:- Avery Dennison Corporation

- Berry Global Group

- Cardinal Health

- DermaMed Coatings Company

- Dermarite Industries

- Flexcon Company

- Johnson & Johnson

- Lintec Corporation

- Lohmann GmbH

- McKesson Corporation

- Medline Industries

- Medtronic

- Nichiban

- Nitto Denko Corporation

- Paul Hartmann

- Smith & Nephew

- Solventum

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | August 2025 |

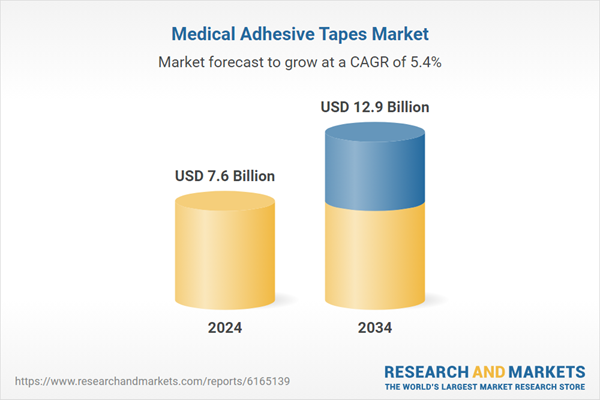

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.6 Billion |

| Forecasted Market Value ( USD | $ 12.9 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |